State pension plans are short on funding for promised benefits by more than $1 trillion, but this shortfall didn’t develop overnight. Over the past couple of decades, pension funds have had trouble keeping up with the accrual of liabilities, largely due to investment returns below expectations and insufficient annual contributions. Due to these conditions, most pension plans failed to fully recover from market losses in 2008. Now, with 2020 shaping up to be a difficult year for market returns, state pension plans face yet another threat to their ability to provide secure and affordable retirement benefits to public workers.

Pension funding involves calculating the cost of promised benefits and making sufficient contributions into a fund so that it can grow through investment gains to meet the cost of providing benefits. Two of the most common metrics to gauge the health of pension funds are the dollar value of unfunded liabilities and the funded ratio percentage, both of which are dependent on the value of accrued liabilities and the value of assets.

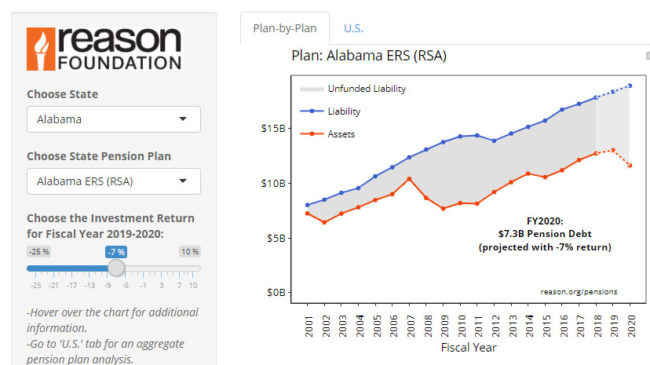

This new interactive tool from the Pension Integrity Project allows you to see the history of asset and liability values for state-run pension plans across the nation. The tool also includes a 2020 market forecast feature that adjusts to the selected return scenario of the user’s choosing.

By selecting a state’s public pension plans, users can see how plan assets have progressed in comparison to the cost of the benefits promised to state workers. Adjusting the 2020 return input shows how one year of bad returns can affect the funding status of a plan and gives a preview of the challenges ahead for state-run pensions.

We recommend viewing this interactive chart on a desktop for the best user experience. If you are having trouble viewing the chart and interactive options on your device, please find a mobile-friendly version here.

Please note that the interactive tool will automatically sleep after a certain idle and can be restarted by simply refreshing the page.

The growth in funding shortfalls amid a record streak of bull market outcomes highlights a major problem in pension policy. And this issue is sure to be exacerbated by losses stemming from COVID-19. Looking forward, state policymakers need to find ways to restructure public pension plans so they are more resilient to market turbulence and are better able to recover from unforeseen events.

Stay in Touch with Our Pension Experts

Reason Foundation’s Pension Integrity Project has helped policymakers in states like Arizona, Colorado, Michigan, and Montana implement substantive pension reforms. Our monthly newsletter highlights the latest actuarial analysis and policy insights from our team.