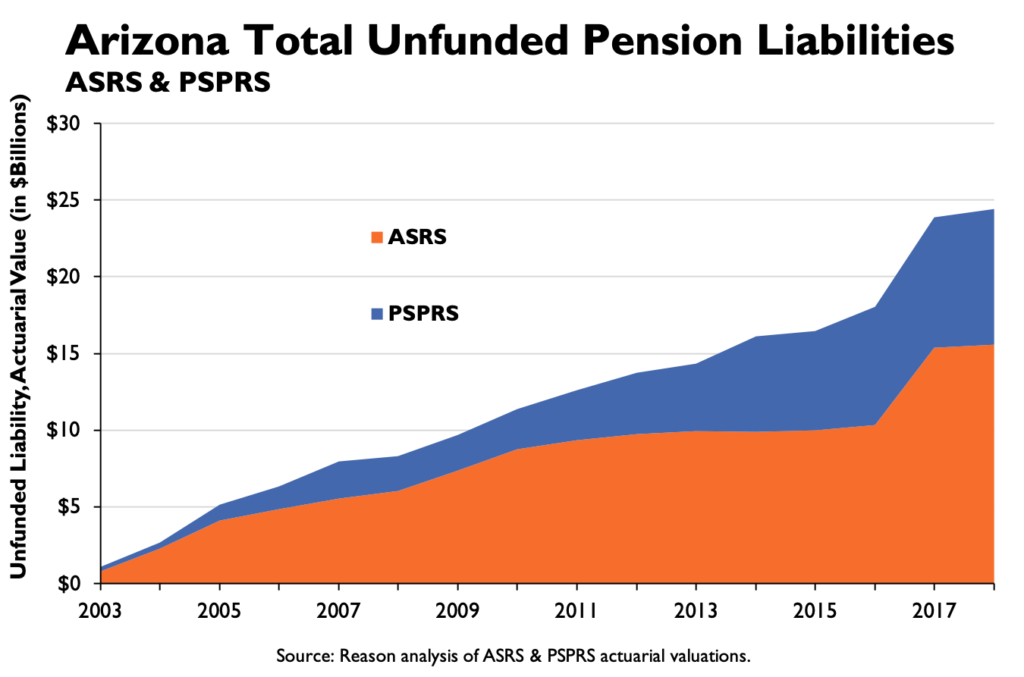

Arizona cities and counties are finding it harder and harder to budget for all of the public services they provide to their taxpayers, and a major culprit is the dramatic growth in pension costs associated both with the Arizona State Retirement System (ASRS) and the state’s Public Safety Personnel Retirement System (PSPRS). An analysis of public financial records reveals that significant growth in pension debt is the primary driver behind the increase in overall costs for Arizona taxpayers. Recognizing this problem, policymakers have implemented some significant reforms for PSPRS over the past few years, though more can be done to improve pension solvency. Even more crucially—judging by the important, and perhaps underappreciated, role it has played in driving costs—policymakers need to consider several areas of reform for ASRS.

