This month’s newsletter from the Pension Integrity Project at Reason Foundation highlights articles, research, opinion, and other information related to public pension challenges and reform efforts across the nation. You can find previous editions here.

In This Issue:

Articles, Research & Spotlights

- Designing an optimized retirement plan for today’s public workers

- North Dakota considers pension reforms

- How ESG policies impact institutional investors

- State pension systems expand high-risk, high-reward investments

News in Brief

Quotable Quotes

Data Highlight

Contact the Pension Reform Help Desk

Articles, Research & Spotlights

Designing an Optimized Retirement Plan for Today’s State and Local Government Employees

The discourse about public retirement policy often revolves around a binary choice between defined benefit (DB) pension plans and 401(k)-style defined contribution (DC) plans. Each has its own unique advantages and drawbacks, but both lack the flexibility to match many unique personal situations. A new paper from Reason Foundation’s Pension Integrity Project proposes that public retirement benefits need not be limited to these two choices any longer. In the new report, public retirement benefit experts and senior fellows Richard Hiller and Rod Crane introduce the Personal Retirement Optimization Plan—or PRO Plan—for the public sector. The PRO Plan adds the element of a guaranteed retirement benefit to a DC foundation to build a more secure, customizable, and portable retirement for public workers. The PRO Plan is built around the objectives of risk-managed retirement income adequacy, and unlike traditional public pension plans, does not impose funding risks on government employers. Testing this newly proposed PRO Plan design, Hiller and Crane find that the costs of providing guaranteed annuitized benefits through the PRO Plan would be much lower than an individual purchasing these benefits on their own.

- Full Report—The Personal Retirement Optimization Plan: An Optimized Design for Government Employees

- FAQ: Frequently asked questions about the PRO Plan

- Webinar: Experts discuss the need for the Personal Retirement Optimization Plan

Evaluating North Dakota’s House Bill 1040

Facing $1.8 billion in unfunded pension liabilities, and projections that the pension fund will be depleted within 80 years, North Dakota policymakers are seeking comprehensive reform of the North Dakota Public Employees Retirement System (NDPERS). The newly introduced House Bill 1040 would address many of the issues that have been plaguing the system for decades. Firstly, it would fix the state’s systematic funding deficiencies by switching from a statutory to an actuarial contribution policy. This would ensure that state and local governments are making the payments needed to fulfill all pension promises by a predetermined date. Second, the reform would provide new hires, beginning in 2025, a defined contribution (DC) plan that meets a high standard of benefit design. Reason Foundation’s analysis of House Bill 1040 finds the proposed reforms would effectively halt the accrual of new unfunded liabilities with new hires, and would reduce long-term costs of the pension plan by responsibly paying down its legacy debt.

- Testimony to North Dakota House Government & Veterans Affairs Committee

- Examining the Benefits of House Bill 1040

- The Public Pension Gold Standard, North Dakota’s HB 1040, and the Status Quo

- Does HB 1040 Meet the Objectives of Good Pension Reforms?

