In This Issue:

Articles, Research & Spotlights

- Analysis of Mississippi’s Pension for Public Workers

- Florida Legislature Considers Costly Reform Rollback

- New Bill in Alaska Would Greatly Improve Retirement Benefits for Teachers

- Success in Achieving Full Pension Funding

- Perverse Incentives from Proposal to Use Citations to Fund a Missouri Pension

News in Brief

Quotable Quotes on Pension Reform

Data Highlight

Contact the Pension Reform Help Desk

Articles, Research & Spotlights

Examining the Mississippi Public Employee Retirement System’s Challenges

The Mississippi Public Employees Retirement System, MPERS, faces significant headwinds in fulfilling the pension promises made to the state’s police, teachers, and other public workers. Persistent investment results below expectations and chronic underpayment into the pension system have resulted in an over $25 billion shortfall in the funds needed to pay for accrued benefits. MPERS estimates it only has 56 cents of every dollar owed to beneficiaries. Complicating matters, the Mississippi legislature has been reluctant to financially commit to the growing public pension costs. To communicate the urgency of the matter facing policymakers, the Pension Integrity Project published a detailed analysis of MPERS’ ongoing funding challenges and the types of solutions needed to get the system back on track. The analysis also includes interactive modeling of the plan to evaluate proposals made by the system, finding that the suggested adjustments will likely not be enough to achieve long-term goals of solvency.

To address growing pension costs and funding challenges, Florida lawmakers passed several reforms to the Florida Retirement System, FRS, in 2011. These changes were a crucial part of the state’s strategy to fully fund the pension system for government employees. Despite still being decades away from achieving this goal, Florida House Bill 151 (HB 151) aims to undo some prudent cost-saving pension reform measures enacted 13 years prior. The legislation—currently under consideration in the House of Representatives—would bring back expensive cost-of-living adjustment (COLA) benefits for employees hired before 2011. The cost of this measure could vary significantly depending on market outcomes. Reason Foundation’s modeling of FRS indicates that House Bill 151 could add over $32 billion in additional costs over the next 30 years. Policymakers must consider the dangers of adding more costs to the already $42 billion in debt FRS has before committing future generations to paying for this additional obligation.

Alaska lawmakers will have the opportunity to weigh two different proposals to change the retirement benefits for public workers in the state. The first, Senate Bill 88, would reopen the pension that was closed to new hires in 2005 due to ongoing funding problems. The second, House Bill 302 (HB 302), aims to greatly improve the defined contribution (DC) benefits currently offered to the state’s teachers, police, and firefighters. HB 302 would increase employer contributions into the defined contribution accounts of public safety workers and grant teachers access to the Supplemental Benefit System-Annuity Plan (SBS-AP) that all other government workers in the state already enjoy. Reason’s Ryan Frost explains how a focus on improving the existing DC benefits would be the better approach and warns that a return of the old pensions would apply immediate risks to the state budget.

How Oklahoma’s Public Pension Reforms Led the State Employees’ Plan to Full Funding

