The nation’s fifth-largest pension system, the Florida Retirement System (FRS), has $36 billion in public pension debt. The Pension Integrity Project’s latest analysis shows that this debt has grown rapidly in the last decade and FRS has accumulated an additional $6 billion in unfunded liabilities since 2018.

The Florida Retirement System manages retirement benefits for almost 648,000 active members and over 584,000 retirees in the state and is comprised of a traditional pension plan and a defined contribution retirement plan option called the FRS Investment Plan.

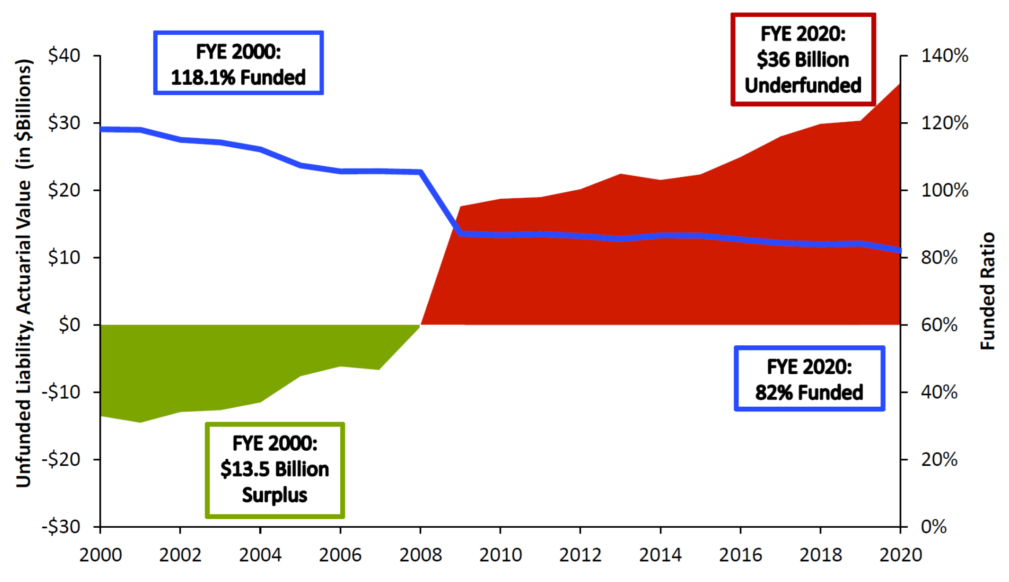

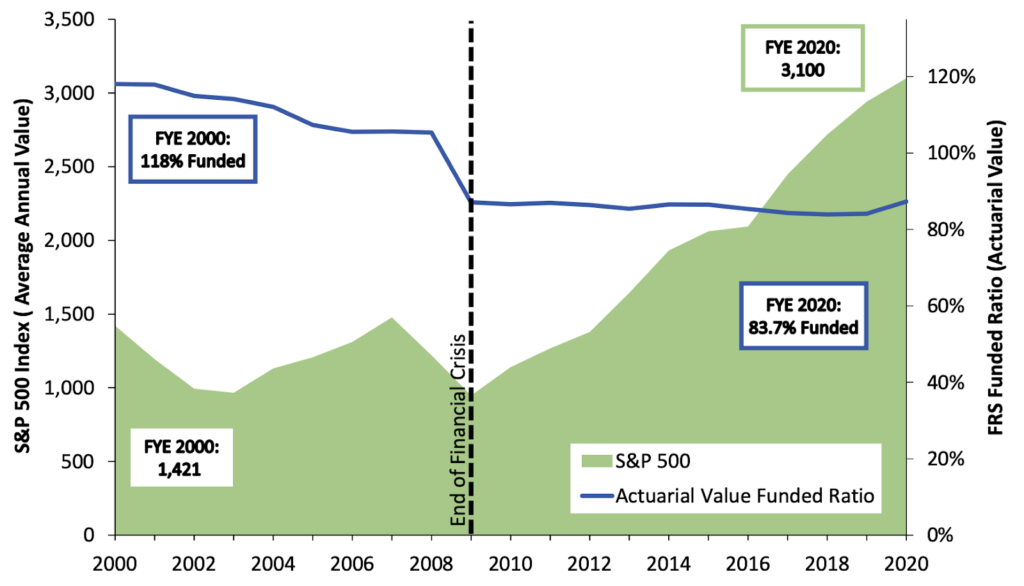

Two decades ago the retirement system held a surplus of over $13 billion in assets and stood at 118 percent funded. Today, FRS finds itself $36 billion in debt with only 82 percent of the assets on hand needed to pay out benefits over the long-term, which represents a net change in position of almost $50 billion in just 20 years.

Investment returns falling short of the system’s expectations have been the largest contributor to the Florida Retirement System’s growing debt, adding $16.4 billion in unfunded liabilities since 2008.

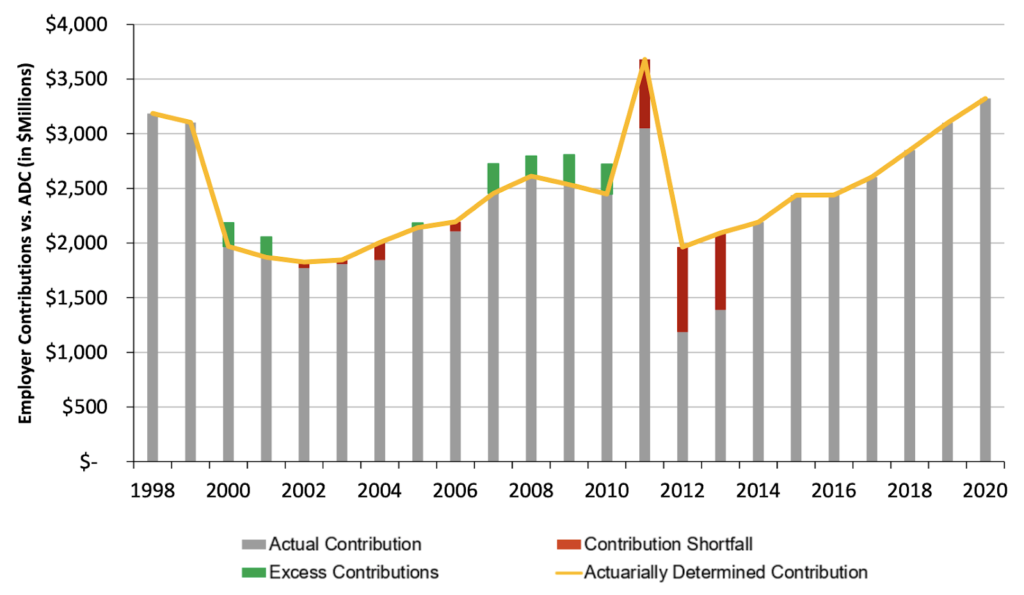

The chart below shows the increase in the Florida Retirement System’s debt since the year 2000:

Despite pension reform efforts in 2011 and 2017, structural deficiencies within FRS continue to risk the retirement security of employees and retirees. The 2011 legislative effort reduced retirement benefits for employees and while such a change did lower some costs, it did not fundamentally address why pension debt continues to grow. Similarly, defaulting new FRS members into the Investment Plan in 2018 was a move that better aligned with workforce mobility trends and reduced future financial risks, but it did not address why the system’s pension debt has persisted for a decade.

