During last year’s legislative session, Georgia’s House Retirement Committee requested cost estimates of House Bills 662 and 667 (as amended). Both measures propose changes aimed at improving the solvency of the Teachers Retirement System (TRS) of Georgia, a plan currently sitting at only 77 percent funded and holding nearly $22 billion in unfunded promises made to Georgia educators.

Since the fiscal impacts will likely drive the committee’s deliberation on these bills in the upcoming legislative session, understanding the bills’ short-term costs along with their potential long-term benefits is critical to fully evaluating these reforms.

Actuarial modeling performed by Reason Foundation’s Pension Integrity Project—calibrated and confirmed by an internal short-term actuarial study prepared for Georgia’s House Retirement Committee—provides some insight into the long-term impact of the proposed legislative changes.

The two bills address TRS’ challenges in different ways:

- HB 662 would lower the assumed rate of return (ARR) for TRS from 7.25 percent to 6.75 percent.

- HB 667 would require all current legacy unfunded liabilities to be paid off by 2037, and put all new unfunded pension liabilities accrued in any given year on a 15-year amortization (e.g., “pay-down”) schedule instead of the current 30 years.

- Both bills would accelerate the frequency of internal TRS actuarial experience studies from the current every five-year review to a lookback every three years.

Both changes would result in higher annual contributions into the system in the short-run, but for that cost Georgians would enjoy a more stable retirement system, both in future contributions and overall retirement security for members.

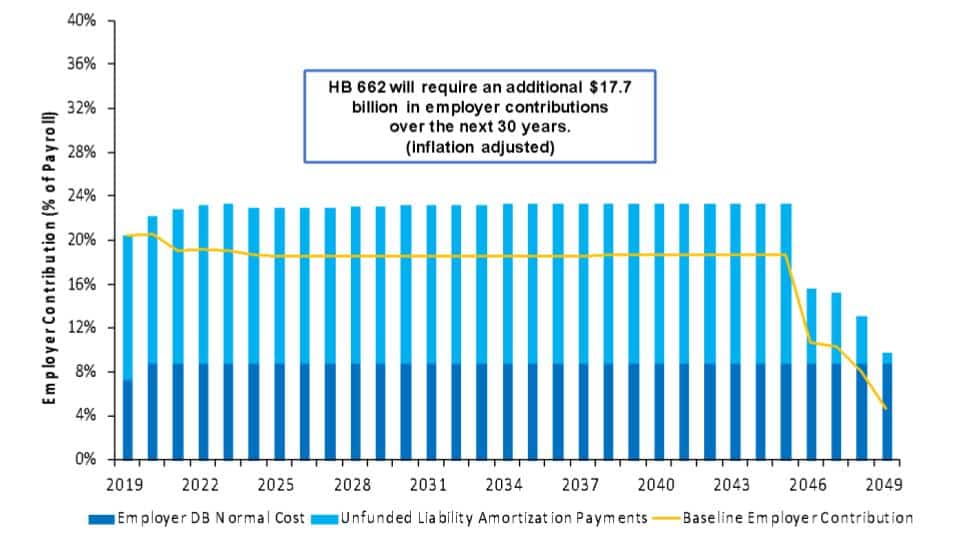

Figure 1 shows how HB 662 would impact employer contributions once the ARR is reduced by 0.5 percent. The forecast indicates the pension reform would result in an additional $17.7 billion in contributions over the next 30 years.

The act of lowering a pension fund’s assumed rate of return has the effect of reducing expected contributions resulting from investment gains, which means the system will need higher annual contributions from taxpayers and/or its members to maintain its current funding trajectory.

[Note: The yellow “baseline” trend line in each figure that follows reflects the current forecasted employer contribution rates for TRS.]

Figure 1. Projected Employer Contributions with Reduced Return Assumption (HB 662)

Source: Pension Integrity Project actuarial forecast of Georgia TRS under HB 662.

