In This Issue:

Articles, Research & Spotlights

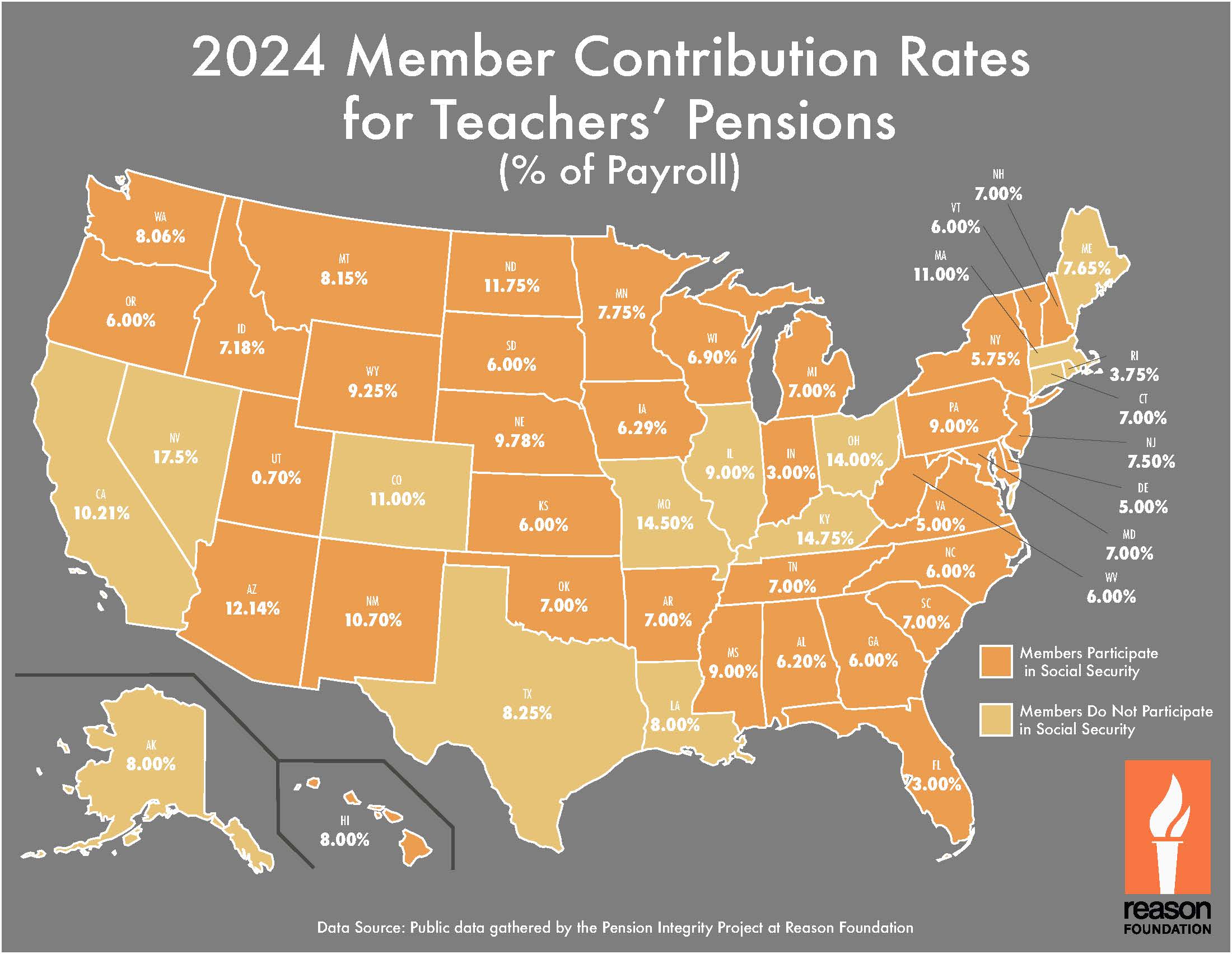

- What Are Teachers Contributing to Their Pensions?

- Proposals to Rebalance Pension Debt Between Michigan’s State and Local Governments

- Plan Administrators Could Do Better at Conveying the Advantages of Their Defined Contribution Retirement Plans

News in Brief

Quotable Quotes on Pension Reform

Data Highlight

Contact the Pension Reform Help Desk

Articles, Research & Spotlights

How Much Are Teachers Paying for Their Pensions?

