This newsletter from the Pension Integrity Project at Reason Foundation highlights articles, research, opinion, and other information related to public pension challenges and reform efforts across the nation. You can find previous editions here.

In This Issue:

Articles, Research & Spotlights

- Webinar: Former SEC Commissioner Paul Atkins, former CKE Restaurants CEO Andy Puzder, and Reason Foundation on the impact of ESG policies

- Best practices for pension COLA design

- Which states and pension systems have adopted ESG policies?

- Cash flow challenges and solutions for public pensions

- Evaluating Alaska’s defined contribution and annuity plans

- Texas counters politicized ESG efforts with more politics

- Participation, not equity, should be the focus of retirement plans

News in Brief

Quotable Quotes on Pension Reform

Data Highlight

Contact the Pension Reform Help Desk

Articles, Research & Spotlights

Webinar: What Does ESG Mean for Public Pension Systems and Taxpayers?

Environmental, social, and governance (ESG) trends are impacting public pension systems, retirees, and taxpayers. Join former SEC Commissioner Paul Atkins, former CKE Restaurants CEO Andy Puzder, and Reason Foundation’s Leonard Gilroy for a webinar on September 20 at 1 pm ET to discuss how ESG policies and politicized public investments may impact investment returns and saddle taxpayers with additional costs. The panel discussion will also examine if legislators pushing broad anti-ESG laws could unleash unintended negative consequences and will explore potential reforms that would help keep politics out of public pensions.

Best Practices for Cost-of-Living Adjustment Designs in Public Pension Systems

Extended periods of high inflation can be particularly challenging for pensioners, whose promised benefits usually come in the form of fixed payments. To protect retirees from losing too much purchasing power, many public employers provide a cost-of-living adjustment (COLA) benefit. Like any other retirement benefit, this brings additional costs and requires appropriate funding and limitations. A new report from the Pension Integrity Project identifies a set of best practices that policymakers should consider when structuring or reforming the COLA benefits offered to public retirees. Among those principles are the recommendations that COLAs should be pre-funded and aligned with explicit retirement plan objectives.

The Public Pension Systems Signing on to Politicized ESG Investment Efforts

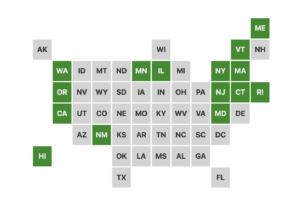

Several state and local public pension systems have signed on to global climate change accords and/or formally joined activist investment groups focused on reducing climate change. This interactive map by Reason’s Jordan Campbell shows the state and local pension plans, treasurers, and investment boards taking such actions to date.

Policy Brief: The Impact of Cash Flow on Public Pensions

Because public pension plans are designed to combine annual contributions with investment returns to fulfill retirement promises, it is crucial to monitor the money flowing in and out—also known as the cash flow—of public systems. In this new policy brief, Reason’s Truong Bui uses the Montana Public Employee Retirement System (PERS) as a case study to examine the impact of cash flow, both historically and in long-term forecasts. The analysis demonstrates some of the risks that can arise when a plan has more money leaving its fund than going in.

How Alaska’s Defined Contribution Plan and Supplemental Annuity Plan Compare to the Gold Standard

Alaska’s defined contribution and supplemental annuity plans are the primary retirement offerings to the state’s public workers. In this analysis, Reason’s Richard Hiller and Rod Crane partner with the Alaska Policy Forum to evaluate these plans according to best practices for defined contribution plans. They find that the plans fulfill some of the best practices of well-structured retirement plans, while also finding that there is still room for improvement in areas such as a formal statement of plan objectives and contribution adequacy for both teachers and public safety workers.

Texas Dangerously Inserts Politics into Pension Investing

In accordance with Senate Bill 13 from the 2021 legislative session, the Texas Comptroller of Public Accounts recently released a new list identifying 10 financial firms and 348 investment funds that Texas claims are boycotting the fossil fuel industry. This means the state’s public pension funds must remove them from their investment portfolios. Reason’s Marc Joffe highlights some of the implications of this new policy and considers how this reaction to ESG investing also elevates politicized investments over core fiduciary decision-making and risks higher costs for taxpayers.