Furthermore, the FRS Investment Plan is no closer to providing retirement security for Florida’s public retirees than the debt-riddled FRS Pension Plan, as it relies on contribution rates that fall far below industry standards for adequate retirement benefits. Industry experts estimate that 10 to 15 percent of annual income should be required as a contribution to a defined contribution retirement to provide adequate retirement income for public workers. FRS’s aggregate 6.3 percent contribution falls well short of this standard.

Bringing stakeholders together around a central, non-partisan understanding of the challenges the Florida Retirement System faces —complete with independent third-party actuarial analysis and expert technical assistance— is crucial to ensuring the state’s financial solvency in the long-term. The Pension Integrity Project at Reason Foundation stands ready to help guide Florida policymakers and stakeholders in addressing the shifting fiscal landscape.

Current Retirement Option Sets

FRS Pension Plan

- Type: Final Average Salary Defined Benefit Pension Plan

- Final Average Salary: Average of the 8 highest years

- Multiplier: 3%

- Vesting: 8 years

- Normal Retirement Eligibility: Any age @ 33 YOS or vested by age 65

- Regular Member Contribution:

- 3.09% for Normal Cost

- 4.30% for Unfunded Liability Payment (beginning FY2019-20)

- Employee Contribution: 3%

FRS Investment Plan

Default option as of January 1, 2018

- Type: Defined Contribution Retirement Plan

- Employee Contribution: 3%

- Employer Contribution:

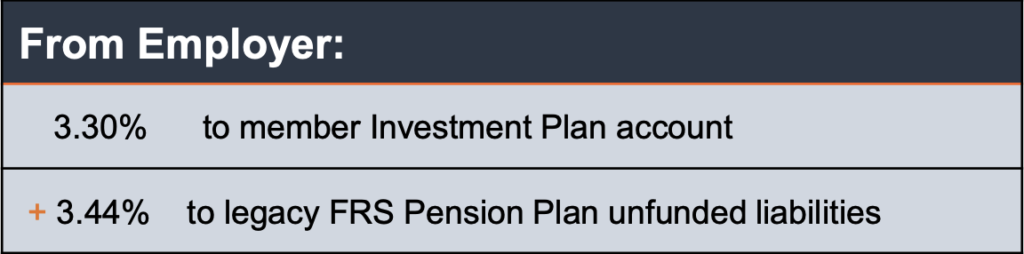

- 3.3% to member IP account

- 3.56% to legacy FRS Pension Plan unfunded liabilities

- Vesting: 1 year

- Investment Options:

- Investment Funds

- Target Date Funds

- Default Investment Strategy: Target Date Funds

Reviewing Prior Reforms

Major Reforms to FRS

2000 – House Bill 2393

- Provided a defined, participant-directed contribution (DC) plan option to FRS members.

- One-year vesting for the portability of employer contributions.

- Based retirement benefits on market returns rather than a fixed benefit guarantee.

- Existing members given the option to switch future FRS participation into the DC plan without losing their already earned pension benefits.

2011 – Senate Bill 2100

- Created a new benefit tier for “special-risk” new hires.

- Renamed the FRS defined benefit plan the Florida Retirement System “Pension Plan.”

- Renamed the FRS defined contribution plan from the Public Employee Optional Retirement Program to the Florida Retirement System “Investment Plan.”

- Eliminated post-retirement increases on pension benefits earned after July 2011.

- Decreased both employer and employee contribution rates effective July 2012.

- Led to unfunded accrued liabilities decreasing from $16.7 billion to $15.6 billion.

2017 – Senate Bill 7022

- Defaults new employees hired after January 2018 into the FRS Investment Plan (DC plan) if no election taken after eight months of employment.

Previous Reforms Have Not Set the FRS on a Path to Sustainability

- The historic 10-year bull market has not helped FRS recover.

- The 2008 financial crisis weakened FRS’s funded status, but since then markets have recovered while pension funding has not.

- Reducing benefits in 2011 reduced some costs at the expense of inflation protection for retirees, but it did not fundamentally address why pension debt continues to grow.

- Defaulting new FRS members into the Investment Plan in 2018 was better aligned with workforce mobility trends and reduced future financial risk, but it did not address why pension debt has persisted for a decade.

- For three straight years (2016, 2017 & 2018) FRS’s consulting actuary has warned that the assumed rate of return is not reasonable.

- Additional reforms are necessary to ensure long-term solvency.

FRS Remains Unsustainable Despite Recent Reforms

Challenge #1:

FRS Defined Benefit Pension Plan Still Not on a Path to Solvency

- Overly optimistic assumed rate of return creates unnecessary risk.

- Unmet actuarial assumptions and slow-paced changes to those assumptions increases unfunded liabilities over time.

- Insufficient employer contributions inhibits plan assets from compounding growth over decades.

- Discount rate misaligned with risk, underpricing pension cost and undervaluing FRS unfunded liabilities.

Challenge #2:

FRS Defined Contribution Retirement Plan Not Built for Retirement Security.

- An inadequate contribution rate is shortchanging worker retirement security.

