Housing prices have skyrocketed in recent years, preventing many workers and families from moving to cities and driving others out of high-cost metropolitan areas. After recovering from the mortgage and housing bubble of 2008, home prices rose steadily over the next decade and then significantly spiked during the COVID-19 pandemic. While multiple factors are driving up housing costs, land-use regulations play an especially significant role.

According to the National Association of Realtors, the median sales price of existing homes in the United States was $382,000 in March of 2022, compared to $274,600 in 2019. Rising costs are pricing many workers out of the housing market, particularly in large coastal cities such as San Francisco, New York, and Los Angeles.

These major metropolitan areas are desirable locations that are also home to higher wages and plentiful employment opportunities. But rising housing costs can be a barrier to those wanting to move to such cities, especially for lower-income workers, younger people, and families looking to buy their first homes.

Ambitious Americans have historically moved to large cities in search of new opportunities. And, in past decades, that goal was achievable. Between 1880 and 1980, migration patterns in the United States were marked by the widespread movement of people from low-income areas to high-income areas in search of higher-paying jobs. As a result, per-capita incomes across states converged by about 1.8 percent each year. In other words, the difference between typical incomes in large coastal cities and in places like the Deep South lessened. However, that convergence has slowed and, to some extent, reversed course in the decades since 1980.

A 2017 analysis concluded that the decline in income convergence could be partially explained by regulations that limit the supply of housing. The authors found that housing regulations cause high-income areas to issue fewer housing permits than they otherwise could, leading to limited supply and higher home prices. Consequently, the movement of low-skill households to higher-income areas has declined while regional inequality in these cities has risen. Rather than finding opportunities for economic mobility in high-income cities, lower-skilled workers are increasingly migrating out of those cities in search of more affordable housing arrangements.

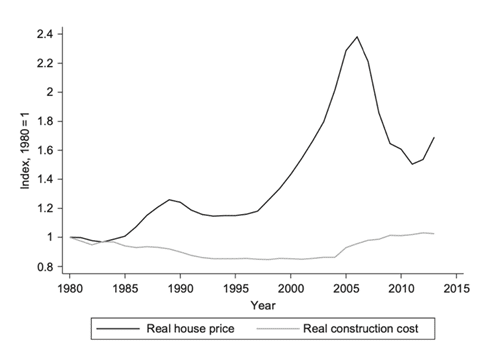

The decline of regional income convergence since 1980 aligns closely with other research finding that housing prices have also risen faster than construction costs since 1980. For example, research by economists Joseph Gyourko and Raven Molloy found that, controlling for inflation, construction costs remained relatively stable between 1980 and 2013 (Figure 1). However, housing prices rose sharply over the same period. As demonstrated in Figure 1, this discrepancy has resulted in a significant divergence between construction costs and home prices.

Researchers have generally attributed this divergence to regulations. Essentially, land-use regulations limit the supply of developable land or place restrictions on the amount of housing that can be built on a particular area of land. These supply constraints––not building costs––have helped drive the rise in housing prices over recent decades.

Figure 1. Real Construction Costs and House Prices Over Time.

It may come as no surprise that large coastal cities have some of the most restrictive housing regulations in the country. Researchers from the Wharton Business School at the University of Pennsylvania developed an index that measures the land-use regulatory environment in metropolitan areas across the country. According to the index:

Nine of the top 10 markets in terms of measured regulatory strictness are situated along either the Northeast Coast (from Boston down through Washington, D.C.) or the West Coast of the country (Seattle, Portland (OR), San Francisco, and Los Angeles). The most lightly-regulated among the group of larger metropolitan areas tend to be declining markets in the Rust Belt region.

One of the researchers’ most notable findings is that housing regulations have not lessened over time. In fact, “there is no case of a highly regulated market…becoming substantially (or even modestly) less regulated” between 2006 and 2018. One explanation is that homeowners in cities hold more political power than those seeking to enter the housing market. To incumbent homeowners, increases in home prices represent an increase in their household wealth. It is therefore in their economic interest to support restrictive land-use policies that limit the construction of new homes and raise the cost of their existing homes.

Housing affordability and rising inequality in the United States are major issues but, for the most part, policymakers in large metropolitan areas have not taken substantial action to expand the supply of housing. As recently noted by Reason Foundation’s Baruch Feigenbaum, many of the biggest changes to housing policy need to happen at the local level, where policies like zoning laws, building-approval processes, and density restrictions are typically determined. There is ample research to point policymakers toward actions that would be beneficial in increasing the housing supply. To name just a few, cities could embrace mixed-use zoning, reduce lot-size-minimums, expand or erase urban growth boundaries, reduce or eliminate minimum parking requirements, allow accessory dwelling units, and raise building height limits.

Rising housing costs are placing additional financial strain on homebuyers and renters across the country. As demonstrated by a growing body of economic research, the rise in housing costs can largely be explained by regulations that limit the supply of housing. Many Americans would benefit from the jobs and economic opportunities available in many of the large metropolitan areas that are increasingly becoming unaffordable, especially for those younger and less wealthy workers. It is therefore incumbent upon policymakers to roll back excessive regulations that are needlessly inflating housing prices and hurting workers and families.