The Michigan Legislature has just passed a first of its kind, innovative pension reform bill that will provide a new set of retirement choices for state teachers and cap the growth of liabilities in the state’s current, structurally flawed retirement plan. Should Gov. Rick Snyder sign the bill, the Michigan Public School Employee System (MPSERS)—currently only 60% funded with $29 billion in unfunded pension liabilities—will have its most realistic path to solvency in the past two decades.

The reform is grounded in a focus on reducing risk, while stabilizing cost, and preserving choice:

- New hires will be auto-enrolled in a defined contribution retirement plan (DC Plan) that has a default 10% total contribution rate. DC Plans inherently have no risk of unfunded liabilities, and the maximum employer share for the plan (7%) is less than what employers should be paying for the current plan.

- However, if new teachers would prefer a defined benefit pension plan (DB Plan), they will have the choice to voluntarily switch to a new “hybrid” plan that, unlike the current “hybrid” plan offered to teachers, uses very conservative assumptions and short amortization schedules and splits all costs 50-50 between the employee and employer.

- Uniquely, the hybrid plan will have a safeguard mechanism that would trigger closure if the funded ratio falls below 85% for two consecutive years.

- And to top it off, the reform design improves certain actuarial assumptions and infuses the plan with $250 million in additional contributions to chip away at the pension debt.

The Pension Integrity Project at Reason Foundation provided technical assistance to many stakeholders throughout the MPSERS reform process, including the bill sponsors (Sen. Phil Pavlov and Rep. Thomas Albert), legislative leadership in the House and Senate, and many individual legislators. We provided independent actuarial modeling during the process and offered advice on design concepts to the legislature, the Snyder administration, and the state’s Office of Retirement Services.

Some other plans in the country have adopted similar components as the Michigan teacher pension reform:

- Florida moved to default employees into a DC Plan earlier this year.

- Pennsylvania overhauled its retirement benefits earlier this month by giving new hires a choice between two hybrids or a DC Plan.

- Arizona has embraced 50-50 cost sharing for its public safety, state employee, and teacher defined benefit plans.

- South Carolina changed its funded policy to increase employer contribution rates by 100 basis points a year until 2023.

- And Kentucky’s state and local pension system moved to adopt a very conservative 5.25% assumed rate of return last month.

But no state in the country thus far has embraced the full scope of these reform components for a teacher pension system in a way that will virtually eliminate the possibility of unfunded liabilities for new hires, while also allowing future teachers a choice of retirement benefit styles (DB or DC). The structure of this blended approach should serve as a model for teacher pension reform in other states facing similar challenges as MPSERS does today.

1. The Problem

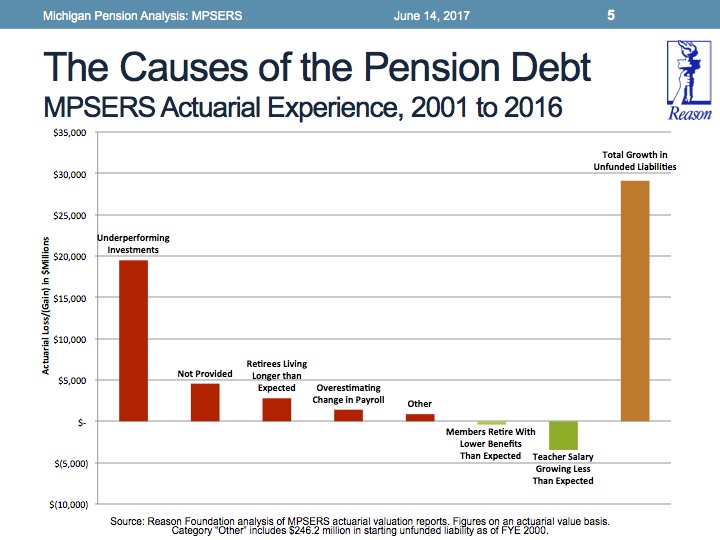

Like many other pension systems in America, MPSERS faces a mountain of unfunded liabilities and future of growing contribution rates. At the turn of the millennium the Michigan teachers plan was reported to be fully funded, but as of the end of last year (June 2016) the plan’s funded ratio was below 60% with $29.1 billion in unfunded liabilities.

