A new interactive website, UnfundedMichigan.org, pulls together data from over 2,700 financial reports by counties, cities, townships, villages, commissions, and authorities across Michigan to give taxpayers a simple, clear way to find and compare the unfunded pension and health care liabilities owed by their local governments at all levels, including, villages, towns, cities, and counties. The website, UnfundedMichigan.org, reveals unfunded retirement benefits total over $18 billion statewide.

While public sector retirement benefits vary considerably from local unit to local unit in Michigan, they are generally provided via defined-benefit pensions and retiree health care insurance, often referred to as ‘other post-employment benefits’ or OPEB.

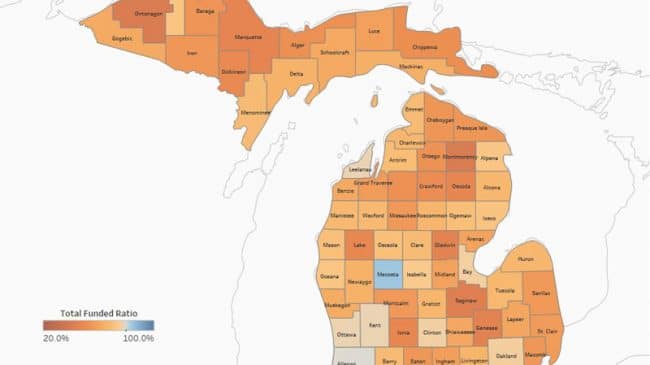

UnfundedMichigan.org reveals that 81 of 83 counties in Michigan have at least one local unit of government with a pension or OPEB plan that is less than 60 percent funded, the level typically considered critically underfunded. In fact, a total of 245 of Michigan’s cities, counties, townships and other municipal units have saved less than 1 percent of what is necessary to pay for retirees OPEB benefits.

“The problem of unfunded local government pension and retiree health care benefits is not isolated to one geographic part of Michigan, or specific to just poor communities or particular types of government agencies,” said Anthony Randazzo, managing director of the Pension Reform Integrity Project at Reason Foundation. “This widespread problem with unfunded liabilities means that more and more revenue from today’s taxpayers is being consumed to cover these obligations, crowding out the ability for local governments to fund basic services, ensure police and fire departments are fully staffed, pay for road improvements, and provide public goods such as libraries and parks.”

County governments have $4.3 billion in unfunded pension and OPEB liabilities. The greatest unfunded and OPEB liabilities for county governments on UnfundedMichigan.org are:

- Wayne County — $336.6 million in unfunded liabilities for OPEB ($350.8 million in projected benefits, $14.2 million in assets)

- Genesee County — $308.8 million in unfunded liabilities for OPEB ($341.6 million in projected benefits, $32.8 million in assets)

- Macomb County — $293.0 million in unfunded liabilities for OPEB ($504.4 million in projected benefits, $210.6 million in assets)

UnfundedMichigan.org finds cities that offer retiree healthcare benefits have only saved 19 percent of the money necessary to pay for their OPEB benefits. The biggest unfunded OPEB liabilities by city include:

- Taylor — $331.1 million in unfunded liabilities for OPEB, and no assets saved

- Westland — $279.6 million in unfunded liabilities for OPEB, and no assets saved

- Flint — $273.7 million in unfunded liabilities for OPEB, and about $138,000 in assets saved

Townships and villages that offer retiree health care benefits have only set aside 20 percent of the money necessary to pay for those benefits. The largest unfunded OPEB liabilities by township and villages:

- Waterford Charter Township — $169.5 million in unfunded in unfunded liabilities for OPEB

- Bloomfield Charter Township (Oakland County) — $152 million in unfunded liabilities for OPEB

- Redford Charter Township (Wayne County) — $126 million in unfunded liabilities for OPEB

“The data on UnfundedMichigan.org shows that public services and retirement benefits are at risk in a much wider area than previously recognized, and that their disruption could affect families in every corner of Michigan,” according to Randazzo.

About Reason Foundation

Reason Foundation is a nonprofit think tank dedicated to advancing free minds and free markets. Reason Foundation produces respected public policy research on a variety of issues and publishes the critically acclaimed Reason magazine and its website www.reason.com. For more information, please visit www.reason.org.

Contact

Patrick McMahon

Communications Specialist

Reason Foundation, Reason magazine, Reason.tv

patrick.mcmahon@reason.org

(954) 415-8913