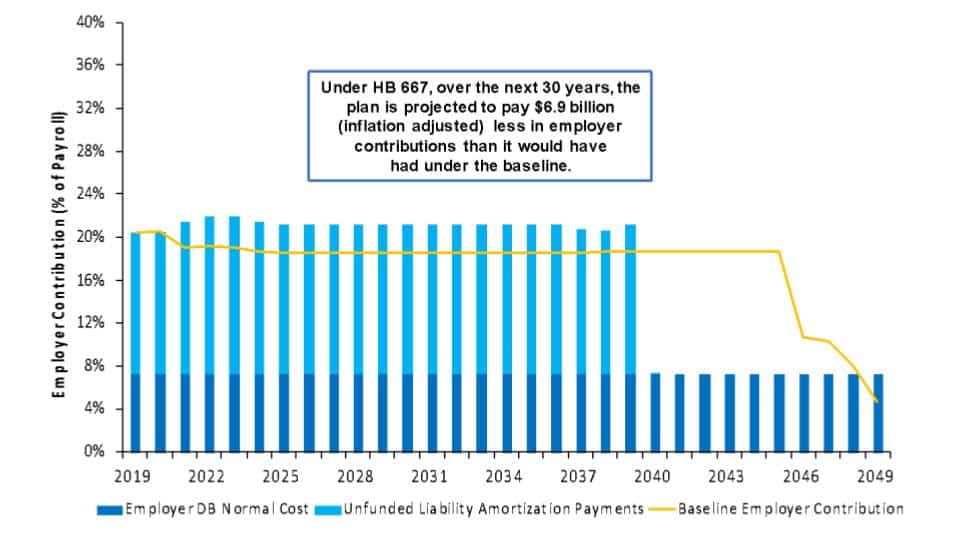

Figure 2 illustrates that under HB 667—modifying the amortization schedules for both legacy and future unfunded liabilities—the plan would pay off legacy unfunded liabilities by 2039. Without this reform, TRS expects to take until 2049 to pay off these debts.

The forecast analysis indicates that shortening the debt-payment schedule by a decade would result in modest increases in contribution rates in the near-term but would reduce total 30-year employer contributions by almost $7 billion dollars when compared to the current baseline trajectory.

The total long-term cost of amortizing both legacy and any future unfunded liabilities would be lower under this proposal, mainly because pension debt would not accumulate as much interest if it is paid off sooner. Because accrued pension liabilities grow at the plan’s discount rate—in this case 7.25 percent annually—the sooner one pays down unfunded pension liabilities the less expensive it will be.

Figure 2. Projected Employer Contributions with Reduced Return Assumption and Shorter Amortization Schedule (HB 667)

Source: Pension Integrity Project actuarial forecast of Georgia TRS under HB 667.