Other actuarial assumptions have created problems for MPSERS too. For example, since 2004, the Michigan Office of Retirement Services (ORS) has been assuming a 3.5% growth in payroll — but there hasn’t been a single year since then that payroll grew at that rate higher than 1.25%. In fact, over the past 15 years the payroll for the plan has actually declined by nearly $2 billion. This grossly unrealistic growth assumption — combined with a long, level-percent of payroll amortization method — has effectively back-loaded billions in unfunded liability payments, making the long-term “plan” to pay off the pension debt increasingly a fantasy.

In 2010, Michigan created a new “Pension Plus Plan” to replace its existing defined benefit plan for future hires. This new hybrid design included the same defined benefit plan — with a 1.25% multiplier, 10-year vesting schedule, and 5-year final average salary — but with a larger employee contribution, slightly changed retirement eligibility age, and no cost-of-living adjustment. Instead of a COLA, the state added a small DC Plan on the side of the DB Plan, with a 1% maximum employer match for the first 2% contributed by the employee. Most importantly, this “hybrid” plan was priced with a 7% assumed rate of return while the main DB Plan continued to use an 8% rate of return.

This change was not enough to fix MPSERS’ problems though. Even the 7% assumed return carried substantial risk. We developed a Monte Carlo analysis of the MPSERS portfolio using asset class forecasts by three leading financial firms plus the Michigan Bureau of Investment’s own forecasts and found that there was less than a 50% chance of achieving a 7% rate of return.

To make matters worse, all of the other unrealistic or inaccurate assumptions being used by MPSERS for the old plan were the same for the Pension Plus hybrid plan. As a result, employers contributed just 3.1% towards the post-2010 defined benefit plan when more realistic assumptions would have required around 7.1% employer contributions.

Meanwhile pension debt continued to accrue in the old plan with its unrealistic 8% assumed return. The adoption of the hybrid plan didn’t fix the problem, and its actuarial assumptions were tacitly underfunding new employee retirement benefits in just the same ways as the old plan.

On top of growing unfunded liabilities, MPSERS has also faced considerable retention problems. Our analysis of termination data provided by ORS found that about 50% of teachers left before vesting in any benefit, and less than a third of teachers actually stayed long enough (30 years) to earn a full pension benefit. The existing system was clearly not working for all teachers.

Using independent actuarial modeling we built for members of the Michigan legislature, our forecast shows that without changes to MPSERS and continuation of recent actuarial experience trends, actuarially required employer contributions would effectively double by the 2030s, from around 30% of payroll today to north of 60% of payroll. Such a nightmare scenario would easily risk crowding out classroom expenditures as all of Michigan education costs — including pension debt costs — come from the same pot of money in the Michigan budget called the School Aid Fund. Facing this kind of unsustainable future, the Michigan legislature knew it needed to act.

2. The Solution

The primary objectives of pension reform in Michigan started with ensuring that all promises made to existing employees and retirees could be kept, and that any solution ensure retirement security for all current and future members. A major focus was on putting a cap on the state’s financial risk while also minimizing increases in normal cost. It was important for many stakeholders in Michigan that employees have the option for a traditional defined benefit, while other stakeholders were focused on providing a robust DC Plan that would provide portable benefits for the more mobile teachers in the state. The final agreement balanced the varying interests and goals of stakeholders from across the legislature and Governor’s office.

Retirement Benefit Design

Future Members —

- DC Default Plan: All new hires as of February 1, 2018 will be automatically defaulted into a DC Plan that has a 4% minimum employer contribution and up to 3% more in matching employer contributions.