Challenge 1: FRS is Still Not on a Path to Long-Term Solvency

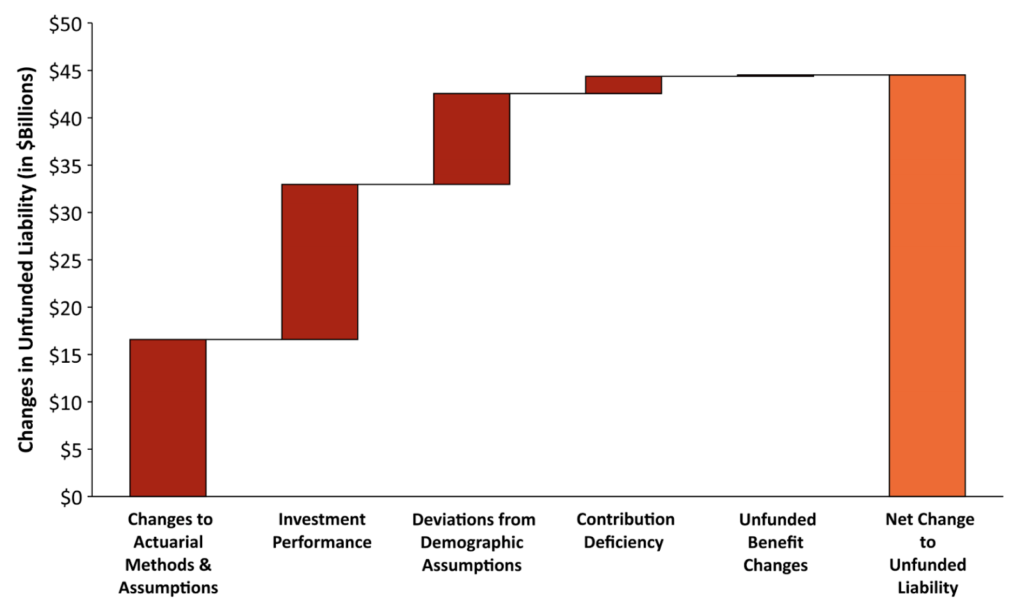

Driving Factors Behind FRS Pension Debt

- Changes to Actuarial Methods & Assumptions to better reflect current market and demographic trends have exposed over $16.6 billion in previously unrecognized unfunded liability.

- Deviations from Investment Return Assumptions have been the largest unintended contributor to the unfunded liability, adding $16.4 billion since 2008.

- Insufficient Contributions contributed $1.8 billion to FRS unfunded liability since 2008.

- Undervaluing Debt through discounting methods has led to the tacit undercalculation of required contributions.

Overly Optimistic Assumed Rate of Return

Unrealistic Expectations: Despite the recent change to 7.0%, the Assumed Investment Return for FRS continues to expose taxpayers to significant investment underperformance risk.

Underpricing Contributions: The use of an unrealistic Assumed Return has likely resulted in underpriced Normal Cost and an undercalculated Actuarially Determined Contribution.

FRS Actuaries on Current Return Assumption

- All models developed in 2017 by Milliman and Aon Hewitt had 50th percentile geometric average annual long-term future returns in the 6.6%-6.8% range.

- Models developed in 2018 by Milliman and Aon Hewitt show the average annual long-term future returns in the 6.4-6.7% range, yet FRS Actuarial Assumption Conference adopted a 7.4% return assumption.

- Presenters at the 2020 FRS Actuarial Conference suggested return assumptions within the range of 6.46% (Aon) to 6.56% (Milliman), with a lower inflation assumption of 2.1% to 2.2% relative to the previous conference assumption of 2.6%.

- The 2020 FRS Actuarial Assumption Conference adopted a 7.0% return assumption.

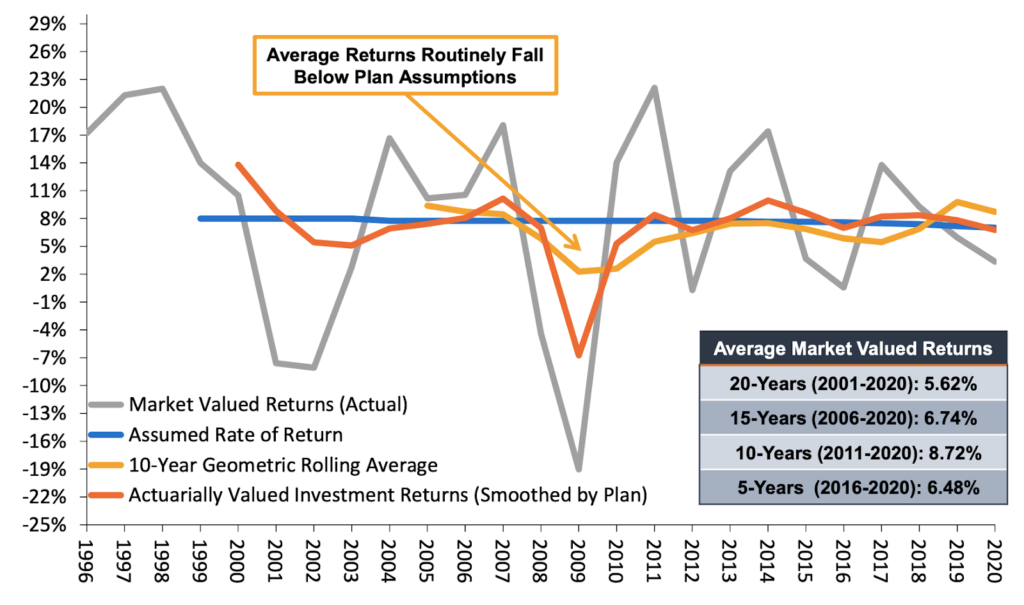

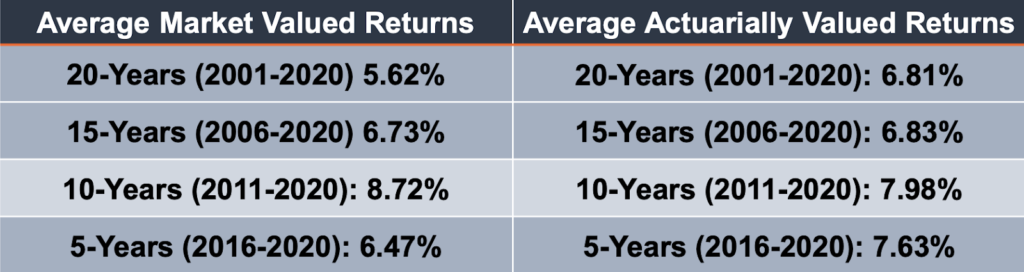

Investment Return History 1996-2020

Investment Returns vs. Assumptions

- FRS historically assumed an investment return rate as high as 8.00% before lowering the assumption to 7.75% in 2004. The plan has adjusted the assumption annually since in 2014, to reach the current 7.0% for 2021.

