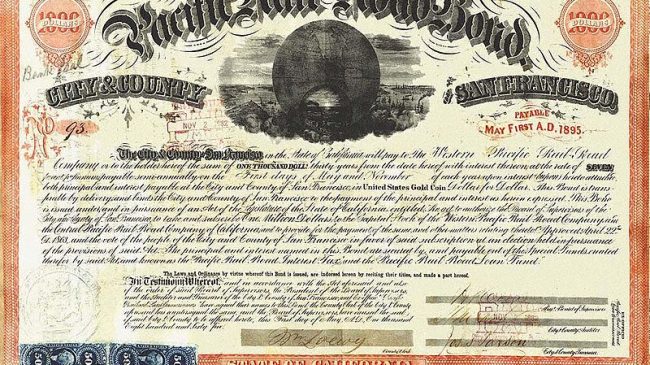

In November, California voters will be asked to support four new state bond measures. While advocates will be offering carefully crafted arguments for each one, voters would be well advised to consider not only the merits of each bond individually but also whether state residents can afford to pile these financial obligations onto an already large stock of public debt.

Last year, I totaled up California’s state and local bonds, other post-employment benefit obligations and pension obligations. Rather than use the inflated discount rates used by the public employee pension systems, I used a more conservative interest rate that is used by Moody’s.

The results of the analysis were shocking: Overall, California’s taxpayers were shouldering a debt burden of almost $1.3 trillion, or 52 percent of Gross State Product. And that doesn’t count Californians’ share of the national debt. If you include publicly held federal debt, California’s overall debt to Gross Domestic Product (GDP) ratio rises to over 125 percent — levels comparable to those seen in Italy and Portugal during the 2012 Eurozone sovereign debt crisis.

Admittedly, California and the US have greater debt carrying capacity than those countries. But there is a limit, and voters may want to exercise caution before testing it. With that perspective in mind, let’s take a look at a couple of the bonds on the November ballot.

The California Children’s Hospital Bond Initiative would authorize $1.5 billion to make capital improvements to children’s hospitals around the state. Principal and interest would be repaid from the state’s general fund. It is hard to argue that building and maintaining children’s hospitals is not a worthy cause. But without questioning the need for excellent children’s hospitals, one might question how much of the construction cost should be borne by present and future taxpayers.

Although most California hospitals are non-profit institutions in a strictly legal sense, the reality is that they can, and do, accumulate profits. To illustrate, let’s look at a children’s hospital in San Diego that would benefit from the new bond measure.

In the 2017 fiscal year, Rady Children’s Hospital reported $183 million of revenues in excess of expenditures. Its total net assets grew to $1.28 billion. Net assets are roughly equivalent to retained earnings in the for-profit world. My question is — Why not reinvest these retained earnings in more and better facilities, rather than transfer the bill to California taxpayers?

And Rady Children’s Hospital is not unique. According to the most recent state-reported data, 13 California children’s hospitals reported $276 million of net income and over $4.6 billion in net assets.

When hospitals retain earnings rather than use them to build facilities, they have more latitude to increase executive compensation. According to Rady Children’s Hospital’s 2016 IRS Form 990 filing, its CEO received over $1.2 million in annual compensation, while two other executives collected over $800,000.

That may not be excessive by corporate standards, but non-profit hospitals, in theory, operate for the public good with large amounts of government support. At Rady, over 60 percent of gross patient revenue comes from government sources. And, by public sector standards, Rady Children’s Hospital’s executive compensation seems quite generous, well above the pay received by local mayors and city managers.

So children’s hospitals may be able to afford more infrastructure by spending some of their net assets and reigning in executive compensation before burdening the general fund.

California voters will also be asked to approve an $8.9 billion water bond championed by agricultural interests and duck hunting groups. Proponents say the bonds will fund “safe drinking water, Sustainable Groundwater Management (SGMA) implementation, watershed restoration, fish and wildlife habitat conservation, infrastructure repair, and many other important water management programs.” The typical urban or suburban voter anxious to secure supplies of affordable water in the face of the state’s recurrent droughts can expect limited benefits from this grab-bag of spending priorities.

Further, voters have already authorized a large volume of bonds that have yet to be issued. According to a recent California bond official statement, California still has $7.2 billion of unissued bonding authority under Proposition 1 of 2014 — the Water Quality, Supply, and Infrastructure Improvement Act. Another $1.6 billion of unused bonding authority is available from the Safe Drinking Water, Water Quality and Supply, Flood Control, River and Coastal Protection Bond Act of 2006. Maybe the state government should draw down these bonds before asking voters for more authority.

Second, there are alternatives to using the general obligation bonds to fund water infrastructure. In San Diego County, a private company, Poseidon Water, built a 50 million gallon-per-day desalination plant in Carlsbad. To finance the construction, over $700 million of municipal bonds were issued, but they were not general obligations. Neither state government taxing power nor local government taxing power may be used to repay the bonds.

Although the bonds were issued through the California Pollution Control Authority, they were ultimately the responsibility of Poseidon Water, which was subject to penalties if the plant was not finished in time or did not produce the contractually specified volume of water.

Californians should welcome more public-private partnerships like the one that created the Carlsbad plant. They can provide reliable water supply to residents today without bankrupting future residents.