After years of unfunded liability accrual and growing legislative solvency concerns, the Mississippi Legislature passed a major pension reform bill to provide a new “hybrid” retirement plan for future state and local public employees and teachers. The reform package included in House Bill 1 (HB1) will slow the growth of liabilities in the Public Employees’ Retirement System of Mississippi (PERS) and expand the portability of benefits for future workers.

Coming on the heels of contribution rate changes enacted by the legislature in 2024, the move will add another critical guardrail in officials’ attempt to put PERS—only 56% funded with $26.5 billion in unfunded pension liabilities—on a path to solvency. However, despite the positive changes, poor market conditions still threaten to bankrupt the PERS pension trust fund. Additional reforms will be necessary for the 2026 legislative session.

The legislature began to tackle the PERS unfunded liability challenge in earnest for the first time in 2024 by enacting a new schedule of incremental increases that required employers to slowly contribute more to PERS over time, along with a one-time supplemental appropriation of $110 million of state surplus funds. These “Phase 1” moves were a good start but did not fundamentally alter the financial trajectory of PERS in a significant way. The legislature prudently opted to call for a new retirement benefit tier (known as “Tier 5”) for the 2025 legislative session, which manifested initially in Senate Bill 2339, then became embedded in the final version of House Bill 1, pairing pension reform with a major tax reform that will lower rates significantly.

The pension reform provisions contained within House Bill 1 will offer all new hires on or after March 1, 2026, a new hybrid retirement plan that combines a defined benefit component like previous tiers with a defined contribution component for added mobility:

- New members can retire at age 62 with at least eight years of membership service. Alternatively, they can retire at any age with at least 35 years of creditable service.

- New members are immediately vested in the defined contribution plan.

- All members will continue to contribute 9% of their earned compensation. For new members, 4% will be allocated to the defined benefit plan, and the remaining 5% will be directed to the member’s defined contribution account.

- Employer contributions will be applied to the system’s accrued liability contribution fund.

- The annual retirement allowance will include a member’s annuity equal to 1% of the average compensation for each year of creditable service.

- For new members, “average compensation” is defined as the average of the eight highest consecutive years of earned compensation or the last 96 consecutive months of earned compensation, whichever is greater.

The Pension Integrity Project at Reason Foundation provided technical assistance to many stakeholders throughout the reform process, including the bill sponsors, legislative leadership in the House and Senate, and many individual legislators. We provided independent actuarial modeling during the process and advised legislative leadership and staff on design concepts.

The new Mississippi PERS Tier 5 hybrid retirement plan is similar to the reform designs enacted by several other governments, all of which have been successful in driving pension sustainability and have been fairly popular with employees:

- The United States moved to a hybrid retirement design for federal workers in 1987 under President Ronald Reagan after Congress passed the Federal Employees’ Retirement System Act of 1986, which blended the Federal Employee Retirement System, defined benefit with the Thrift Savings Plan, defined contribution into one combined benefit. The Thrift Savings Plan’s annual member satisfaction survey in 2024 found that 84% of federal workers were satisfied with their plan.

- All United States Uniformed Services (Department of Defense, United States Coast Guard, National Oceanic and Atmospheric Administration, and United States Public Health Service) moved to a hybrid military retirement plan called the Blended Retirement System, BRS, beginning in 2018. As of January 1, 2024, over 1.3 million members were enrolled in BRS, representing 68% of active members and 46% of Reserve and National Guard personnel.

- The hybrid plan design option has also been the most popular alternative to traditional pensions among state governments that have enacted major plan design reforms, with states like Tennessee, Georgia, Virginia, Pennsylvania, Washington, Oregon, Utah, and Rhode Island all transitioning one or more legacy pension designs to a hybrid approach.

The pension reform in HB1, combined with modest funding improvements enacted in 2024, represents two strong initial phases of reform critical to turning around decades of declining financial health in Mississippi PERS. However, a third (and potentially more) phases of reform remain critical targets for legislative action in 2026, as outlined in the recommendations section below.

How Mississippi got here

At the turn of the century, the Mississippi Public Employee Retirement System, PERS, faced a funding gap of $2.3 billion, with 87.5% of its obligations covered. Since then, the situation has deteriorated significantly, largely due to investment returns falling short of overly optimistic forecasts and a gradual reduction in those expectations to more realistic levels. As a result, PERS now carries an unfunded liability, or pension debt, exceeding $25 billion.