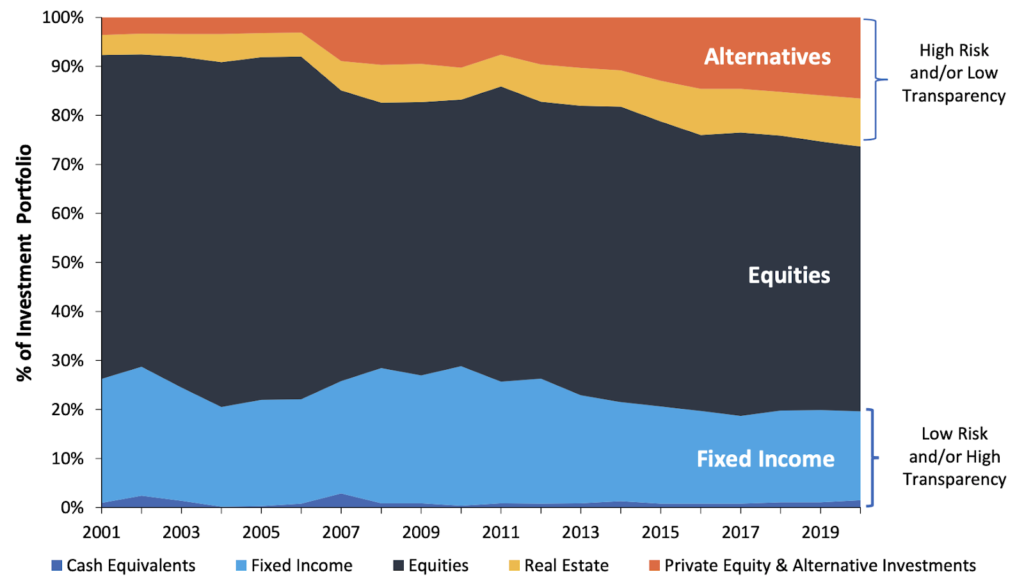

- FRS expanded investments in high-risk holdings in a search for greater investment returns over the past decade.

- The FRS Pension Plan investment portfolio’s trends have not matched longterm assumptions:

Note: Past performance is not the best measure of future performance, but it does help provide some context to the problem created by having an excessively high assumed rate of return.

FRS Funded Ratio Did Not Recover Despite a Historic Decade for the Stock Market

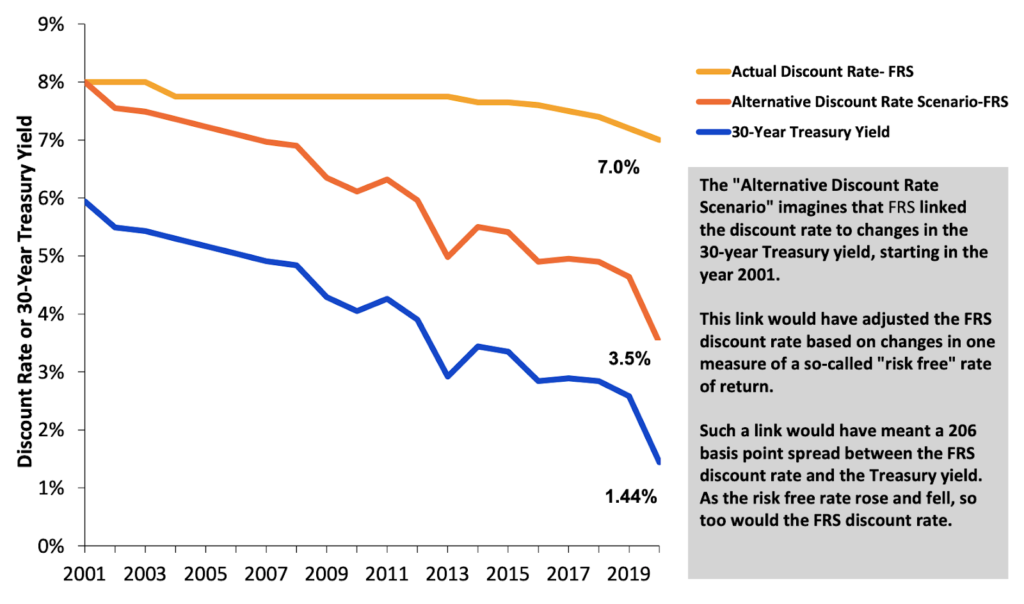

New Normal: The Market Has Changed

The “new normal” for institutional investing suggests that achieving even a 6% average rate of return in the future is optimistic.

- Over the past two decades there has been a steady change in the nature of institutional investment returns. 30-year Treasury yields have fallen from near 8% in the 1990s to consistently less than 3%. New phenomenon: negative interest rates, designates a collapse in global bond yields. The U.S. just experienced the longest economic recovery in history, yet average growth rates in GDP and inflation are below expectations.

- McKinsey & Co. forecast the returns on equities will be 20% to 50% lower over the next two decades compared to the previous three decades. Using their forecasts, the best-case scenario for a 70/30 portfolio of equities and bonds is likely to earn around 5% return.

- The FRS Pension Plan 5-year average return is around 6.48%, well below the assumed 7% return assumption.

Expanding Risk in Search for Yield

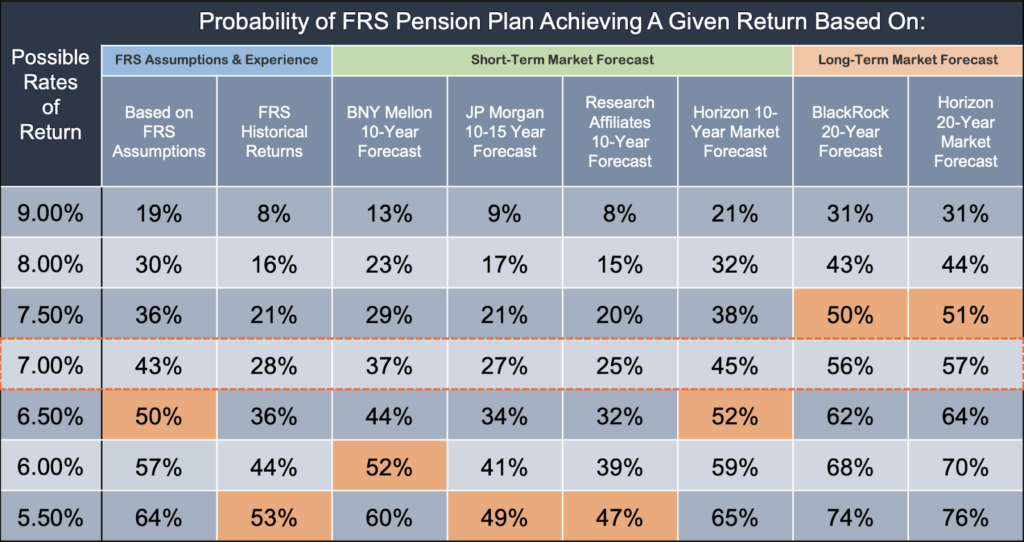

Probability Analysis: Measuring the Likelihood of FRS Achieving Various Rates of Return

Probability Analysis: Measuring the Likelihood of FRS Achieving Various Rates of Return

FRS Assumptions & Experience

- A probability analysis of FRS historical returns over the past 20 years (2000-2020) indicates only a modest chance (28%) of hitting the plan’s 7.0% assumed return.

