In This Issue:

Articles, Research & Spotlights

- Pension Reform Drives Fiscal Responsibility, Not Inequality

- How Would Property Tax Cuts Affect Pensions in Texas?

- Pensions Pose a Massive Threat to Louisiana Taxpayers

News in Brief

Quotable Quotes

Data Highlight

Reason Foundation in the News

Articles, Research & Spotlights

Public Pension Reform Does Not Increase Inequality

Facing rising costs and changing retirement needs among modern public workers, many states have reformed their public pension systems in various ways. Many governments have begun offering defined contribution (DC) plans, which pose no risk of unfunded liabilities and provide greater flexibility for public employees. A 2024 paper asserts that this overarching shift from defined benefit pension plans to defined contribution plans in the public sector has slowed economic growth and is to blame for increasing income inequality among this cohort. In a recent commentary, Reason Foundation’s Mariana Trujillo, Rod Crane, and Thuy Nguyen address these claims, identifying problems with the paper’s overly broad categorizations and correlations. A more robust perspective, particularly one that includes intergenerational equity concerns, indicates that good pension reform promotes fairness and does not pass on the costs of today’s public services to future taxpayers.

Will Texas Teacher Pensions Suffer if Property Taxes Are Slashed?

The governor and some Texas lawmakers are vowing major cuts to property taxes this legislative session, but the rising costs for the state’s teacher pension plan would make those property tax cuts particularly difficult. With over $60 billion in pension debt, actuaries for the Teacher Retirement System of Texas (TRS) recently warned of the state’s growing unfunded pension liabilities, which will push the retirement system’s full funding target date beyond 35 years. To address this pension debt, Texas school districts may need to significantly increase their contributions to raise an additional $1 billion per year. Delivering on the envisioned property tax relief will require Texas policymakers to first stabilize the growing costs of TRS with meaningful reform, writes Reason Foundation’s Steven Gassenberger.

In a recent op-ed, Louisiana Gov. Jeff Landry expressed concerns for the growing costs of college football (specifically, coaching contracts) and the potential burden this could impose on Louisiana’s taxpayers. Reason Foundation’s Steven Gassenberger grants that it would be unfair to expect the state’s taxpayers to fund the high costs of firing college football coaches with massive buyouts, but notes that in the case of LSU, private donors are funding the latest coaching buyout, and the governor should be focused on the state’s growing pension debts, which pose a much larger fiscal risk to taxpayers. The state’s pension plan for teachers, for example, has an $8.6 billion funding shortfall, generating annual debt servicing costs that exceed the total budgets of many state agencies combined. This legislative session, Louisiana lawmakers should seek public pension reforms that use realistic funding assumptions and align pension benefit promises with the needs of public employees.

News in Brief

Modest Pension Funding Gains, Driven by Markets

The National Association of State Retirement Administrators (NASRA) 2024 Public Fund Survey shows a small improvement in aggregate public pension funding, rising from 75.7% to 76.7% since 2023. The gain is largely attributable to strong recent investment returns. Funding outcomes vary widely across plans, with funded ratios ranging from 28% to 108% and a median of 77.8%.

Over the past 30 years, roughly 60% of public pension revenue has come from investment earnings, meaning pensions remain highly dependent on market performance to fulfill benefit promises to public workers. Nearly all plans continue to pay out more in benefits than they receive in contributions.

Covered payroll growth accelerated markedly over the past two years, with the median plan reporting 6.8% payroll growth–the highest levels of the century. This rebound partially offsets the post-Great Recession shortfall, but two-thirds of plans still have a smaller payroll base than they would have had under steady 3% annual growth since FY 2009. Read the full report here.

Quotable Pension Quotes

“We have been clear and consistent: investment decisions must be driven by financial returns and fiduciary duty, not political ideology, foreign influence, or outsourced voting decisions that do not serve retirees or taxpayers.”

––Oklahoma State Treasurer Todd Russ quoted in “Executive Order Reinforces Work Underway to Restore Fiduciary Discipline and Protect Investors,” Oklahoma Farm Report, Dec. 22, 2025.

“We’ve reduced it probably by 7 or 8 (billion dollars) by the time you cut through all the actuarial math. So, it’s great progress in paying down the debt, but we still have a material debt.”

––North Carolina State Treasurer Brad Briner quoted in “Despite investment changes paying off, NC treasurer opposes COLA for state retirees,” WFAE, Dec. 20, 2025.

Data Highlight

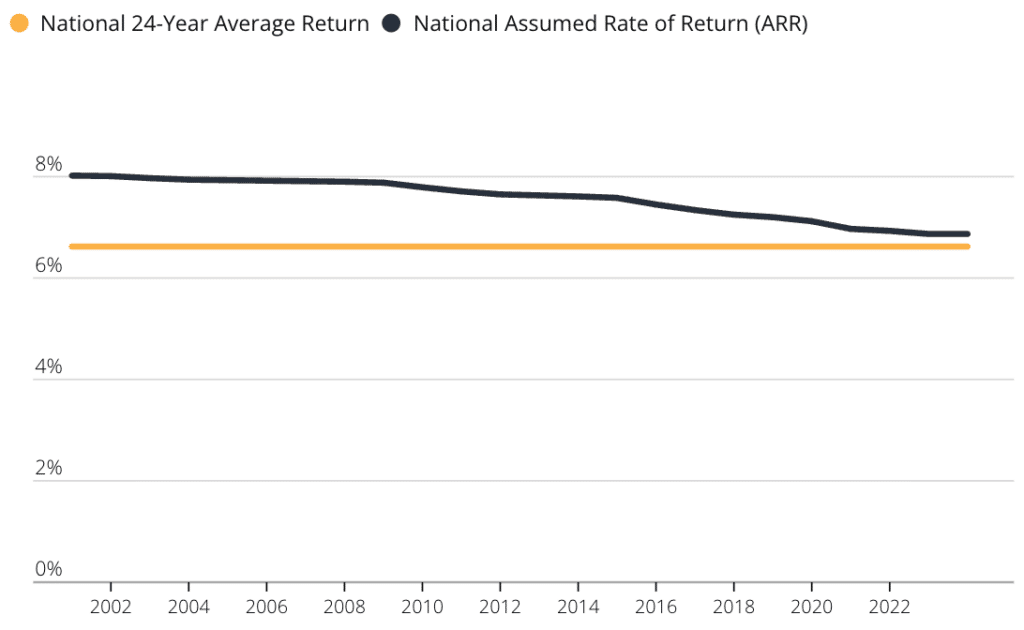

Reason Foundation’s Annual Pension Solvency and Performance Report illustrates changes to the national average assumed rate of return for public pension plans. Since 2001, market assumptions have been adjusted from a national average of 8% to an average 6.9% in 2024. Today’s average assumed rate of return still remains above the 24-year average return result, which is 6.6%. Read the full analysis here.

Reason Foundation in the News

“The Reason Foundation reports it [Illinois] is the only state whose systems owe over $100 billion more than they have on hand.”

— “4 Ways to Break Out of Illinois’ Pension Trap,” by the Illinois Policy Institute, Jan. 13, 2026.