Over the past 25 years, American states and municipalities have accrued billions in public employee debt, threatening the funding of essential governmental services. With $1.3 trillion in public pension debt as of 2023, it is evident that policy changes must be made to improve the solvency of US public pension systems.

During pension reform discussions, proposals that deviate from the entrenched and familiar defined benefit (DB) pension are often seen as heretical. Unions and other pro-DB proponents tout that because DBs are allegedly much better for public employees, it’s harder to attract and keep talent without them.

However, as Reason Foundation’s Jen Sidorova argues, some research shows pension enhancements or structure changes have not been demonstrated to impact the turnover or retention of public employees.

Proponents of defined benefit pension plans have responded to these findings by suggesting that more effective education to employees would “enhance” the desirability of such pensions, as “financial literacy [is] a significant challenge in the United States.” They advocate for public employers to provide their workers with “the necessary education around these benefits” so that they understand just how valuable defined benefit pension plans supposedly are.

However, both common assumptions popularized by defined benefit plan sponsors—that such pension plans are inherently better for most public employees and that their members will come to appreciate them under proper financial education—are false. While members who work for an entire career in a DB plan will earn a good retirement benefit, how many public employees stay long enough to gain the benefits? Very few.

According to actuarial estimates, most public employees do not remain in their positions long enough to vest full retirement benefits.

Most public workers will leave their jobs within five years

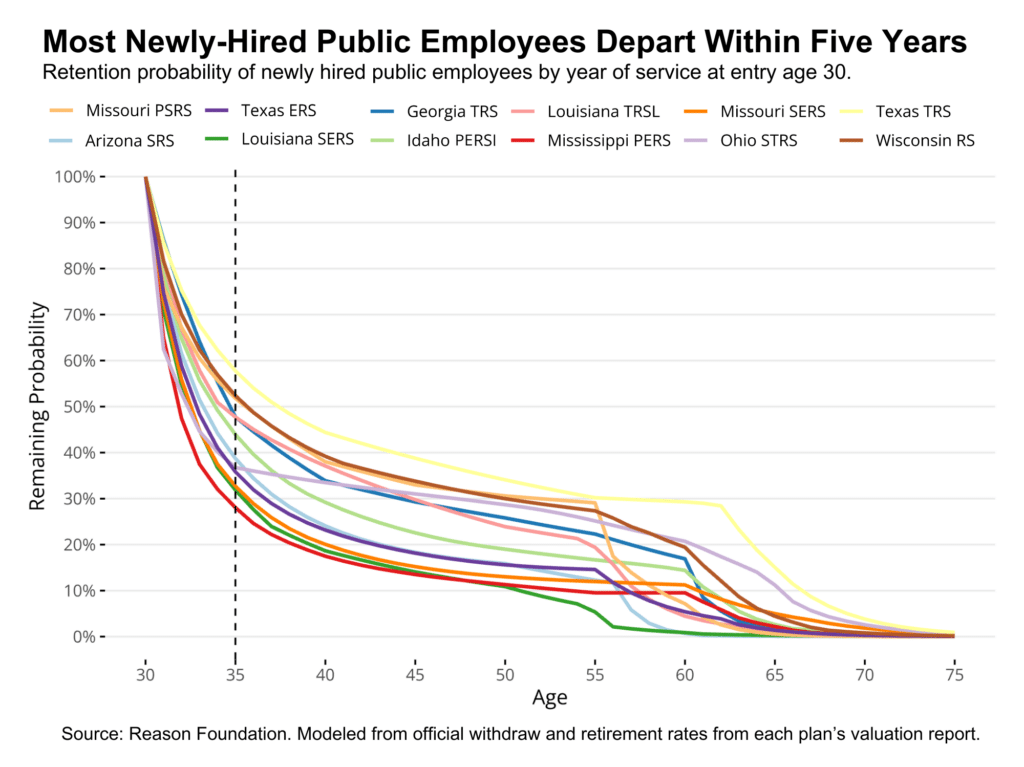

Figure 1: Retention Probability of newly hired employees by year of service in 12 state-run pension systems

The analysis above plots the probability of a newly hired employee staying in their role (reported as a theoretical employee starting in the position at age 30) in 12 state-run public pension systems Reason Foundation’s Pension Integrity Project is examining. Reason Foundation plots these curves using withdrawal and retirement rate assumptions from actuaries based on historical data of each plan’s workforce.