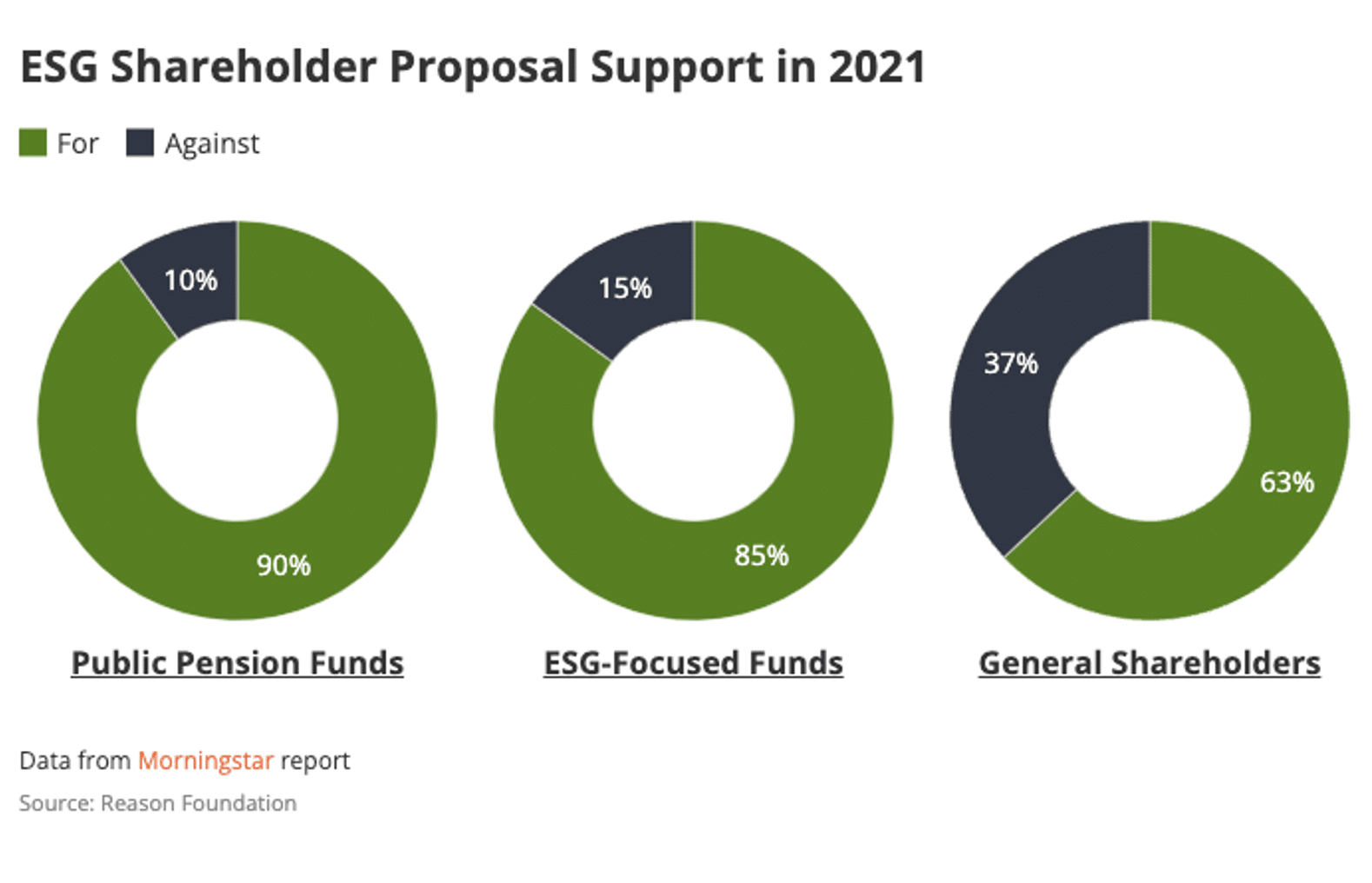

The Mechanics of ESG-Driven Divestment, Engagement, and Proxy Voting

Environmental, social, and governance (ESG) policies can take many different forms and are applied by a wide variety of organizations, but the foundational goal is to influence investors’ and corporations’ decision-making. In this commentary, Jordan Campbell examines two main avenues used to leverage this influence and how groups are trying to reshape the market through divestment and corporate engagement. Although there is no clear impact of ESG divestment practices, there has been a noticeable rise in ESG engagement practices, namely proxy voting. Data indicates that public pension funds have outpaced other institutional investors—and even ESG-focused funds—in throwing support behind ESG resolutions.

