Last month the Pension Integrity Project at Reason Foundation submitted public comments on the Texas Sunset Advisory Commission Staff Report and Recommendations regarding the Teacher Retirement System of Texas (TRS).

In their report, the Sunset Commission staff found the need for greater transparency of the Teacher Retirement System’s investment practices. This call comes shortly after TRS received significant pushback regarding its plans to lease a downtown Austin office building for the hefty price of $326,000 per month. While acknowledging that TRS does not have an adequate process for reviewing internal investments, like real estate decisions, the report also highlighted the need for increased transparency of high risk, alternative investments that have become increasingly popular with public pension systems who are in search of higher investment yields.

The Pension Integrity Project’s comments both concur with this finding and outline how TRS can include clear, easy to understand information about alternative investments in its Comprehensive Annual Financial Report each year. Doing so would be a step towards a more sustainable and responsible retirement system that protects Texas teachers and taxpayers.

Our full comments are available on the commission’s website and below.

Prepared for: Sunset Advisory Commission

Prepared by: Marc Joffe, Senior Policy Analyst, Reason Foundation

Steven Gassenberger, Policy Analyst Reason Foundation

Date: April 30, 2020

Thank you for the opportunity to submit written comments regarding the Sunset Advisory Commission Staff Report and Recommendations regarding the Teacher Retirement System of Texas (TRS).

The Pension Integrity Project at Reason Foundation offers pro-bono consulting to public officials and other stakeholders to help design and implement policy solutions aimed at improving public pension plan resiliency and promoting retirement security for all public employees.

While we appreciate the four issues identified in the Sunset Staff Report and agree generally with the recommendations provided, in our opinion those recommendations pertaining to the level of transparency regarding TRS investment practices, oversight and valuation can be strengthened by drawing on the best practices of other similarly sized states and plans.

Issue #3: As One of the Largest Public Pension Funds in the U.S., TRS Would Benefit from Additional Oversight and Greater Transparency of Its Investment Practices.

We at the Pension Integrity Project fully agree with the Sunset Advisory Commission staff’s finding that TRS investment reporting falls short of the stakeholder – and member-friendly reporting standards set by other large state public pension systems, particularly as it relates to alternative investments.

Additional transparency around investments in the TRS asset class identified as “alternative” assets—e.g., private equity, hedge funds, real estate, private debt, energy holdings, natural resources and other non-traditional assets—within Texas’ state-sponsored public pension funds, including TRS, is paramount to effectively valuing these assets, setting actuarial expectations regarding required contributions, and holding asset managers accountable for substandard benchmark performance on behalf of Texas’ public employees.

