This newsletter from the Pension Integrity Project at Reason Foundation highlights articles, research, opinion, and other information related to public pension challenges and reform efforts across the nation. You can find previous editions here.

In This Issue:

Articles, Research & Spotlights

- Who benefits most from defined benefit and defined contribution plans?

- California’s public pension losses will impact local governments.

- A new survey suggests retirement plans are poor tools for recruitment and retention.

- More transparency is needed on public pensions’ private equity investments.

News in Brief

Quotable Quotes on Pension Reform

Data Highlight

Articles, Research & Spotlights

Examining the Populations Best Served by Defined Benefit and Defined Contribution Plans

Research by some pension advocacy groups suggests that defined benefit pension plans enjoy a cost efficiency advantage over defined contribution plans (e.g., they generate a greater value for the same cost), but this conclusion is based on too narrow of a perspective. In a new analysis, Reason Foundation’s Swaroop Bhagavatula, Rod Crane, and Richard Hiller posit that there are many more factors that need to be considered to evaluate the efficiency of a public retirement plan. They introduce the concept of benefit efficiency, which measures how well a plan distributes its benefits to all of its members. Using hypothetical pension plans, their analysis shows that a standard defined benefit plan maximizes “efficiency” for only a narrow group of plan members, making it a less optimal option for the vast majority of public workers.

California’s Unfunded Pension Liabilities Will Burden State and Local Governments

Reporting a -6.1% return for its 2022 fiscal year, California’s pension system serving most state and local public workers—CalPERS—is bracing for growth in its unfunded liability and the inevitable hike in annual costs. Reason Foundation’s Marc Joffe notes that while CalPERS may have outperformed some institutional investors, the nation’s largest pension system’s losses in the last quarter may not have been fully captured in this figure due to the standard lag in reporting on private equity assets. Either way, Joffe notes the growth in California’s public pension debt will impose higher costs on already cash-strapped local governments and taxpayers in the state.

Retirement Plans’ Impact on Recruiting and Retention in the Public Market

A new survey of 319 government respondents by the MissionSquare Research Institute sheds some light on a common question in the sphere of public employment: Does the quality or type of a retirement plan impact a government’s ability to recruit or retain workers? Reason’s Richard Hiller argues the survey results suggest pension plans have little to no impact on a public employer’s ability to attract or keep their employees. The survey results do suggest, however, that employees respond to their perceived wellness and overall happiness. Hiller says public employers should focus on providing effective retirement plans that are optimal for as many employees as possible to improve their perceived well-being.

As Public Pension Plans Take Risks, SEC Wants More Transparency from Private Equity Funds

With economic uncertainty and shifting investment strategies, many public pension systems are now relying heavily on alternative investments to help secure the investment returns they need to fund promised retirement benefits. Reason’s Jen Sidorova outlines some of the key challenges that arise from alternative investing, including a lack of transparency and predictability. She also notes how the Security Exchange Commission’s newly proposed reporting requirements could help public pension investors better evaluate the risks involved in this opaque asset class.

News in Brief

New Report Underscores Volatility for State Pensions

A new report from S&P Global Ratings highlights the impact volatile markets are having on the funded ratios of public pension plans across the country. On average, after last year’s excellent returns, pension plans went from 69% funded in 2020 to 81% funded in 2021. According to this report, however, pension plans will likely drop back to 2020’s funded levels after this year. The report also highlights the states that used 2021 to shore up their unfunded liabilities. Thirty-eight states met their minimum contribution requirements, and 16 states exceeded them, the report finds. States like Washington, Indiana, and Utah had some of the highest contributions above what was required in 2021. The report concludes that with an economic recession likely looming, many state-level public pension reform efforts have been put on the back burner. The full brief is available here.

Quotable Quotes on Pension Reform

“Larger public pension funds fared better than smaller ones over the past year, with those managing more than $1 billion returning a median minus 6.6% and plans over $5 billion returning a median minus 5.1%, the data showed.”

—Heather Gillers, citing data from Wilshire Trust Universe Comparison Services in “Market Rout Sends State and City Pension Funds to Worst Year Since 2009,” The Wall Street Journal, August 9, 2022

“Implementing programs that enhance corporate profits is the age-old guiding principle for corporate management and no new ESG [environmental, social, and corporate governance] management principles are required to achieve these ends. Therefore, ESG as a management paradigm is only necessary when the proposed ESG programs are financially harmful to the company—the company would not adopt the program without explicit pressure from ESG advocates. Implementing programs that reduce profitability is a serious violation of management’s fiduciary responsibility.”

—Wayne Winegarden, in “Proxy Advisory Firms and The ESG Risk,” Forbes, July 25, 2022

Data Highlight

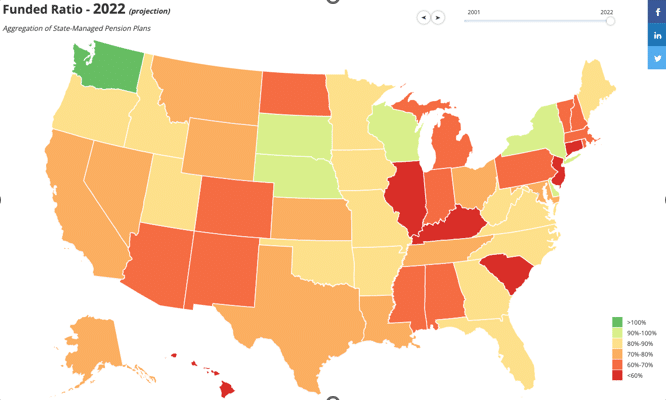

Each month, we feature a pension-related chart or infographic of interest generated by our team of Pension Integrity Project analysts. This month, analyst Jordan Campbell created an updated interactive map showing aggregated state pension funding levels from 2001 to 2022. You can access the map here.

Contact the Pension Reform Help Desk

Reason Foundation’s Pension Reform Help Desk provides information on Reason’s work on pension reform and resources for those wishing to pursue pension reform in their states, counties, and cities. Feel free to contact the Reason Pension Reform Help Desk by email at pensionhelpdesk@reason.org.

Follow the discussion on pensions and other governmental reforms at Reason Foundation’s website and on Twitter @ReasonPensions. As we continually strive to improve the publication, please feel free to send your questions, comments, and suggestions to zachary.christensen@reason.org.

Stay in Touch with Our Pension Experts

Reason Foundation’s Pension Integrity Project has helped policymakers in states like Arizona, Colorado, Michigan, and Montana implement substantive pension reforms. Our monthly newsletter highlights the latest actuarial analysis and policy insights from our team.