Maricopa County: A 14x Increase in Pension Costs

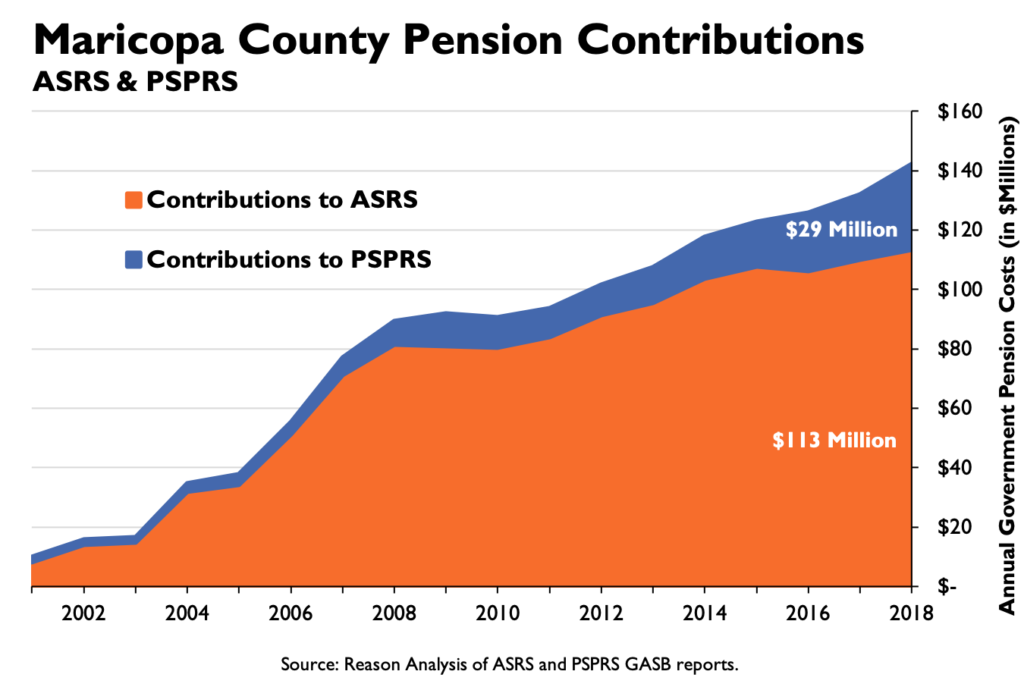

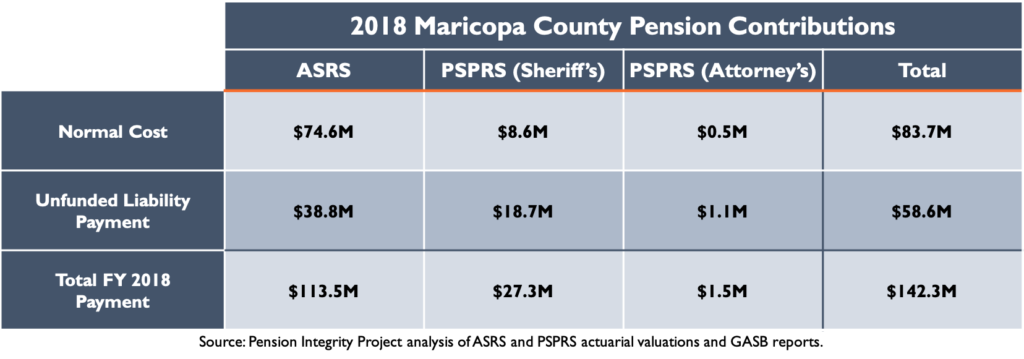

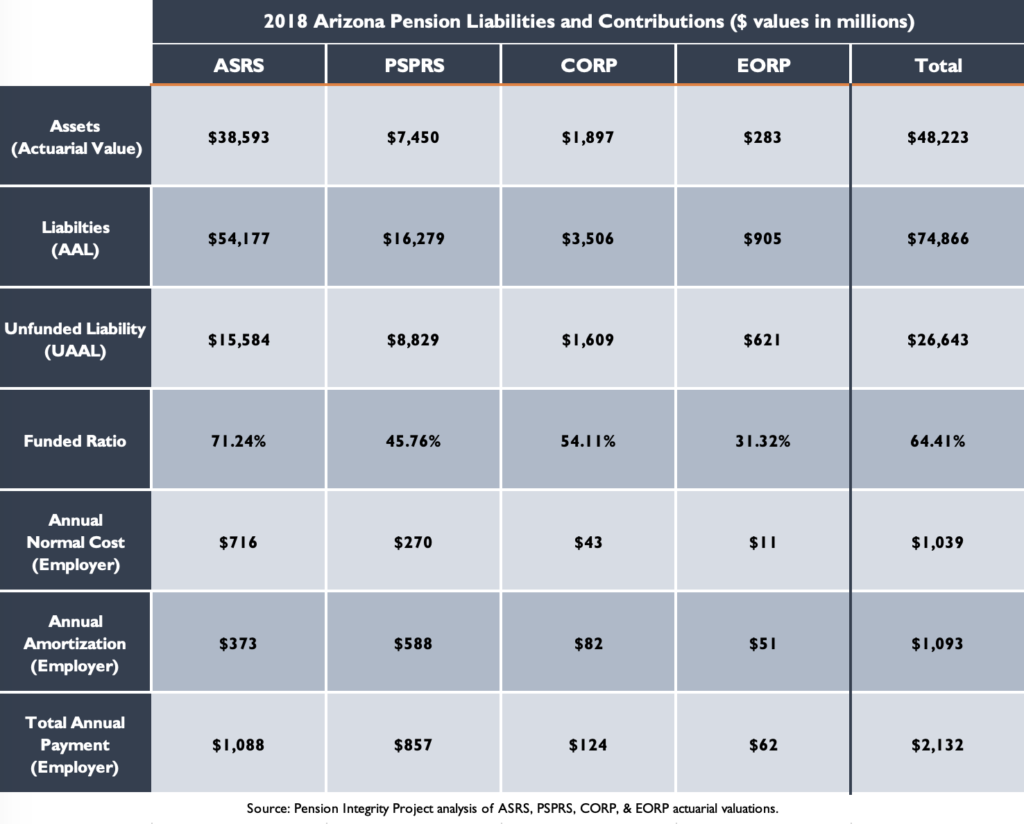

The state’s most populous county, Maricopa, is no stranger to the increasing costs of public pensions. According to the Pension Integrity Project’s analysis of financial documents, the county’s total payments to ASRS and PSPRS have skyrocketed from about $10 million per year in 2001 to more than $142 million in 2018, with $113 million going to ASRS and $29 million going to PSPRS. This analysis does not account for additional costs derived from the Corrections Officers Retirement Plan (CORP) or the Elected Officials Retirement Plan (EORP), which means the costs have grown even more than displayed here (though at a much smaller scale for CORP and EORP relative to ASRS and PSPRS).

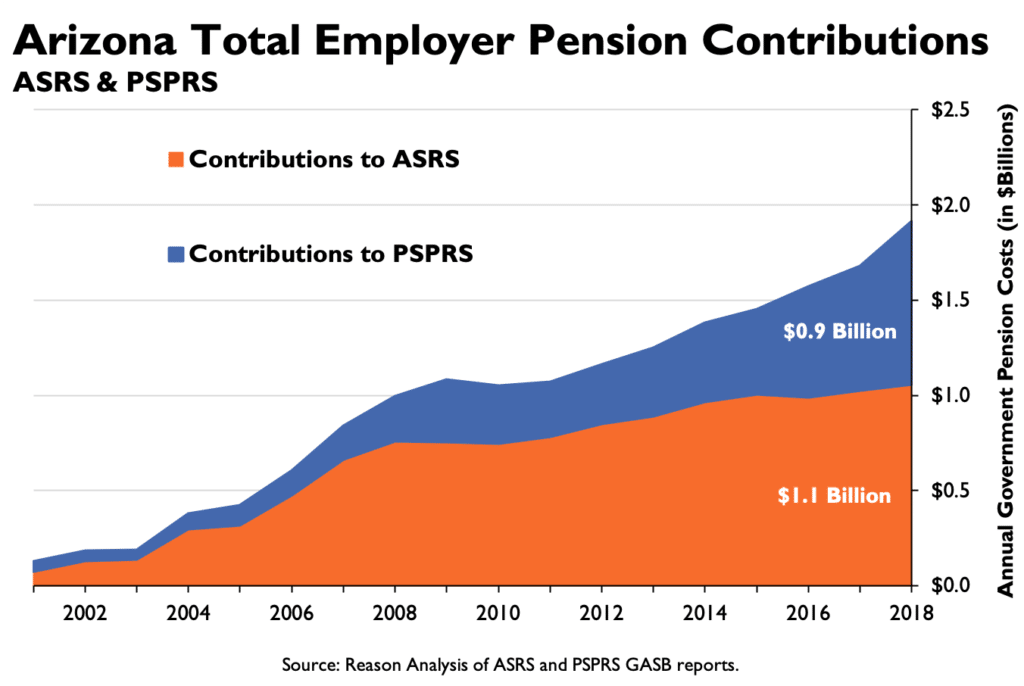

An increase in costs this large has far-reaching effects in local governments—Maricopa County is paying more than 14 times more in aggregate ASRS and PSPRS contributions relative to what it used to less than two decades ago. This is reflective of the overall statewide trend. The total combined annual contributions into ASRS and PSPRS have risen to nearly $2 billion, a big jump from the $128 million in payments in 2001. Though there are certainly varying degrees of severity—some municipalities like Prescott and Bisbee have explored bankruptcy in the recent past in large part due to the rising costs of servicing pension debt—governmental units across Arizona are facing similar challenges to Maricopa County, and local policymakers all across the state are weighing a range of options between reducing services, raising taxes or reprioritizing spending to keep up with the higher price tags attached to ASRS and PSPRS.

