This commentary is the second in a series explaining data center electricity use and the nuances in regulating it. Here are the first and third pieces in the series.

Growing data center energy use continues to make headlines. In my first post on data center electricity use, I focused on the technologies that make AI possible and on broad trends in data center investment and electricity demand forecasts out to 2028.

Electricity demand forecasts

More demand forecasts in the U.S. and globally suggest growing electricity demand. The International Energy Agency forecasts an international average annual growth rate of 3.4% from 2024-2026, 85% of which will come from China and outside of the set of advanced economies. The Electric Power Research Institute (EPRI) published a white paper this past spring motivated by the sudden growth in AI-driven computation:

AI models are typically much more energy-intensive than the data retrieval, streaming, and communications applications that drove data center growth over the past two decades. At 2.9 watt-hours per ChatGPT request, artificial intelligence (AI) queries are estimated to require 10 times the electricity of traditional Google queries, which use about 0.3 watt-hours each; and emerging, computation-intensive capabilities such as image, audio, and video generation have no precedent. (EPRI 2024, p. 2)

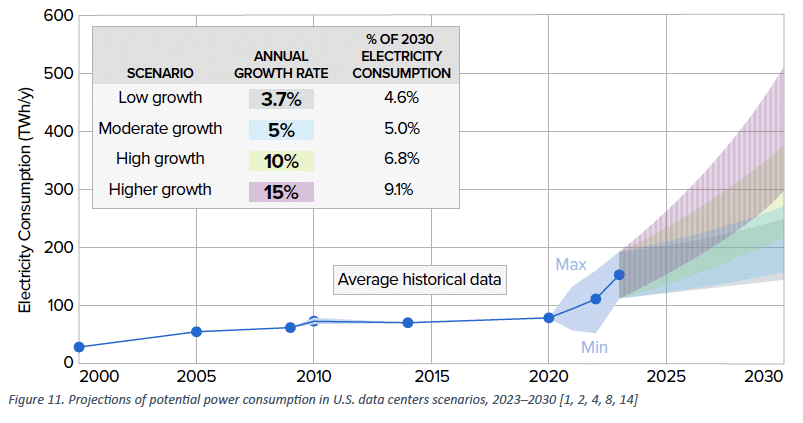

Their analysis of U.S. demand included low, moderate, high, and higher growth scenarios through 2030, with electricity demand growth rate forecasts ranging from 3.7% to 15%. These scenarios suggest that data center share of electricity demand will be in the range of 4.6-9.1% of 2030 consumption, compared to 4% today (A May 2024 Axios article provides a helpful summary of the EPRI analysis).

A recent Energy Information Administration analysis shows that commercial sector electricity demand has grown fastest in states with rapid computing facility growth (including Virginia and Texas to no surprise, but surprisingly also including North Dakota).

Electricity demand also grew substantially in Texas, where relatively low costs for electricity and land have attracted a high concentration of data centers and cryptocurrency mining operations. North Dakota stands out with the fastest relative growth at 37% (up 2.6 BkWh) between 2019 and 2023, attributed to the establishment of large computing facilities in the state. In addition, western states such as Arizona and Utah have shown robust growth in commercial electricity demand, further contributing to the overall increase in the top 10 states. (EIA Today In Energy 6-28-2024).

Marshall’s Model of Time, illustrated by fishing

Some basic economic analysis will help us understand what’s happening, why, and what to expect. I’m going to get some help from pioneering economist Alfred Marshall for this analysis.

First, let’s gather the data we want to understand:

- Technological change is leading to an increase in data center computing, which is creating an increased level of demand and a faster growth rate of demand for electricity.

- Building a data center requires high capital expenditure and takes 18-24 months.

- Building new electricity infrastructure (generation, poles, wires, transformers) requires high capital expenditure, and the current regulatory and business structure takes up to 10 or even 20 years.

- New resource interconnection with a regional transmission grid can take on average 3.5 years in ERCOT in Texas and up to 6 or more years in other regions. The difference is the institutions, or rules, that ERCOT uses called “connect and manage.”