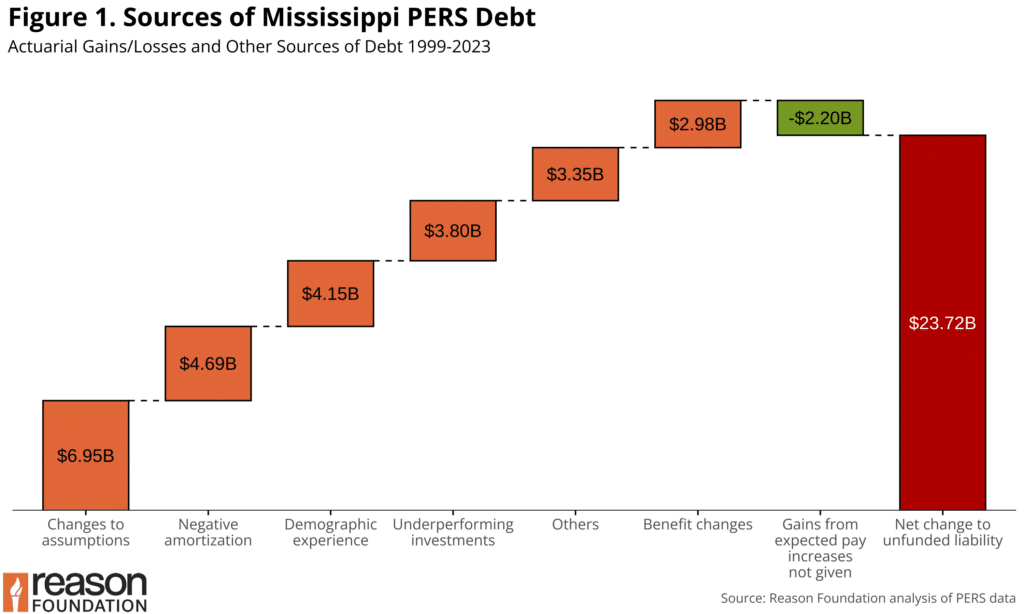

Figure 1 breaks down the contributors to the pension debt, which include underperforming investments ($5.7 billion) and revised investment assumptions ($7.0 billion). Additionally, negative amortization—when contributions in a given year fail to cover that year’s interest on existing debt—has increased the shortfall by another $4.9 billion. The system’s cost-of-living adjustment (COLA), a fixed 3% annual increase, does not align with actual inflation and has grown to consume a larger share of payouts, further straining finances. Expected salary increases for employees that were never actually granted have slightly reduced the total unfunded liability.

Beyond these financial challenges, structural funding issues persist. As of 2025, PERS is in a tenuous position with costs that are extremely vulnerable to volatility in global investment markets. PERS actuaries have warned that contributions from employers–even at the increased 19.9% rate–are insufficient to pay off debt and fully fund promised pension benefits. According to system estimates, employers would need to contribute an amount equal to 22.4% of payroll to achieve full funding within 30 years. Maintaining the current insufficient statutory contribution rate will result in much slower and likely stagnant progress in eliminating the state’s pension debt, with tens of billions in debt remaining and accruing expensive interest over 50 or more years.

