As Louisiana’s educators continue to face challenges on multiple fronts, from staff shortages to stagnant pay, lawmakers have approved a pair of measures that, while seemingly helpful, could ultimately burden taxpayers without solving the underlying problems.

House Bill 473 by Rep. Julie Emerson (R-39) and House Bill 466 by Rep. Josh Carlson (R-43) would, together, execute a three-step plan aimed at producing a permanent pay increase for Louisiana’s public educators. Without any actuarial review, the legislature concluded that the resulting savings to employers would be enough of a budget windfall to fund a permanent teacher pay raise. However, appropriating $2 billion to the Teachers’ Retirement System of Louisiana (TRSL) without addressing the glaring weaknesses that led to a $8 billion growth in pension debt is akin to bailing out a sinking boat without first plugging the hole.

The well-intended, though misguided, three-step plan is simple, in concept. Step one, as passed in HB 473, is a question lawmakers will put before voters on the April 2026 ballot. If approved on the ballot, HB 473 would dissolve the Louisiana Education Quality Trust Fund, the Louisiana Quality Education Support Fund, and the Education Excellence Fund (EEF). The beginning Fiscal Year 2025 balances in the three funds, according to the Legislative Fiscal Office, totaled nearly $2 billion, with the Quality Fund equaling $1.45 billion, the Support Fund totaling $36.2 million, and EEF being worth $482 million. Step two would be the reallocation of that $2 billion towards TRSL and its $8 billion unfunded liability. Step three, outlined in HB 466, occurs when the sudden influx of cash into the TRSL trust fund triggers a change in the subsequent actuarially determined annual employer contribution rate. HB 466 ensures employers use funds freed by the resulting rate reduction to fund permanent pay raises.

In 2023, over half of all funds contributed towards TRSL–15.71% of the required 28.82% contribution–went towards paying down unfunded liabilities, rather than funding teacher benefits. If the voters approve HB 473 in April and the three-step plan is implemented, the 15.17% figure will be reduced to around 12%, resulting in a cost reduction of approximately 3% for hiring new educators in Louisiana. However, those cost savings are unlikely to materialize when the vast majority of the employer rate goes to servicing past debt. This is because contribution rates change annually based on investment returns. This issue was raised indirectly by the legislative auditor’s office in their fiscal note on HB 473 when they warned that the legislation’s “actual impacts will not be known until the time the funds are fully liquidated, their balances transferred to TRSL, and the retirement contribution rate of TRSL is re-amortized.”

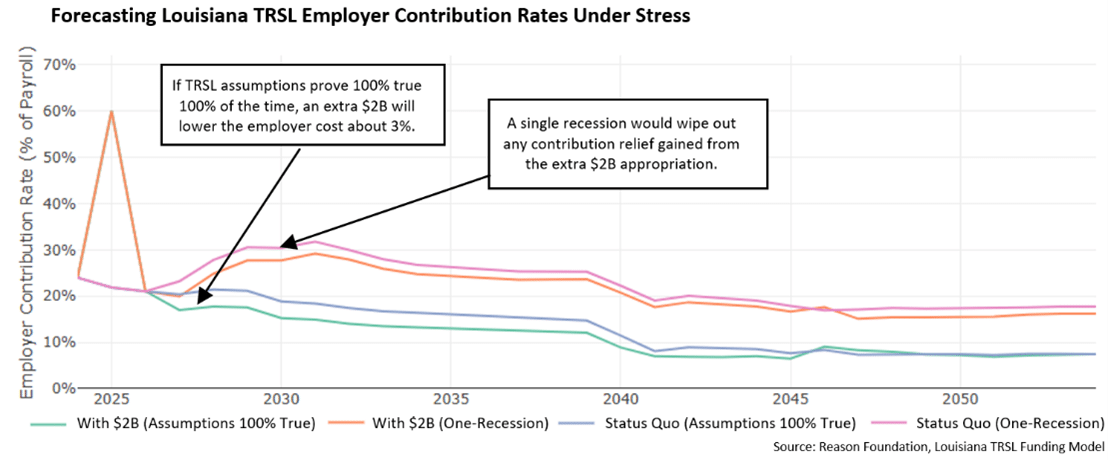

Indeed, a $2 billion supplemental contribution to the TRSL fund is expected to immediately lower the required employer contribution rate by about 3% and improve the system’s funded ratio by about 8%. The multi-billion dollar question is, what happens the next time investments underperform actuarial assumptions?

The answer isn’t complicated—but it is costly. The shortfall becomes new pension debt, stretched over 30 years, which means a larger unfunded liability and higher employer contribution rates the very next year. Even a basic economic stress test of TRSL makes clear just how fragile the system becomes under market pressure.

Only by coupling the three-step plan proposed in HB 466 and HB 473 with a modernized TRSL tier for new hires can lawmakers confidently say Louisiana provides sustainable benefits without burdening future generations of taxpayers. All active and retired members of TRSL should feel confident that their retirement benefits are constitutionally protected and guaranteed. That doesn’t mean the state should be relegated to legislative budgeting with a perpetual albatross around its fiscal neck. Other benefit designs that include guaranteed lifetime income and inflation protection options, while better managing risk, could be considered.

Voters will decide in April 2026 if they want to dedicate another $2 billion towards the $8 billion TRSL debt and execute the legislature’s misguided plan for a permanent teacher pay raise. In the meantime, liberal actuarial assumptions, unsuitable benefits, high costs, and limited transparency remain well-known issues with TRSL that lawmakers should address in the next session. Without systemic reform, the extra funding could disappear, and lawmakers will continue to expose taxpayers to cost overruns, thereby preventing the much-needed modernization of retirement benefits for today’s increasingly diverse and mobile public education workforce. This is precisely why Gov. Jeff Landry must reject injecting more taxpayer funds into a structurally unsound system via HB 466 and instead reform the TRSL benefit for new hires.