Florida Gov. Ron DeSantis recently signed Senate Bill 7024, which makes several changes to state employee retirement plans in the Florida Retirement System. The bill is a mixed bag, with some provisions adding more risks and costs to an already strained public pension system, but the more impactful change is improving the long-term viability of the state’s defined contribution plan.

The first change in the law rolls back several cost-saving reforms that were implemented in 2011 for public safety workers, an unfortunate move considering the pension system is still on a long path to consistently being fully funded.

Alongside this potentially costly change, however, comes a positive development for Florida employees and taxpayers. With the passage of Senate Bill 7024, public employers will now increase their contributions to the state’s defined contribution (DC) plan, dubbed the Investment Plan. While this contribution increase comes with a cost increase for taxpayers, it’s crucial for the benefit adequacy of the defined contribution plan, which is a key component in the state’s effort to reduce long-term pension risks and costs for taxpayers.

Florida’s Investment Plan has been a valuable retirement savings option for public workers since 2002. After years of wrestling with unpredictable runaway costs associated with the FRS pension plan, state legislators voted to make the existing DC plan the default option for new hires—excluding police and firefighters—beginning in 2018. Now, the majority of newly hired teachers and government workers participate in the Investment Plan, making it the state’s primary retirement plan and a keystone of the Florida Retirement System for the foreseeable future.

With its increasingly prominent role in providing retirement security for the state’s government workers, many began taking a closer look at the Investment Plan’s long-term viability. Experts familiar with the retirement plan warned that contribution rates below industry standards could result in inadequate savings for retirees, presenting a major hazard for policymakers. If the state’s now-default DC plan was not receiving adequate contributions, it would be unable to achieve its primary purpose of providing a valuable retirement to its members. This meant the strategy of using the Investment Plan to reduce long-term costs and risks was in peril.

Under the guidance of policy experts, including my colleagues at Reason Foundation’s Pension Integrity Project, lawmakers began to address this in 2022 with a 3% increase in employer contributions for all members participating in the defined contribution plan. Prior to this increase, with employees contributing 3% of their paychecks and public employers contributing 3.3% for “Regular Class” employees, most Investment Plan members were seeing a total of only 6.3% of their pay going to their retirement. This was well below the industry guidelines of 12% to 15% of pay going toward retirement.

This inadequate retirement contribution rate also put Florida well below other states that provide DC plans to public workers. With the additional 3% mandated by the 2022 reform, employers’ contributions, paid by taxpayers, increased to 6%. So employees were now seeing a total of 9.3% of their pay going to retirement savings, closing the gap between the contribution amount prescribed by financial experts and seen in other states like Oklahoma and Pennsylvania.