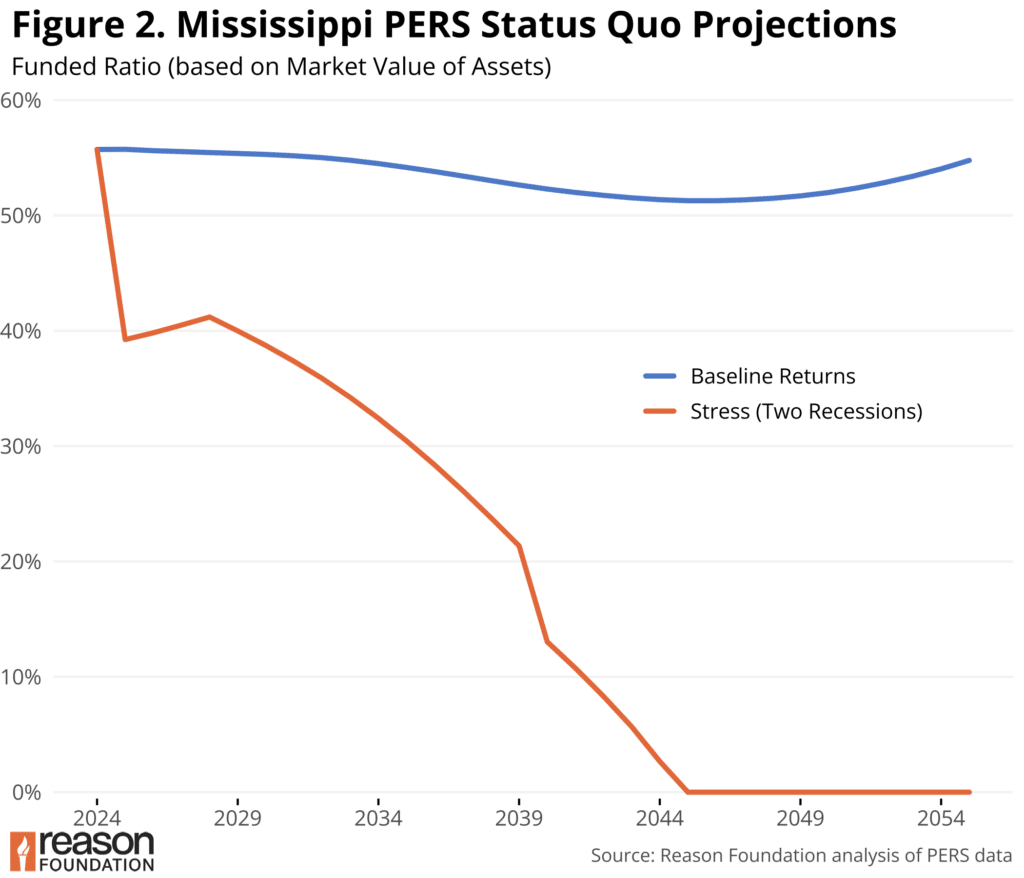

These projected outcomes are far worse if market returns are much lower than plan assumptions, which policymakers must account for. The ultimate cost of the pension system will grow significantly (adding over $13 billion) over the next 30 years if markets return the 6% average expected by market watchers. If the economy and pension system encounter two recessions over the next 30 years (Figure 2), the system is projected to run out of funding, which would force the state into a pay-as-you-go (paygo) funding policy, meaning benefits would need to be paid without the benefit of accrued investment savings. If PERS were to face insolvency, contributions from employers would need to rise above 49% of compensation (well above the current 22.4% requirement), costing taxpayers more than $27 billion in additional contributions over the next 30 years to pay for pension promises.

Explaining the reform

The new PERS tier (“Tier 5”) established in HB1 is a crucial step for Mississippi’s retirement system if it is ever going to recover from decades of underfunding. It reforms the system by enrolling all new hires into a hybrid plan and adjusting some of the other benefits associated with the pension, effectively slowing the growth of liabilities attached to public workers going forward.

Instead of using all of their 9% contribution for a pension benefit, new hires enrolled in the hybrid Tier 5 benefit will see the same rate split between a pension and a defined contribution (DC) plan. Tier 5 employees will see 4% of their paycheck used to fund the pension portion, and 5% go toward an individual 401(a) account. PERS employers will continue to contribute the statutorily required amount equal to 19.9% of the total payroll, which will still be used to pay for the system’s unfunded liabilities.

The pension portion of the Tier 5 hybrid will secure a guaranteed lifetime benefit about half the size of Tier 4 (using a 1% multiplier in the benefit calculation instead of 2%). The calculation’s final average salary (FAS) portion will also use a member’s eight highest-paid years rather than the current four-year average used in Tier 4. The DC portion will give employees a more flexible benefit that will require no vesting period, be less vulnerable to inflation with returns accruing throughout employment and retirement, and be more portable to other jobs and retirement plans.

Tier 5 also adjusts some of the retirement eligibility requirements for the pension portion of the hybrid. Instead of eligibility beginning at age 60 or at 25 years of service, the pension portion of the new hybrid will be available at age 62 after 30 years of service or age 65 (eight years served minimum) or at any age after 35 years of service.

