The Florida Retirement System’s declining funding should concern the state’s employees and taxpayers. As it currently sits, the pension plan only has 82 cents of every dollar needed to pay future retirement benefits to over one million retirees and employees. This funding shortfall puts the unfunded accrued liability of the Florida Retirement System at a staggering $36 billion.

The Florida Retirement System (FRS) was fully funded as recently as 2008 but since that time the plan has failed to rebound from steep losses during the 2007-2009 financial crisis. Instead of digging back to full funding during the longest bull run in stock market history, the pension plan’s debt increased by $18.9 billion after 2009 (on an actuarial basis).

The interactive chart below shows how the pension plan’s debt has grown since 2001 and displays how the funded ratio for FRS declined by 7 percent over that same period.

Financial forecasting shows that if FRS meets its investment return assumptions for the next 18 years, it would improve its funding to 90 percent by 2038. Unfortunately, looking at both historical investment performance and future economic and stock market forecasts, this rate of investment return is unlikely to be met.

Over the last 20 years, the Florida Retirement System’s compound annual growth rate was only 5.62 percent, which is well short of the 7 percent it hopes to earn in the future. Future return analysis based on FRS’s target asset allocation and 10-to-15-year market forecasts from four large financial institutions show that FRS has less than a 50-50 chance of meeting or exceeding its 7 percent return target.

The interactive chart below shows a realistic funding scenario for FRS given the unlikelihood the plan will meet its investment targets in the long term. When modeling a 6 percent investment return and two recession over the next 30 years, we can see that FRS would be below 70 percent funded by 2050.

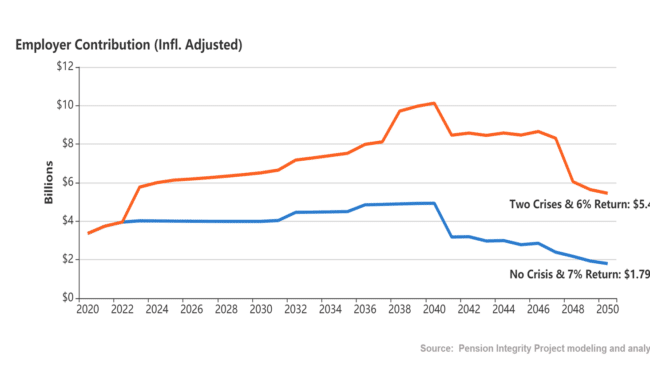

The employer contribution chart below shows how much employer costs would rise if FRS were to meet this fate. Under this scenario, taxpayer costs would nearly triple.

These analyses make it clear that Florida’s public pension plan has not recovered from the 2007-2009 market challenges of over a decade ago, and it doesn’t look to be equipped to effectively handle any future economic and market challenges either.

To prevent unfunded liabilities from spinning out of control, FRS needs structural reform. The needed reforms include implementing more realistic actuarial assumptions, using clear-eyed risk assessments to gauge future performance, and creating shorter timelines to pay off future unfunded liabilities when they are created.