It’s been nearly two years since the Texas Sunset Advisory Commission released its report on the state’s largest public pension fund, the Teachers Retirement System of Texas (TRS). The below analysis recaps the committee’s findings and reviews TRS’s recent responses to the Commission’s recommendations. This commentary builds upon previous analysis of the Sunset Committee’s recommendations that can be found here.

Quick Facts—Sunset Commission Findings and Recommendations:

- Staff Report Issue #3: “As One of the Largest Public Pension Funds in the U.S., TRS Would Benefit from Additional Oversight and Greater Transparency of Its Investment Practices.”

- Staff Report Finding: “TRS lacks stakeholder- and member-friendly investment reporting on alternative investments.”

- Staff Report Recommendation #3.3: “The Sunset Commission staff recommends TRS clearly indicate in its Comprehensive Annual Financial Report the percentage of the trust fund held in alternative investments for the past one, three, five, and 10 years in a graphical representation such as a pie chart or bar graph.”

- Staff Recommendation #3.3 Goal: “Reporting this information in the Comprehensive Annual Financial Report would improve transparency, helping TRS members, the Legislature, and the public better understand how TRS manages its assets.”

- TRS Response of Staff Recommendation #3.3: “TRS agrees with this recommendation and will add an easy-to-understand graphical representation of alternative investments to the fiscal year 2020 CAFR.”

Where Do the Sunset Review Commission’s Concerns Regarding Alternative Assets Come From?

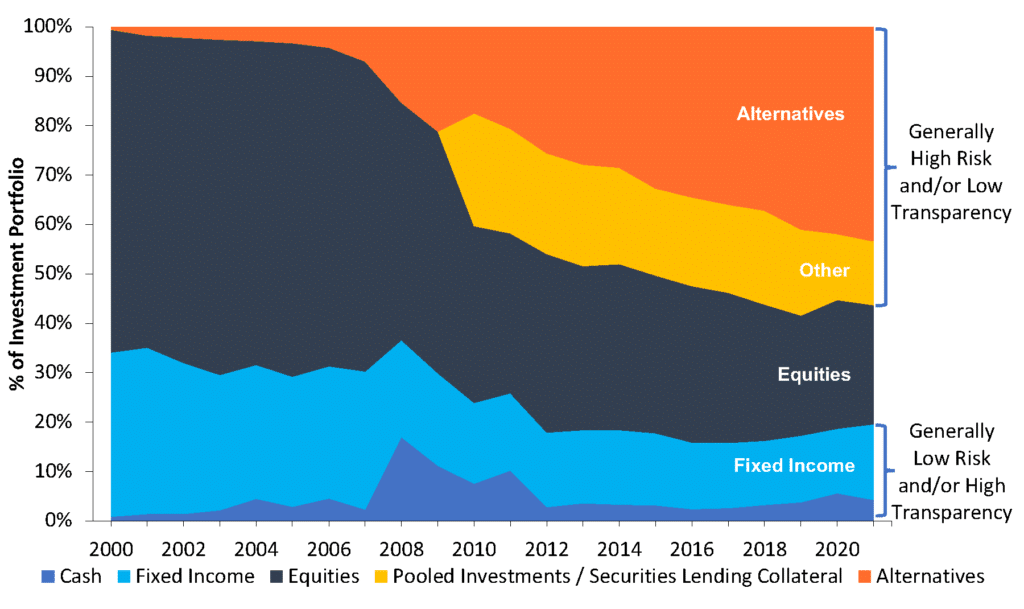

From the 1950s through the early 2000s, TRS was mostly invested in relatively safe fixed-income and large U.S. equity assets. Through the 1990s and up until the 2008 financial crisis, TRS was able to maintain a fully funded status and consistent contribution rates. However, with declining interest rates and the lasting impact of the financial crisis, TRS has struggled to maintain its funding levels, resulting in its funded status dropping below 80% and requiring higher contribution rates. To address those rising costs, TRS turned to investment managers to increase the performance of its investment portfolio. These investment managers have moved away from safe, reliable, yet low return fixed assets and towards potentially higher-yielding—and more volatile—alternative assets to increase revenue from investments. International equities, hedge funds, private equities and other alternative investment categories now make up the majority of assets upon which TRS relies to fund their pension benefit obligations.

According to the 2021 Sunset Commission staff report, TRS has increased the allocation of its alternative investments from 20% in the fiscal year 2009-10 to 46% in the fiscal year 2019-20. Because asset managers often charge high fees, it is likely that this shift to alternative investments has drastically increased TRS’ investment costs.

Figure 1: TRS Asset Allocation from 2001 to 2021

Despite this transition to high risk, lower transparency assets, TRS continued to accumulate unfunded liabilities as a result of returns routinely falling below expectation over the last decade. The plan returned only 6.5% on assets between 2015 and 2020, according to Sunset staff, which fell short of the plan’s 7.25% assumed rate of return. It wasn’t until last year’s historic one-year return on investments that TRS saw any meaningful increase in its funding.

What are Alternative Assets?

Alternative assets are investments that fall outside traditional cash, publicly traded stocks, and bonds. Commonly, alternative investments take the form of shares in limited partnerships, as with private equity funds. As a statutorily protected fund worth over $165 billion, TRS is one of the largest institutional investors globally and along with other Texas and state-level pension systems across the country is considered a major source of capital for alternative investment providers.

