A new study and interactive dashboard by the Yankee Institute and Reason Foundation show that Connecticut’s 2017 bipartisan financial reforms known as the “fiscal guardrails” have saved the state more than $170 million since enacted and, if kept intact, can save $7 billion over the next 25 years.

The Case for Connecticut’s Fiscal Guardrails: How to Protect Public Pensions and Taxpayers examines how they have improved Connecticut’s creditworthiness, making it less expensive for the state to borrow money to finance necessary projects. Moreover, the guardrails have reversed decades of pension underfunding, reducing the risk that Connecticut will face tax increases to make the pensions’ minimum liability payments during a recession.

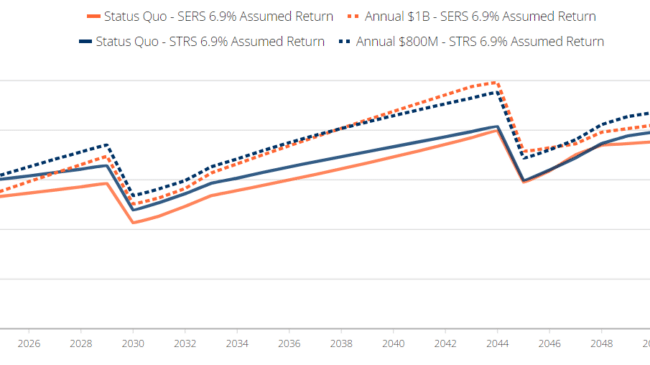

The interactive Reason Foundation-Yankee Institute CT Pensions Dashboard explores various economic scenarios for reducing the state’s public pension debt. The study and dashboard are built upon dual pension models of the State Employee Retirement System, SERS, and the State Teacher Retirement System, STRS. The models account for the assumed rates of investment returns, payroll growth rates, cost-of-living adjustment provisions, and mortality assumptions, among dozens of other variables.