Updates to Florida Investment Plan Contributions by Employment Class

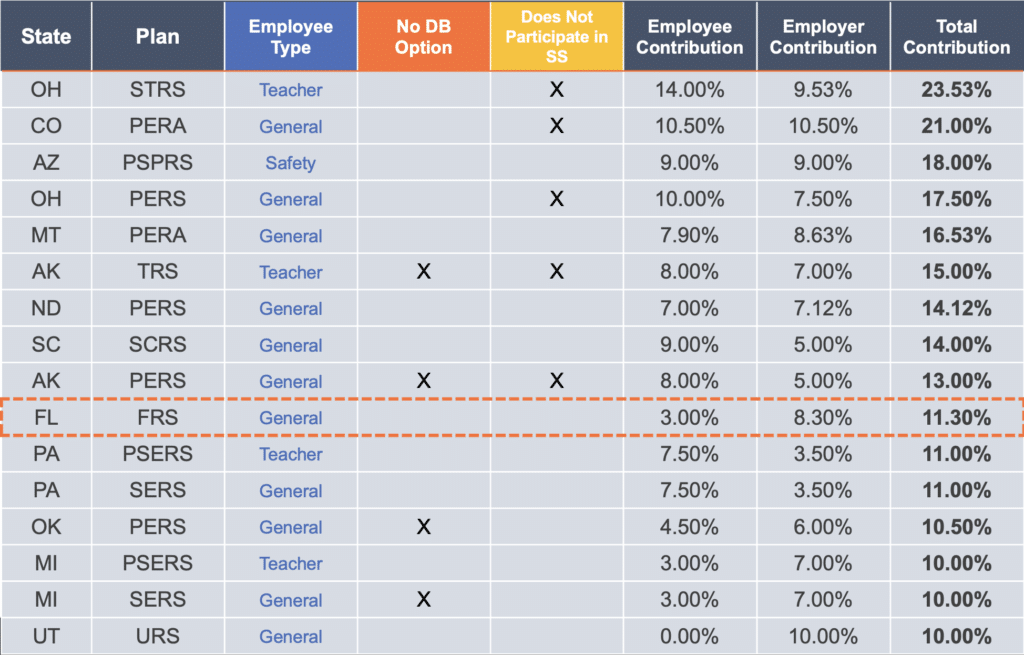

With the passing and signing of SB 7024 into law, Florida lawmakers have taken a crucial second step to address the Investment Plan contribution challenge. The 2% taxpayer-funded contribution increase in SB 7024, on top of the previous 3% increase, brings employer contributions for the state’s Regular Class employees—by far the largest subgroup that covers teachers and most other non-public safety employees—to 8.3% and total contributions to 11.3%. The change pulls Florida’s Investment Plan up from having the lowest contributions among other states with defined contribution retirement plans to being closer to, and even above, some of its peer states.

Contribution Rates for State-run DC Plans (FRS updated)

These successive contribution increases indicate the state’s commitment to providing adequate retirement benefits that do not impose expensive and unpredictable costs on future taxpayers. Florida’s defined benefit pension plan has yet to fully recover from its financial losses during the 2007-2009 Great Recession, which helped generate costs that are nearly double what was previously required (Regular Class government employers have gone from paying 6.18% of their payroll for their employees’ pensions in 2003 to more than 11.91% in 2022).

The defined contribution plan, on the other hand, poses no risk of unexpected costs to the state’s taxpayers. As more incoming workers enter into the DC plan and more DB participants age out, Florida will inch closer to its goal of eliminating costly pension debt. This—along with evolving needs for an increasingly mobile workforce—is why state legislators made the defined contribution plan the default option for new hires beginning in 2018. This move alone significantly slows the accrual of future unfunded public pension liabilities and greatly reduces the long-term costs that come with expensive pension debt.

However, Florida policymakers should not surmise that their work is done now that these changes have been applied to the Investment Plan. Contributions for the Regular Class remain near the bottom ranges of the 12% to 15% standards commonly given by industry experts. Both recent contribution increases have been born solely by employers and, therefore, taxpayers. The next round of reforms should look to increase employee contribution rates, which have remained at 3% for decades.

Florida policymakers should also be wary of more calls to undo previous cost-saving reforms. Despite a still-growing $38.3 billion shortfall in assets needed to cover pension promises already made to FRS members, some have taken the state’s recent budget surpluses and renewed calls from public unions about recruitment and retention challenges to justify costly boosts to retirement benefits. Adding more pension liabilities while the state is having trouble paying for the ones already promised is bad practice and exacerbates a costly problem for Florida taxpayers.

While it did make prudent improvements to the defined contribution plan, Senate Bill 7024 also added new liabilities by restoring pre-2011 features for law enforcement and firefighters’ pensions. The bill drops the retirement age for this group back down from 60 to 55, reduces years of service requirements to 25 years, and eases requirements for members to enter the Deferred Retirement Option Program (DROP). These changes are direct reversals of significant cost-saving measures the state made in 2011. Not only will rolling back these previous pension reforms add annual costs, but they also expose taxpayers to the same risks of unexpected costs that contributed to Florida’s current $38 billion in pension debt.

Giving at least some consolation, lawmakers did partially respond to warnings by removing a provision in the original version of the bill that would have restored a pre-2011 cost of living adjustment (COLA) for retired police and firefighters, which would have added significant costs—around $2 billion annually according to early estimates—and risks to an already underfunded pension system.

The recent actions of Florida policymakers—at least the contribution improvements to the DC plan—are prudent steps toward achieving the difficult task of providing adequate retirement benefits for public workers at a responsible level of risk and cost to the taxpayer. By improving the state’s defined contribution plan, they are bolstering its long-term plan of reducing runaway costs, which will be instrumental in reducing and preventing expensive pension debts for future generations.

Florida policymakers should continue to seek reforms that strengthen the Investment Plan and reduce the risks of public pension debt. It is important to vigilantly guide FRS all the way back to full funding without adding more risks of runaway costs.