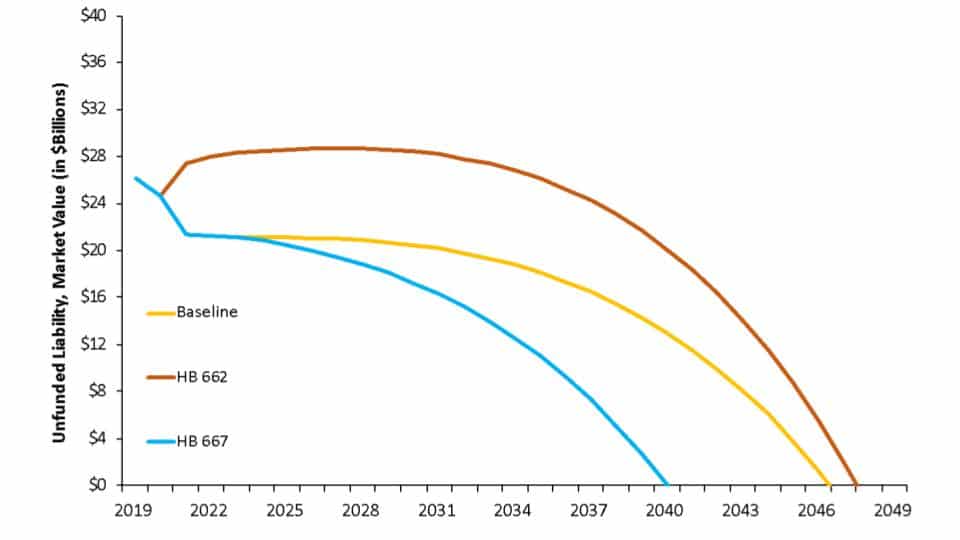

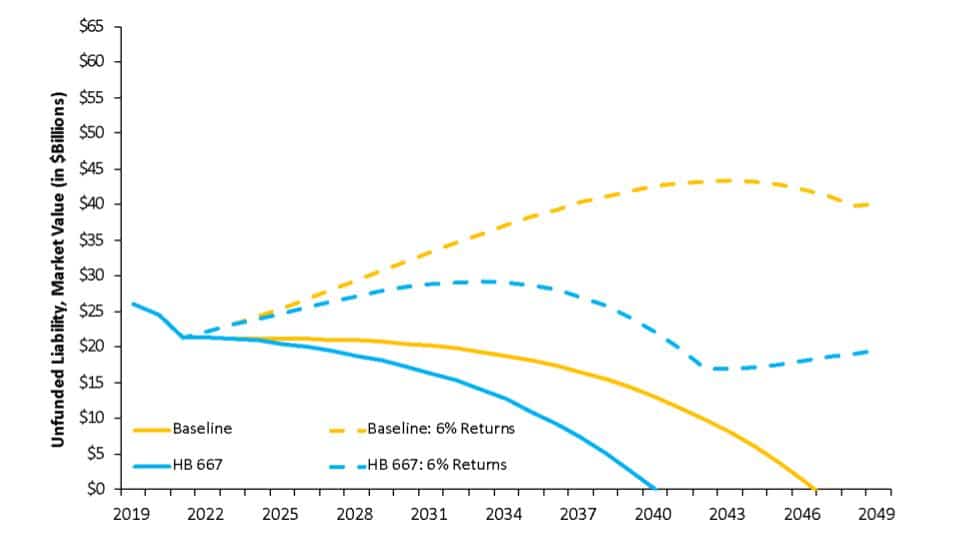

Figure 3 forecasts the system’s unfunded liabilities under HB 662 and HB 667, respectively, if one or the other were to become law. Assuming investment returns match the plan’s expectations, the two reforms are likely to make significant changes to the system’s funding status.

HB 662 would increase the amount of recognized unfunded liabilities in the mid-term, but will gradually line up with the current trajectory while HB 667 accelerates pension debt payments, so it understandably decreases unfunded liabilities much faster and eliminates the current $22 billion shortfall by 2040.

Figure 3. Effects of HB 662 and HB 667 on TRS Pension Debt

Source: Pension Integrity Project actuarial forecast of Georgia TRS using HB 662 and HB 667.

As the Pension Integrity Project’s fiscal 2018 analysis of TRS suggested, the main contributor to the system’s declining fiscal health has been low investment returns. Although the TRS governing board took an important step last year towards reducing the system’s risk by lowering the ARR to 7.25 percent from 7.5 percent, this is a small reduction relative to what is likely needed given diminished capital market expectations for investment returns over the next decade or two. It would be prudent to consider lowering the ARR even further as proposed in HB 662 given the system’s financial future relies heavily on the accuracy of this assumption.

A TRS investment portfolio analysis using various capital market forecasts issued by leading global financial institutions suggests that TRS is more likely to achieve lower-than-assumed returns, potentially in the five-to-six percent range in the next 10-15 years—a timeframe used due to the uncertainty of investment market forecast extending more than two decades into the future.

