A recent analysis by the Yankee Institute for Public Policy shows a bleak picture of Connecticut’s public pension system. By the state’s own estimations, pension liabilities for active and retired state employees, teachers, and judges totaled $48.2 billion in 2012. The total assets, however, were only $23.7 billion, leaving an unfunded liability of $24.5 billion. The funded ratio was as a result 49 percent, one of the lowest in the nation.

The unfunded gap has expanded since 2002, as shown in “Chart 1” of the study. The funded status saw a miniscule rise in 2008, but then it deteriorated afterwards. That improvement was largely the result of the state government’s issuance of $2 billion in General Obligation Bonds (GO) for the Teachers’ Retirement System (TRS) to make up for the funding shortfall. Essentially, the state borrowed money to fund the pension, reflecting an attempt to engage in “risk arbitrage”: putting the borrowed money in high-yield investments that earn a higher return than the interest of the bond. The implied logic is that the use of GOs would profit the pension without imposing any extra cost on the state. That logic is specious, as evidenced by the worsening funded status after 2008. What the state of Connecticut did was not arbitrage, but gambling with money that posed considerable risks. As the authors of the study put it, “this is the equivalent of homeowners taking a second mortgage on their houses to invest in the stock market in the hope that the investments pay more than the cost of the mortgage.”

The official numbers however do not show the whole picture. Connecticut’s pension system is in a much worse shape if a more realistic discount rate is used. A near risk-free discount rate brings the funded ratio down from 49 percent to a dismal 25 percent, which is the second lowest in the US, after Illinois. The state’s more realistic estimate of pension unfunded liability is thus $76.8 billion. This translates to $21,378 unfunded liability for every person in Connecticut, 4th highest in the country.

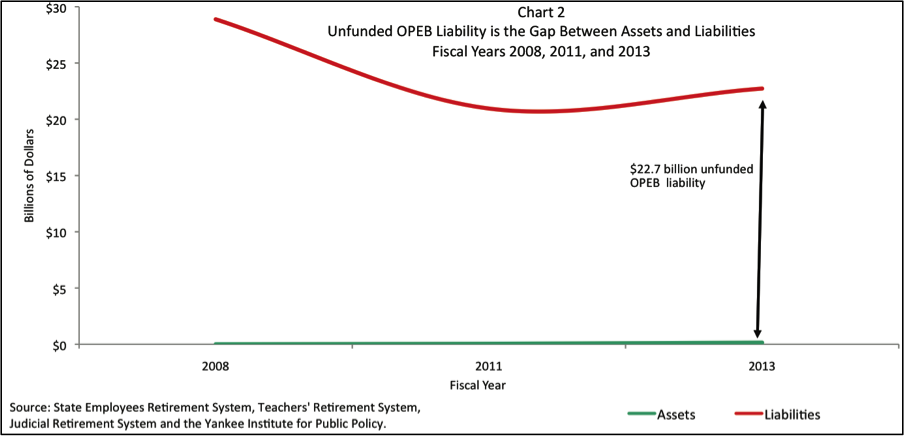

If Connecticut’s pension funding is bad enough, its Other Post-Employment Benefits (OPEB) system, which includes healthcare and life insurance obligations, is in a direr state. The OPEB funded ratio in 2013 was 0.6 percent. The state has set virtually zero assets ($144 million) to cover $22.7 billion in OPEB obligations (see “Chart 2” below). Add that to the previous estimate of the pension debt and the state owes almost $100 billion in unfunded pension and benefit liabilities, which calculates out to be $27,668 of debt for every man, woman, and child in Connecticut.

Future generations of Connecticut will bear this huge financial burden if the state does not take early action. One option is to raise taxes. According to the study, closing the unfunded gap would require increasing the top individual income tax rate from 6.7 percent to 9.25 percent, a rise of 38 percent. Such a large tax increase would inflict a substantial “deadweight” loss to the state’s economy. Raising taxes however does not solve the central problem: the defined benefit pension system containing perverse incentives that encourage underfunding, excessive risk taking, and investment politicization.

The study suggests that a more fundamental solution is pension reform, moving away from the defined benefit system towards a defined contribution system preferred in the private sector. Hybrid pension plans adopted by Indiana, Oregon, Georgia, and West Virginia are also better choices than the current design. While moving to a new system may not bring down the unfunded liability, the new plan will not add further to the current debt and assure that the “damage” is limited to the old plan. Undertaking necessary actions is not easy, but Connecticut cannot afford to wait.

To read the study by the Yankee Institute for Public Policy, go here.