New research shows that the Teachers Retirement System of Georgia (Georgia TRS) may not be a good fit for all new expected teachers.

Retirement systems regularly publish estimates of how long new public employees will stay in the workforce. Bellwether Education Partners analyzed these results and published their findings at the end of 2018. They found that for the average entrant into Georgia TRS —in this case, a 25-year old female starting her teaching career— there is just a 30 percent chance they will still be teaching within 10 years.

Because Georgia TRS has a 10-year vesting requirement, this means that the retirement system is expecting that just a third of new public educators would stay long enough to qualify for any pension benefits. For those who expect to work a full career, this won’t be much of a concern. But for younger, more mobile, teachers this means Georgia TRS is not a path towards retirement security.

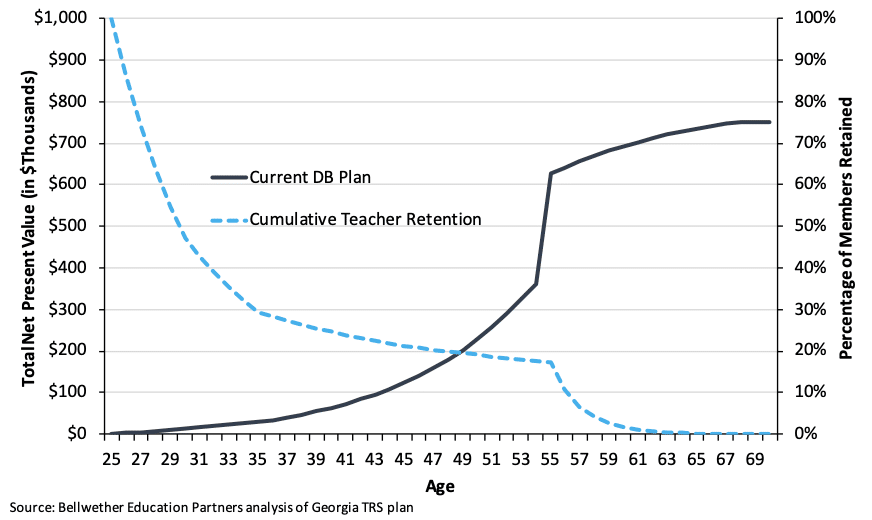

Figure 1 below shows the expected turnover pattern for a new, 25-year-old entrant to Georgia TRS. As the blue dotted line shows, only 17 percent are expected to stay long enough to earn benefits in full. This is measured against the net present value of defined benefit accruals over the same time period. Because the benefits are backloaded — as is typical of a final average salary defined benefit (DB) plan — most of the benefits in Georgia TRS are accruing to the roughly 1/5 that stay in the system.

Figure 1. Georgia TRS: Member Retention vs. Benefit Accrual

Although there is little to no evidence that retirement benefits — whether pensions, defined contribution plans, or any other retirement plan design — play a major role in drawing individuals into the educational profession, as teachers gain more experience retirement benefits do incentivize them staying for a full teaching career. Research by Jason Richwine and Andrew G. Biggs, for example, finds that pension benefits and savings could be boosting public school teachers’ average wage anywhere from 11 to 32 percent, depending on the discount rate used. After all, pension benefits provided by the state and local governments are often more generous than private-sector plans, which arguably do provide some positive effects in retaining highly experienced police officers, judges, teachers and other public workers.

In short, the lion’s share of pension benefits in Georgia TRS are accrued near the end of a teaching career. And a major spike in benefit accruals usually happens when a member reaches a certain age and/or years of service needed to qualify for full retirement, mainly because members are often penalized for retiring earlier than designed by the plan. In this case, this spike occurs around year 30 of employment, which is when teachers attain eligibility to receive a full, unreduced retirement benefit.

Generally, the purpose of this backloaded benefit accrual schedule is to help keep highly-experienced public teachers in a job longer. But the opposite side of this coin is that many teachers, especially younger ones, might be losing out not only on their pensions when they decide to leave but on their own contributions into the system (more on that later). This can, in turn, be a significant detriment to the security of their retirement.

