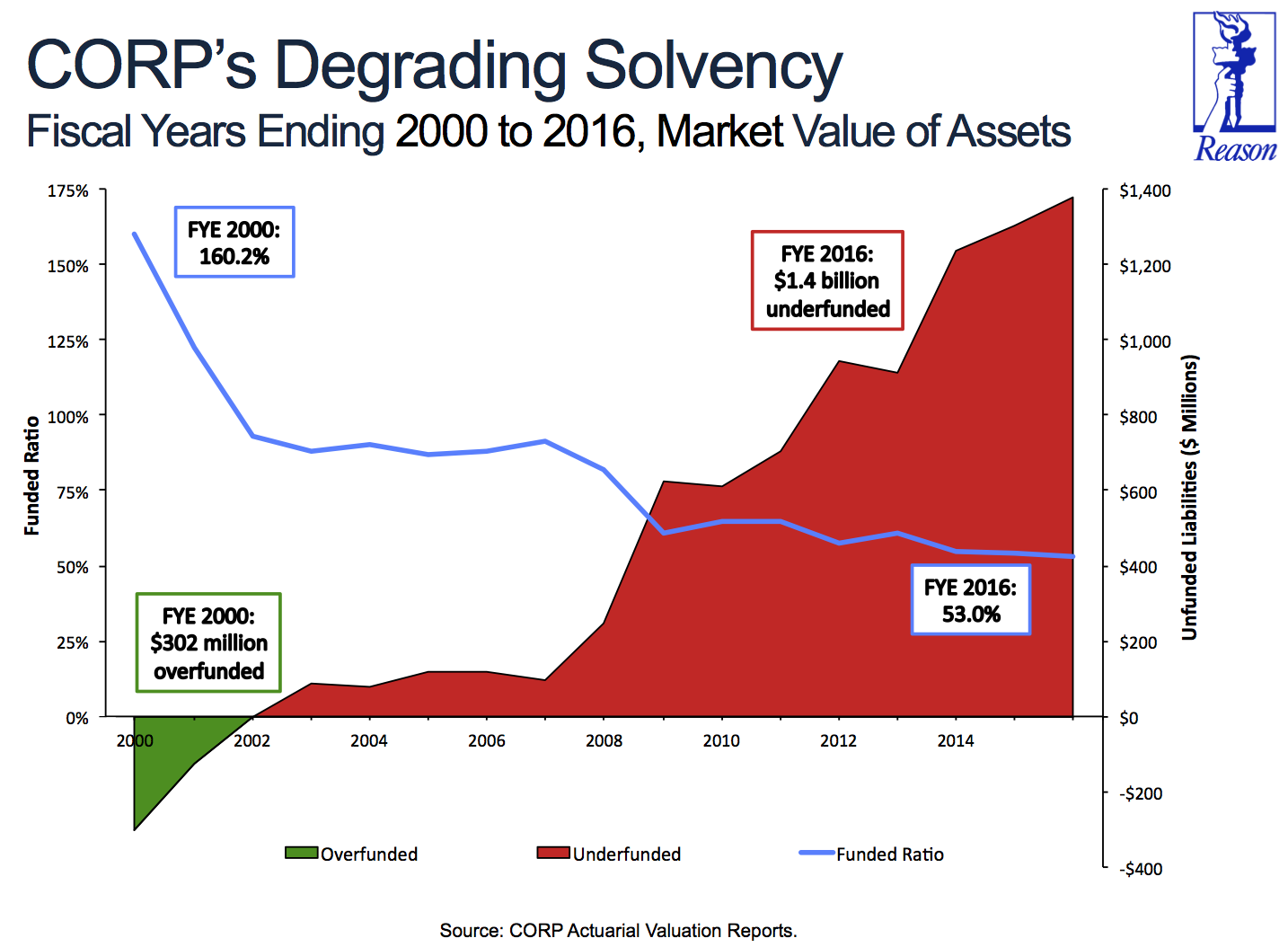

Arizona Gov. Doug Ducey signed into law today pension reform legislation (Senate Bill 1442) that will put Arizona’s struggling Corrections Officer Retirement Plan (CORP) on a path to financial solvency. CORP covers all state and local corrections, detention and probation officers statewide, but has accumulated at least $1.4 billion in unfunded liabilities since 2000 and stands at only 53% funded today.

