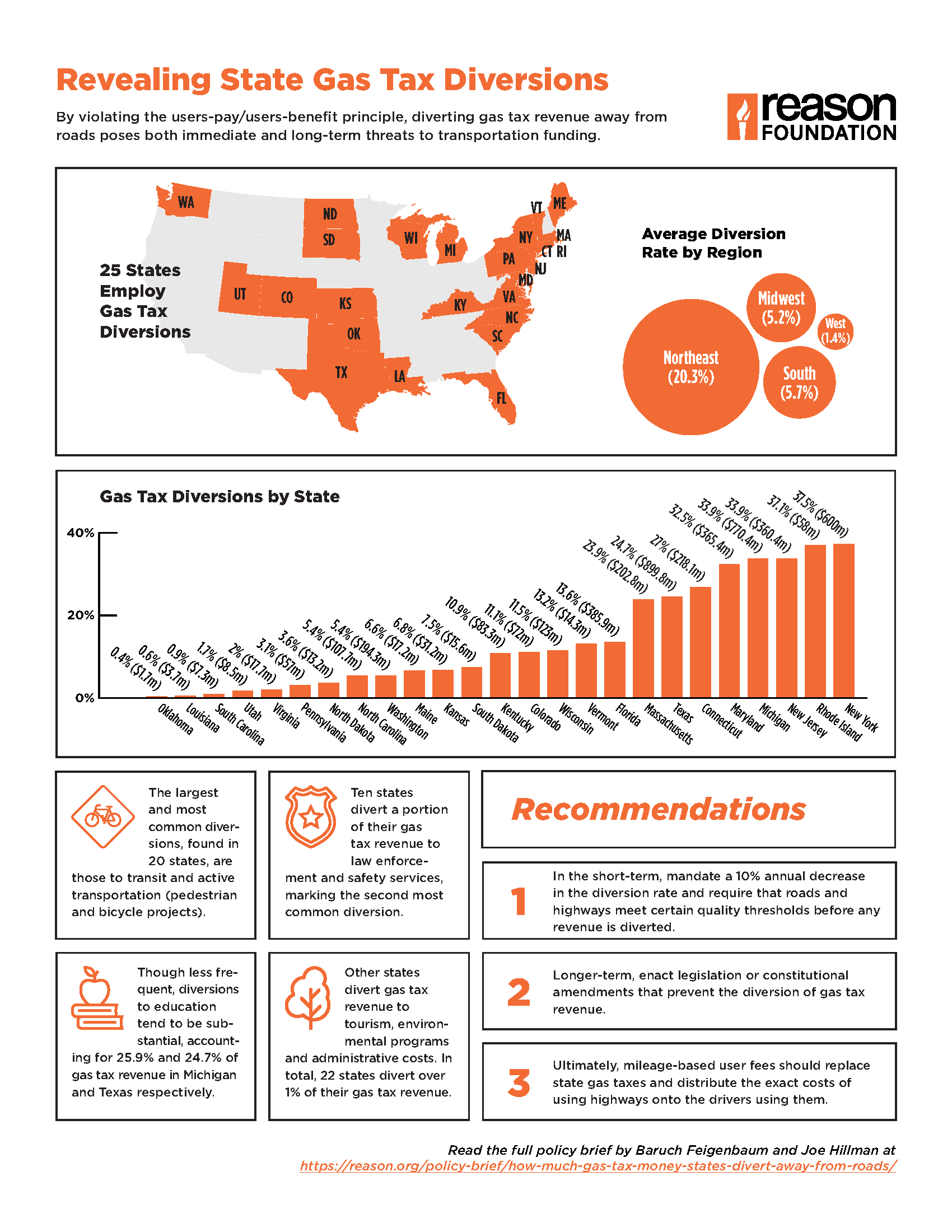

A recent Reason Foundation policy brief examines the state gas tax money that states divert away from roads and highways. New York, Rhode Island, New Jersey, Michigan, and Maryland all divert over 30% of their state gas tax revenues away from roads.

The 10 states diverting the largest percentage of their gas tax money: New York diverts 37.5% of its gas tax revenue, Rhode Island diverts 37.1%, New Jersey and Michigan divert 33.9%, Maryland diverts 32.5%, Connecticut diverts 27%, Texas diverts 24%, Massachusetts diverts 23.9%, Florida diverts 13.6% and Vermont diverts 13.2%.

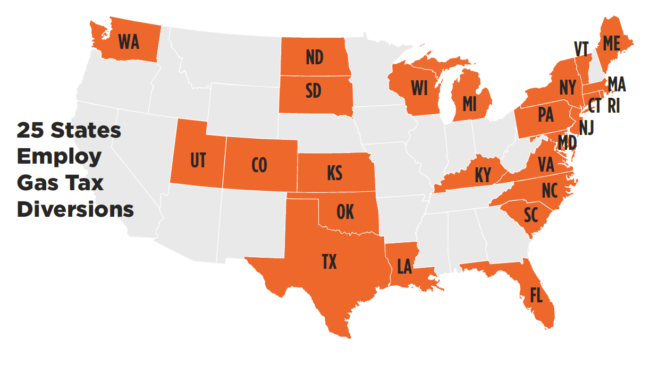

The policy brief catalogs state gas tax diversions of the 25 states that employ that practice and outlines potential policies that will strengthen the users-pay/users-benefit model of transportation funding. It also notes that states like California aren’t listed among those diverting state gas taxes. California does not divert its gas tax revenue. Instead, the state collects over $8 billion in revenue per year from vehicle registration and miscellaneous motor vehicle fees. Those funds are partially allocated to programs such as the California Highway Patrol, the California High-Speed Rail Authority and local public transportation agencies and projects.

Infographic: State Gas Tax Money Diverted Away From Roads