In a candid February interview with the Financial Times, The Vanguard Group Chief Executive Officer Tim Buckley caused a stir by plainly explaining the company’s restraint on environmental, social, and governance (ESG) investing.

“We cannot state that ESG investing is better performance-wise than broad index-based investing,” Buckley said. “Our research indicates that ESG investing does not have any advantage over broad-based investing.”

Buckley’s statements followed Vanguard’s withdrawal from the Net Zero Asset Managers (NZAM) initiative—a group of 301 asset managers that says it is “committed to supporting the goal of net zero greenhouse gas emissions by 2050 or sooner, focused on lowering carbon emissions in their portfolios.”

Previously, Vanguard had thrown its support and market influence—managing over $8 trillion in assets—behind the initiative. Now the company appears to be adopting a more neutral approach that still allows inclined investors to pursue ESG strategies if they choose. In December, Reuters reported:

“We have decided to withdraw from NZAM so that we can provide the clarity our investors desire about the role of index funds and about how we think about material risks, including climate-related risks—and to make clear that Vanguard speaks independently on matters of importance to our investors,” Vanguard said in the statement.

In his interview with the Financial Times, Buckley stated, “Politicians and regulators have a central role to play in setting the ground rules to achieve a just transition to a lower carbon economy,” but Vanguard is “not in the game of politics.”

The shifts and statements come at a time when government funds and institutional investors find themselves in the middle of a political tug-of-war, with many parties seeking to influence the investment decisions of public pension systems and others by injecting objectives that extend beyond the standard considerations of returns and risk. Of the so-called “Big Three” asset managers—Vanguard, BlackRock, and State Street—Vanguard has been the least enthusiastic in its embrace of ESG.

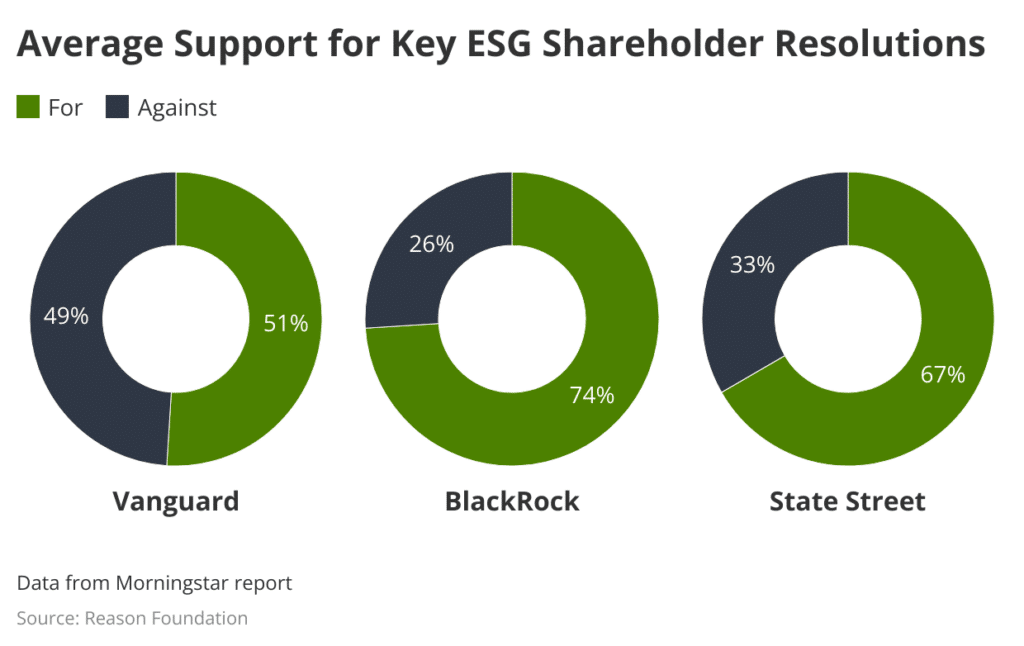

Vanguard operates 28 sustainable funds, compared to BlackRock’s 282. An analysis of 2021 proxy voting from Morningstar found that Vanguard’s average percentage of votes in favor of key ESG shareholder resolutions was 51%, considerably lower than BlackRock’s 74% and State Street’s 66%.

Buckley clarified the reasoning behind Vanguard’s relatively lower support for ESG shareholder resolutions in the interview. “It would be hubris to presume that we know the right strategy for the thousands of companies that Vanguard invests with,” Buckley said. “We just want to make sure that risks are being appropriately disclosed and that every company is playing by the rules.”

Vanguard’s measured approach to ESG is consistent with the company’s history of focusing on offering low-cost, passive investments to the public. The company further innovated the investment landscape by offering low-cost, passive index investments, giving small individual investors access to parts of the market usually exclusive to institutional investors, all without high fees or massive commitments of assets. The competitive effects of Vanguard’s products are likely an important driver behind expense ratios, the percentage of a fund’s assets used to cover costs of operating and maintaining the fund, coming down across the market. According to a recent report by Morningstar, asset-weighted passive funds have experienced a 66% decrease in fees since 1990. This trend is a boon for investors seeking to minimize expenses, but it has put serious pressure on asset managers to cut costs.

For many asset managers, including some working with public pension systems, ESG funds are a hack to help relieve them from these competitive pressures. In 2019, Michal Barzuza, Quinn Curtis, and David Webber wrote a Southern California Law Review paper arguing that appealing to the social values of millennial investors (i.e., ESG) gives these potential clients a reason to choose them despite their disadvantage in higher fees. “With fee competition exhausted and returns irrelevant for index investors, signaling a commitment to social issues is one of the few dimensions on which index funds can differentiate themselves and avoid commoditization,” they wrote.

ESG investment vehicles have higher expense ratios than their non-ESG alternatives. Morningstar’s research found in 2021 a considerable “greenium” upcharge for ESG funds. Although fees reached an all-time low in 2020, the average expense ratio for sustainable funds was 0.55% on an asset-weighted basis, notably higher than the 0.39% ratio for conventional funds.

In part, this might be attributable to the generally smaller size of these funds or just the back-end work involved in constructing and maintaining these indices. Still, higher expense ratios necessitate higher returns to maintain parity. In prior years this worked out well for ESG indices because they tended to be weighted heavier in tech, which performed well. As interest rates began to rise in 2022 and energy prices rose, the relative performance of ESG indices has waned.

The chart below shows the percentage change in the Vanguard Total Stock Market Index Fund ETF (VTI) and the Vanguard ESG U.S. Stock ETF (ESGV). The standard index VTI has an expense ratio of 0.03%, and ESGV has an expense ratio of 0.09%.

While some asset managers may view ESG funds as an opportunity to differentiate themselves from competitors and help alleviate cost pressures—and are free to do so in the market‚ for many individual investors and public pension systems, it is likely worth noting that Vanguard’s position appears to be one that does not put ESG interests above other priorities.

Editor’s Note: Vanguard Charitable is a contributor to Reason Foundation.