Now let’s bring Marshall in. According to Wikipedia, “Alfred Marshall (26 July 1842 – 13 July 1924) was an English economist and was one of the most influential economists of his time. His book Principles of Economics (1890) was the dominant economic textbook in England for many years. It brought the ideas of supply and demand, marginal utility, and costs of production into a coherent whole. He is known as one of the founders of neoclassical economics.”

If you want a quick overview of Marshall’s importance, I recorded a short video on him for my History of Economic Thought class a while back that you may find useful. And if you want to explore his seminal work Principles of Economics, it’s all available for you at Econlib.

One of the most important contributions Marshall made to economic theory was his conceptualization of time. Time is not a chronological phenomenon per se, but is rather divided into categories depending on how people can or cannot change their consumption, production, investment, innovation, and institutional decisions. His model provides a foundational framework for understanding how supply and demand respond to changes over different time horizons. He used the fishing industry to illustrate these time scales, showing how producers’ abilities to respond to changes in demand evolve over different periods.

Marshall introduces three distinct time scales: the immediate run, the short run, and the long run.

- Immediate Run: In the immediate run, supply is fixed and cannot respond to changes in demand. This period is so short that no adjustments in production can be made. Prices may fluctuate significantly due to demand changes, but the quantity supplied remains constant. Marshall’s use of a day’s catch in the fishing industry illustrates this concept. Fishers can sell only the fish they have already caught, and no additional boats or nets can be deployed on such short notice.

- Short Run: In the short run, supply is somewhat elastic but still constrained by existing capacity and resources. Producers can adjust their output to a limited extent by using current assets more intensively, such as working longer hours or employing more labor. But they can’t yet make significant capital investments or changes to their production methods. This response might involve fishers using their boats more frequently or employing more crew members, but they still cannot build new boats or expand their fleet immediately.

- Long Run: In the long run, supply becomes highly elastic as producers can adjust their production capacity fully. This period allows for significant investments in new capital, technology, and infrastructure. In the fishing industry, responses could include building more boats, acquiring better equipment, and improving techniques, thereby increasing the overall catch. Over the long run, the market can reach a new equilibrium where supply meets the altered demand at a more stable price.

In Marshall’s abstract model, this adjustment process is smooth and frictionless, although he was a relentless empiricist, so he recognized inevitable frictions. Let’s apply this general model to the current situation with data center electricity use and analyze the facts laid out above.

Short-run dynamics: Inelastic supply and immediate responses

In the short run, the supply of electricity is relatively inelastic. This means that the quantity of electricity that can be generated and supplied to the market cannot be adjusted quickly in response to changes in demand. This inelasticity is due to the significant time and capital investment required to build new power plants or upgrade existing infrastructure. So when data centers increase activity or new ones come online, electricity suppliers may struggle to meet this demand without resorting to costly measures such as purchasing power from other regions or using less efficient peaking power plants. This struggle also has policy implications, as we will see in future posts, due to the closely regulated nature of the electricity industry and its century-old business model. Note, in particular, the large timing mismatch between data center capacity expansion and electricity infrastructure capacity expansion.

Marshall’s discussion of time in economics provides a useful analogy. Just as fishermen cannot instantly increase their catch in response to rising fish prices due to the time required to build more boats and nets, electricity providers cannot immediately ramp up production in response to increased demand from data centers. In both cases, the immediate run is characterized by fixed supply and price fluctuations driven by demand changes.

Also, the environmental impact of relying on peaking power plants, which often use fossil fuels, can be significant, contributing to higher carbon emissions and undermining efforts to transition to cleaner energy sources. Those impacts are a topic for a future post.

Long-run adjustments: Investment and capacity expansion

The long-run situation differs considerably. Over time, the supply of electricity becomes more elastic as new generation capacity is added and existing infrastructure is upgraded. This long-run elasticity is driven by investment in new power plants, renewable energy projects, and advancements in energy storage technology. Data center operators and electricity providers can plan for and respond to anticipated increases in demand by investing in capacity expansion.

Marshall’s framework helps us understand this transition. In the long run, fishers can build more boats and improve their fishing techniques, thereby increasing their catch and stabilizing prices. Similarly, in the electricity market, long-run adjustments involve substantial capital investment and technological innovation, leading to a more elastic supply curve and a more stable equilibrium between supply and demand.

