Leonard Gilroy is vice president of government reform at Reason Foundation and senior managing director of Reason's Pension Integrity Project.

Under Gilroy's leadership, the Pension Integrity Project at Reason Foundation assists policymakers and other stakeholders in designing, analyzing and implementing public sector pension reforms. The project aims to promote solvent, sustainable retirement systems that provide retirement security for government workers while reducing taxpayer and pension system exposure to financial risk and reducing long-term costs for employers/taxpayers and employees. The project team provides education, reform policy options, and actuarial analysis for policymakers and stakeholders to help them design reform proposals that are practical and viable.

Gilroy and the Pension Integrity Project have provided technical assistance to several successful pension reform efforts in recent years in Michigan, Colorado, Arizona, South Carolina and other states aimed at tackling persistent pension solvency challenges.

In his role as vice president, Gilroy also leads Reason's government reform efforts, with over 18 years of experience researching fiscal management, government operations, infrastructure public-private partnerships, government contracting, and urban policy topics. He also regularly consults with federal, state and local officials on ways to improve government performance and efficiency.

Gilroy has a diversified background in policy research and implementation, with particular emphasis on competition, government efficiency, transparency, accountability, and government performance. Gilroy has testified before Congress on several occasions and has testified on pension reform before the Arizona, Florida, Michigan, and Texas legislatures. Gilroy works closely with state and local elected officials across the country in efforts to design and implement market-based policy approaches, improve government performance, enhance accountability in government programs, and reduce government spending.

Gilroy's articles have been featured in such leading publications as The Wall Street Journal, Los Angeles Times, New York Post, The Weekly Standard, Washington Times, Houston Chronicle, Atlanta Journal-Constitution, Arizona Republic, San Francisco Examiner, San Diego Union-Tribune, Philadelphia Inquirer, Sacramento Bee, and The Salt Lake Tribune. He has also appeared on CNN, Fox News Channel, Fox Business, CNBC, National Public Radio and other media outlets.

Prior to joining Reason, Gilroy was a senior planner at a Louisiana-based urban planning consulting firm. He also worked as a research assistant at the Virginia Center for Coal and Energy Research at Virginia Tech. Gilroy earned a B.A. and M.A. in Urban and Regional Planning from Virginia Tech.

-

Nonprofit announces new partnership with Ohio to tackle opioid addiction with ibogaine

A promising new partnership announced in Ohio this week will explore the use of the psychedelic compound ibogaine to treat opioid use disorder.

-

A policy framework for personal psychedelics licenses

Psychedelic licenses for consumers have advantages over the current approach in two U.S. states that rely on professionals to dispense and facilitate services.

-

Major costs and risks associated with restoring the Florida Retirement System’s cost-of-living adjustment

Florida's cost of bringing back COLAs could rise above $32 billion over 30 years.

-

Missouri’s bill would revive bad pension funding policy

Pensions should not rely on variable fee revenue streams tied to the volume of activity in the criminal justice system.

-

Alternative approaches to psychedelics legalization and regulation after California Gov. Newsom’s veto

California is still in a strong position to pioneer the best regulatory system for psychedelics in the world.

-

Texas legislature should prioritize open enrollment and TRS reform in special session

School choice and public school advocates should agree to let students attend any public school with open seats and address the Teacher Retirement System's $63 billion debt.

-

North Dakota enacts landmark public pension reforms

The new pension reform will help solve NDPERS' unfunded liabilities and unsustainable financial trajectory like an oil spill—by both capping the spill and cleaning up what’s already spilled.

-

Examining an Alaska pension reform counterfactual

A look at what would have happened to the Public Employee Retirement System and Teacher Retirement System if proposed pension reforms from 2021 had been enacted.

-

Senate Bill 88 would expose Alaska to potentially higher pension costs

Senate Bill 88 would likely cost Alaska more than $8 billion in the coming decades.

-

House Bill 22 and Senate Bill 35 threaten Alaska’s budgets

HB 22 and SB 35 would likely cost Alaska upwards of $800 million in the coming decades.

-

Senate Bill 11 would bring public pension risk back to Alaska

SB 11 would likely cost Alaska $9 billion in the coming decades.

-

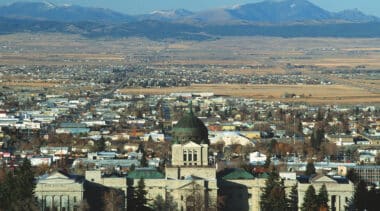

Montana’s default retirement benefit option should best serve most public workers

Montana House Bill 226 would better align the default retirement benefit option with what would best most workers need.

-

Modeling methodology and approach to analysis of public retirement systems

The Pension Integrity Project uses custom-built actuarial and employee benefit models that are tailored to reflect each unique retirement system.

-

Pension changes in House Bill 22 and Senate Bill 35 threaten Alaska’s budgets

HB 22 and SB 35 could cost Alaska upwards of $800 million in the coming decades.

-

Scrutinizing NDPERS’ cost claims on House Bill 1040

NDPERS is choosing to adopt the costliest interpretation of HB 1040 and is cherry-picking the worst from a range of actuarial cost estimates to scare away proponents.

-

Examining the pension reform benefits of North Dakota House Bill 1040

HB 1040 would shift NDPERS to an actuarially sound method of funding, ensuring the state can deliver on its promises to members and retirees.