Why Pension Costs Are Growing

To some degree, increased dollar values dedicated to these pension payments is expected—as the state’s population grows, state and local governments need more employees, which generates higher overall pension liabilities over time. But in this case—and the case with many underfunded pension systems in the US today—the disparate rates of growth between payroll and pension payments indicate that there is something outside of growing employment that is the main source of increased costs.

To illustrate this point, the total payrolls for ASRS and PSPRS have nearly doubled since 2001. Pension costs, on the other hand, are now fourteen times the amount they were in 2001 for ASRS and seventeen times the amount for PSPRS employers.

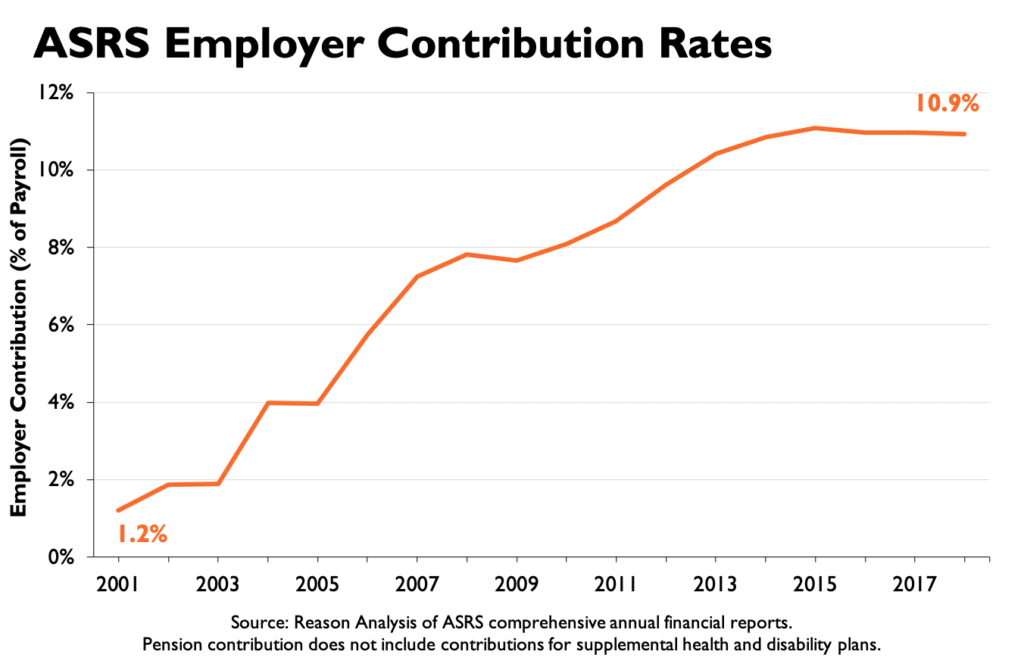

This trend is also visible in annual contribution rates, which are expressed as a percentage of covered payroll. [Note: For the purpose of this analysis, we will consider ASRS as an example since they represent the largest pool of pension liabilities and constitute the majority of overall public pension contributions statewide; however, a similar analysis can be performed for PSPRS.] Employers participating in ASRS have seen their required contributions to the pension plan—excluding contributions to the health and disability plans—go from just under 2 percent of payroll in 2002 to nearly 11 percent over the last sixteen years, a nearly six-fold increase. [Note that the total required contribution for all ASRS post-employment programs, including the health plan, was 11.5 percent of payroll in 2018]. This means that employers like school districts are having to dedicate a significantly larger portion of their budget to pension costs, diverting resources away from the classroom and making it increasingly difficult to adjust teacher salaries and fund other priorities like technology and student enrichment programs.

Notably, since 2001, there have been no major increases in retirement benefits for ASRS members and retirees that would prompt a commensurate ramp-up in costs. In other words, the overall benefits promised to teachers and state and local public employees has remained relatively static over the past two decades, but costs have gone up significantly.