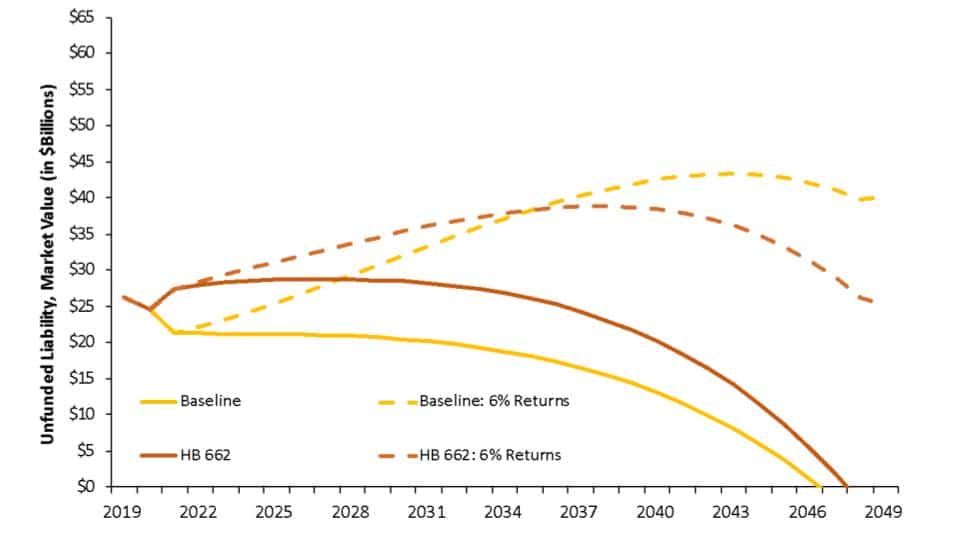

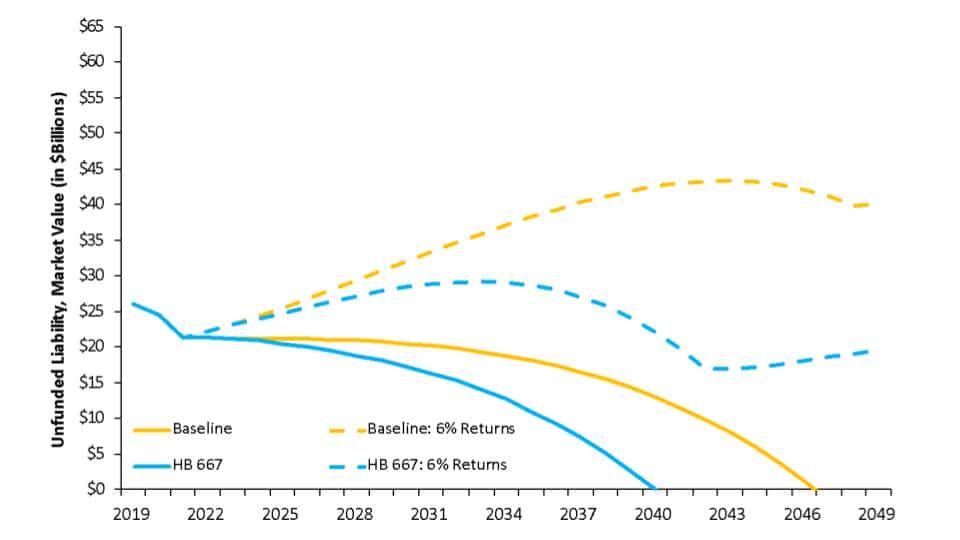

In what follows, Reason Foundation’s Pension Integrity Project examines the possible impacts on the Teachers Retirement System (TRS) of Georgia’s unfunded liability over the next 30 years using a six percent investment return scenario.

As shown in Figures 4 and 5, projected unfunded liabilities can still vary greatly depending on the plan’s long-term market experience. A long-term investment return of six percent leads to unfunded liabilities growing to as high as $39 billion under HB 662 and $29 billion under HB 667. Both outcomes are better than the status quo, where a six percent average return would drive unfunded liabilities as high as $43 billion.

It should also be noted that under both reform scenarios, unfunded liabilities would not grow as much or as fast then they would under the status quo.

Figure 4. Sensitivity of Pension Debt After HB 662

Source: Pension Integrity Project actuarial forecast of Georgia TRS using HB 662.

Figure 5. Sensitivity of Pension Debt After HB 667

Source: Pension Integrity Project actuarial forecast of Georgia TRS using HB 667.

Figure 6 presents the results of a combination scenario in which both bills are assumed to be enacted. While the reduction in risk would expose otherwise unaccounted liabilities in the short-term, TRS’ unfunded liabilities would be eliminated five years earlier if both reforms were enacted, assuming expected returns are realized.

Figure 6. Sensitivity of Pension Debt after Both HB 662 and HB 667 pass

Source: Pension Integrity Project actuarial forecast of Georgia TRS using HB 662 and HB 667.

Perhaps more striking in terms of conveying the potential risk mitigation benefits of the proposed reforms is that in the case of an underperforming market environment—a hypothetical, but realistic, six percent average investment return—the plan accumulates a significantly higher unfunded liability over time, nearly double the current level as shown by the dotted yellow line in Figure 6.

By contrast, if both bills were to pass and TRS experienced an average six percent investment return, unfunded liabilities would not be entirely eliminated but would fall to less than half the current level, demonstrating a clear risk reduction benefit.

