Does size matter in the institutional investment world? Conventional wisdom might suggest that it does: The larger the public pension fund, surely the greater the potential investment success. After all, larger pension funds can spend more on consultants and researchers and may have access to better trading and sales infrastructure. Some theorize that a pension system’s sheer size would give it more bargaining power and the ability to negotiate better management fees—a matter where every basis point matters.

However, a closer look at data over the past two decades years reveals that asset size is not meaningfully related to investment performance.

The correlation between public pension funds’ returns and asset size

At the outset, consider that an eventual relationship between asset size and investment return could run in either direction: perhaps larger public pension funds achieve better investment returns, or perhaps larger pension funds are somewhat larger precisely because they achieved better returns in the past. To address this, this analysis considers the relationship between a public pension fund’s investment returns in a given year and the market value of its assets in the previous year.

This analysis uses data from the inaugural edition of the Reason Foundation’s Annual Pension Solvency and Performance Report from 2001 to 2023, which comprises more than 296 individual local and state public pension plans.

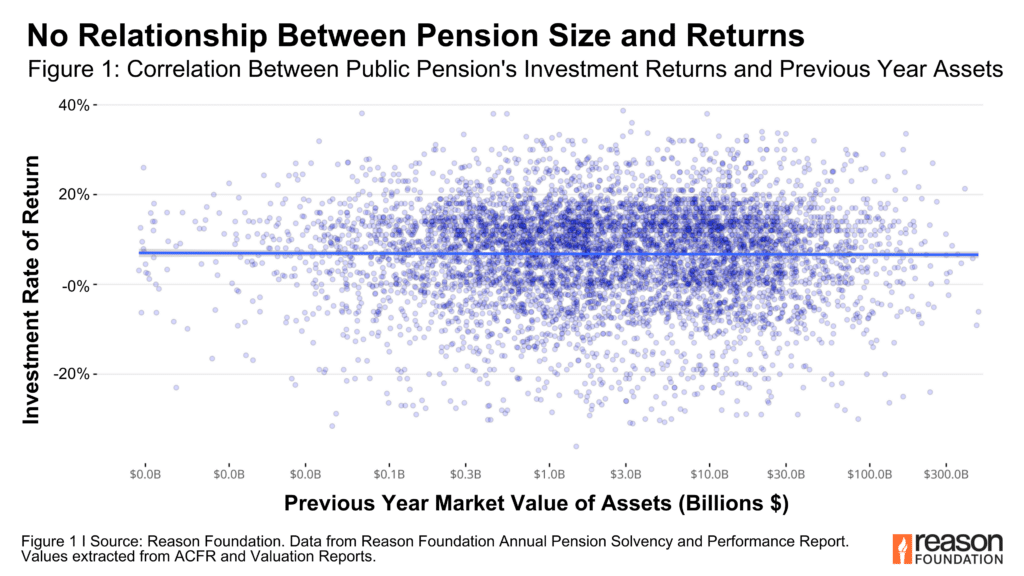

Figure 1 plots the correlation between asset size and investment return. Each dot represents an individual public pension plan’s investment return in a given year and the fair market value of its assets in the previous year.

Figure 1

As observed by the nearly flat line in the graph and the near zero correlation coefficient, the relationship between investment return and previous-year asset size is almost nonexistent. The statistical analysis confirms this weak relationship, with a high p-value (0.609), suggesting that any connection between asset size and returns is likely random rather than meaningful. (For those interested, more detailed statistical results are available in the technical note at the end of this piece.)

Contrary to conventional wisdom, over the past 23 years, virtually none of the variability in investment returns among U.S. public pension funds can be explained by asset size.

But if pension size doesn’t explain investment performance, then what does?

Controlling management quality by size

A National Bureau of Economic Research paper by Juliane Begenau and Emil Siriwardane analyzed the variance of fees charged to public pension funds by private capital funds. The study was based on data from Preqin, a specialized data provider in alternative assets markets, encompassing $438 billion in investments by 218 public pensions into 2,400 funds managed by 856 general partners (GPs). The researchers found that there seemed to be two tiers of pension fees, with a select group of public pensions consistently paying relatively lower fees and achieving higher returns across all their private investments.

The asset size of a pension fund was found to increase its likelihood of being in the “top tier” group—that is, achieving better returns from private capital fund investments at lower fees. However, even after controlling for observable characteristics—including asset size—researchers still found significant disparities in outcomes. This led them to conclude that a significant determinant of pension investment outcomes in private markets is attributed to unobservable and fund-specific traits, like negotiation and expertise.

The largest public pension funds are not always the best

While it’s tempting to assume size would be the most important proxy for a fund’s managerial quality, looking at the top-performing public pension plans over the last 23 years indicates otherwise.

There is no overlap between the top 10 public pension funds by asset size and those by investment returns. Notably, the largest public pension systems tend to significantly underperform the top-performing pensions. Among the top-performing funds, some manage less than $1 billion in assets.

For instance, the Kansas Public Employees Retirement System, KPERS, the best performer in our analysis, delivered an 8.58% average return over the past 23 years with just $26 billion under management.

In contrast, California's Public Employees' Retirement System, CalPERS, the largest public pension in the United States, managed $465 billion in 2023 but only achieved an average return of 5.62% from 2001 to 2023.

Funding level might be a better proxy than size

In a paper titled "Desperate Capital Breeds Productivity Loss," Vrinda Mittal explores the correlation between pension fund size, funding level, and investment outcomes. The study was based on Census Bureau micro-data tracking 9,300 private equity targets from 1979 to 2019 and explored what kinds of pensions end up investing in the best (and worst) private equity funds.

Mittal's findings indicate that companies owned by private equity funds, predominately financed by the most underfunded public pensions, experienced a -5.2% annual change in labor productivity. In contrast, firms backed by all other investors enjoyed, on average, a +5.2% productivity gain.

The study found that the most underfunded pensions consistently invest in the lowest-quality private equity firms. On average, pensions with the lowest funded ratio observe a -10.4% productivity decline in the companies where their private equity general partners invest compared to other investor-backed firms. Funding status, rather than asset size, was a better predictor of public pension investment success in private equity.

The popular belief that larger pension funds have better investment outcomes and necessarily pay lower fees is inaccurate. Size may indeed provide some advantages, but those do not seem to necessarily translate to better returns. The striking variety in size among the public pensions with the best investment performance illustrates the findings of the academic literature. Ultimately, it’s not about the size of a plan’s assets but how its administrators use them. In this context, pension size doesn’t seem to matter.

Technical Notes

Relationship between U.S. Pension Plans investment returns and previous year's asset size data: Reason Foundation’s Annual Pension Solvency and Performance Report.

The correlation and linear model use the previous fiscal year’s asset size (market value of assets) and annual returns for a given year (declared returns in Valuation reports). Because the distribution of asset sizes is heavily skewed while returns are normally distributed, we used a log transformation of asset size to make the data more comparable.

Adjusted R-squared of - 0.0001181, p-value: 0.6087. Similar values are found when using data from PPD (public plan's data).