The CORP pension reform follows—and shares some common features with—the successful reform of the state’s Public Safety Personnel Retirement System (PSPRS) last year:

- Both reforms replace a broken permanent benefit increase (PBI) mechanism with a traditional cost of living adjustment (COLA) tied to inflation. The post-retirement PBI was problematically funded from skimming assets off the top of good investment years and was a key factor driving the growth in CORP’s unfunded liabilities.

- Both reforms created new retirement plan designs for future public safety personnel that will provide better retirement security for employees while minimizing financial risks to taxpayers.

- Both reforms provide new hires for typically full career public safety positions with the choice between a fully funded defined benefit (DB) plan or a professionally managed defined contribution (DC) retirement plan.

- In a unique feature, the CORP reform also provides a portable, professionally managed defined contribution retirement plan for corrections officers that historically have experienced significant turnover, ensuring that all employees have access to secure retirement savings.

Combined, the CORP pension reform effort is expected to shift approximately 90% of new hires into a DC retirement plan and nearly eliminate the potential for new unfunded liabilities once the current pension debt is paid off.

The CORP reform legislation had strong bipartisan support—passing the House of Representatives overwhelmingly with a 53-4 vote, and the Senate by a 23-7 vote. This overwhelming support was possible largely due to the fact it is the negotiated result of a 6-month, collaborative stakeholder process launched by State Senate President Pro Tem Debbie Lesko that ultimately garnered the support of a wide range of stakeholders, including public safety associations, employers, and taxpayer advocates.

Like the PSPRS reform in 2016, the Pension Integrity Project at Reason Foundation played a central role in designing policy options and negotiating the final reform. Our project team provided education, policy options, and actuarial analysis for stakeholders throughout the process, and we helped facilitate a consensus among stakeholders on the conceptual design and other parameters of the reform.

Key public safety associations were active in the stakeholder discussions—specifically the Arizona Police Association, the Consolidated Law Enforcement Associations of Arizona, and the Arizona Police Officer Association—and ultimately supported the CORP reform package in the interest of improving the plan’s solvency and putting a sustainable retirement system in place for the future. Additionally, the state lodge of the Fraternal Order of Police took a neutral position on the main reform legislation (SB 1442), but supported the companion legislation (Senate Concurrent Resolution 1023) that refers a constitutional amendment related to the PBI-to-COLA change to the ballot.

Other organizations supporting CORP reform include the County Supervisors Association of Arizona, Goldwater Institute, Americans for Prosperity-Arizona, Arizona Free Enterprise Club, and Retirement Security Initiative.

That a comprehensive pension reform could attract such a diverse group of stakeholder supporters is noteworthy on its own. Even more important is that the CORP pension reform marks the completion of a two-year bi-partisan process of overhauling retirement benefits for all public safety employees in Arizona. The CORP and PSPRS reforms together offer evidence that a collaborative, stakeholder engagement process can successfully deliver substantive policy change without the typical political divisiveness often seen in pension reform debates.