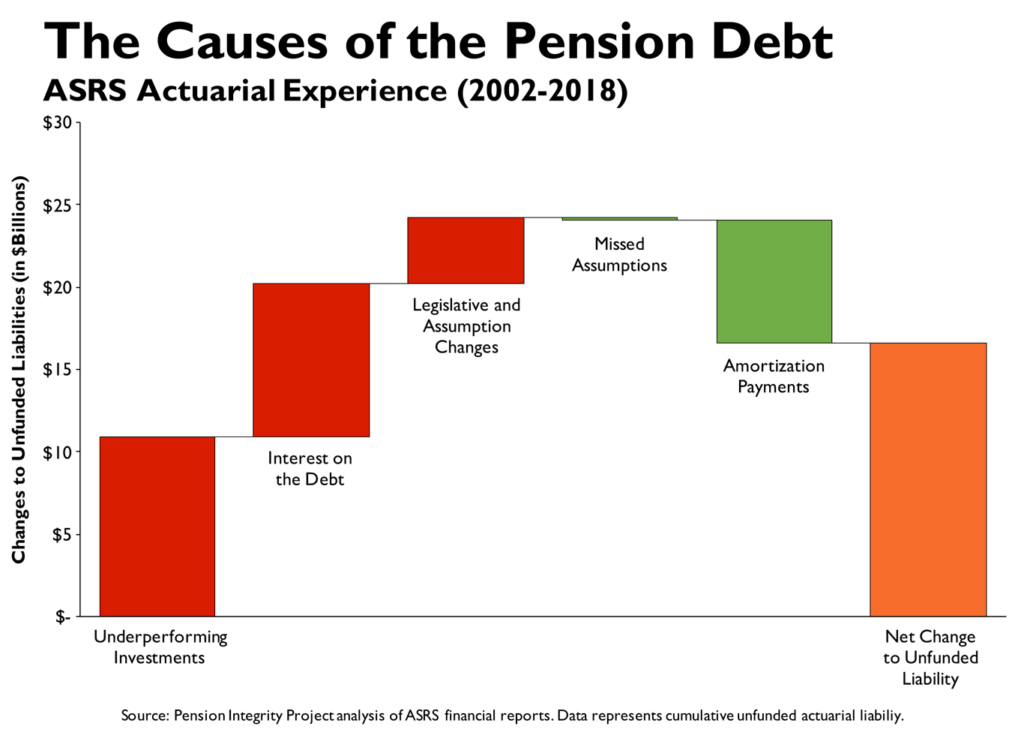

So, what is driving up the costs of Arizona’s pension plans? A deeper analysis of ASRS and PSPRS contributions reveals that Arizona’s escalating pension debt is the primary culprit. Over the past two decades, ASRS has precipitously accumulated an unfunded liability of $15.6 billion, with most—but not all—of the shortfall stemming from underperforming investments. This growing shortfall requires greater annual payments into the fund, so the system can eventually get back to full funding.