Conclusion

Both HB 662 and HB 667 would reflect important steps towards putting the plan on track for long-term solvency and be fiscally prudent steps to take in the process of shoring up TRS for future educators. HB 662 would lower the assumed investment return to a more realistic level, while HB 667 would establish a shorter amortization schedule more in line with guidance from the Society of Actuaries, using larger contributions upfront to reduce long-term costs.

That said, even taking such important steps would not obviate the need to continue seeking additional reforms down the road. For example, while HB 662 would represent a positive step by adopting a more conservative investment return assumption, continuing reductions would further reduce the risk of future underfunding. The assumed rate of return is just one assumption among many that impact TRS.

Analysis of the causes of TRS pension debt reveals other important factors that led to the decline in the fiscal health of the plan, the most important of them being missed demographic assumptions.

Unfortunately, neither proposal would address the chronic problems and additional costs driven by missed demographic assumptions, nor would they expand retirement security options offered to retirees unwilling to commit 30-plus years of their careers to government service upon being newly hired. The current structure generally benefits those who stay in the system their entire career, leaving those who switch to a different career or relocate to a different state with little to no retirement savings. Providing additional options could better serve a larger range of teachers and accommodate a modern workforce that tends to value more flexibility and portability when considering retirement.

There is a range of options and trade-offs to consider before policymakers decide how to move forward with reforms to improve TRS and its long term solvency. Finding effective ways of managing existing pension debt while reducing future risks the plan could face should be the primary focus.

Judging by the variety of challenges facing TRS, it is unlikely that any single change in policy (either HB 662 and HB 667) would achieve long-term fiscal solvency goals. In that light, both bills offer serious policy options to start—but not end—a process of reform to ensure that Georgia teachers and taxpayers will be able to depend on the long-term financial stability of TRS.