The Need for Reform

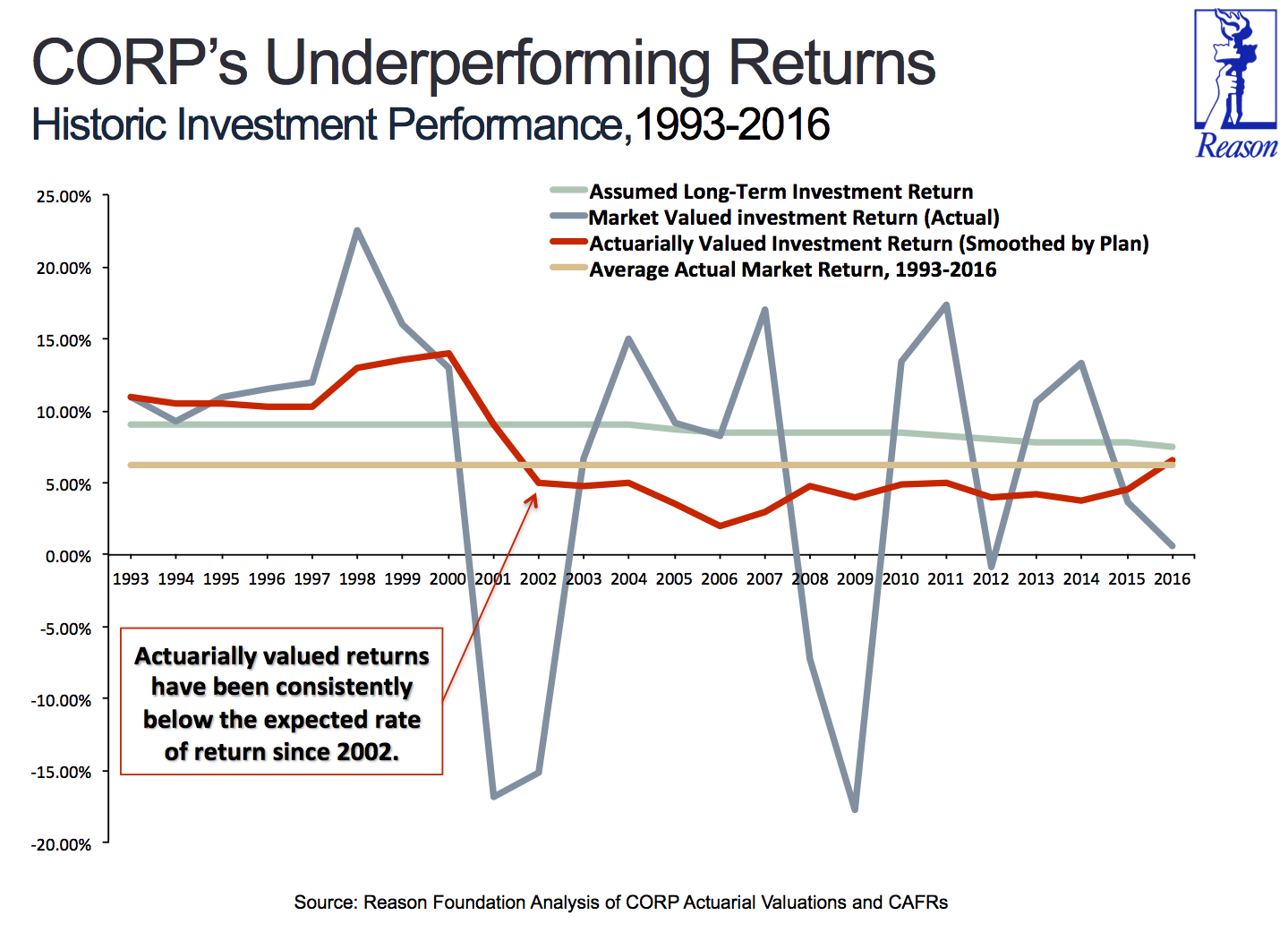

The two biggest factors influencing CORP’s decline have been: (1) the system’s current permanent benefit increase mechanism (PBI), and (2) underperforming investment returns.

The PBI mechanism has undermined CORP’s solvency by skimming assets off the top of the fund in years of good market performance and paying them out as permanent benefit increases to retirees over time to partially offset inflation. Among the problems associated with the PBI:

- For most retirees today, half of CORP’s annual investment returns over 9% (mistakenly deemed “excess” returns) are diverted to a separate fund to pay out PBI benefits. Thus, these funds cannot be cannot earn interest over time and cannot be used to reduce unfunded liabilities, effectively constraining the growth of CORP’s assets.

- One-time high market returns were used to justify permanent benefit increases on an ongoing basis.

- PBI benefits are not directly linked to inflation and are dependent upon investment returns, making it a poor method of adjusting retiree benefit levels to keep up with actual changes in the costs of living.

- Until recently, the PBI benefit had not been pre-funded like a traditional cost of living adjustment (COLA) used by many pension systems. In recent years, the PSPRS board (which also governs CORP) has begun requiring employers to make an additional contribution to offset some of the PBI’s skimming effects.

Given current market conditions and future market forecasts, it is doubtful whether retirees would receive future PBI distributions on a regular basis. Until two years ago when the PBI account ran dry, most CORP retirees had received a PBI benefit for well over a decade, despite the continuing decline in CORP’s funding status. Now that the PBI account is empty, the plan would need to have several years of very strong returns for retirees to receive a full PBI.