A final major change for new public hires in Mississippi will be that there will no longer be a guaranteed 3% COLA to insulate pension benefits from inflation. It will be possible for the legislature to grant benefit adjustments on a discretionary basis through legislative action, but COLAs will not be included in the liability and cost projections for Tier 5. While this aspect of HB1 will help mitigate future costs and risks, it also represents a significant shift in benefits offered to new hires, as discussed further below.

Analysis of HB1’s reforms

Mississippi’s pension reform aims to bend the PERS liability curve downward by slowing the growth of pension benefit accruals, making it somewhat easier for funding to catch up eventually. Actuarial modeling prepared by the Pension Integrity Project at Reason Foundation indicates that HB1 will likely achieve this goal if actuarial assumptions such as investment return and payroll growth prove accurate.

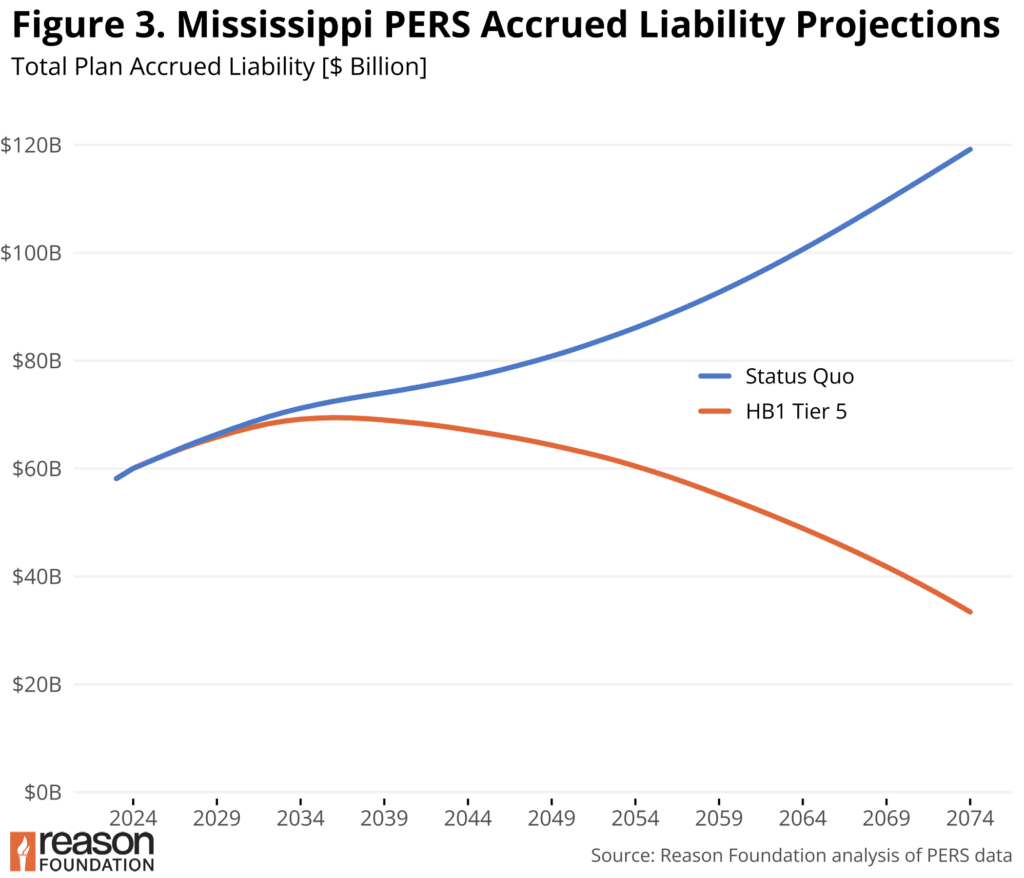

Because the Tier 5 hybrid plan reallocates retirement benefits from a defined benefit that serves a fraction of members to a defined contribution benefit (which cannot accrue a liability and cannot create unexpected costs), the growth of liabilities is expected to slow. Additionally, suspending costly COLA benefits for new hires has reduced the impact on the accrual of PERS benefits going forward.

Reason modeling of PERS shows a distinct long-term impact (Figure 3). Applying the new Tier 5 reform will ultimately reduce liability accrual by more than $80 billion by 2074.