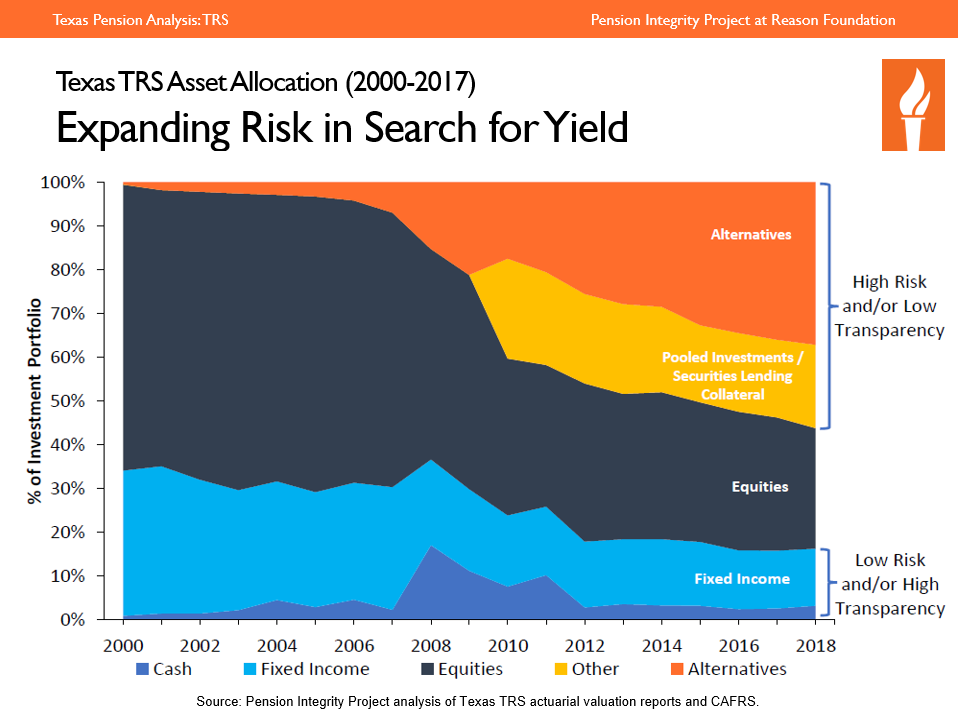

Over the last three decades, asset allocations within the TRS investment portfolio has moved from a nearly 60%/35% split between fixed-income assets and large US equities; with real estate and international equities making up only 5% of TRS assets in 1992 to international equities, private equities and alternative investment assets now making up the majority of assets upon which TRS relies upon to ensure long-term solvency. As shown in Figure 1, this trend began after the Dot.com bubble in the early 2000s but expanded exponentially after the 2008 financial crisis, according to TRS Comprehensive Annual Financial Reports.

Figure 1

Despite this transition to high risk, low transparency assets, TRS continued to accumulate unfunded liabilities and underperform in the market – returning only 6.2% on assets over the last 5 years despite historic market growth, according to Sunset Commission staff.

The constitutional cap placed on TRS contributions from public employers, and the TRS investment committees subsequent attempt to earn higher yields, has limited the ability for members and stakeholders to hold managers accountable when higher member and employer contributions are required as was codified in Senate Bill 12 of 2019.

TRS is not unique in this regard. Like most of their peers, TRS and other Texas pension funds invest in a broad array of alternative assets for which fee structures and even market valuations can be opaque. We believe that the commission should make a further recommendation in this regard.

Sunset Staff Recommendation 3.3: Direct TRS to include clear, easily understandable information about alternative investments in its Comprehensive Annual Financial Report

Building on Sunset Commission staff recommendation 3.3, it is our opinion that TRS and its membership, as well as every other state-sponsored public pension member and system in Texas, would benefit from periodically publishing a list of its alternative investment holdings for review by stakeholders and watchdogs alike. Specifically, within the established reporting requirements, we recommend TRS include the following regarding all investments:

- The Name of Each Vehicle

- When the Investment Was Made

- The Amount of Capital Committed

- The Amount of Capital Contributed

- The Amount of The Capital Distributed

- A Measure of The Annualized Return on Capital Invested

This level of transparency is provided by other similar-sized public pension systems in similar-sized states, such as California State Teachers’ Retirement System (CalSTRS). CalSTRS’ publishes a report, which can be found here, that lists these data points in a stakeholder friendly format. CalSTRS’ private equity performance report, including the internal rate of return, is maintained internally by CalSTRS and published annually.

To be clear, our recommendation regarding additional reporting on these assets maintained by state-sponsored pension systems is not an admonishment of the asset class itself. As previously reported by TRS investment managers, the volatility of these assets is equaled by their potential for returns. It is our opinion that fiduciaries of the fund should allocate the TRS portfolio in whatever manner is best to leverage taxpayer and member contributions for maximum return.

As CalSTRS observes, there are also limitations to the level of analysis that can come from such a report due to the nature of the asset class itself. For example, “the purchase of secondary interests by limited partners of TRS (i.e. private equity firms) makes for unique comparison problems due to the specific pricing and timing characteristics of the transaction when contrasted with the direct limited partnership investment.” In that case, as noted by CalSTRS, not until a partnership is liquidated, typically over 10 to 12 years, can the true value of the investment be determined.

Despite the challenges in valuing and assessing the performance of private equity funds, increased transparency through a basic disclosure of the assets and the funds committed would provide independent observers a better opportunity to assess TRS’ investment policies and results.

We believe that public sector retirement systems should work for all public employees and taxpayers. Affordable retirement plans with transparent and accountable management are necessary to support all aspects of good governance. States, cities, and counties will increasingly struggle to provide public services unless they are able to adopt financially sustainable retirement standards and practices, and the Sunset Commission staff recommendations, with this addition, are a positive step towards achieving that goal on behalf of current and future Texas public servants and taxpayers.