In addition to the PBI problem, CORP has seen underperforming investment returns relative to its assumed rate of return.

Goals of Reform

The primary goals of the CORP reform included:

- Providing retirement security for all retirees and employees (current and future)

- Stabilizing contribution rates for the long-term

- Reducing taxpayer and pension system exposure to financial risk and market volatility

- Reducing long-term costs for both employers/taxpayers and employees

- Ensuring government employers’ ability to recruit 21st Century employees

Reform Overview

The CORP pension reform includes three core elements, detailed below:

- Improvements to ensure benefit sustainability for current employees and retirees,

- A new defined contribution plan for corrections/detention officers hired after July 1, 2018, and

- A new choice of retirement plans for probation/surveillance officers hired after July 1, 2018.

1. Improvements to Ensure Benefit Sustainability for Current Employees and Retirees

For current employees and retirees, the reform will replace the uncertain and unsustainable PBI with a traditional, pre-funded cost of living adjustment (COLA) that provides certainty in retirement. This will serve the public interest by fixing the broken PBI mechanism that has been a major factor causing increased unfunded liabilities:

- The new COLA will be based on the changes in the consumer price index for the Phoenix region, with a cap of 2% maximum.

- The new COLA will be pre-funded and actuarially accounted for in advance as part of normal cost determination, which has historically not been the case with the current PBI.

- Replacing the PBI with a traditional COLA for current personnel and retirees will require a constitutional amendment subject to voter approval in the November 2018 election, similar to how the passage of Proposition 124 completed the PSPRS reform in 2016.

2. New Defined Contribution Plan for Corrections/Detention Officers Hired After 7/1/2018

The reform creates an entirely new retirement plan design for all new correctional and detention officers entering CORP, which today account for approximately 90% of plan members. CORP employees hired on or after July 1, 2018 that are not sworn probation/surveillance officers will be offered a defined contribution (DC) retirement benefit:

- The employer will automatically contribute 5% of pay to the employees’ DC plan.

- The employee will contribute a default of 7% of pay to their own DC plan, with the individual option to reduce that contribution to a minimum of 5% of pay or increase it to the limit allowed by the IRS.

- The DC plan vehicle will be the new optional 401(a) DC plan created in last year’s PSPRS reform, which will be professionally managed and includes annuitization options, participant counseling and financial advice, restrictions against borrowing against 401(a) assets, and other guardrails designed to enhance retirement security.

- A new DC disability & death benefit plan will provide an equivalent benefit for new hires relative to members in the new defined benefit pension plan for probation and surveillance officers (described below).

3. New Plan Choice for Probation/Surveillance Officers Hired After 7/1/2018

The reform will allow all new sworn probation officers or surveillance officers hired on or after July 1, 2018 the choice of entering the full corrections defined contribution plan described above, or a modified, lower-risk defined benefit plan. The new Tier 3 Probation defined benefit plan:

- Changes the pension benefit multiplier from a flat 2.5% to a graded multiplier that ranges from 1.25% to 2.25% depending on years of service.

- Requires employees to pay 67% of normal cost and 50% of any potential future unfunded liabilities if the plan’s experience does not meet actuarial assumptions.

- Requires employers to pay 33% of normal cost and 50% of any potential future unfunded liabilities if the plan’s experience does not meet actuarial assumptions.

- Adopts a pensionable compensation cap of $70,000 (indexed every three years to the annualized growth in probation pay scales)

- Uses a compounding COLA based on regional CPI with a 2.0% cap, unless the funded ratio of the plan falls below 90%.

- Prevents COLAs from being issued in any year in which the funded ratio of the Tier 3 Probation defined benefit plan falls below 70%.

- Increases the minimum benefit eligibility age from 52.5 years old to 55 years old (an actuarially equivalent benefit is available at age 52.5).

Effects of Reform: Fiscal

In addition to improving retirement security and reducing financial risk, one of Sen. Lesko’s policy priorities outlined at the beginning of the process was to keep the reform cost-neutral over the long-term. In the end, the CORP reform achieved this goal and is expected to yield short-term cost savings and long-term cost neutrality:

- The aggregate employer contribution rate and total pension liabilities are immediately reduced under the reform.