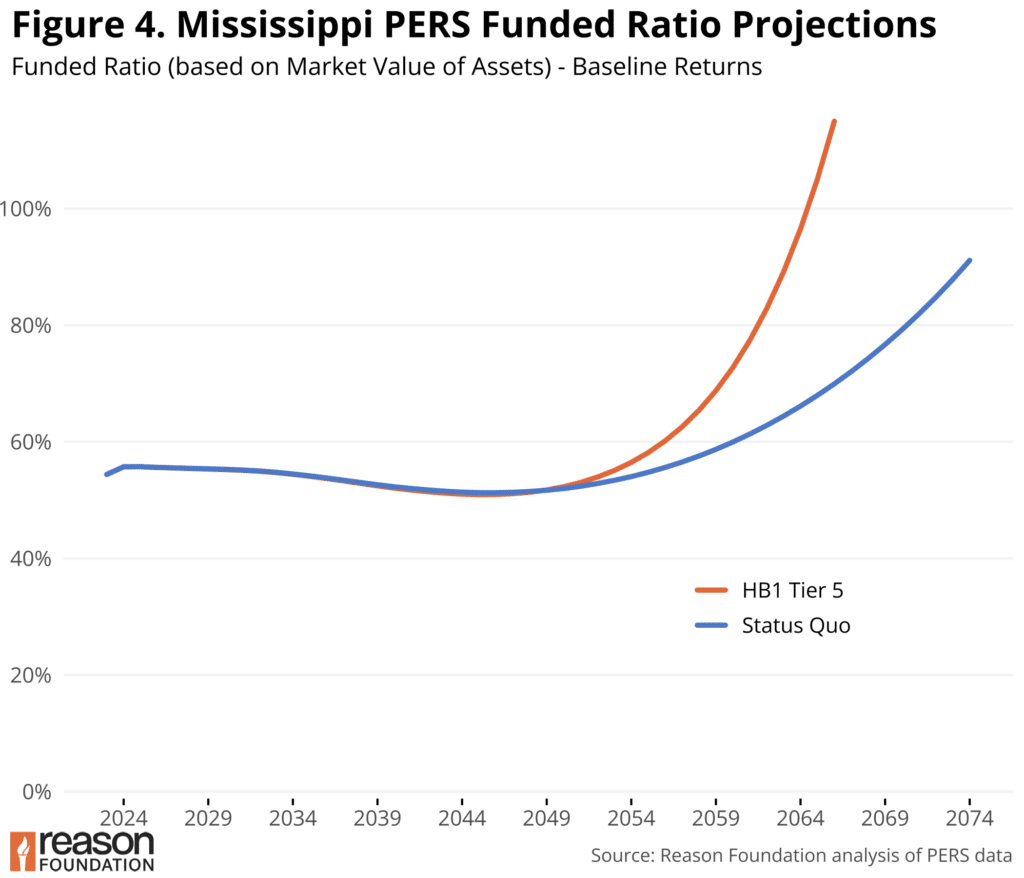

This slowing of liability accrual gives Mississippi a better chance of achieving full funding. Reason modeling shows that the new benefit and funding structure could bring PERS to full funding at least a full decade sooner if market outcomes match plan expectations (Figure 4). This would have a significant impact on the overall costs for government employers and taxpayers.

Reduced liabilities and the much-improved trajectory of PERS funding will likely generate significant savings over the long run. Looking at both projected unfunded liabilities and all employer contributions to the plan, this reform is projected to save $6.5 billion over the next 30 years and over $17 billion over the next 50 years. Importantly, the risk-reducing features of the reform go a long way in managing these costs under less-than-ideal market scenarios. According to Reason’s modeling, this reform would save more than $30 billion if PERS were to experience multiple recessions and returns below the current 7% expectation over the next 50 years.