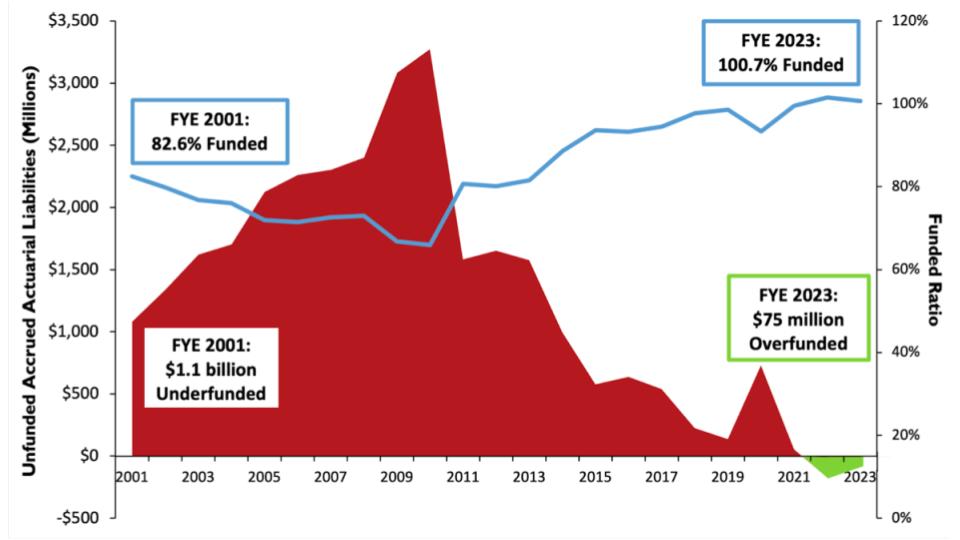

In an environment of chronically underfunded public pensions nationwide, Oklahoma stands out in proactively addressing the challenges that led to massive pension debt for the Public Employees Retirement System in the early 2000s. Due to significant pension reforms in 2011 and 2014, which eliminated costly benefits and directed all new hires into a well-structured defined contribution plan, policymakers rapidly improved the pension system’s funding from just 66% in 2010 to its current full funding. Reason’s Rod Crane explains what Oklahoma did right in this transition from a defined benefit plan to DC and the process of properly recovering from the Great Recession. Crane also highlights the valuable DC benefit that better fits modern workers in the public sector and the importance of staying the course after effective reforms are achieved.

Missouri’s House Joint Resolution 92 Would Revive Bad Pension Funding Policy

A proposal being considered in the Missouri legislature (House Joint Resolution 92) would tie public pension contributions to revenues from traffic citations, directing $3 from each violation fee to pay for the Missouri Sheriffs’ Retirement System. A backgrounder from Reason Foundation’s Leonard Gilroy and Ryan Frost explains that this is an improper method for funding promised pension benefits, as contributions will fluctuate depending on the number of violations pursued, not to mention the perverse incentives it would unjustly apply to maximize enforcement. Instead, lawmakers should pursue actuarially sound methods to pay for the state’s public pension systems.

News in Brief

Analyzing the Risks of Pension Obligation Bonds, a Case Study from Massachusetts

A recent paper by Mark Davidson at Clark University conducted a case study on pension obligation bonds (POBs) by analyzing recent issuances from three Massachusetts municipalities. The average yearly POB repayment as a percentage of annual discretionary expenditures for the cities analyzed neared 30%. The paper discussed the potential for investment underperformance, which may pressure pension investment managers to pursue even more risky investments. Timing of issuance matters, as common times of POB issuance can be counterproductive for yielding positive returns–that is times with falling interest rates but increasing investment appetite. The paper also sheds light on the illusory effect of pension obligation bonds on funding ratios and their potential to obscure the need for pension reforms. The full paper can be found here.

The Rise in Pension Contributions in 2022: Report Discusses Trends in Government Spending with Pensions

The latest Issue Brief by the National Association of State Retirement Administrators (NASRA) delves into the landscape of state and local government pension spending in the United States. In 2021, 5.06% of all state and local government spending (excluding federal funds) was used to fund pension benefits for state and local government employees. In 2022, $221 billion in public dollars were directed to public pension funds, an increase of nearly 20% from the prior year, primarily due to the increase in additional funding above actuarial requirements by several state and local governments in that year. The study anticipates a substantial increase in public pension spending, projecting an uptick from 5.06% to 5.76% of annual budgets spent for the incoming fiscal year 2022 numbers due to the above actuarially required contributions. Notable instances include Arizona’s $1 billion supplement, California’s $1.9 billion payment to address the California Public Employee Retirement System’s (CalPERS) unfunded liability, Connecticut’s $1.6 billion excess contributions, and Virginia’s $750 million supplemental payment. There is significant variation among states and municipalities on the share of state direct spending directed to pensions, ranging from under 2.0% to over 10.0%. The full report can be found here.

Quotable Quotes on Pension Reform

“We should not be looking to use our pension funds as a lever to enact public policy,”

—New Jersey Business and Industry Association Vice President Ray Cantor in “Pushing NJ pension funds to unload fossil-fuel investments (again),” NJ Spotlight News, Feb. 6, 2024

“If you can’t meet your obligations, and this is an obligation, then I don’t know why anybody would come work at the city,”

— Dallas Ad Hoc Pension Committee Councilmember Paula Blackmon in “Dallas Continues To Look for a Long-Term Plan To Fix Its Pensions” Dallas Observer, Feb. 1, 2024

Data Highlight

Each month, we feature a pension-related chart or infographic of interest generated by our team of analysts. This month, we are showcasing a graph from Reason Foundation’s Rod Crane, visualizing the unfunded liability journey of the Oklahoma PERS plan after major pension reforms made in 2011 and 2014. You can access the visualization and a detailed examination of the topic here.

Stay in Touch with Our Pension Experts

Reason Foundation’s Pension Integrity Project has helped policymakers in states like Arizona, Colorado, Michigan, and Montana implement substantive pension reforms. Our monthly newsletter highlights the latest actuarial analysis and policy insights from our team.