- FRS’s own investment return assumptions imply a 43% chance of achieving their investment return target over the next 20 years.

Short-Term Market Forecast

- Returns over the short to medium term can have significant negative effects on funding outcomes for mature pension plans with large negative cash flows like FRS.

- Analysis of capital market assumptions publicly reported by the leading financial firms (BlackRock, BNY Mellon, JPMorgan, and Research Affiliates) suggests that over a 10-15 year period, FRS returns are likely to fall short of their assumption.

Long-Term Market Forecast

- Longer-term projections typically assume FRS investment returns will revert back to historical averages.

- The “reversion to mean” assumption should be viewed with caution given historical changes in interest rates and a variety of other market conditions that increase uncertainty over longer projection periods, relative to shorter ones.

- Forecasts showing long-term returns near 7.0% likely also show a significant chance that the actual long-term average return will fall far shorter than expected.

- For example, according to the BlackRock’s 20-year forecast, while the probability of achieving an average return of 7.0% or higher is about 56%, the probability of earning a rate of return below 5.5% is about 26%.

Risk Assessment

How resilient is FRS to volatile market factors?

Important Funding Concepts

Statutory rates are more susceptible to the political risk inherent to the legislative process and often result in systemic underfunding, especially when legislatively established rates fall short of what plan actuaries calculate as necessary to ensure funding progress.

Employer Contribution Rates

- Statutory Contributions: Annual payments usually based on rates set in state statute, meaning contributions remain static until changed by legislation.

- Actuarially Determined Employer Contribution (ADEC): Unlike statutory contributions, ADEC is the annual required amount FRS’s consulting actuary has determined is needed to be contributed each year to avoid growth in pension debt and keep ERS solvent.

All-in Employer Cost

- The true cost of a pension is not only in the annual contributions, but also in whatever unfunded liabilities remain. The ”All-in Employer Cost” combines the total amount paid in employer contributions and adds what unfunded liabilities remain at the end of the forecasting window.

Baseline Rates

- The baseline describes FRS current assumptions using the plan’s existing contribution and funding policy and shows the status quo before the 2020 market shock.

Quick Note: With actuarial experiences of public pension plans varying from one year to the next, and potential rounding and methodological differences between actuaries, projected values shown onwards are not meant for budget planning purposes. For trend and policy discussions only.

Stress Testing FRS Using Crisis Simulations

Our risk assessment analysis shows that under likely market fluctuations, FRS funding could decline significantly more.

If you assume FRS will achieve an average six percent rate of investment return over the next 30 years plus experience one financial crisis in this time, analysis shows that the pension plans unfunded liability would spike to $80 billion before the year 2050.

This likely economic scenario would cost the state almost $120 billion more in pension contributions than what they currently plan to spend on the plan.

Seeing as FRS only averaged a 5.62 percent market valued investment return rate between 2000 – 2019, and that we have seen two major economic crisis in the last 20 years, it is reasonable to assume the next 30 years will look somewhat similar.

An additional $120 billion in pension costs would put significant strain on the state budget.

Stress on the Economy:

- Market watchers expect dwindling consumption and incomes to severely impact near-term tax collections – applying more pressure on state and local budgets.

- Revenue declines are likely to undermine employers’ ability to make full pension contributions, especially for those relying on more volatile tax sources (e.g., sales taxes) and those with low rainyday fund balances.

- Many experts expect continued market volatility, and the Federal Reserve is expected to keep interest rates near 0% for years and only increase rates in response to longer-term inflation trends.

Methodology:

- Adapting the Dodd-Frank stress testing methodology for banks and Moody’s Investors Service recession preparedness analysis, the following scenarios assume one year of -24.6% returns in 2020, followed by three years of 11% average returns.

- Recognizing expert consensus regarding a diminishing capital market outlook, the scenarios assume a long-term investment return of 6% once markets rebound.

- Given the increased exposure to volatile global markets and rising frequency of Black Swan economic events, we include a scenario incorporating a second Black Swan crisis event in 2035.

Outdated and Aggressive Actuarial Assumptions and Methods

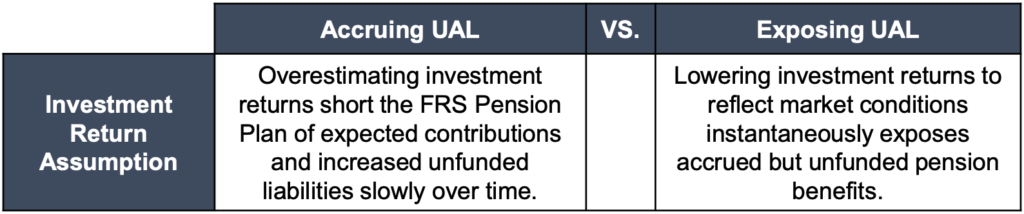

- Deviations between actuarial experience and assumptions, and delays updating those assumptions, has led to an underestimation of the total FRS Pension Plan liability.

- Adjusting actuarial assumptions to reflect the changing demographics and new normal in investment markets exposes hidden pension cost by uncovering existing but unreported unfunded liabilities.

- If aggressive assumptions continue to misprice pension benefits, FRS experience will continue to deviate from the plan’s expectations and allow for the continued growth of unfunded liabilities.

- Generally, each assumption used by plan actuaries to calculate the cost of benefits over time come with the inherent risk of being wrong any given year resulting in unfunded liabilities.

- When an assumption is off, and assets actuaries were expecting from a given source are not contributed to make up the difference, the plan passively accrues unfunded.

- When an assumption is deliberately adjusted in a way that increases the probability of the expected outcome, cost hidden in the assumption are exposed, resulting in unfunded liabilities increasing in exchange for a more stable assumption and contribution rate.

