This newsletter from the Pension Integrity Project at Reason Foundation highlights articles, research, opinion, and other information related to public pension challenges and reform efforts across the nation. You can find previous editions here.

In This Issue:

Articles, Research & Spotlights

- Great Investment Return News, But Public Pensions Still Need Reform

- New York State Adopts Lower Investment Return Assumption

- Ohio Teachers Seek More Transparent Investments

News in Brief

Quotable Quotes on Pension Reform

Data Highlight

Contact the Pension Reform Help Desk

Articles, Research & Spotlights

Three Reasons Why Public Pensions Still Need Reform Despite Strong 2021 Returns

Record investment returns in the 2021 fiscal year will have a significant positive impact on the funding of public pension systems, but it is also important for policymakers to recognize that one year of excellent returns does not mean public pensions no longer need reform.

The Pension Integrity Project’s latest analysis gives three reasons why a year of very good investment returns, while welcomed, has not changed the underlying challenges that continue to threaten the long-term security of most public pension plans. First, current actuarial practices mute the effect of one outsized year of good or bad performance in order to help maintain budget predictability. Second, market experts are still projecting future investment returns to be well below the assumed rate of return of most public pension plans. And third, using the modeling of various market stress scenarios, it is clear that some public plans remain very vulnerable to volatile market swings.

New York Lowers the State’s Assumed Rate of Return for Public Pension Investments

The New York State Common Retirement Fund—the nation’s third-largest public pension system—announced a blockbuster reduction to its assumed rate of return (ARR). The plan will wisely lower its assumed rate of return from 6.8% to 5.9%. This new assumption will be the second-lowest ARR among the nation’s 180 largest state and local pension plans. Reason’s Jen Sidorova details the reasoning behind this move, explaining that the new assumption will match recent experience for state pensions (5.7% over the last 20 years) and reduce the risks of future growth in unfunded pension liabilities.

Ohio’s Teacher Retirement System Lacks Investment Transparency

An independent review commissioned by the Ohio Retired Teachers Association found that the state’s teacher pension plan is paying a high price to investment managers and is lacking in transparency. Using public reporting, Reason’s Marc Joffe finds that the plan’s $175 million in alternative investment fees make up the bulk of this expense. With $24 billion in unfunded liabilities (and that amount is calculated using an overly-optimistic assumed rate of return), Ohio’s teacher plan needs to identify ways to cut costs and improve funding.

News in Brief

New Report Evaluates the ‘Funding Discipline’ of Public Pensions and OPEBs

A new report for S&P Global surveys the funding progress of state pensions plans and other post-employment benefits (OPEBs). While most plans saw a drop in funding by the end of fiscal year 2020, S&P Global finds that excellent 2021 returns will greatly improve funding levels. OPEBs, on the other hand, remain significantly underfunded, with most states not contributing enough to prefund these promised benefits. The report identifies several examples of increased “funding discipline” among pensions, in which plans are adopting less risky investment strategies while simultaneously lowering their assumed rates of return. They anticipate that this trend will continue with more plans going forward, which will lead to higher reports of liabilities, but also improvements to funding progress and volatility management. The full report is available here.

Two New Reports Assess Pension Funding Progress but Warn of Risks Ahead

Two newly released reports update the overall funding progress of state and local plans. First, Equable Institute’s “State of Pensions” report finds a dramatic funding increase in all pension plans due to the outstanding FY2021 market returns, with the aggregate funded ratio improving from 71% to 80.9%. According to the analysis, reported unfunded liabilities among all major state and local pension plans will drop from $1.48 trillion to $1.08 trillion. Despite these positive results, Equable predicts that public pension plans will (and should) continue to reduce their assumed rate of return in the coming years. Positive steps are being made to improve the resiliency of pension plans, but reforms are still needed to ensure their long-term viability. This full report is available here.

Second, a new brief from The Pew Charitable Trusts also finds that 2021 returns will help the funded levels of public pension plans exceed 80% for the first time since 2008. They recognize that state and local governments have improved on annual funding policies, leading to contributions that are closer to actuarial requirements. An increasing number of states are achieving positive amortization, meaning that they are now making progress in eliminating their public pension debt. These very positive developments aside, the report notes long-term investment returns are expected to remain low so most public plans will still need to make reforms. The full Pew report is available here.

