Public employee pension system investment management is a high return, high-risk affair—but it wasn’t always that way. A look back through public pension history—particularly that of the California Public Employees’ Retirement System (CalPERS)—shows that public pension systems used to take a very different approach to investments which may offer some lessons for us today.

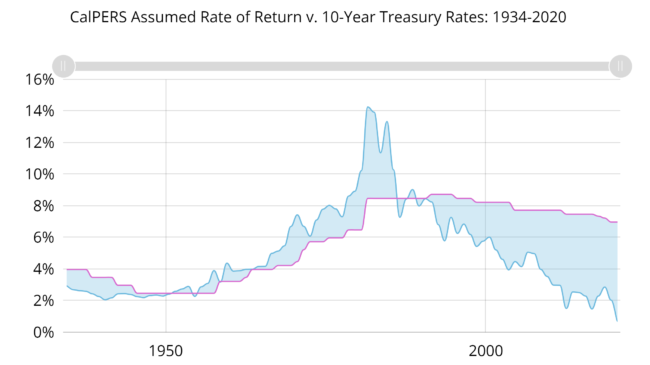

This visualization compares 10-year U.S. Treasury rates with the assumed rate of return assumptions used in CalPERS actuarial valuations since the system’s inception (CalPERS was originally known as the California State Employees Retirement System). This analysis dates back to the system’s first actuarial valuation in 1934. Hovering over the relevant portion of the chart will display rates for any given year.

CalPERS began its history by investing exclusively in municipal bonds and was not alone in doing so. The U.S. Census Bureau has been collecting data on public employee pension systems since the early 1940s. and in 1942 it found that the vast majority of pension fund assets were invested in municipal bonds. The full range of what are now common pension fund investments—including corporate stocks, bonds, real estate, and other alternative investments—were not broken out. Instead, they were all lumped into a category called “Other Investments,” which accounted for only 7 percent of total assets.

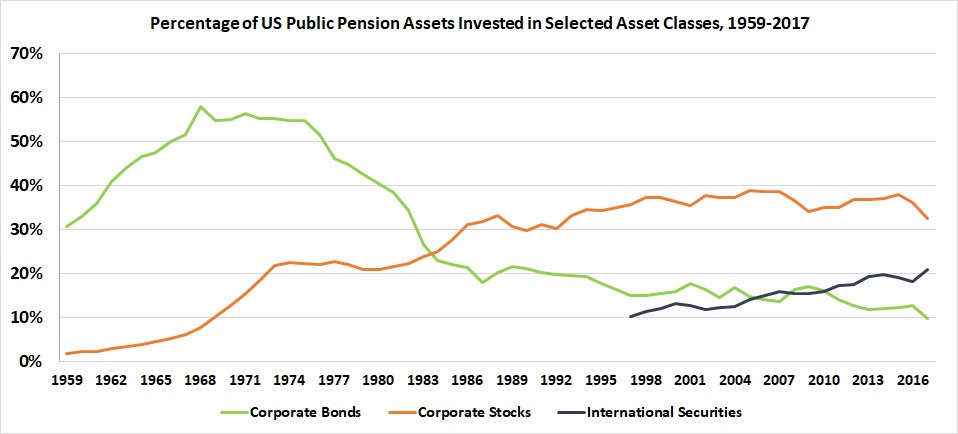

In 1959, the Census began reporting more detailed asset mix data on an annual basis. By then, non-governmental securities had grown to 39 percent of total holdings, but the bulk of this was invested in corporate bonds. Corporate stocks accounted for less than 2 percent of public pension assets.

Figure 1 traces the proportion of public pension assets in corporate bonds and stocks since 1959. In 1997, the Census added a category called “International Securities” which represents a mixture of non-US bonds and stocks. So, although the Census has shown a corporate stock weighting of between 32 percent and 39 percent over the past two decades, the actual proportion would be considerably higher if international stocks were included.

Figure 1

Source: U.S. Census Bureau

Greater investment in stocks and other risky securities tracked with more bullish actuarial return assumptions. Although the Census did not collect actuarial return assumptions (which are usually the same as the discount rate applied to system liabilities), we can look at figures published by individual systems—as our visualization does in the case of CalPERS.

At first, CalPERS’ assumed rate of return roughly tracked yields on high-quality municipal bonds. Because municipal bond interest rates fell during the Great Depression and World War II, CalPERS lowered its initial assumed rate of return from 4 percent to 2.5 percent by 1945. It stayed there until 1958 until the inexorable rise to today’s lofty return assumptions began.

CalPERS initially invested exclusively in California municipal bonds. Treasury securities and corporate bonds were added in the 1940s, but the system was not among those that pioneered equity investments in the 1950s. In 1960, CalPERS commissioned a study by Moody’s Investors Service and pension consultant Paul Howell to review the system’s investment policies. They concluded that CalPERS should replace its government bond investments with corporate stocks, real estate and mortgages because, the study said, the more aggressive investment mix would allow CalPERS to increase returns and provide more generous benefits.

It took some time to convince California voters of the wisdom of this higher-risk/higher-return approach. In 1964, they rejected a proposition that would have allowed CalPERS to invest in stocks. One local newspaper editorialized that the measure represented “a needless risk of public retirement funds, a possibility of use of political pressures in the administration of such funds, and a further possibility of involving these funds in the management of private corporations.” However, a second ballot measure was approved in 1966, perhaps because it capped stock investments at 25 percent of system assets. That cap was removed by another ballot measure in 1984.

Along with greater market risk came a sequence of political moves to increase benefit levels over many years. At its inception, the pension system paid 1.43 percent of final compensation per year of service at age 65. Over time, state legislators raised benefit rates and lowered retirement ages, despite increased lifespans. The correlation between more bullish return assumptions and enhanced benefits was especially pronounced during the early 1970s when CalPERS increased its return expectation from 4.5 percent to 5.75 percent while legislators mandated a benefit formula increase from 1.67 percent to 2 percent per year for non-safety employees. The legislature authorized another large benefit increase in 1999, when it authorized payments of 3 percent of final compensation per year of service at age 50 for safety employees — including those who had previously been hired at a lower benefit rate.

CalPERS has gradually reduced its assumed rate of return from a peak of 8.75 percent in the early 1990s to 7 percent today. But this reduction has not kept pace with the fall in Treasury bond rates, which roughly approximate the returns a pension fund can expect without taking any risk.

At the end of June 2020, 10-year Treasuries yielded 0.68 percent. This gap of 6.32 percent between the CalPERS assumed rate of return and 10-Year Treasury yields is a historic high.

Notably, most public pension plans in the U.S. today are maintaining investment return assumptions even higher than the 7 percent rate used by CalPERS.

Given historically high spreads between public pension return assumptions and Treasury yields, most large pension systems like CalPERS increasingly depend on chasing high investment returns to meet their future benefit commitments. While it is true that stocks usually outperform bonds over the long term, they can also suffer precipitous declines.

A California State Assembly report commissioned in the aftermath of the October 1987 stock market crash found that CalPERS and CalSTRS suffered a one-day loss equal to 22 percent of the value of their equity portfolios and concluded: “that the asset allocation chosen for these trust funds should become more reflective of the special fiduciary responsibilities entrusted to pension system boards and administrators.”

This warning from 1987 still resonates today. With stocks plummeting and then bouncing back to all-time highs while unfunded public pension liabilities show few signs of abating, it is a good time for policymakers and pension administrators to consider whether now might be a prudent time to lower assumed rates of return. Legislators and public pension systems should ensure that the promises they’ve made to workers and retirees are properly funded, just as they were back in the old days.