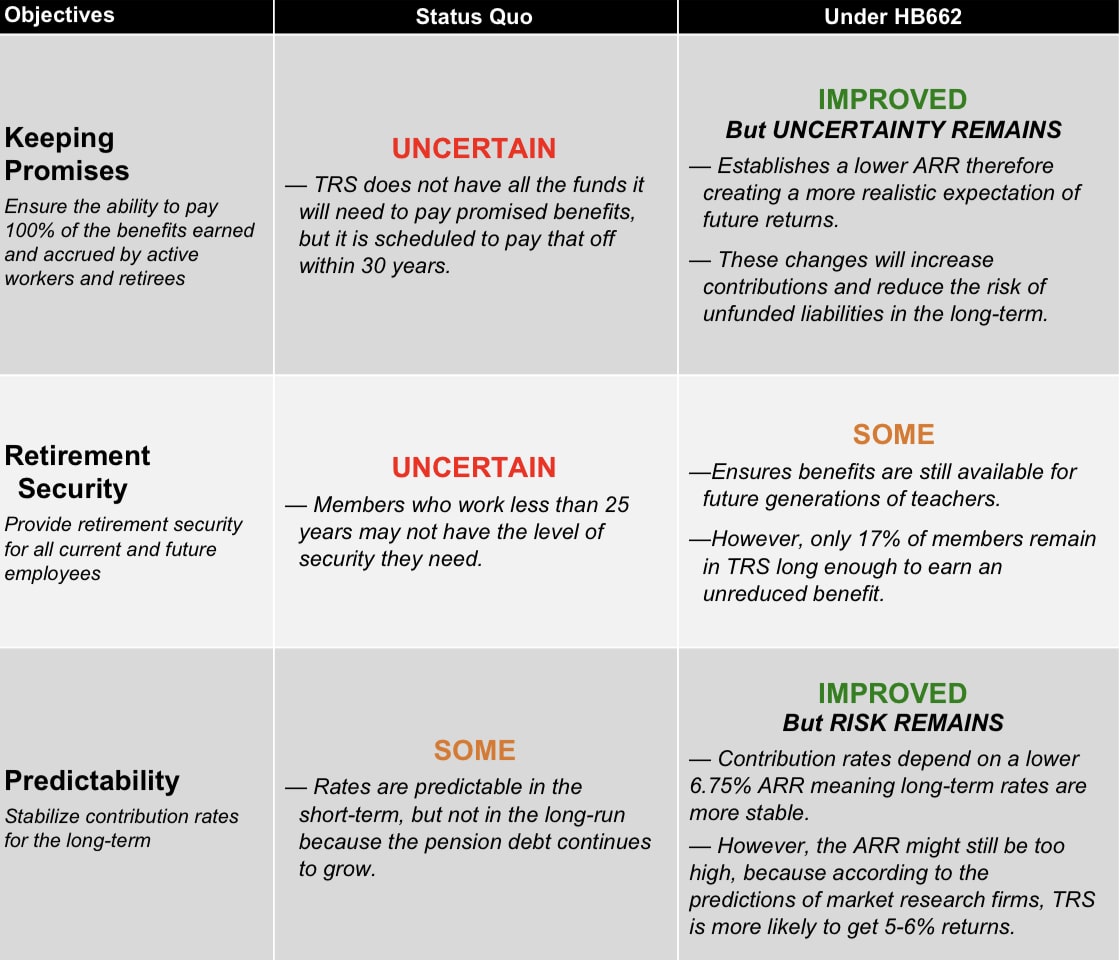

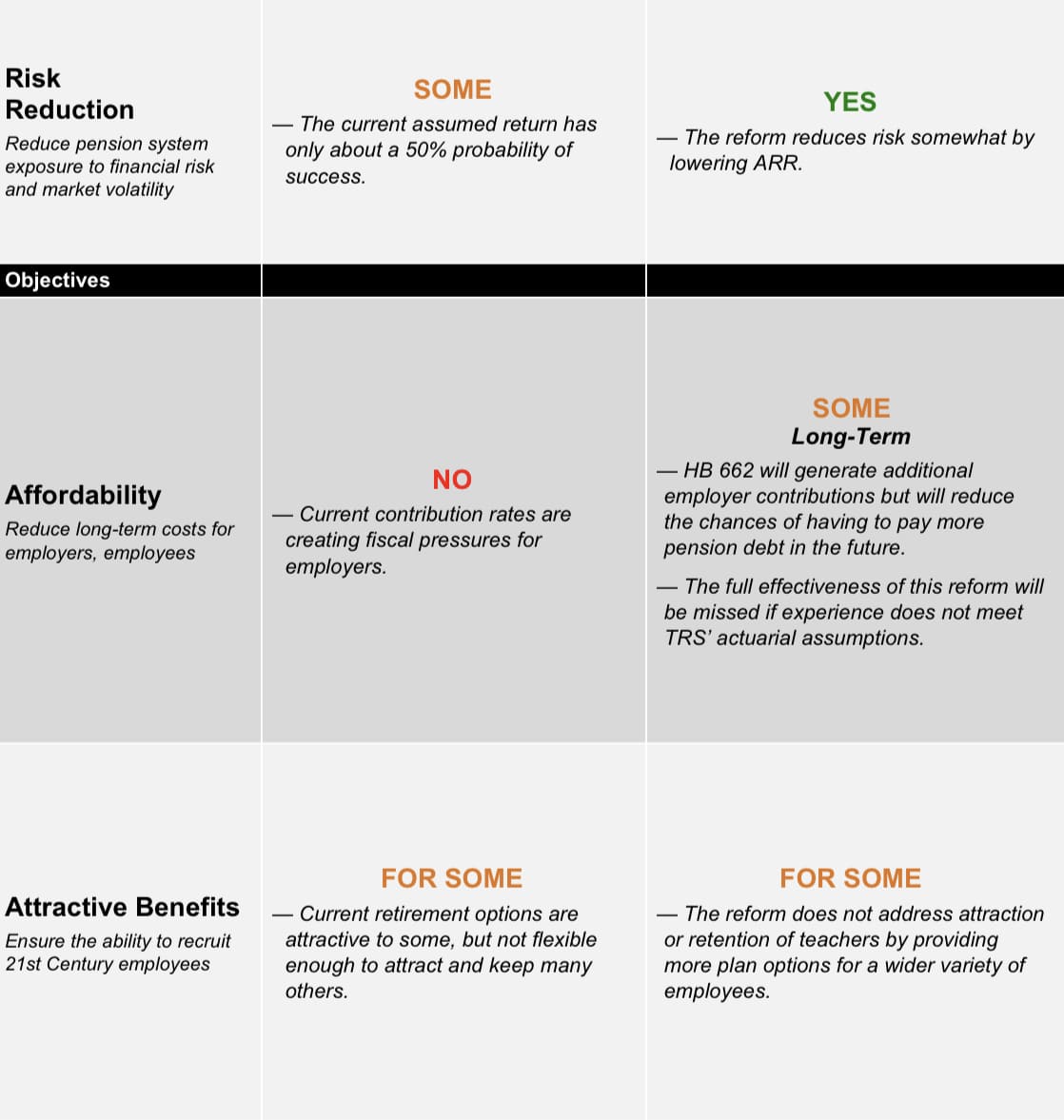

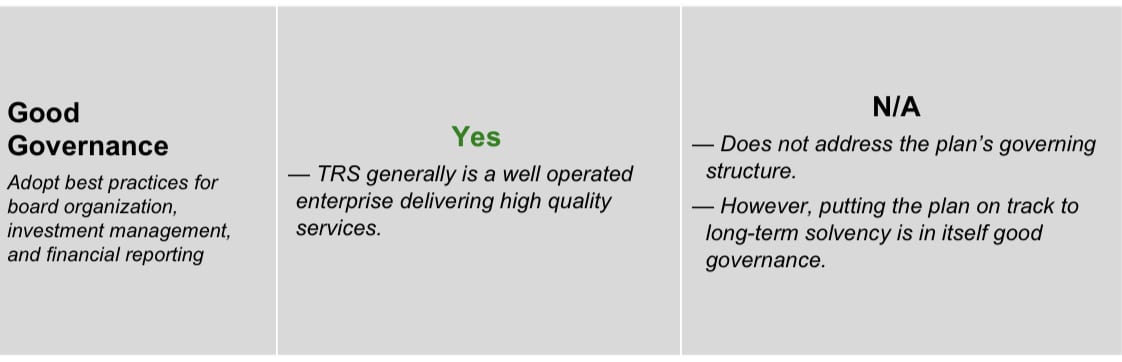

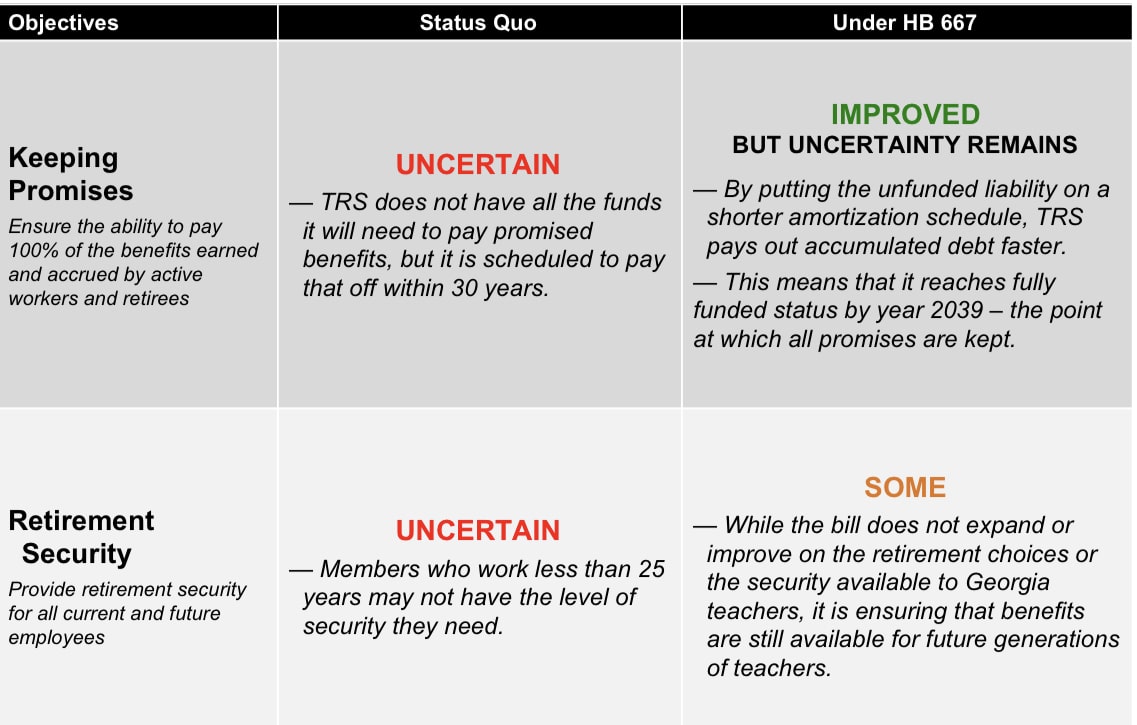