Many of the TRS assets deemed alternative are classified as “Level 3” under fair value accounting rules promulgated by the Financial Accounting Standards Board. Level 3 assets are the most challenging to value, requiring assumptions to be made about future cash flows and valuation multiples that could be obtained during a future sale.

When public pension boards choose to engage in alternative asset investing, they must manage these investments either in-house or via hired investment consultants paid to manage the planning and execution of the board’s stated investment goal. When contracted, these services often involve fees decoupled from the portfolio’s performance. These service providers are tasked with helping the board determine where to invest, making them important appropriators of retiree and taxpayer dollars. The limited partnerships managing the alternative asset enjoy the standard “2 and 20” compensation package where managers take 2% of all assets being managed and 20% of all returns.

The Challenge with “Alternative Assets” & Importance of Transparency

Despite alternative assets being a type of security, they are usually exempt from registration and disclosure rules set by the Securities and Exchange Commission (SEC). Because these alternative assets provide limited reporting, they are hard to value. This can create a circumstance where it is possible that TRS will experience unexpected losses when their alternative assets are liquidated due to previous valuations of those assets being too optimistic. In many cases, TRS is a limited partner in an investment vehicle operated by a private equity firm, which acts as the general partner. Only when a partnership is liquidated, typically over 10 to 12 years, can the true value of the investment be determined; however, annual valuations of TRS are conducted and subsequent policies based on those valuations are developed on an annual basis, creating a lag between data and policy decisions.

Although it may not be possible for the public to value holdings within private equity and other alternative investment funds, knowing which funds TRS participates in would allow external observers to follow TRS alternative investments by knowing the identity of the general partner.

Despite the challenges in valuing and assessing the performance of private equity funds, increased transparency through a basic disclosure of the assets, funds committed, and investment costs would provide independent observers a better opportunity to assess TRS’ investment policies and results.

How to Strengthen Sunset Commission Staff Recommendations

The issues highlighted by the Sunset Commission staff recommendation 3.3 reflect how the last two decades have changed the funding landscape for large pension systems like TRS. As treasury bond yields remain low and policymakers remain sensitive to unexpected contribution increases, funds like TRS will continue to meet the needs of their members by attempting to secure the highest investment returns possible. If traditional fiduciary standards are used to determine the usefulness of alternative investment to TRS, then investment advisors and board members should feel free to engage in those opportunities. However, without increased transparency and reporting on these assets, the capability of underwriters (taxpayers) to achieve any oversight is drastically limited.

TRS and its membership, as well as every other state-sponsored public pension member and system in Texas, would benefit from two annual reports regarding the system’s alternative investment holdings. Both suggested reports below are currently produced by comparable state-sponsored pension systems outside Texas and would not require any additional appropriation from the legislature.

Suggested Report #1: Private Equity Portfolio Performance

The Private Equity Portfolio Performance report would publicize specific information regarding the private equity holdings of TRS for third-party monitoring and evaluation. The report takes the form of a simple six-column table populated with the following data points per holding:

- Name of Each Investment Vehicle

- Date of Each Investment

- Amount of Capital Committed

- Amount of Capital Contributed

- Amount of Capital Distributed

- Internal Rate of Return (Annualized Return Estimate on Capital Invested)

This level of transparency is provided by other similar-sized public pension systems like the California State Teachers’ Retirement System (CalSTRS). CalSTRS’s publishes a report, which can be found on CalSTRS’s website, that lists these data points in a stakeholder-friendly format. CalSTRS’s private equity performance report, including the internal rate of return, is maintained internally by CalSTRS and published annually.

Suggested Report #2: Annual Investment Cost Report

Shifting to alternative assets usually involves higher costs, as actively managed private equity and hedge funds tend to demand higher fees for the services relative to passively managed assets like index funds. A 2018 report by the Pew Charitable Trusts found pension plans spend at least $2 billion a year on investment fees alone, and TRS is no exception to this trend.

Last year, TRS administrators set the system on a five-year plan to reduce fees by over $1.4 billion through increased in-house investment management. However, unreported fees such as carried interest (i.e. performance fees) are not addressed in the recent operational changes set in motion by TRS. Performance fees for private equity investments are typically far higher than the ordinary management fees for those assets, and most public pension funds—including TRS—do not report those performance fees.

An Investment Cost Report directly addresses the issue of opaque fee reporting by directly outlining the fees and other expenses a pension system incurs in the process of managing its portfolio. Again, CalSTRS offers a model, producing a report showing investment costs by type and asset category. An example report can be viewed directly from CalSTRS.

This report is designed to provide stakeholders with detailed fee data and trends over a four-year period for each asset class and investment strategy. Reporting this ratio analysis to show the cost-effectiveness of the total fund, asset classes, and strategies over time provides a quantitative metric to compare costs against the returns generated from those costs.

The benefits of TRS members are paid from net returns and not from gross returns. Since increased investment costs reduce net returns, fees and expenses should be consistently monitored and managers held accountable for the costs and benefits of investments relative to the overall growth and resiliency of TRS as a long-term provider of pension benefits to Texas educators.

Contact Information:

Marc Joffe (Marc.Joffe@reason.org), Senior Policy Analyst

Steven Gassenberger (Steven.Gassenberger@reason.org) Policy Analyst

Stay in Touch with Our Pension Experts

Reason Foundation’s Pension Integrity Project has helped policymakers in states like Arizona, Colorado, Michigan, and Montana implement substantive pension reforms. Our monthly newsletter highlights the latest actuarial analysis and policy insights from our team.