The vast majority of public school teachers around the country have a pension offered by their state government, with most educators making contributions to their pension plans through deductions from their paychecks. A new analysis from Reason Foundation’s Zachary Christensen illustrates the different pension contribution rates that teachers are paying around the country, noting some major differences from one state to another. There are several factors that drive differences in pension contribution requirements, including whether the state has its teachers participating in Social Security or not, how the system’s costs are balanced between the teacher and the employer, and the underlying generosity of the promised pension benefits.

State Taxpayers’ Share of Michigan Pension Debt Would Increase Under Various Proposals

A new Pension Integrity Project analysis examines a group of legislative proposals in Michigan that would all involve having the state pay more for local school districts’ teacher pension costs. While the total contributions required to pay down the existing teacher pension debt would not change across the proposals, the distribution of these costs between the state and employers (K-12 school districts) varies significantly. For example, one House proposal would require over $26.5 billion in additional state contributions. These findings raise questions about how Michigan and other states balance the burden of pension costs between state and local budgets.

Public Pension Plans Need to Better Communicate the Benefits of their Defined Contribution Plans

Many government employers offer flexible defined contribution (DC) plans to new hires, which can provide optimized retirement benefits for today’s increasingly mobile workforce. Unfortunately, as Reason Foundation’s Richard Hiller points out, these advantages are often poorly communicated to new and current workers. Administrators of public DC plans should focus on educating their members on the advantages of DC plans, which could reduce dissatisfaction with benefits offered and reduce calls to replace them with costly and usually sub-optimal defined benefit (DB) pensions.

News in Brief

Public Pension Returns Underperform a Simple Bond/Stock Index Portfolio

A recent brief by the Center of Retirement Research assesses whether public pension plans’ recent investment strategies yielded better returns when compared to simple index investing. Public pension funds have been shifting from traditional equities and bonds to alternative assets and active management, aiming for higher returns. This shift has spurred skepticism on whether it can outperform simple strategies after accounting for the fees and expenses associated with private investments. The brief compares the past two decades of returns for public pension plans to a simple 60/40 index portfolio (60% stocks, 40% bonds) from 2000 to 2023. It finds that while public pensions performed similarly to the index over the long term, they lagged behind after the 2007 global financial crisis. The authors suggest public pension plans should not expect higher long-term returns from complex, actively managed approaches and might benefit from simpler, cheaper, and more transparent investment strategies. The full brief is here.

Disability Incidence in Public Retirement Systems

A recent analysis by the National Association of State Retirement Administrators (NASRA) examines the incidence of disability benefits in public retirement systems, focusing on occupational class, eligibility criteria, and plan design. The study finds that public safety officers, such as police and firefighters, have higher disability rates due to their hazardous job conditions, with median disability incidence rates of nearly 5%, compared to less than 1% for teachers. Systems with more permissive eligibility criteria, like the “own occupation” standard, report higher disability rates than those with stricter criteria, such as the “any employment” standard. Additionally, hybrid plan designs, which combine disability retirement and income replacement features, show higher disability incidence across all occupational classes. The full brief can be accessed here.

Quotable Quotes on Pension Reform

“We plan to make the changes that are necessary to provide [pension funding reform], but we also have to recognize that taxpayers are underwriting this, and it has to be a solution that works for the firefighters and the taxpayers,”

—Midland Mayor Lori Blong quoted in “Firemen urge Midland City Council for pension reform during special meeting” yourbasin.com, June 18, 2024.

“To be very clear: I remain committed to protecting all of the retirement benefits of all of our retirees and our current employees. I also remain committed to shoring up the retirement system, which the executive director has now informed us is $25 billion underfunded.”

—Mississippi Lieutenant Gov. Delbert Hosemann quoted in “Hosemann: Study confirms PERS ’13th check’ for Mississippi retirees protected,” Mississippi Today, July 4, 2024.

“It’s the investment account that will give us a return on the investments through the stock market, which in the long run helps the city. If we get returns on our investments, that’s less money the city has to put in in future years.”

—Attorney Dennis Orsey quoted in “Fight over $3.5 million to help fund East St. Louis police pensions heads to court,” Belleville News-Democrat, July 5, 2024.

Data Highlight

Each month, we feature a pension-related chart or infographic of interest generated by our team of analysts. This month, we are showcasing a map from Zachary Christensen’s analysis mentioned above. Christensen illustrates the share of their pay teachers must contribute to their pension fund in each state.