Insufficient Contributions

Imprudent Funding Policy is Creating Structural Underfunding for FRS

- From 2011-2013, FRS employer contributions failed to meet the actuarially determined contribution (ADC), increasing the Unfunded Actuarial Liability by $2.45 billion.

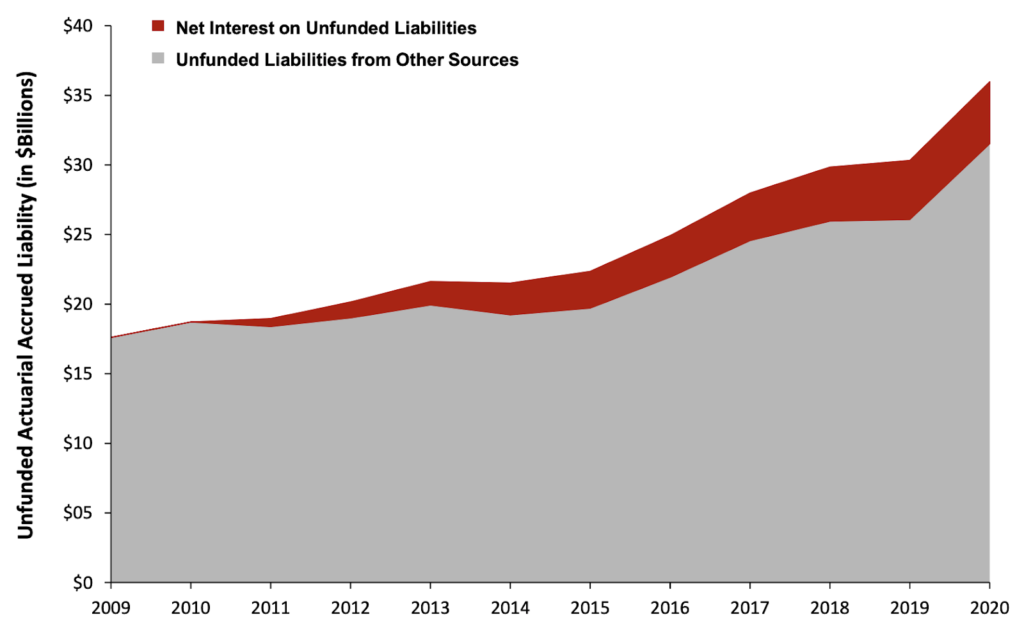

- In 7 of the past 17 years, employer contributions have been less than the interest accrued on the pension debt (e.g., negative amortization), which allowed for the unfunded liability to grow in absolute terms.

- The 30-year period FRS uses to pay off unfunded liabilities is greater than the Society of Actuaries’ recommended funding period of 15 to 20 years, resulting in higher overall costs for the plan. Due to the long 30-year closed amortization schedule used to pay off the annual unfunded liability employer pension contributions have not always kept up with the interest accrued on the pension debt.

Actual v. Required Contributions

Negative Amortization: Understanding the Current Funding Policy

- From 2011-2013, FRS employer contributions failed to meet the actuarially determined contribution (ADC), increasing the Unfunded Actuarial Liability by $2.45 billion.

- Starting in the 1998 actuarial valuation, the Legislature required all UAL bases in existence to be considered fully amortized, since the plan was in a surplus position.

- As part of the funding policy selected by the Florida Legislature, the actuarially calculated contribution rate is based on a “layered” approach that includes closed 30-year charge and credit bases for the amortization of any accrued UAL.

- The Unfunded Actuarial Liability (UAL) is amortized as a level percentage of projected payroll on which UAL rates are charged in an effort to maintain level contribution rates as a percentage of payroll during the specified amortization period if future experience follows assumptions.

Negative Amortization Growth (2009-2020)

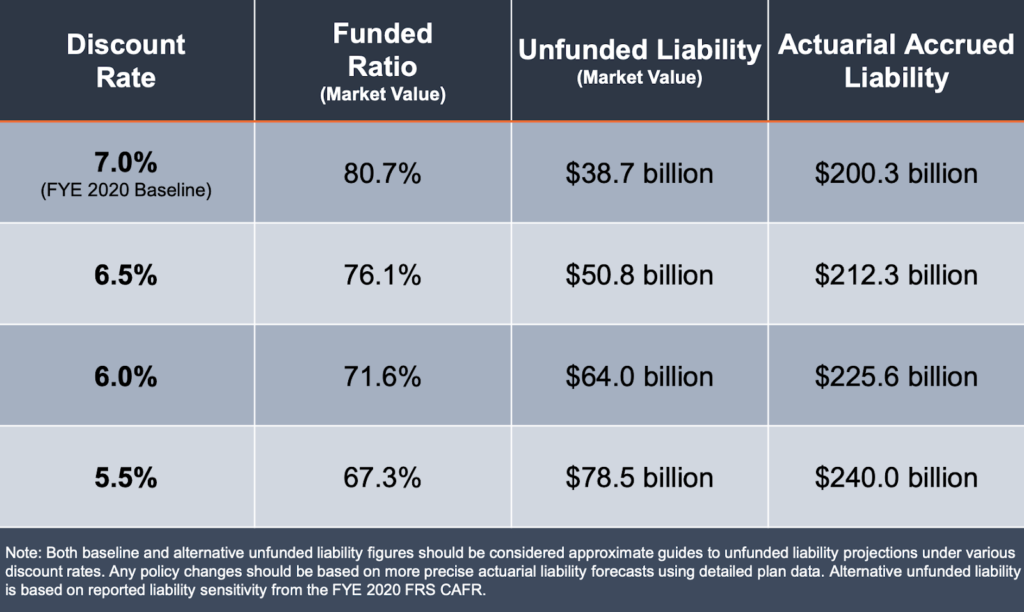

Discount Rate & Undervaluing Debt

The “discount rate” for a public pension plan should reflect the risk inherent in the pension plan’s liabilities:

- Most public sector pension plans — including FRS — use the assumed rate of return and discount rate interchangeably, even though each serve a different purpose.

- The Assumed Rate of Return (ARR) adopted by FRS estimates what the plan will return on average in the long run and is used to calculate contributions needed each year to fund the plans.

- The Discount Rate (DR), on the other hand, is used to determine the net present value of all the already promised pension benefits and supposed to reflect the risk of the plan sponsor not being able to pay the promised pensions.

Setting a discount rate too high will lead to undervaluing the amount of pension benefits actually promised.

- If a pension plan is choosing to target a high rate of return with its portfolio of assets, and that high assumed return is then used to calculate/discount the value of existing promised benefits, the result will likely be that the actuarially recognized amount of accrued liabilities is undervalued.