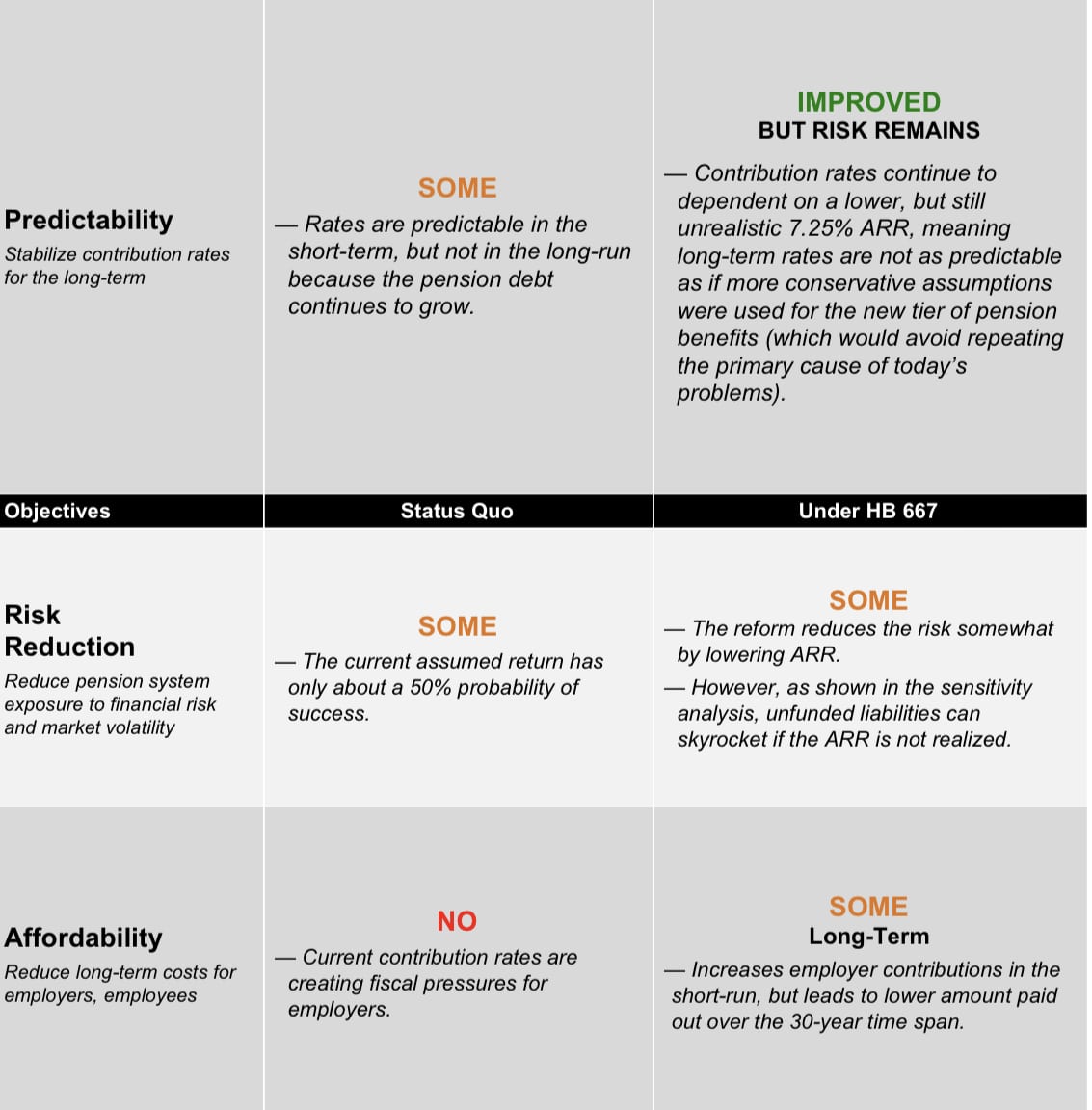

Below we present a breakdown of how well HB 662 and HB 667 meet the Pension Integrity Project’s reform objectives:

Assessing the Impacts of Proposed Changes to Georgia’s Teacher Pension System – House Bill 662

Assessing the Impacts of Proposed Changes to Georgia’s Teacher Retirement System – House Bill 667