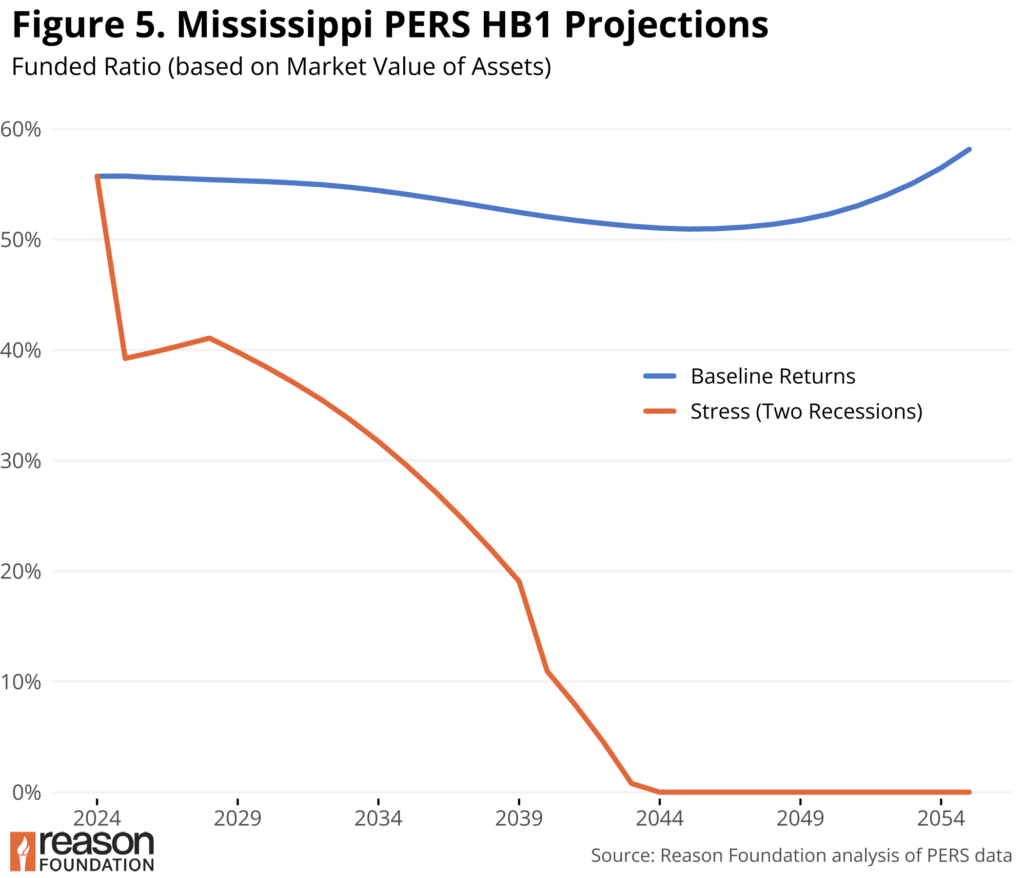

Mississippi policymakers should be warned that, while this reform does reduce long-term costs, it is not projected to reduce the chances of PERS becoming insolvent and exhausting all assets. Figure 5 shows the projected funded ratio of the reformed system, both under a scenario of 7% annual returns and one that involves two recessions and returns below expectations (6%). Comparing these outcomes to the pre-reformed system (Figure 2), a less-than-ideal investment outcome still results in plummeting and eventual exhaustion of funding. HB1 has not eliminated the danger of insolvency facing PERS, which must be addressed in future reforms.

Assessing the Tier 5 benefit

Another advantage to Mississippi’s Tier 5 reform is that it will offer a retirement benefit that better reflects the evolving needs of new hires today. Pensions tend to reward lifetime employees or those who stick around their entire career. This type of employee is increasingly rare in both the private and public sectors. According to Reason’s analysis, PERS expects most new hires to have left by year five, years before the pension’s steep eight-year vesting requirement. That means the current pension offers little to most of the state’s new workers.

Retirement plans must adapt to meet the needs of today’s employees. Hybrid plans balance risk between employers and employees while offering more flexibility than traditional pensions. Employers benefit from reduced financial exposure, while employees—who often change jobs before qualifying for a full pension—gain some portability and access to market-driven growth. Unlike Tier 4, which requires workers to leave their contributions in the plan with minimal interest or withdraw them—often forfeiting employer contributions—a hybrid plan allows employees to take the defined contribution (DC) portion with them when they move to a new job.