- Milliman, argues the discount rate for calculating the total pension liability should be equal to the return assumption.

It is reasonable to conclude that there is almost no risk that Florida would pay out less than 100% of promised retirement income benefits to members and retirees.

- State law requires protection of pension benefit payouts. Florida State Statutes § 121.011- 121.40; 121.4501-121.5912 & Florida Administrative Code 60S-4

The discount rate used to account for this minimal risk should be appropriately low.

- The higher the discount rate used by a pension plan, the higher the implied assumption of risk for the pension obligations.

Sensitivity Analysis: Pension Debt Comparison Under Alternative Discount Rates

Change in the Risk-Free Rate Compared to FRS Discount Rate (2001-2020)

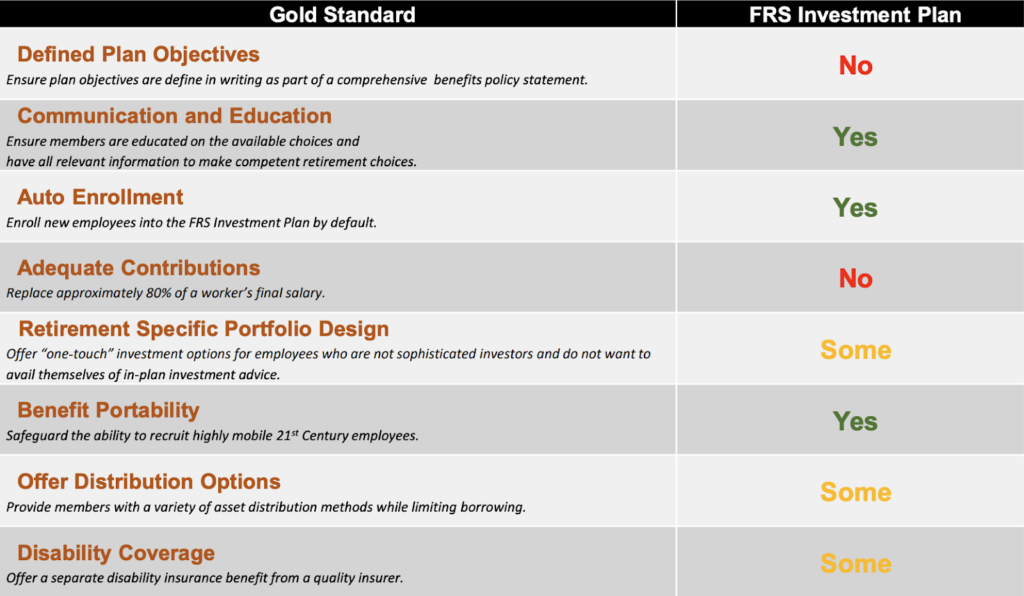

Challenge 2: FRS Defined Contribution Plan is Not Built for Security

FRS Defined Contribution Plan Overview

The FRS defined contribution retirement plan—the FRS Investment Plan—is the state’s current default (as of 2018).

- Members are vested after one year of service in the FRS Investment Plan.

Employees may choose to receive their account balance at the end of employment as a lump sum or take periodic withdrawals either on-demand or by a pre-determined payout schedule.