- Full Match Auto-enroll: Employees will be auto enrolled with a 3% contribution to receive the full employer match, resulting in a default 10% DC plan. Employees will have their contributions automatically increased by 1% each year up to 7% total employee contributions, but always have the right to voluntarily reduce the contribution back down to whatever their preference. Cumulatively, this means that within 4-years of membership, a teacher would be fully vested in a 14% DC Plan, a level that will provide for a robust retirement benefit.

- Pension Plus 50-50 Plan: All new hires as of February 1, 2018 will have the option to choose a new, de-risked “hybrid” plan. They will have 75 days to make this election and will be presented with information about both the DC Plan and hybrid plan. Employees making the election will need to acknowledge receipt of this information with a signature to ensure they are being properly educated about their decision. (See below for details on the Pension Plus 50-50 Plan design.)

Current Members —

- Upgrade Current DC Members: Teachers who had selected a DC only plan first available in 2012, but that only had a 3% employer contribution will be upgraded to the more generous DC Plan created under this pension reform with an up to 7% employer contribution.

- Retirement Age Linked to Mortality: For teachers in the existing (and new) hybrid plan, their retirement age will be subject to increase should there be a meaningful change to mortality tables. For each year in additional life expectancy relative to 2017 assumptions, the board will increase the retirement age one or two years as necessary.

- Offer Annuities: The Michigan Treasury department, which manages the existing DC Plan that is primarily used by state employees, will be required to add to its mix of investment options that are provided by a third-party vendor at least one fixed rate annuity, and at least one variable rate annuity. This is intended to provide options at retirement for plan members.

Funding Policy Improvements for the Existing Plan: While the primary changes of the Michigan teacher pension reform were a cap on liabilities and improved benefit design structure, there were also funding policy changes that cumulatively will result in approximately $250 million in the current year budget being appropriated to make a down payment on the existing debt above and beyond the actuarially determined contribution.

Assumption Changes —

- Assumed Return: Earlier this year the state decided to lower the assumed rate of return for the “Basic” pre-2010 defined benefit plan (which has most of the MPSERS accrued liabilities) from 8% to 7.5%. Technically, the funding for this change was included in a separate appropriations bill, but the agreement to embrace the change and fund it was part of the overall conceptual approach to funding policy reform whereby the state will periodically start reducing its rate of return. The next reduction will likely accompany a MPSERS actuarial experience study scheduled for 2018.

- Adjusted Payroll: Change the basis of the amortization schedule from covered payroll to current operating expenditures of a school district; the underlying assumption does not change in this bill but will be lowered in next year’s actuarial experience study, which involves a deep analysis of all assumptions used by the plan compared to actual historic performance with the goal of proposing adjustments to improve funding.

Method Changes —

- No Normal Cost “Credits”: The normal cost in any given year cannot be reduced due to reported “overfunding”

- Contribution Rate Floor: The unfunded liability amortization payment in any given year cannot be less than the prior year until the plan is fully funded

Transparency Improvements —

- Probability of Return Study: The Michigan Treasury department will be required to produce a report along with the MPSERS experience study that shows the various probable rates for return for the existing portfolio, i.e. the probable rate of return at the 5th percentile, 25th percentile, etc.

New Pension Plus 50-50 Plan Design: A key innovation in the Michigan teacher pension reform is the creation of a retirement option that combines a de-risked defined benefit pension plan with a defined contribution retirement plan.

