It was just two years ago that I wrote about the long and expensive history of cost-of-living adjustments in these public pension plans and why using scarce taxpayer dollars from local governments to fund these retirement benefit increases would be the worst fiscal solution to Washington’s pension challenges.

For a quick background on PERS 1 and TRS 1, these plans closed in 1977 to all new hires, and the vast majority of their members are retired or very near retirement. These public pension plans did not have a pre-funded cost-of-living adjustment, which makes the plans generally less expensive for the members and state than pension plans that are pre-funding that benefit adjustment. But this also requires members to plan for a future where they will be at the whim of the state legislature to provide any increases to their pension benefits.

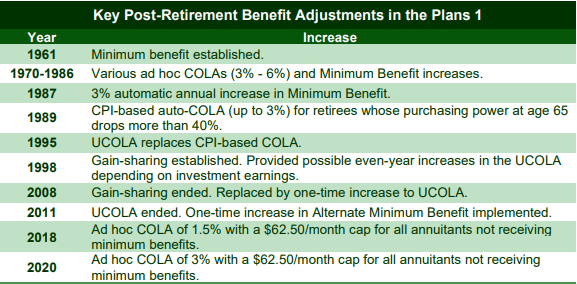

Despite the non-guaranteed cost-of-living adjustment, the state granted additional payment options to retirees through 2011 which protected member benefits at every range of the pension income threshold. Retirees who would be hit the hardest by drastic increases in inflation (those with fewer years of service and lower pensions) would be protected by an ever-increasing minimum benefit threshold implemented by the state. Members not at the minimum benefit received 13th checks tied to extraordinary investment returns through a policy called ‘gain sharing.’ In a recent presentation, staff for the select committee gave a historical breakdown of the changes made to PERS 1 and TRS 1 over the last 60 years.

Despite not requiring any pre-funding from members or employers for a cost-of-living adjustment, retirees received regular increases to their pension, totaling about 3 percent per year, until 2011. When the state legislature decided to discontinue those increases, it offered members the chance to buy their own cost-of-living increases, paid for by a reduction to their initial pension benefits. Those members who were earning what the state considers a “minimum benefit” still receive annual increases to this day.

Washington’s 10-year costs of the 2018 and 2020 ad-hoc increases to PERS 1 and TRS 1 were $305 million and $381 million respectively. These costs necessitated increased contributions for state and local government employers. And these costs may even be understated, as Washington’s pensions still use a 7.5 percent investment return assumption – well above the national median investment return rate assumption of 7 percent. These plans currently sit at approximately 65 percent funded and are otherwise a black eye on the rest of the state’s well-funded and managed pension plans.

The most disconcerting part of this situation is that these expensive benefit increases—pushed for years by influential retiree groups—are generously provided on behalf of taxpayers, with the end goal of these efforts being a guaranteed, annual COLA to match the rest of the plans in Washington. Members in the current PERS and TRS plans (Plan 2’s) contribute portions of their salary for their entire working careers to have a COLA, whereas the members in PERS 1 and TRS 1 did not.

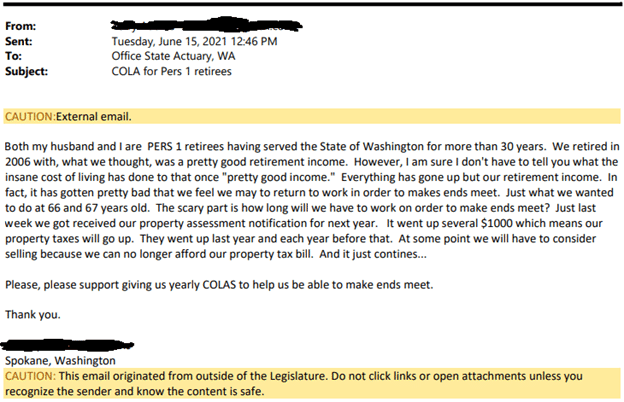

In addition, the retirement ages in the Plan 2’s are at 67, where the Plan 1’s had an enormously generous retirement age of 50 with 30 years of service or 55 with 25 years of service. The following email was sent by a retiree (at the urging of public employee retiree associations) to the select committee imploring them to grant yearly cost-of-living adjustments.

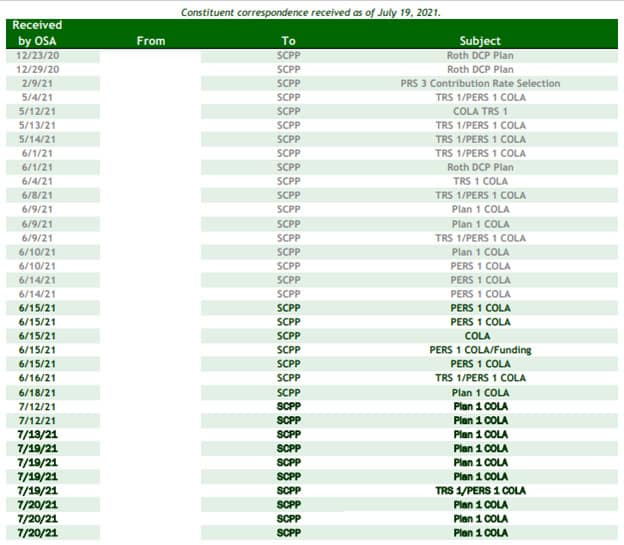

This couple retired at ages 51 and 52 respectively with full pensions (worked 30 years in Plan 1), received 5 years of additional payments on their pensions from 2007-2011, and then received two more increases in 2018 and 2020. No funds were set aside for these pension benefit increases during the couple’s employment, and their contribution rates while employed were much lower than they would have been if a COLA or other retirement benefit increase was guaranteed. This is a common theme among the emails and letters sent to the Select Committee on Pension Policy, with 31 of the last 35 pieces of constituent correspondence related to asking for Plan 1 COLA increases.

There are a few realities that need to be addressed here. First, yes, it is true that Plan 1’s do not have a prefunded cost-of-living adjustment. Should they have been offered one during their working careers, as the current plans do? Maybe, but the time to solve that issue was at the time of plan design, when decades of contributions and investment returns could pay for it, not when over 99 percent of the plan’s members are retired. Plan members have been aware of the lack of cost-of-living adjustment or benefit adjustment included in their contract for decades. Second, it is also true that every Plan 1 retiree post-1987 has had the option to purchase a COLA at retirement by taking an actuarially equivalent reduction on their benefit. How many retirees took that option? An extreme minority, and why would they take it? The legislature had constantly provided free increases throughout the plans’ histories.

This cost-of-living adjustment issue will continue to come up in Washington until a permanent solution is found. The easiest and most fair solution would be to offer retirees a window to purchase their own cost-of-living adjustment, the same offer they had at retirement. The most unfair solution to this public pension issue is to continue to allocate hundreds of millions of taxpayer dollars to annually fund increased benefits for retirees who provided zero public services to the taxpayers who are footing the bill.