- The PBI-to-COLA change is expected to result in an immediate improvement in CORP’s funded ratio, according to estimates by the plan actuary.

- In the long run, the reform is essentially cost neutral on a normal cost basis, according to actuarial modeling by both the plan’s actuary and Reason Foundation.

- By shifting most new CORP hires into a defined contribution plan, the reform will establish budget predictability for employers and employees while nearly eliminating all financial risk to taxpayers over time.

Effects of Reform: Risk Reduction

The CORP reform will reduce risks over time by shifting the majority (approximately 90%) of new hires into a defined contribution plan, where, by definition, there is no possibility of new unfunded liabilities. The primary value of the reform from a solvency perspective is that it creates a long-term path to a scenario where CORP does not carry significant financial risks:

- The reform will reduce the growth in accrued liabilities (total pension promises) by 67% by 2047 and then eventually level-off.

- The reform practically eliminates the taxpayer’s exposure to future market risk and the potential for new unfunded liabilities to accrue for the next generation of workers.

- All newly hired probation and surveillance officers after July 1, 2018 that choose the defined benefit pension plan will equally share investment risk with taxpayers under this reform, as any new unfunded liabilities are split between employers and employees on a 50/50 basis.

It must be noted that the reform does not reduce the amount of pension benefits already promised—all of those still need to be paid and remain exposed to underfunding (unless the PSPRS/CORP board makes substantial changes to key actuarial assumptions). Nonetheless, with fewer liabilities exposed to underperforming asset risk, total unfunded liability payments will be less under the proposed reform in an underperforming scenario than under the baseline.

Effects of Reform: Benefit Improvements

Creating a defined contribution plan for most new hires helps current employees and retirees in the existing CORP pension plan by capping liabilities and improving the plan’s solvency over time, as there would be fewer accrued liabilities exposed to the risk of underperforming assets or other overly optimistic actuarial assumptions.

The reform also creates a secure, portable benefit, allowing newly hired correctional/detention officers to move their pension benefits anywhere (unlike the current CORP pension plan). Further, the reform will offer a benefit better suited to the experience and demographics of the profession:

- Today, approximately 80% of correctional officers leave their job prior to the current 10-year pension vesting period, forfeiting the employer portion of their pension contributions.

- Those employees only get back their own pension contributions, with some interest.

- Under the reform, after three years correctional officers will get to keep 100% of both their own retirement contributions and their employer’s contributions, improving retirement security for all employees.

Last, the reform also creates more beneficiary choices for new employees, as retirement benefits under reform could be passed on to any beneficiary. By contrast, only spouses or minor children are entitled to a portion of the employee’s pension today.

Conclusion

Like PSPRS in 2016, the CORP reform offers an excellent example of how state and local governments can approach meaningful pension reform. In both cases, stakeholders from across the spectrum convened and successfully forged a consensus agreement on what can often be a politically contentious issue. In CORP’s case, the reform package gained bipartisan support in the legislature, plus the support of employee associations, employers, and taxpayer advocates.

The reform takes a multifaceted approach to tackling CORP’s solvency problems. It will replace the broken permanent benefit increase mechanism undermining the plan with a traditional COLA tied to inflation. It will also offer new retirement plan designs for future CORP members that will provide better retirement security for employees while minimizing taxpayers’ exposure to financial risk. Overall, the reform is designed to ensure that all CORP pension commitments are met, while putting into place a more financially sustainable retirement plan for the future.

Additional Resources:

- Reason Foundation presentation: Analysis of Arizona CORP Pension System & Reform (.pdf)

- Full text and legislative history: Senate Bill 1442 | Senate Concurrent Resolution 1023

- Reason Foundation analysis of 2016 PSPRS Reform

- Arizona Auditor General, Performance Audit and Sunset Review of the Public Safety Personnel Retirement System (Report No. 15-111, September 2015)

Leonard Gilroy and Anthony Randazzo are managing directors of the Pension Integrity Project at Reason Foundation. Pete Constant is senior fellow at the Pension Integrity Project and is the chief executive officer of the Retirement Security Initiative.