While we now know the COVID-19 pandemic’s effect on state government tax revenues was far milder than predicted, it is harder to gauge the nationwide impact the pandemic has had on counties, cities, towns, and other local government entities’ tax revenues.

There are about 39,000 local governments across the country, and, unlike the 50 states, most do not post monthly tax collection statistics. That said, we have reason to believe that, with some exceptions, the COVID-19 pandemic’s impact on local government tax revenues has been modest.

A key reason for this optimism is the fact that local governments primarily rely on property taxes which have been largely insulated from the COVID-19’s economic impact. According to data from the Census Bureau’s Annual Survey of State and Local Government Finances, in 2018, 72 percent of all local government tax revenue came from property taxes.

Unlike during the Great Recession (2007-2009), property tax revenues have mostly remained stable, and may even increase as the country emerges from the COVID-19 downturn. In most areas, property values have performed well during the pandemic.

Looking back at the Great Recession, home prices, as measured by the Zillow Home Value Index (ZHVI), peaked in early 2007, fell rapidly later that year, and then continued to decline until early 2012. Over the entire period from February 2007 to February 2012, the ZHVI fell 33 percent.

By contrast, ZHVI has risen every month during the coronavirus pandemic. The latest available reading shows the ZHVI was up 8 percent from its pre-pandemic level (February 2020) as of January 2021.

Unlike residential real estate, however, commercial property has performed poorly during the pandemic. According to Green Street Advisors, commercial real estate values were 7 percent below pre-pandemic levels at the end of January 2021. But, in most cities and counties residential parcels account for most of the property tax base. At the end of 2018, nationwide owner-occupied home values were estimated at $27 trillion versus an estimated $16 trillion aggregate value for commercial real estate.

Commercial real estate is also more concentrated in specific cities and counties. New York City is one entity with a high concentration of commercial property. New York City’s commercial properties accounted for 8 percent of all local government tax revenue reported by the Census Bureau in 2018. New York City is not only America’s most populous city by a wide margin, but it also carries out the functions normally reserved to county governments because the city encompasses five counties.

Fortunately, New York City is among the local governments that report quarterly revenue data. According to its recently updated revenue data set, New York City’s 2020 calendar year tax revenue was $64.8 billion,1.9 percent above 2019 levels. Comparing the second quarter of its fiscal year 2021 (October 2020 through December 2020) with that of the same period during 2019, the city comptroller reported:

The largest revenue source, the real property tax, increased 18.1%. The personal income tax was flat. The sales tax declined $695 million, or 29.1%. NYC retail stores continue to suffer from reduced sales as the City’s cultural attractions remain closed and out-of-town visitors remain home.

Some other large cities and counties have also posted interim revenue results. Phoenix, for example, reported its 2020 calendar year revenues were 11.4 percent above the prior-year levels.

On the other hand, some other major cities reported declines. Columbus (OH), the city of Houston, Texas, and the country it is in —Harris County, along with Philadelphia, all reported tax revenue decreases in 2020, ranging from 1 percent to 7.2 percent.

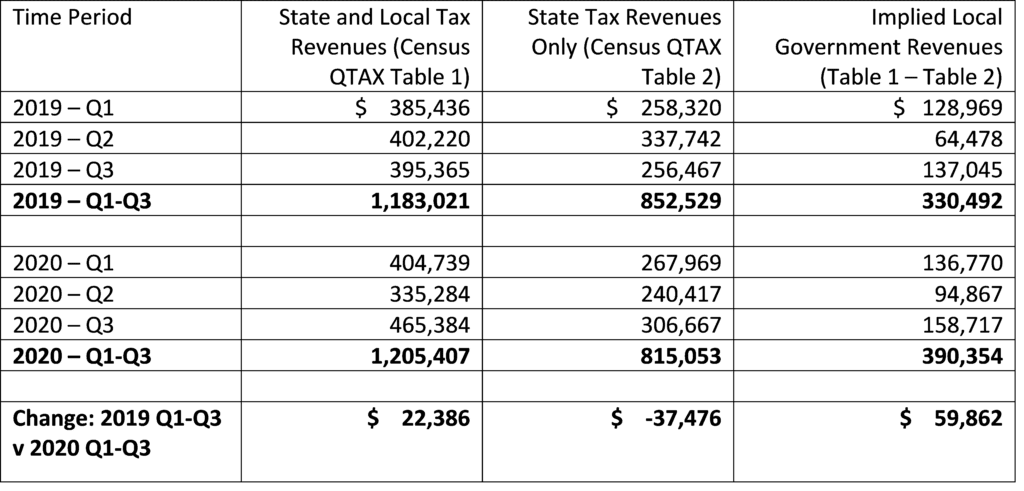

A final indication of local tax revenue performance across the country can be inferred from quarterly Census surveys. In December 2020, the Census Bureau published data for two series: National Totals of State and Local Government Tax Revenue and National Totals of State Government Tax Revenue. The difference between the two series should represent local government revenue collections.

The Census data for the first three quarters of 2019 and 2020 are presented in the accompanying table.

State and Local Revenue, Q1-Q3 2019 v 2020

Source: Census Bureau Quarterly Tax Revenue Surveys

This analysis implies a nationwide increase in local government tax revenue of almost $60 billion for the first three quarters of the year, according to the Census Bureau Quarterly Tax Revenue Surveys data. Because these data are preliminary and there may be sampling differences across the two surveys, we cannot be sure that this estimate is definitive. But these results do not support the notion of a nationwide local government revenue crisis.

As time passes, annual disclosures from cities and counties will trickle in, allowing us to make a more definitive conclusion about local government revenue performance during the COVID-19 pandemic. But, for now, it appears that the most pessimistic revenue scenarios outlined at the beginning of the COVID-19 crisis are failing to materialize for most local governments.