Improved Cost Sharing and Methods —

- All normal costs and any potential unfunded liability amortization payments necessary for this tier are split 50-50 between the employers and employees

- 6% assumed rate of return

- 10-year, level-dollar amortization schedules on a layered basis

Defined Benefit Plan —

- 1.25% multiplier and 5-year final average compensation

- 10-year vesting

- Retirement Eligibility: Age 60 with 10 years of service

Defined Contribution Plan —

- Employer match of 50% of employee contributions with a maximum of 1%

- Employees defaulted at 2% contribution to receive the full match, but can reduce or increase their rate

Catastrophic Downturn Safeguard Mechanism —

- If the funded ratio for the new hybrid plan falls below 85% for two consecutive years, then the plan will be closed to new hires within 12 months following the actuarial valuation showing the second year of 85% or less funding

- The funded ratio is measured on an actuarial value using 5-year smoothing

- Explicit underfunding by the legislature (i.e., failing to pay the actuarially determined rate) to try and trigger closing will not be counted towards the 85% funded ratio

3. Pension Integrity Project’s Role

Our Pension Integrity Project team provided technical assistance to many stakeholders in the MPSERS reform process. We provided independent actuarial modeling for members of the state House and Senate (including, most importantly, the bill sponsors), as well as policy design advice to legislative leadership, governor’s office, and the state’s Office of Retirement Services based on our experience assisting in other states. Whenever we look at a proposed pension reform package we always compare it our objectives for good pension reform. Ultimately, the MPSERS reform bill compared very favorably to our matrix:

- Keeping Promises: The adopted legislation will help to improve the solvency of MPSERS by gradually, but dramatically, reducing the possibility of unfunded liabilities, which will help ensure the state’s ability to live up to its pension promises. No part of the proposed legislation takes away any retirement benefit from any member or retiree.

- Provide Retirement Security: The reform will make it easier to pay off unfunded liabilities in the long-run and ensure 100% funding for promised benefits. The DC Plan provides a competitive retirement benefit modeled after the same plan all new state employees in Michigan have received since 1997. And the Pension Plus 50-50 Plan preserves the option for a traditional pension for those that want it — and are willing to contribute more to pay for it.

- Stabilize Contribution Rates: The current Pension Plus Plan does not have stable rates because it is using mostly the same faulty actuarial assumptions as the old legacy defined benefit plan closed in 2010. The proposed DC retirement plan would have no volatility for new hire benefits, creating fixed costs in the long-term. Plus, the new hybrid plan would have equal cost sharing with short amortization schedules, minimizing the potential for contribution rate volatility.

- Reduce Risk: The reform package will result in the gradual reduction in taxpayer-guaranteed pension benefits, which will mean a gradual reduction in risk exposure because there will be fewer promises exposed to potential underfunding.

- Reduce Long-Term Costs: The current employer contribution forecasts for the Pension Plus Plan of around 3.1% for the defined benefit portion are underpricing the actual costs of that benefit. The new Pension Plus 50-50 Plan design would mean a slightly higher employer contribution to retirement benefits (an estimated 5-6%) compared to the current forecast — however, compared to a realistic pricing on the current plan (around 7%), the new plan is cheaper. Plus, because there is much less possibility to accrue unfunded liabilities under the adopted reform, it means that long-term costs are going to be lower because of the changes.

- Ensure Ability to Recruit/Retain: DC Plans are portable and have flexible contribution rates, making them an attractive option for certain employees. The ability to adjust rates based on an individuals own retirement goals while also receiving a generous employer contribution (7%) make the new DC Plan more attractive than previous options for teachers. Having a choice of benefit makes the new plan even more attractive from a recruitment perspective too.

The Michigan Legislature should be congratulated for adopting such an innovative teacher pension reform package that will reduce risk, provide choice, stabilize contribution rates, offer retirement security, and keep promises. Other states and cities should look to this design for inspiration in solving their similar pension woes.

Additional Resources:

- Full text and legislative history: Senate Bill 401 & House Bill 4647 (mirror bills)

- Pension Integrity Project’s MPSERS reform fact sheets and issue explainers: reason.org/MPSERS

- Pension Integrity Project 6/14/2017 testimony to the House and Senate Education Committees (includes our complete actuarial analysis of MPSERS and detailed analysis of the adopted changes)

- Additional Pension Integrity Project information