This newsletter from the Pension Integrity Project at Reason Foundation highlights articles, research, opinion, and other information related to public pension challenges and reform efforts across the nation. You can find previous editions here.

In This Issue:

Articles, Research & Spotlights

- New federal rule puts ESG spotlight on states

- The shortfalls of ESG investing

- California’s growing pension debt

- FTX and crypto warnings for pensions

- Georgia improves its hybrid plan

- Pension policies should be set by those who bear the risks

News in Brief

Quotable Quotes on Pension Reform

Data Highlight

Contact the Pension Reform Help Desk

Articles, Research & Spotlights

The Department of Labor’s New ESG Rule Puts the Onus on States

The US Department of Labor (DOL) has released a new rule that reverses previous limits on what private retirement plans can consider in investment decisions. The move essentially gives plans permission to take environmental, social, and governance (ESG) factors into account, which was traditionally outside the scope of those acting as fiduciaries. The rule applies to private plans through the Employee Retirement Income Security Act (ERISA), which is not applied to public pension plans. The change does highlight, however, the ongoing debate around the politicization of retirement funds. The DOL rule also demonstrates how the answers to this debate will largely be determined through state legislation. Reason Foundation’s ESG resource website outlines issues related to ESG and public pensions and offers model legislation to help protect taxpayers’ funds from political activism.

Scrutinizing High ESG Fees, Greenwashing, and the Politicization of Public Pension Funds

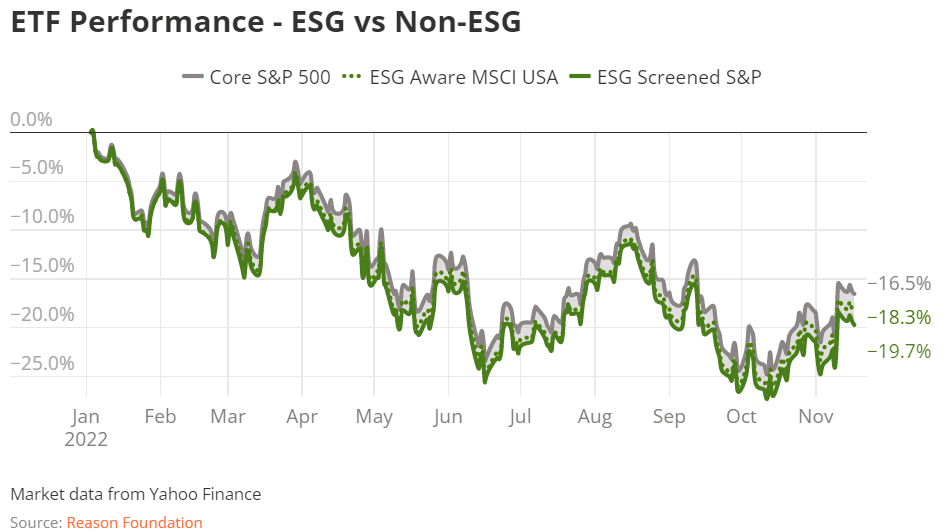

Assets that focus on ESG are becoming more popular among investors but come with several challenges for consumers and policymakers. Reason’s Jordan Campbell identifies three growing problems with ESG-focused investing that even supporters are concerned about. First, environmental grading can be arbitrary and easy to manipulate. Second, ESG assets often incur expensive fees with little evidence of advantages in returns. Third, government involvement with this strategy can be a politicization of public funds.

California’s Public Pension Debt Grows

The California Public Employees’ Retirement System (CalPERS) recently updated its investment results from the fiscal year ending June 2022, adjusting its actual loss of assets from -6.1% to -7.5%. This new accounting means the nation’s largest pension lost nearly $30 billion in 2022, which will impact state and local government employers with higher annual contribution requirements. In a commentary published in the Orange County Register and elsewhere, Reason’s Jen Sidorova examines the growth of the system’s unfunded liabilities and what it means for California’s governments and taxpayers.

FTX Collapse Is a Reminder that Public Pensions Should Exercise Caution

The collapse of the FTX cryptocurrency exchange platform, and a year marked by significant crypto losses, have renewed questions and concerns about the pressures for public pensions to invest in these types of volatile assets. Examining public pension investments in crypto markets, Reason’s Swaroop Bhagavatula finds that some states, including Kansas, Missouri, Alaska, and Washington, have reported FTX-related losses, although not at significant levels, but, generally, public pensions plans seem to have largely avoided significant exposure.

