Pension Integrity Project

The Pension Integrity Project at Reason Foundation offers pro-bono consulting to public officials and other stakeholders to help them design and implement pension reforms that improve plan solvency and promote retirement security.

-

Evaluating public employee defined contribution options in Oklahoma

Oklahoma's Pathfinder is a leading government-sponsored defined contribution plan, but further modernization is needed.

-

The Gold Standard In Public Retirement System Design Series

Best practices and recommendations to help states move into a more sustainable public pension model for employees and taxpayers.

-

A legislative template for a modernized public sector defined contribution plan

This legislative template offers a policy-based plan design that synthesizes the best aspects of both defined benefit and defined contribution models.

-

Examining the Mississippi Public Employee Retirement System’s challenges

Data and modeling highlighting the causes of Mississippi PERS' rising costs, $25 billion in unfunded liabilities, and the best strategies and policies going forward.

-

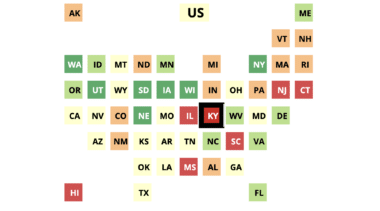

Forecast: State pension debt totals $1.3 trillion at the end of 2023

California, Illinois, New Jersey, and Texas have the most public pension debt.

-

North Dakota enacts landmark public pension reforms

The new pension reform will help solve NDPERS' unfunded liabilities and unsustainable financial trajectory like an oil spill—by both capping the spill and cleaning up what’s already spilled.

-

The costs and risks of proposed public retirement changes in Alaska

Examining several pieces of proposed legislation impacted public pensions in Alaska.

-

Steps to protect public finance from ESG activism

Public pension systems are particularly exposed to the risks associated with ESG and politically-driven investing strategies.

-

Major Florida legislation improves the state’s default defined contribution plan

With this move, Florida continues to demonstrate its commitment to maintaining a retirement system that works for both taxpayers and public workers.

-

Improving the Florida Retirement System’s Investment Plan through increased contributions

The combined 6.3% rate fails to meet private industry minimum standards and places Florida at the bottom of states that offer a defined contribution retirement plan option as a primary source of retirement income.

-

Modernizing Florida retirement: Analyzing recent reform concepts

Comprehensive reform to the Florida Retirement System could protect taxpayers and offer employees a secure retirement.

-

The Challenges Facing the Florida Retirement System Explained

Why Florida's pension debt is rapidly growing, how public pensions are really funded, the ways Florida is failing to provide retirement security to workers, and more.

-

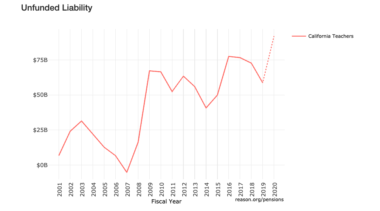

How Teacher Pension Plans Are Impacted by the Economic and Market Volatility

Choose a public pension plan and an investment return rate to see how that plan's unfunded liabilities and funded ratios change.

-

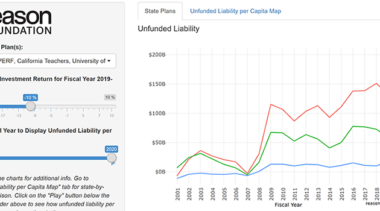

State Pension Challenges – Unfunded Liabilities Before and After COVID-19-Related Economic Downturn

This new interactive tool shows how one year of bad returns can affect the funding status of public pension plans and previews the challenges ahead for state-run pensions.

-

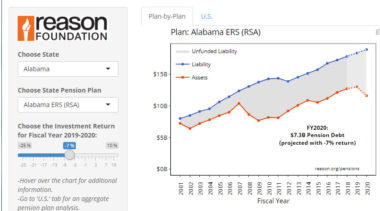

Previewing the COVID-19 Impact on State Pension Plans

Use this tool to choose your state's public pension plans and possible investment return rates to see how unfunded liabilities and funded ratios are impacted.