This week, the Democratic leadership in the U.S. House of Representatives released their draft continuing resolution to avoid a government shutdown. Included was a one-year extension of the Fixing America’s Surface Transportation Act, or FAST Act, the current surface transportation law enacted in 2015 that is set to expire on Sept. 30. The uncertainties surrounding the COVID-19 pandemic and recession may subside next year—or maybe not—but Congress should take full advantage of its brief reprieve to start developing answers to a growing list of long-term surface transportation infrastructure policy questions.

Introduced on Sept. 21, House Democratic leadership initially planned a quick vote on their continuing resolution but that vote was postponed as congressional Republicans balked at the omission of billions of dollars in requested subsidies they wanted to go to farmers who have been hurt by the White House’s multi-front trade war. But by early evening, a deal was reached after both sides secured additional spending favors they wanted and the bill easily passed the House in a 359-57 vote. Fortunately, the “clean” surface transportation extension component of the House’s continuing resolution largely flew below the radar.

If passed, as expected by the Senate, the one-year extension of the FAST Act will largely continue policy and spending levels from FY2020. But even though additional year-over-year spending growth is essentially zero, the extension includes a $13.6 billion Highway Trust Fund bailout. Although the pandemic and resulting reduction in travel briefly caused fuel tax receipts to dip, Congress has deliberately set spending levels well above projected Highway Trust Fund revenue since 2008. Including the latest extension, Highway Trust Fund general fund bailouts over the last 12 years now total $153.5 billion. Long before the coronavirus pandemic hit, the traditional pay-as-you-go nature of the Highway Trust Fund had been replaced by a bailout-to-bailout new normal.

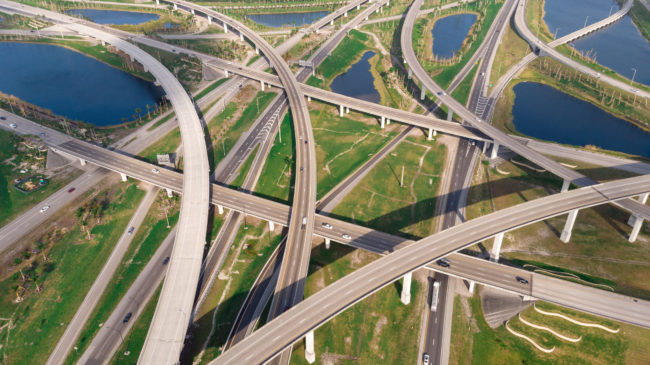

This increasingly strained relationship between revenue and spending comes at a time when core assumptions underlying federal surface transportation programs must be revisited. The vehicle fleet is increasingly fuel-efficient and transitioning away from fossil fuels, leading to declining tax revenue per vehicle-mile traveled. At the same time, the infrastructure these programs were specifically designed to build in the mid-20th century is nearing the end of its functional life and must be replaced from the ground up. A recent Transportation Research Board study estimated that replacing the Interstate Highway System alone would cost at least $1 trillion over the next 20 years.

Much like the increasingly obsolete surface transportation infrastructure, the federal programs that have supported it over the last half-century need to be rethought and replaced. This will require a heavy lift from Congress, but the good news is Congress can help deliver 21st-century infrastructure while simultaneously ending the bailout culture that has defined federal surface transportation programs in recent years.

To facilitate this needed modernization, Congress should eliminate existing barriers to state self-help. State and local governments own and manage virtually all surface transportation infrastructure in this country but face limited financing options due to inflexible federal rules. The existing general prohibition on states tolling their own Interstate highway segments, for example, should be repealed. As the viability of per-gallon taxation continues to decline in the coming years, the easiest way to begin transitioning to per-mile charging is by allowing states to toll their heavily trafficked limited-access highways, rather than continuing to fund them via fuel taxes.

Congress should also eliminate the maxed-out $15 billion lifetime volume cap on surface transportation private activity bonds to encourage innovative infrastructure financing practices through long-term, toll-backed concession agreements between states and private firms. These taxpayer- and customer-friendly arrangements have grown quite popular in many of the United States’ peer countries, but are vastly underused in the U.S. largely due to outdated federal law.

To be sure, neither of these low-cost policy changes would necessarily disrupt the status quo. States would ultimately have the final call. But if states were freed from the unnecessary federal restrictions, some would take advantage of these new choices. From there, we would expect to see a lot more experimentation and honing of best practices—and hopefully convince the skeptical or obstinate states that there are superior alternatives to cash funding major highway projects with gas tax revenue.

On that note, Reason Foundation’s Director of Transportation Policy Robert Poole recently authored two studies—Why Florida Should Shift from Gas Taxes to Per-Mile User Fees—and How to Do It and Can Interstate Tolling Be Politically Feasible? A Customer-Friendly Approach—that make strong cases for these needed reforms.

Congress should spend the time it buys with the short-term FAST Act extension to seriously examine these innovative practices and commit to eliminating the federal barriers that stand between states and 21st-century surface transportation infrastructure.