A lot has been written about the manipulation of investment return assumptions to understate pension costs and liabilities. Much less attention, however, has been paid to how state and local pension plans misuse funding policies—especially pension debt repayment policies (known as unfunded liability amortization methods)—to push costs into the future. Practices such as stretching out unfunded liability amortization schedules, back-loading amortization payments, and sometimes simply paying less than actuarially required have all contributed to the chronic underfunding of public sector pension plans. And two new studies explore this subject further.

One recent study by Lisa Schilling and Patrick Wiese at the Society of Actuaries (SOA) provides a detailed picture of pension debt amortization practices of 160 state and local plans over the last decade (2006-2014). The study examines how actual employer contributions stacked up against six contribution benchmarks:

1. Target Contribution: The contribution level needed to meet requirements established by the employer itself (typically the Annual Required Contribution before GASB 67/68 and the Actuarially Defined Contribution after GASB 67/68)

2. Maintain Unfunded Liability: The contribution level needed to keep the unfunded liability from growing (assuming all actuarial assumptions are met). This equals the normal cost plus the interest on the unfunded liability.

3-4. 30-Year Funding Pace: The contribution level needed to eliminate the unfunded liability in 30 years. This includes two benchmarks: one using a level-percent of payroll amortization method, and one using the level dollar amortization method.

5-6. 15-Year Funding Pace: This is similar to the 30-Year Funding Pace, but with a 15-year time frame.

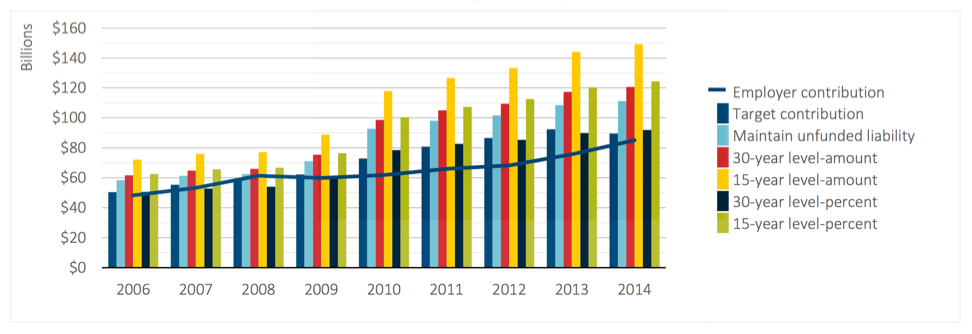

The graph below summarizes the findings and shows that the actual total employer contributions made each year fell short of most benchmarks before 2009, and missed every benchmark after 2009. The contribution gaps were also generally larger after 2009 than before 2009, as plans were struggling to deal with the financial crisis aftermath.

Actual Employer Contributions Fell Short of Most Funding Benchmarks

Notably, the actual total contributions fell short of the Maintain Unfunded Liability benchmark in every year except 2008. Further, the aggregate Target Contribution benchmark was consistently lower than the Maintain Unfunded Liability benchmark during the whole period.

Taken as a whole, this means that public plans’ owned required contributions were not enough in any year to keep the pension debt from growing in the first place. Put another way, the total amortization payments continuously failed to cover the interest on the unfunded liabilities, causing negative amortization for this set of public plans as a whole.

What was the reason for this? One of the primary culprits is the funding policies for themselves. A close examination of the figure above will show that there is a close similarity between the Target Contribution benchmark and the 30-Year Level-Percent benchmark over time. This suggests that public plans in general adopted more or less this very funding policy to pay off their pension debts. A combination of overly long amortization periods (25-30 years) and the level-percent of payroll method often produces large negative amortization at the early part of the amortization timeline. This amortization policy therefore pushes a substantial portion of the unfunded liability into the future (i.e. it back-loads amortization payments), violating intergenerational equity and increasing funding risks.

The actuarially prudent practice is to amortize the unfunded liability over the expected remaining working lifetime of the covered employees, which is typically no more than 15-20 years. The SOA study however shows that almost 80% of the public plans failed to meet the 15-year level-percent benchmark, and near 90% of them fell short of the 15-year level dollar benchmark.

One limitation of the SOA study is that it does not address in depth the problem of open amortization. Some pension plans combine the level-percent amortization method with an “open” approach (the amortization schedule is reset every year), often resulting in perpetual negative amortization, i.e. the amortization payment is always lower than the interest on the unfunded liability, which consequently keeps growing in perpetuity. This practice potentially played an important role in the funding insufficiency depicted in the SOA report.

So, what explains the public plans’ choices of amortization policies and funding methods in general? A recent study by Jeffrey Diebold and others at North Carolina State University attempts to answer this question. Covering 103 state pension plans, the study looks at how the levels of normal costs and unfunded liabilities affect funding policies, controlling for a variety of economic, political, and budgetary factors.

The study finds that during the 2001-2014 period, plans with higher normal costs and younger active members were less likely to use the entry age normal actuarial cost method, which front-loads the contribution schedule compared to the projected unit credit method, and thus imposes higher funding costs at the beginning. In a similar fashion, plans with higher unfunded liabilities tended to choose an open amortization schedule over a closed one to reduce funding pressure in the short run.

The authors see those findings as consistent with other related studies on the manipulation of public plans’ valuation methods to reduce short-term fiscal stress. They are also consistent with public choice theory, which predicts that policymakers (who are plan administrators in this case) tend to favor policies that yield immediate, easily seen benefits at the expense of long-term but less visible financial health.

Though these two papers provide useful insights into the funding policies of public plans, the time frames they study are still quite limited, with year 2014 being the latest covered. More up-to-date research looking at more years after the enactment of GASB 67/68 would shed additional light on the issue, given the fact that the new GASB standards mark a definitive separation of financial reporting from funding policies.