In Search of Higher Returns, Public Pension Systems Dive Deeper into Alternative Investments

Public pension plans saw significant investment losses in 2022, and economic forecasts indicate that more market turbulence is in store for 2023. Facing this increasingly unpredictable and volatile investment environment, and under pressure to achieve often overly-optimistic investment return assumptions, many public pension plans continue to dive deeper into high-risk, high-reward strategies. Reporting on these trends, Reason’s Steve Vu highlights several states, including New York, California, Texas, Ohio, Iowa, and New Mexico, where policymakers are loosening up limits and increasing targeted allocation in alternative investments like private equity, private credit, and real estate.

News in Brief

End-of-Year Update Describes a Tough 2022 for Public Pensions

An update to the State of Pensions report by Equable Institute summarizes the funding status of 228 state and locally administered pension plans at the end of the 2022 calendar year. Their calculations indicate that the aggregate funded ratio of these plans dropped from 83.9% funded the previous year to 77.3% in 2022, marking a significant reversal of the investment gains gathered during a record-breaking year of returns in 2021. They estimate an average return of -6.14% for the last year, which falls dramatically below the average plan assumption of 6.9%. Analysis in the report finds that—facing ongoing challenges in 2023—most state retirement systems remain fragile to a volatile and increasingly unpredictable market. The full update is available here.

Brief Examines Pension Contribution Behaviors of Governments

A new brief by the National Association of State Retirement Administrators (NASRA) focuses on the contributions that state and local employers made to fund the pension benefits promised to public workers through 2021. They find that of the more than $10 trillion in pension revenue generated since 1992, $2.5 trillion came from employer contributions, $1.1 trillion came from employee payments, and $6.5 trillion (64%) came from investment returns on those gathered funds. The brief recognizes the efforts of governments to reach actuarially determined contribution rates, finding that the average percentage of actual to actuarial contributions to be 99.3% in 2021, the best rate since 2001 and a major improvement from the below 80% paid in 2012. The brief attributes much of this improvement to reforms of contribution policies and supplemental payments from general government funds. The full brief is available here.

Quotable Quotes on Pension Reform

“There’s going to be acute fiscal pain and pressure the more you ignore the cost…If you’re not paying it down, you’re chasing it.”

—Leonard Gilroy, managing director of Reason Foundation’s Pension Integrity Project, on unfunded pension liabilities in “State Pension Plans Were Hammered in 2022. Next Year Will be Worse,” Politico, Dec. 28, 2022.

“Chicago government-worker pensions are massively underfunded. So in typical Chicago-land fashion, the City Council is betting on casino revenue to plug the pension gap. Do taxpayers and workers feel lucky?… The police and firefighter pension funds are only about 20% funded—among the worst in the country—even though 80% of city property tax dollars go toward pensions. The city’s annual pension payments have risen by $1 billion over the past three years.”

—The Wall Street Journal Editorial Board on the move to build a casino to generate tax revenue dedicated to the police and fire pension funds in “Chicago’s Big Pension Gamble,” The Wall Street Journal, Jan. 2, 2023.

Data Highlight

Each month we feature a pension-related chart or infographic of interest generated by our team of Pension Integrity Project analysts. This month, analyst Jordan Campbell, using Morningstar data, created a visualization comparing how public pensions and other institutional investors voted on ESG shareholder proposals. You can access the graph here.

Contact the Pension Reform Help Desk

Reason Foundation’s Pension Reform Help Desk provides technical assistance for those wishing to pursue pension reform in their states, counties, and cities. Feel free to contact the Reason Pension Reform Help Desk by e-mail at pensionhelpdesk@reason.org.

Follow the discussion on pensions and other governmental reforms at Reason Foundation’s website and on Twitter @ReasonPensions. As we continually strive to improve the publication, please feel free to send your questions, comments, and suggestions to zachary.christensen@reason.org.

Stay in Touch with Our Pension Experts

Reason Foundation’s Pension Integrity Project has helped policymakers in states like Arizona, Colorado, Michigan, and Montana implement substantive pension reforms. Our monthly newsletter highlights the latest actuarial analysis and policy insights from our team.