California’s state and local agencies have $187 billion in unfunded retiree health care and other benefit liabilities that threaten to crowd out public services, such as public safety and education, that Californians expect government to provide.

Fortunately, state and local officials have more options to manage these other post-employment benefits than they do for public pensions. It’s urgent that they start exercising these options.

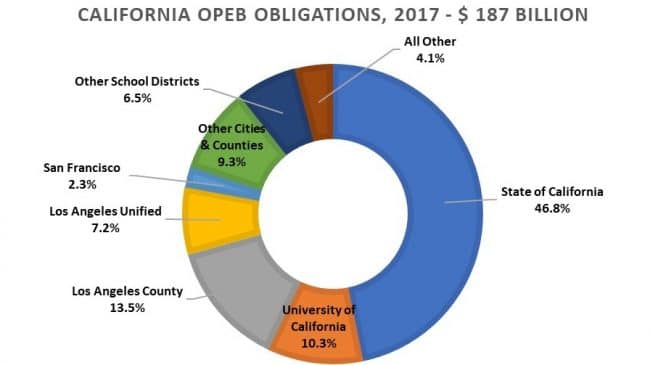

The estimated $187 billion in unfunded liabilities comes from a Reason Foundation review of audited financial statements published by the state, University of California system and several hundred local governments, including counties, cities, school districts, community college districts and other special districts for the 2017 fiscal year.

The bulk of the unfunded liabilities are carried by the state —$88 billion— and a handful of large agencies, such as Los Angeles County, with $25 billion in unfunded post-employment benefits, and the University of California system, with $19 billion.

Perhaps the biggest impact is being felt by the Los Angeles Unified School District, which is struggling with declining enrollment and long-term budget issues. Lower enrollment means reduced state aid.

Since post-employment benefit costs are relatively fixed, they become an increasing burden as the school district’s revenue falls. In the case of Los Angeles schools, post-employment benefit costs for retired teachers and staff amount to $700 per student annually and consumed 4 percent of the district’s total revenue in 2017, according to data in the district’s own audited annual financial report.

Unlike pensions, other post-employment benefits, including healthcare coverage, are not covered by the California Rule, which locks in an employee’s ability to continue accruing benefits under current or more generous terms. If an employee’s pension benefit is now growing at 3 percent of his or her salary for each year of service, the California Rule requires that this benefit growth rate continue. By contrast, state law provides no similar floor for other post-employment benefits, so they can be altered or abolished by each government, although such changes are subject to collective bargaining for represented employees.

At the extreme end, for example, the city of Stockton terminated retiree health benefits when it filed for bankruptcy but left public pension benefits untouched. Of course, terminating retiree benefits without notice is not the desired outcome and one that can and should be avoided through sound public policy.

This means that governments should pay for other post-employment benefits as they are earned, a practice known as pre-funding, and that the benefits promised to government workers should be sustainable. Fortunately, there are several avenues for more responsible policy.

Many agencies constrain other post-employment benefit liabilities by asking retirees to pay a portion of their own health insurance costs. Agencies such as L.A. Unified that currently make the full premium payment should consider introducing a retiree responsibility component, especially for higher-income retirees who can afford to pay for a portion of their own benefits.

Further cost savings can also be achieved by reducing or eliminating coverage for a retiree’s dependents.

It is usually less costly to provide retiree health benefits to people over 65 because this group is eligible for Medicare. Governments that offer other post-employment benefits should limit benefits for their retirees over the age of 65 to the cost of Medicare wraparound policies that cover gaps in federal coverage for things like prescriptions and deductibles.

Medicare expansion or single-payer health care policies could greatly reduce or eliminate state and local other post-employment benefit liabilities but these programs would be shifting the costs elsewhere and could have more serious fiscal downsides for taxpayers. For example, a California single-payer plan passed by the state Senate in 2017 was estimated to cost $400 billion annually.

Unfunded post-employment benefit obligations represent a growing burden on public agencies. While federal or state health care legislation might someday help resolve the problem, such changes would be controversial and costly. Rather than hope for a bailout, governments now facing large unfunded post-employment benefit obligations should look toward realistic reforms.

Pre-funding, requiring retirees to pay for a portion of their own benefits, and limiting dependent coverage are the most sensible paths to start digging out of the $187 billion hole facing taxpayers and future retirees.

——

This commentary originally appeared on CalMatters.

Stay in Touch with Our Pension Experts

Reason Foundation’s Pension Integrity Project has helped policymakers in states like Arizona, Colorado, Michigan, and Montana implement substantive pension reforms. Our monthly newsletter highlights the latest actuarial analysis and policy insights from our team.