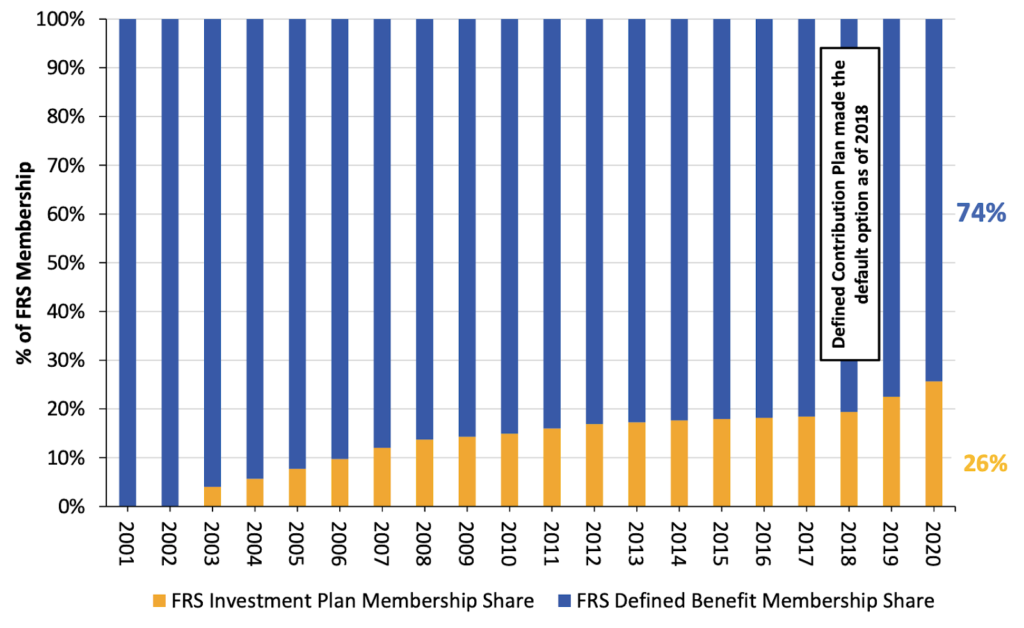

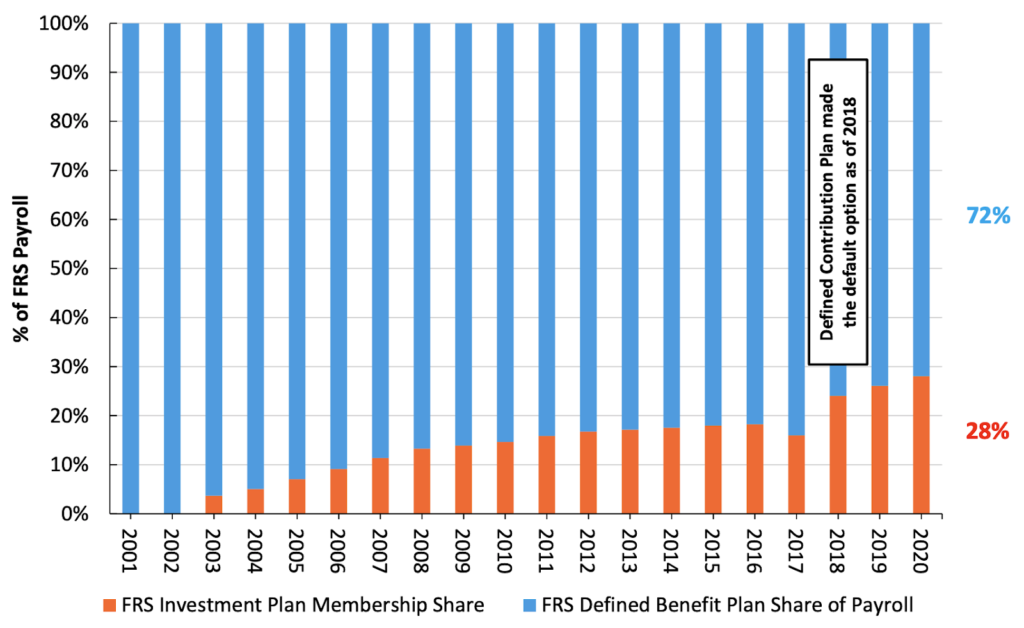

The FRS Investment Plan has shown consistent growth since its introduction in 2002.

- FRS Defined Contribution Plan members currently account for nearly 23% of total FRS membership and 26% of total FRS payroll.

The Legislature can increase or decrease the amount employers and employees contribute to plan members’ accounts.

FRS Investment Plan Funding

Current FRS Investment Plan contribution breakdown:

Best practice says employers should continue making payments towards their legacy pension debt as if all new hires were still entering the Pension Plan.

Inadequate Contribution Rates are Jeopardizing Retirement Security

- The aggregate 6.3% FRS Investment Plan contribution rate falls far below industry standards for retirement benefit adequacy.

- Industry leaders, retirement experts and independent studies consistently estimate 10% to 15% of annual income to be required to provide adequate retirement income.

- For regular plan members alone contribution rates need to rise at least 400 basis points to provide retirement security.

- Higher contribution rates may be required for older workers to achieve adequate savings for retirement due to chronic underfunding.

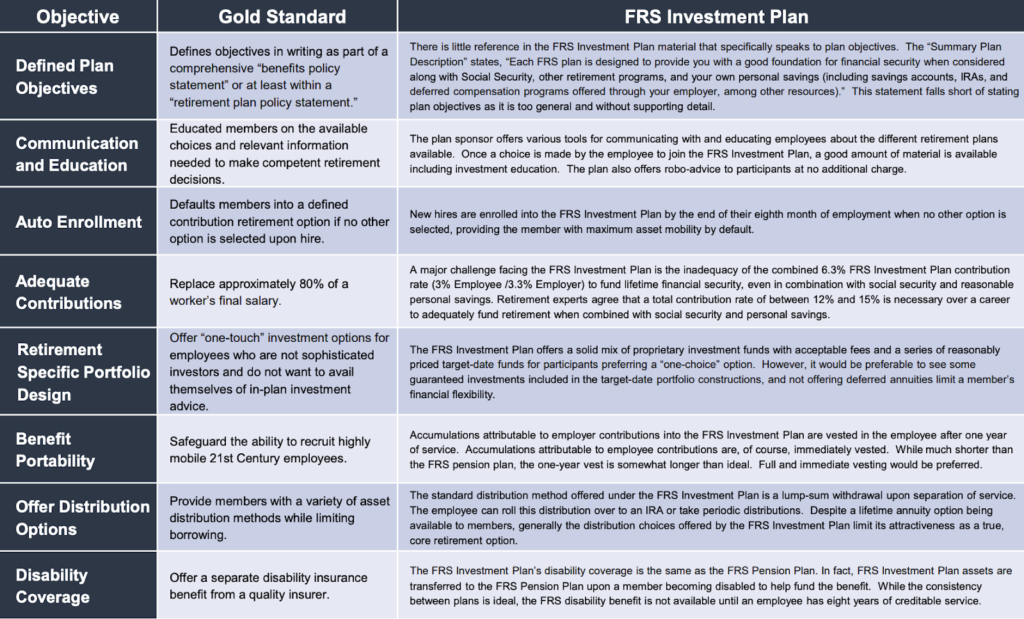

FRS Investment Plan – Gold Standard Score

A Framework for Policy Reform

- Keeping Promises: Ensure the ability to pay 100% of the benefits earned and accrued by active workers and retirees

- Retirement Security: Provide retirement security for all current and future employees

- Predictability: Stabilize contribution rates for the long-term

- Risk Reduction: Reduce pension system exposure to financial risk and market volatility

- Affordability: Reduce long-term costs for employers/taxpayers and employees

- Attractive Benefits: Ensure the ability to recruit 21st Century employees

- Good Governance: Adopt best practices for board organization, investment management, and financial reporting

Defined Contribution Reform Best Practices

1. Adopt Better Risk Assessment and Actuarial Assumptions

- Lower the assumed rate of return to align with independent actuarial recommendations.

- These changes should aim at minimizing risk and contribution rate volatility for employers and employees.

2. Establish A Plan To Pay Off The Unfunded Liability As Quickly As Possible

- The Society of Actuaries Blue Ribbon Panel recommends amortization schedules be no longer than 15 to 20 years.

- Reducing the amortization schedule would save the state billions in interest payments.

3. Review Current Plan Options To Improve Retirement Security

- Consider offering additional retirement options that create a pathway to lifetime income for employees that do not stay in public service.

4. Adopt Better Funding Policy

- Financial experts strongly recommend contributions 10 to 15 percent of pre-tax earnings into a retirement account.

- Older workers with a closer retirement horizon and inadequate savings may need to contribute even more.

5. Encourage Use of Target Date Funds

- Well-designed DC plans should also offer the correct age-appropriate investment mix. This is generally accomplished by using target date funds that adjust investment risk to the employee’s retirement horizon to protect the value of the account from market fluctuations as the worker nears retirement.

6. Encourage Use of Annuities for Improved Retirement Security

- The mix of proprietary investment funds and reasonably priced target-date funds give participants adequate “one-choice” options. However, without guaranteed investments included in the target-date portfolio constructions and deferred annuities the FRS Investment Plan will continue to limit a members’ financial flexibility.

- Despite a lifetime annuity option being available to members, generally the distribution choices offered by the FRS Investment Plan limit its attractiveness as a true, core retirement option.

Full Florida Retirement System Pension Solvency Analysis

Stay in Touch with Our Pension Experts

Reason Foundation’s Pension Integrity Project has helped policymakers in states like Arizona, Colorado, Michigan, and Montana implement substantive pension reforms. Our monthly newsletter highlights the latest actuarial analysis and policy insights from our team.