Policymakers Should Focus on Improving Participation Rates in Retirement Plans

Recent reporting from the National Institute on Retirement Security (NIRS) identifies economic inequities caused by tax incentives in retirement savings, but this analysis overlooks some key facets of how the laws promoting savings operate. Reason’s Rod Crane asserts that tax incentives are working exactly as they are meant to by benefiting those who are closer to retirement. Instead of focusing on retirement benefit inequities between the upper- and middle-classes, policymakers should simply seek to maximize the number of employees that are participating in retirement saving programs.

News in Brief

New Report Underscores Volatility for State Pensions

A new paper published by the Center for Retirement Research looks at the impact of declining stock market returns and rising inflation on pension funds. The paper shows that, despite the market drop, pension funds have still seen a net increase in funded ratios by one percentage point between 2020 and 2022. The paper goes into more depth as to how this affects amortization payments and overall contribution rates. Regarding inflation, the only types of COLA plan offered by pension plans affected by inflation are CPI (Consumer Price Index) linked. Other types, such as ad-hoc and invested-based COLAs, are unaffected. CPI-linked COLAs typically have caps of around 3.5%. Due to these caps, increases in amortization payments from inflation will be relatively limited (estimated to be between 0.4% to 1.6% of payroll). The full brief is available here.

Paper Examines Purpose and Effectiveness of ESG ratings

A new working paper from the Rock Center for Corporate Governance at Stanford University reviews the stated purpose of ESG ratings and how effective they are at achieving these goals. The paper identifies the shortcomings that exist in both the objectives and execution of current methods in grading the nonfinancial impact of companies. It also asks if the motivations of fund managers are aligned to produce accurate and reliable reports, which are crucial for calibrating ESG ratings that the market can confidently apply to decision-making. The working paper is available here.

Quotable Quotes on Pension Reform

“Starting in FY 2024, the budget will start reflecting the impact of adverse financial market conditions on pension returns.”

—New York City Comptroller Brad Lander cited in “NYC Will Need to Chip in an Extra $6 Billion to Shore up Pension Funds — Comptroller” in Pensions & Investments, September 7, 2022

“For a while, ESG looked like a good bet, and values seemed cheap. In a down market, though, ESG’s true cost is starting to reveal itself—and in a more volatile, energy-scarce market, it will only get more expensive. Politics aside, few people or fund managers will tolerate funds that underperform, and this may be the real reason ESG funds have peaked.”

—Manhattan Institute Senior Fellow Allison Schrager in “The ESG Bubble Is Bursting” in City Journal, August 30, 2022

“The concern for most investors now is ‘how do I find exposures that are going to help me stabilize the portfolio vs. investing with my values?’”

—Managing Director at FLX Networks Jill DelSignore cited in “The ESG Crown Is Slipping, and It’s Mostly the Fund Industry’s Own Fault” in Bloomberg, September 2, 2022

Data Highlight

Each month we feature a pension-related chart or infographic of interest generated by our team of Pension Integrity Project analysts. This month, analyst Jordan Campbell created an interactive map showing the state and local government pension plans that have signed on with the Ceres Investor Network on Climate Risk and Sustainability and Climate Action 100+. You can access the map here.

Contact the Pension Reform Help Desk

Reason Foundation’s Pension Reform Help Desk provides technical assistance for those wishing to pursue pension reform in their states, counties, and cities. Feel free to contact the Reason Pension Reform Help Desk by e-mail at pensionhelpdesk@reason.org.

Follow the discussion on pensions and other governmental reforms at Reason Foundation’s website and on Twitter @ReasonPensions. As we continually strive to improve the publication, please feel free to send your questions, comments, and suggestions to zachary.christensen@reason.org.

Stay in Touch with Our Pension Experts

Reason Foundation’s Pension Integrity Project has helped policymakers in states like Arizona, Colorado, Michigan, and Montana implement substantive pension reforms. Our monthly newsletter highlights the latest actuarial analysis and policy insights from our team.