The investment in new generation capacity to meet the growing energy demands of data centers is already evident. For example, many data center operators are entering into power purchase agreements (PPAs) with renewable energy providers to secure a stable and sustainable energy supply. These agreements not only ensure a steady flow of electricity but also promote the development of wind, solar, and other projects like storage and geothermal. Advancements in battery storage technology enable data centers to store excess energy generated during periods of low demand and use it during peak periods, smoothing out fluctuations in electricity consumption.

Unlike Marshall’s stylized fishing example, these long-run adjustments in electricity take a long time, longer than they could, because of many frictions that slow down or prevent such flexible adjustments. Permitting bureaucracy and delays add years to infrastructure projects, with dubious or nonexistent benefits to those delays. The same holds for grid operator interconnection, long delays with unclear commensurate benefits. Permitting and interconnection are brakes on long-run supply adjustments that could otherwise be more fluid. Supply chain problems are also an adjustment challenge, such as the bottleneck that transformer supply presents for infrastructure expansion projects. That bottleneck itself provides an example illustrating Marshall’s point:

Additionally, the surge in demand for electrical equipment may only last for a few years, which makes suppliers hesitant to invest in greater supply capabilities that could result in over-supply conditions when demand eases. This phenomenon mirrors past experiences in markets like semiconductors, where short-term market booms led to increased capacity, only to face challenges when the market dynamics shifted. (Wood Mackenzie 2024)

The role of technological innovation

Technological innovation will play a crucial role in shaping the long-run dynamics of data center energy use and electricity demand. Innovations in data center design, cooling technologies, and energy efficiency measures can reduce the amount of electricity consumed per unit of computing power significantly.

One important example is how the shift from traditional air cooling to liquid cooling systems has improved energy efficiency by reducing the need for air conditioning (also the topic of a future post). Algorithms to optimize server workloads and minimize idle times can also enhance energy efficiency.

Other production process changes, such as the transition to more energy-efficient hardware like advanced processors and memory modules designed to consume less power, are helping data centers reduce their overall energy footprint. These technological advancements will lower operating costs for data center operators and mitigate the impact on the electricity grid, making it easier to accommodate the growing demand for AI and other digital services. But even these within-firm capital investments take time.

The role of markets and price signals

One of the significant challenges in the electricity industry is the lack of effective market signals and price mechanisms to indicate relative scarcity and manage demand. In a more flexible and responsive market, prices would rise when electricity is scarce and fall when it is abundant, signaling to both producers and consumers to adjust their behavior accordingly. Implementing such price signals could lead to greater flexibility and efficiency in the electricity market.

For example, real-time pricing or time-of-use pricing could be introduced to reflect the actual cost of electricity production and supply at different times of the day. Under real-time pricing, electricity prices would fluctuate based on current supply and demand conditions, encouraging consumers to shift their usage to off-peak times when prices are lower. Data centers that can schedule non-urgent computational tasks could take advantage of lower prices during periods of low demand, reducing their overall energy costs and alleviating pressure on the grid during peak times. Given their substantial and often flexible energy consumption, data centers are also good candidates for bulk-scale demand response services offered by companies like Voltus and CPower. By temporarily scaling down operations or shifting workloads to off-peak periods, data centers can help balance supply and demand, stabilize prices, and reduce the need for expensive and emissions-heavy peaking power plants.

However, the regulatory and market institutions have to enable such markets and price signals to reduce frictions that maintain the timing mismatch between demand growth and increasing supply. They do not. While some demand response integration exists in wholesale power markets, it’s limited and heavily constrained. That constraint, alongside the frictions of permitting and interconnection that act as brakes keeping supply more inelastic than it could otherwise be, shows that we still have a lot to learn from Marshall’s model of time.

Electrons are like fish because catching them requires building stuff. Building stuff is costly and takes time, much more so in the case of electrons than of fish, due to regulatory impediments that are frictions that amplify the timing mismatches in the adjustment of both demand and supply.

A version of this commentary was first published at Substack in the newsletter Knowledge Problem.