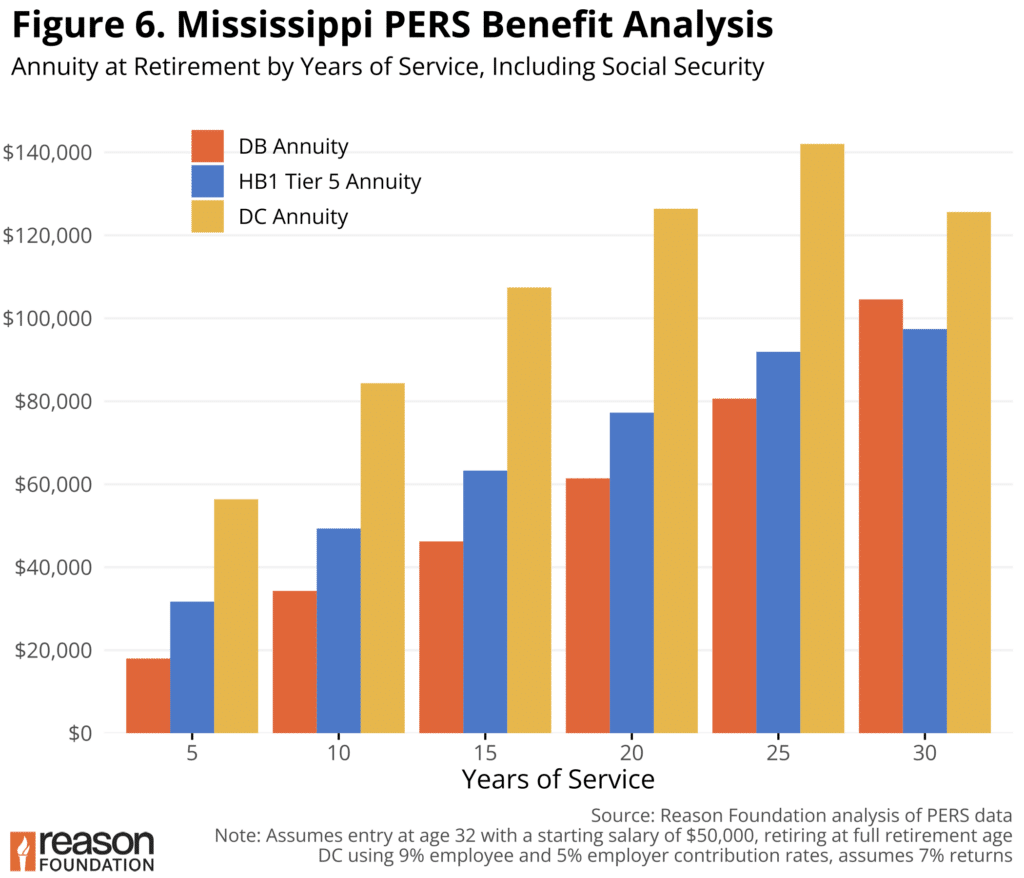

New employees will enjoy more than just the benefits of modernized flexibility in the Tier 5 hybrid. The DC element of the hybrid is expected to improve retirement benefit outcomes for most new hires. Figure 6 compares the estimated value of the PERS DB plan, the new Tier 5 hybrid, and a pure DC plan. To compare the value of one plan type to another, the analysis calculates the amount that could be generated in annual annuity payments (meaning guaranteed lifetime benefits) for someone hired at age 32 at increasing years of service.

The analysis shows that the new Tier 5 benefit actually outpaces the retirement value generated by the state’s pension until year 30, at which point the pension provides a slight advantage. Keeping in mind that very few newly hired members (less than 10%) stay in their position for 30 years, it is clear that the HB1 Tier 5 hybrid actually provides a greater benefit for the vast majority of PERS members.

This analysis also includes the accrued annual lifetime benefits that an employee could earn from a pure DC plan with 9% employee and 5% employer contributions. The advantages of a DC plan of this type would further improve the retirement offerings to public workers. Mississippi policymakers should consider granting a full DC plan as an option to new hires.

A pure DC option could also address one of the primary concerns expressed about the Tier 5 hybrid. Since no COLA benefit will be provided for the DB portion of the hybrid, new public employee hires will see part of their retirement reduced over time from year-to-year inflation. The DC element of the hybrid will grow with market returns, providing at least some cushion from the loss of COLA benefits. Still, having no COLA will represent a significant recalibration of expectations from legacy to new hires in Mississippi. To further alleviate this concern, lawmakers should give employees the ability to select a full DC plan instead of the new hybrid, which would eliminate any concerns about managing a fixed lifetime benefit with no protection from inflation

Completing the reform to prevent MSPERS insolvency — framing a 2026 policy agenda

The new Tier 5 benefit design included in HB1 is a necessary and critical step in addressing the state’s growing pension challenges. The new Tier 5 plan design alone will not solve the PERS underfunding crisis, however, and state lawmakers need to continue to seek an additional Phase 3 of reforms in 2026 to avoid insolvency and secure PERS for future generations.