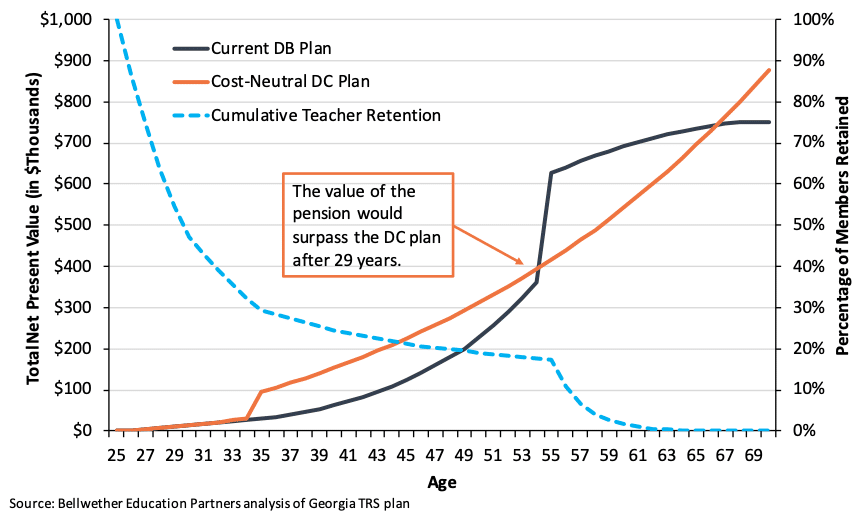

If, however, the same Georgia educator was to put all of the same pension contributions to a separate defined-contribution (DC) account that is structured to have employer matching with a constant 6.5 percent return (i.e. 1 percentage point lower than the Georgia TRS 7.5 percent rate of return assumption), the value of such an account would be higher than that of defined-benefit (DB) pension benefits throughout her career — up until they reach the normal retirement threshold (see Figure 2).

In other words, the present value of pension benefits maximizes at or near the normal retirement point in the current plan, but is higher with the proposed DC account for anyone leaving or retiring before that. Not surprisingly, per the latest data, the average years of service at retirement for a Georgia TRS member was 30.5 – just slightly north of the 30-year service requirement.

Figure 2. Georgia TRS: Member Retention vs. DB and DC Benefit Accruals

As such, a combination of high turnover rates and back-loaded benefit accruals shows that many public-sector educators in George who switch careers can expect to earn less in retirement benefits than the value of pension contributions (plus 4.5 percent interest) they’ve put in. In fact, according to the Bellwether Education Partners, only 25 percent of teachers in Georgia TRS will break even. And according to a 2017 report by the Thomas B. Fordham Institute, it would take 20 years for teachers in Gwinnett County Public Schools, Georgia to break even on their pension contributions without accounting for a separate supplemental plan that mimics Social Security benefits. Some educators may find themselves breaking even around that point if their district has opted-out from providing Social Security coverage (e.g. metro Atlanta, DeKalb, Fulton, and Clayton counties) or offer supplemental programs.

Thus, it is not clear if such back-loaded benefit design works as intended for most public employees. In fact, there is evidence that some risk-averse teachers, who are aware of the so-called “attrition” risks —or know that they will likely leave before reaching the normal retirement threshold – might prefer a more even pattern of retirement benefit accrual over the current backloaded pension design. Luckily, there are several possible options that would help award more consistent benefits for each year of work, such as shorter pension vesting periods, a graded pension benefit multiplier, some employer match on employee contribution refunds, or a shift to—or perhaps more appealingly, the choice of—an alternative DC, cash balance or hybrid plan design.

The uneven nature of pension benefit accruals along with weak retention rates should signal to policymakers that they need to better tailor plan designs to the needs of public workers. These adjustments can be made in ways that both maintain retirement security and keep the costs for the taxpayer at bay. Such considerations can help make sure new, especially younger, teachers in Georgia do not miss out on the maximum level of retirement security and are properly rewarded for their work.

Notes:

- It is worth noting, however, that the present value of pension benefits is calculated using a pension plan’s discount rates, which are often overly optimistic. And therefore, should be taken with a grain of salt. If, for example, Georgia TRS – that earned just 5.7 percent (geometric mean), on average, over the past 18 years – was to apply a more reasonable discount rate the value of individual DB benefits should have been adjusted upwards, requiring higher annual contributions to pre-fund the adjusted value.

Stay in Touch with Our Pension Experts

Reason Foundation’s Pension Integrity Project has helped policymakers in states like Arizona, Colorado, Michigan, and Montana implement substantive pension reforms. Our monthly newsletter highlights the latest actuarial analysis and policy insights from our team.