Georgia Reinforces Its Hybrid Retirement Plan

In what is commonly known as a hybrid approach, Georgia’s retirement plan for state employees uses a combination of defined benefit (DB) and defined contribution (DC) elements to balance portability, cost, funding, and longevity risks. Now, state policymakers are reinforcing their commitment to both this plan and its members with an increase in employer contributions to the DC portion. Reason’s Jen Sidorova outlines these changes, explaining how they will benefit both state employees and taxpayers with a more stable and adequate retirement offering.

Who Should Be Responsible for a Public Pension Plan’s Risk Management Policy?

Market volatility and years of growing shortfalls in pension funding raise questions about who ultimately is responsible for the risk-related decisions involved in managing a publicly sponsored retirement plan. As Reason’s Rod Crane explains, risk strategies and policies have largely been left to plan administrators to set and monitor, but the government backing of these plans means the taxpayer is the true bearer of cost-related risks. Crane reviews how industry experts imagine this risk should be balanced between parties, noting the need for pension oversight bodies with the direct authority to set and manage assumption, funding, and investment policies.

News in Brief

Policy Brief Examines Application of a New Actuarial Requirement

In anticipation of a new actuarial reporting standard to be implemented in February of 2023, S&P Global Ratings has released a brief explaining what the new requirement could mean for public pension plans. The new requirement from the Actuarial Standards Board (ASB) will have pensions reporting their low-default-risk obligation measure (LDROM), which will be an accounting of liabilities and funding measurements using a very low discount rate. S&P explains that this measurement will be useful in that it will demonstrate what the costs of a plan could be if they were to eliminate market risk from their investment profile. While neither S&P nor ASB are advocating for such a shift in investment policy, the new reporting could be a valuable way to measure and compare a plan’s exposure to market risk. The full brief is available here.

New Commentary Revisits the Success of Canadian Public Pensions

An article posted in the Harvard Law School Forum on Corporate Governance by KPA Advisory Services’ Keith Ambachtsheer examines the history of Canada’s public pension plans, focusing on the adoption of revolutionary funding and governance philosophies in the early 90s that continue to serve the plans to date. The post titled “How Peter Drucker Revolutionized Canada’s Public Sector Pension System: Lessons for Americans” details how a mindset focused on policies that were intergenerationally fair along with unbiased, experienced governance led Canadian pensions to maintain full funding through a volatile and changing market. The plans achieved this through the early adoption of lower, risk-reduced assumptions on returns and inflation protection benefits conditional on how well the plan is funded. The full article is available here.

Quotable Quotes on Pension Reform

“Defined benefit pensions ‘are too critically important to the participants to use precious resources to engage in these risky strategies…We need to get back to basics and focus on the promise’ that has been made to participants in these plans.”

—Russell Kamp, managing director at investment management firm Ryan ALM, on public pensions investing in crypto in “Amid FTX fallout, public pension fund defends its big bet on crypto-related holdings,” MarketWatch, November 29, 2022.

“The more you limit the investments out there, there is at least a fair possibility that might ultimately impact the return. As a policymaker, I think they’ll need to be aware of that,”

—Kansas Public Employees Retirement System Executive Director Alan Conroy on proposals to direct the system’s investments in “Kansas Pension Investment Advisers Caution Against Robust Legislative Rebuttal to ESG Activists,” Kansas Reflector, November 22, 2022

Data Highlight

Each month, we feature a pension-related chart or infographic of interest generated by our team. This month, Jordan Campbell created a visualization comparing the performance of ESG investments to the rest of the investments in 2022. Access the graph here.

Contact the Pension Reform Help Desk

Reason Foundation’s Pension Reform Help Desk provides technical assistance for those wishing to pursue pension reform in their states, counties, and cities. Feel free to contact the Reason Pension Reform Help Desk by e-mail at pensionhelpdesk@reason.org.

Follow the discussion on pensions and other governmental reforms at Reason Foundation’s website and on Twitter @ReasonPensions. As we continually strive to improve the publication, please feel free to send your questions, comments, and suggestions to zachary.christensen@reason.org.

Stay in Touch with Our Pension Experts

Reason Foundation’s Pension Integrity Project has helped policymakers in states like Arizona, Colorado, Michigan, and Montana implement substantive pension reforms. Our monthly newsletter highlights the latest actuarial analysis and policy insights from our team.