Quotable Quotes on Pension Reform

“If we have another 2008, that’s going to devastate a lot of plans…These plans are paying out more in benefits than they are collecting in contributions, and so you have a down year, you have less assets to recover.”

—Chief Executive Officer of Cheiron actuarial consulting firm Gene Kalwarski, cited in “Blockbuster Gains Have Public Pensions Dialing Back Projections,” Bloomberg, Aug. 26, 2021

“The reality is that the problems detailed in this report are significant and can no longer be ignored. While I commend Gov. Murphy for making the full pension payment this year, the reality is that there is no solution in sight for a year when we do not have federal financial assistance. It is now time to act for the sake of our state’s future.”

—Former New Jersey Gov. Thomas H. Kean on a new state budget analysis, cited in “GSI Report: Toward a Fiscally Sustainable New Jersey: Analysis & Recommendations,” The Garden State Initiative, Sept. 22, 2021

“This is a critical issue, and one of the reasons that this needs to be watched closely is that there is such a mix of short-term and long-term benefits and challenges, depending on how this is addressed…There’s an immediate budget challenge posed by the need for this huge increase in the contribution in 2023.”

—President of Wisconsin Policy Forum Rob Henken on Milwaukee’s pension challenge, cited in “Milwaukee’s Pension Problem is Threatening City Services. Here’s What You Need to Know About the City’s Tough Choices”, Milwaukee Journal Sentinel, Sept. 9, 2021

Data Highlight

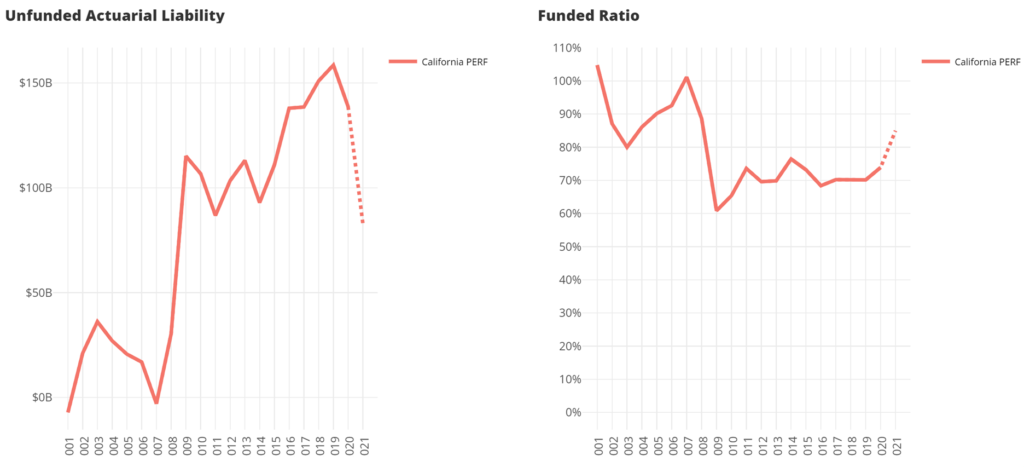

Each month we feature a pension-related chart or infographic of interest generated by one of our Pension Integrity Project analysts. This month, analysts Truong Bui and Jordan Campbell generated a tool to project 2021 unfunded liabilities and funding ratios for each major state pension plan. The tool visualizes funding progress going back two decades and allows the user to apply any 2021 return rate to preview the estimated results. You can access the tool here.

Contact the Pension Reform Help Desk

Reason Foundation’s Pension Reform Help Desk provides information on Reason’s work on pension reform and resources for those wishing to pursue pension reform in their states, counties and cities. Feel free to contact the Reason Pension Reform Help Desk by e-mail at pensionhelpdesk@reason.org.

Follow the discussion on pensions and other governmental reforms at Reason Foundation’s website and on Twitter @ReasonPensions. As we continually strive to improve the publication, please feel free to send your questions, comments and suggestions to zachary.christensen@reason.org.