This legislative session, Alaska lawmakers are considering several bills that would roll back a 2006 pension reform that closed the state’s defined benefit (DB) pension plan for public workers.

In 2006, Alaska’s two pension systems—the Teachers’ Retirement System (TRS) for teachers and Public Employees’ Retirement System (PERS) for all other public safety and government employees—were closed to new hires due to significant funding and cost issues. As part of that reform, all new and future hires were to be enrolled in a defined contribution (DC) plan. Even with no new entrants earning benefits in the closed plan, Alaska’s unfunded pension liabilities for current and retired public employees have grown to a combined $6.7 billion.

The argument being made today for reopening the defined benefit plan for existing and new workers is that the defined benefit plan supposedly provides a better benefit. Therefore, some claim it would improve Alaska’s ability to attract and retain teachers, public safety, and other government workers. However, an in-depth analysis that evaluates these two Alaska plans under several career situations shows that the defined benefit plan is not optimal for most workers.

To foster informed decision-making in the legislative process, Reason Foundation’s Pension Integrity Project has developed a dynamic interactive analysis that compares Alaska’s DB and DC benefits under multiple variations of common situations, and we confirmed the validity of our analysis with the Alaska Department of Administration’s Division of Retirement and Benefits.

A comprehensive comparison of the closed defined benefit plan, the DB proposed in Senate Bill 88 (currently being considered in the state legislature), and the existing defined contribution plan suggests that the DC plan is the optimal benefit for most new hires.

Any comparison between DB and DC benefits must first answer the question, ‘For whom?’ Both types of retirement benefits are subject to several factors that can vary significantly from person to person. The age a worker begins employment (or entry age) and the rules for when they can start drawing retirement benefits (requirements that differ between public safety, teachers, and other employment types) are major considerations. The investment returns on savings, annuity payout rates, and assumed wage increases also impact the value of benefits.

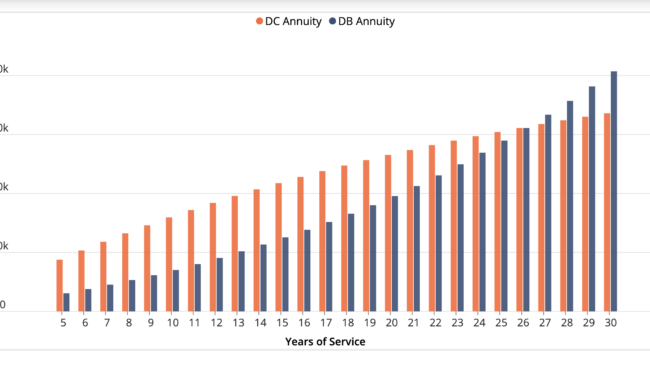

The dynamic benefit analysis of Alaska’s plans shows the annual retirement benefit (or annuity) that a retiree could expect after a range of years of service. To show how these benefits will compare over common situations and assumptions, all factors listed above can be adjusted and visualized for all years of service until full retirement eligibility is achieved.

Generally, the value of the defined contribution annuity will exceed that of the legacy defined benefit plan for many years of service. In most cases, the value of the DB benefits will surpass that of the DC plan only in later years of service, a situation that retention data suggests is much less common:

- According to assumptions used by PERS and TRS, about 50% of new public safety members and 70% of new teachers and other members leave within 10 years; and

- About 60% of new public safety members and 77%-to-85% of new teachers and other members leave within 20 years (assuming an entry age of 25).

This analysis shows that while a select group of workers could enjoy an improved benefit by reopening the defined benefit plan, the vast majority of Alaska’s public employees would be better served in the existing defined contribution plan.

Notes on Methodology

- To calculate the annual annuity for defined contribution plans, the analysis applies the assumed return to the required contribution amounts for the average starting salary of $80,435 for public safety members, $59,581 for teachers, and $57,949 for other members.

- In situations where a member would fulfill the requirements for full pension benefits (based on either age or years of service), the analysis assumes the member would also use existing DC savings to purchase an annuity at that point. This can come after just 20 years of service for public safety members and teachers, which (depending on entry age) can mean beginning guaranteed benefits through annuities at an unusually early age, thus generating a significant reduction in annual benefits. This assumption can be toggled off in the tool with the “DC Annuitization at 60: Off” button.

- The annuity payout rate is the interest rate used to convert the DC balance into an annuity. We assume a life expectancy of 85 for the annuitization calculation.

- To calculate the annual annuity generated by the defined benefit plan, the analysis applies the selected variables to the plan’s existing benefit calculation.