A new report from J.P. Morgan Asset Management suggests that a number of states will likely struggle to keep up with their pension and retiree health care obligations during the coronavirus pandemic and economic downturn. According to the report, Illinois, New Jersey, Hawaii, Connecticut and Kentucky will face the biggest immediate pressures.

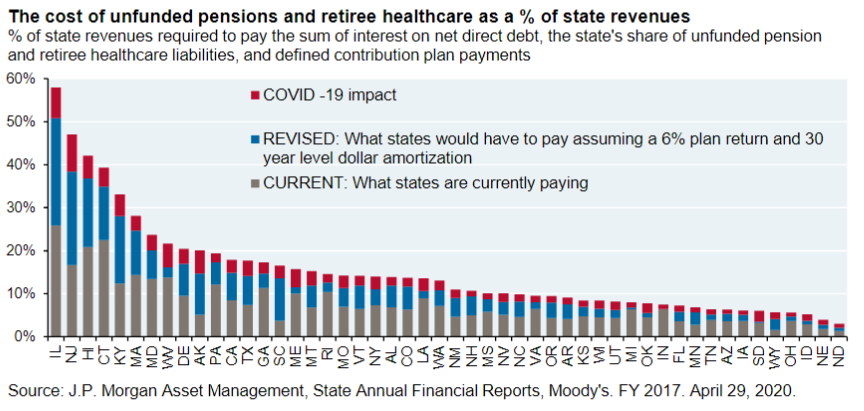

J.P. Morgan’s Michael Cembalest has published a series of reports featuring his IPOD ratio which measures interest expenses, pension contributions, other post-employment benefits (OPEB) contributions, and defined contribution costs as a percentage of a state’s own source of revenues. Cembalest’s ratio is not based on actual pension and OPEB contributions, but rather those that would be actuarially required, assuming a 6 percent discount rate and 30-year level dollar amortization of unfunded liabilities. Essentially, his IPOD ratio estimates the cost burden of paying interest on debt and sustainably funding retirement costs.

In his latest analysis, Cembalest estimates the IPOD ratio for the next fiscal year while also taking into account projected tax revenue declines triggered by the economic downturn. The report finds that about one-third of US states have projected IPOD ratios of 15 percent or more of their total revenue, while the worst five states exceed 30 percent.

In my research on Great Depression government defaults, I found that governments typically defaulted after their interest to revenue ratio rose above 30 percent. I observed this ratio in Arkansas, the Canadian province of Alberta and the Australian state of New South Wales ahead of their respective bond defaults.

Back in the 1930s, public pensions were not a significant factor to state budgets and OPEBs were unheard of, so it is reasonable to think of the IPOD ratio as a modern-day equivalent to the interest to revenue ratio. But in today’s context, an outright default on bonded debt service, like we saw in Puerto Rico recently, seems unlikely. Instead, states can implicitly default by continuing their practice of underfunding their pension and OPEB plans.

Of the five states with the highest IPOD ratios, two— Illinois (at 58 percent) and New Jersey (47 percent— receive the most negative ink in the public finance press. Two other states— Connecticut (39 percent) and Kentucky (33 percent)—are also high on the radar screens of people monitoring public pension systems. But the third most vulnerable state by this IPOD measure— Hawaii (42 percent)—receives less attention perhaps because it carries high credit ratings. All three major credit rating agencies rate Hawaii just one notch below their top AAA/Aaa rating.

Yet, Hawaii has been struggling with severe pension underfunding. The Employees’ Retirement System of Hawaii (ERS), which serves both state and local employees, had a funded ratio of just 55 percent as of June 30, 2019, according to the most recent actuarial valuation. This year’s stock market downturn is likely to exacerbate ERS’ severe underfunding.

The state’s most recent Comprehensive Annual Financial Report shows a $6.8 billion unfunded pension liability based on a 7 percent discount rate, as well as a $7 billion OPEB liability using the same discount rate assumption. Although Hawaii makes an effort to prefund its OPEB benefits, unlike other states, its OPEB assets amount to just 12 percent of its actuarial liabilities.

Hawaii’s IPOD ratio is also more likely to spike during the pandemic because of its dependence on tourism. Visitor expenditures accounted for 17 percent of Hawaii’s gross state product in 2019. Today, tourism is essentially halted, as the state requires arriving non-Hawaiian passengers to quarantine for 14 days. Even once the quarantine order is lifted, tourism is expected to come back gradually, as many prospective visitors may remain reluctant to fly. The overall result of the pandemic and downturn will almost certainly be severely depressed tourism and tax revenues for Hawaii.

Like other states with high IPOD ratios, Hawaii shouldn’t rely on the prospect of federal aid to fix its problems with retirement benefit sustainability. Now is the time to start considering policies to increase the resilience of public employee retirement benefit plans.

Stay in Touch with Our Pension Experts

Reason Foundation’s Pension Integrity Project has helped policymakers in states like Arizona, Colorado, Michigan, and Montana implement substantive pension reforms. Our monthly newsletter highlights the latest actuarial analysis and policy insights from our team.