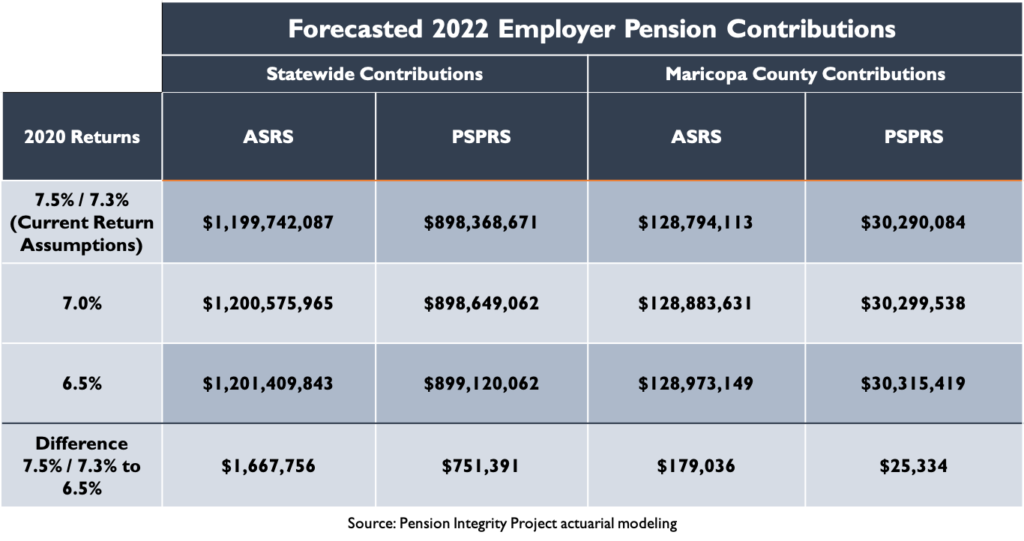

Due to slow adjustments to assumptions and a forecast of lower overall returns when compared to previous decades, investment returns below expectations are likely to apply continued pressure in the form of more pension debt and, consequently, higher annual contributions. Using forecasts of future ASRS and PSPRS contributions under various one-year return scenarios, it is clear that investment underperformance can play a significant role in even more prohibitive costs for all Arizona municipalities.

Just one year of returns at 6.5 percent—about one percentage point below the assumed rate—would require an additional $2.4 million in 2022 contributions for both ASRS and PSPRS combined. Assuming contribution shares stay relatively similar, Maricopa County would be facing an additional $204,370 in 2022 pension expenses under this scenario, with over 87 percent of that ($179,036) coming from added ASRS costs.

Breaking Down the Pension Costs: Funding Benefits Earned Today v. Paying Pension Debt

Splitting annual pension contributions into the amount needed to prefund benefits (also known as the normal cost) and the amount needed to amortize (or pay off) pension debt demonstrates the influence unfunded liabilities are imposing on ASRS and PSPRS contributions. Where no pension debt amortization payments were necessary in 2001, debt payments now make up a third of the annual $1 billion costs for ASRS and two-thirds of the annual $857 million contributed to PSPRS. Splitting contributions by these two categories shows that the main driver of increasing pension costs is, in fact, the significant amount of debt accrued by the system. The following charts illustrate how normal cost and amortization payments have each contributed to growing ASRS and PSPRS costs.

The rising contribution rates reflect that previous economic and demographic assumptions that influence pension math have not held and that the pension promises made to public employees are going to be much more expensive going forward—hence, the rise in the “normal cost” of prefunding future benefits. What’s worse, it took the ASRS board of trustees many years to change outdated actuarial assumptions—primarily the assumed rate of return—creating a large fiscal hole related to current pension liabilities that needs to be filled through additional pension debt payments.

Effectively, employers and members of ASRS are having to pay for both increases at once. This interaction, with pension debt amortization payments driving up pension costs, is ubiquitous among all Arizona governments, from Maricopa County with its 4,000,000 residents to the city of Bisbee with its population of just over 5,000. These amortization payments create significant difficulties for local governments, as they are required to allocate funds that are several multiples of what they used to be just a few years ago. Taxpayers and public employees also bear the brunt of this issue, via increased taxes and pension contributions, all with no improvement (or often a reduction) in services and benefits.

Conclusion

State and local policymakers owe it to their constituents to continue to build upon the reform efforts undertaken with PSPRS in recent years and expand them to ASRS. Through a multi-year effort, public safety employees and employers collaboratively made great strides in addressing the system’s most immediate needs through reform, while not sacrificing the value and attractiveness of the plan. There are still more reforms that could be considered, however, including improvements to funding and amortization policies. Likewise, several issues associated with ASRS continue to put the retirement security of Arizona workers at risk. Stakeholders for both systems need to foster a comprehensive and collaborative effort to manage the growing costs of the retirement plans, preferably one that is based on sound research and common understanding.

Notes on Methodology:

Contribution amounts for Globe are given in ASRS and PSPRS GASB 67 reports going back to 2016. Contributions before 2016 are calculated by applying the average contribution share from 2016-18 to total statewide contributions. Forecasted 2022 contributions use Pension Integrity Project actuarial modeling. Contributions for Globe use the city’s average share of the state’s total contributions from 2016-18 and apply this share to the forecasted total contribution under different return scenarios.

Stay in Touch with Our Pension Experts

Reason Foundation’s Pension Integrity Project has helped policymakers in states like Arizona, Colorado, Michigan, and Montana implement substantive pension reforms. Our monthly newsletter highlights the latest actuarial analysis and policy insights from our team.