As the graph shows, based on the actuarial estimates of the listed pension systems, many public employees will never accrue substantial retirement benefits. Among these 12 pension systems, only 42.1% of new hires will remain in the system for over five years, and only 38.03% are expected to stay long enough to meet the system’s vesting requirements.

Consider the probabilities: A newly hired employee has varying chances of staying in their role long enough to vest retirement benefits from a defined benefit pension plan. The Teacher Retirement System of Texas (TRS) is the plan with the highest retention rates of our sample. It requires five years of service to vest, and even then, the plan’s actuaries estimate only 57.8% of newly hired members will still be in service after five years.

The public pension plan in our 12-plan sample with the lowest retention rates, the Public Employees’ Retirement System of Mississippi (PERS), requires eight years of service to vest retirement benefits. By then, actuaries estimate only 20.4% of newly hired members will still be in service. This means that approximately 80% of all new hires in Mississippi PERS will never earn a retirement benefit from the plan.

According to a 2022 Equable study, the average minimum vesting period for state-defined benefit plans was 6.9 years. On average, teachers and public school employees typically need 6.4 years, while public safety officers require eight years of service—with many plans stipulating at least 10 years of service for the entitlement of retirement benefits.

As most public employees tend not to stay long enough in their roles to reap significant retirement benefits of their pension, the labor force’s demonstrated unresponsiveness to DB plans seems perfectly rational.

Even for public workers who stay, defined benefits are often suboptimal

Most public workers will not remain in their jobs long enough to earn full pension benefits. However, even for the minority who stay long enough to optimize their benefits through vesting, the benefits are often suboptimal compared to what a defined contribution (DC) plan could offer.

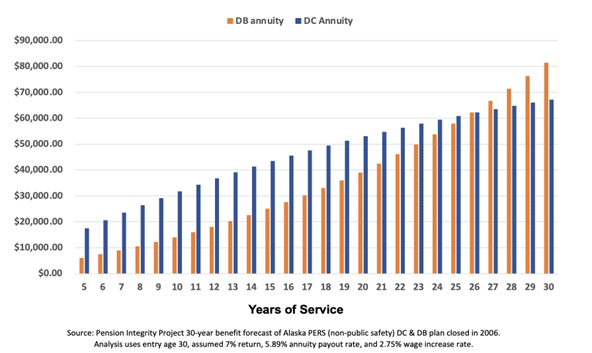

This dynamic was illustrated in a recent analysis presented by the Reason Foundation to the Alaska House of Representatives regarding Senate Bill 88, which proposed switching public employees from a DC to a DB plan. As the analysis demonstrates, DC plans provide better benefits than the proposed DB unless an employee stays in their role for over 26 years—an unlikely scenario for most workers.

Figure 2: Annuity Earned at Tenures of Service for Alaska’s PERS Defined Contribution and Defined Benefit Plans

The difference is that contributions to DC plans continue to compound until one’s retirement, offering better annuities—even for workers who leave public sector jobs early. In contrast, DB benefits are, as the name would suggest, defined. If a member leaves the plan, their benefits are frozen in time, and are unable to compound before retirement. This leads to suboptimal returns for most employees entering a DB plan today.

Additionally, defined contribution plans, by design, can never become underfunded. In a DC plan, benefits are determined by the actual contributions made and their investment performance, not by formulas. DB plans, however, often become underfunded as investment income and contributions tend to fall short of the initial estimated amounts needed to cover the legal promises made to public employees when they were hired. When that happens, employers and, often, employees must increase contribution rates. This puts pressure on city and state budgets and directly impacts employees’ take-home pay, all for a benefit that won’t be realized for decades. Consequently, DC plans eliminate the systemic fiscal risk that unfunded pension debt poses to municipalities and, ultimately, taxpayers.

Pension indifference on the rise

The belief that defined benefit pensions are inherently superior and that educating workers about these plans will increase their appeal is misguided. Workers’ disengagement with DB pensions is completely rational. Public employees, especially newcomers, would be even less likely to value their defined benefit pensions as they recognize the likelihood of them staying in the system long enough to vest substantial benefits is slim.

As technology enables employees to find and switch jobs more easily than ever, this trend will likely intensify. Understanding this new reality is crucial for policymakers aiming to implement effective public pension reforms that align with the evolving preferences of their workforce and the future workers they’re hoping to attract.