Recommendation 1: Fix the broken PERS’ funding policy

Pension Integrity Project modeling of PERS indicates that while the hybrid plan for new hires will improve the system’s trajectory, the system will remain at risk of insolvency under recession scenarios. The main culprit threatening the state’s pension funding will continue to be its rigid contribution policy with rates set in statute rather than adjusting each year to achieve a payoff goal. The current approach represents a failed pension funding policy, as it:

- Is the primary reason PERS remains underfunded today and is structurally underfunding PERS every single year;

- Has no relation to actuarial calculations nor is it set to achieve full funding;

- Pretends that 19.9% has some objective meaning other than being the rate policymakers today would prefer to pay into the PERS system; and

- Sacrifices long-term funding needs for year-to-year cost stability.

Looking to the next legislative session, policymakers should pursue reforms to establish a more reflexive annual contribution that will avoid the long-standing systematic underfunding issues that have thrust the state into the current pension debt quagmire. Using an actuarially determined employer contribution (ADEC) is considered the gold standard policy for responsibly funding pension benefits. Still, there are many incremental steps in between that would improve the state’s current statutory approach. Any effort to accelerate the growth of the system’s assets–for example, a supplementary contribution or any type of contribution increase–will not only better secure PERS, but it will also end up saving taxpayers tremendous amounts of money by avoiding decades of expensive interest on the burdensome pension debt.

Recommendation 2: Adopt an optional defined contribution (DC) retirement plan

The new hybrid plan is a notable step toward meeting the flexibility needs of the modern workforce, but state policymakers missed out on a major opportunity to make PERS more valuable to a broader set of potential new hires.

With the creation of individual 401(a) plans for the DC side of the hybrid in Tier 5, it would be easy for PERS to now offer a full DC retirement plan option for those who want to take advantage of this type of retirement plan. Offering an option to have all contributions go to a DC plan would expand the system’s ability to serve more unique employee situations and would do so while actually reducing the risk of runaway costs even more than the new hybrid approach. Several state-run retirement plans have enjoyed success in offering a full DC option, and Mississippi’s lawmakers should prioritize this in the 2026 session.

Conclusion

Through several years of study and coalition building, and with the assistance of the Pension Integrity Project, Mississippi policymakers have enacted a reform that will greatly improve the long-term viability of its retirement plan for public workers. The reformed Tier 5 benefit for new public employee hires will establish a more balanced and risk-managed plan that works better for most employees and the taxpayers who fund the system in the end. The reform is a clear, positive step in improving the system’s long-term solvency and will improve the chances of achieving crucial long-term funding goals. However, it should be clear to policymakers that the work in Mississippi is not done, as PERS remains very much at risk in the face of a volatile and unpredictable future.

To complete the state’s path toward a comprehensive reform, lawmakers must next address longstanding funding issues with changes to the annual contribution policy. They should also set up an optional DC plan for public employees, improving the retirement benefits for most of those beginning employment. These steps would better secure PERS for future generations and reduce expensive debts that have created massive unexpected costs for Mississippi taxpayers.

Additional resources

- Mississippi PERS Data & Modeling: Pension Integrity Project Dashboard

- Commentary: A New & Necessary Approach to Mississippi’s Pension

- Commentary: Mississippi PERS’ $25 Billion Problem

- Commentary: Mississippi’s Low Pension Contributions Cause S&P Global to Downgrade Its Credit Outlook

- Commentary: Modernizing PERS to Serve Mississippi’s Public Workforce

- Commentary: Mississippi Municipalities Should Brace for Higher Pension Contributions

- Commentary: Mississippi Needs to Fix the Way It Pays for Public Pensions

- Commentary: Mississippi Lawmakers Can Take the Best from Other Successful State Pension Reforms

Full Explainer: Does the hybrid plan established in HB1 meet the objectives for good pension reform?