When public schools remained closed for months during the COVID-19 pandemic, they sent students and families a harmful message: missing a lot of school is ok.

Before the pandemic, only 15% of students were classified as chronically absent (missing at least 18 days of school), but by the 2021-22 school year, chronic absenteeism rates had soared to an unprecedented 31%.

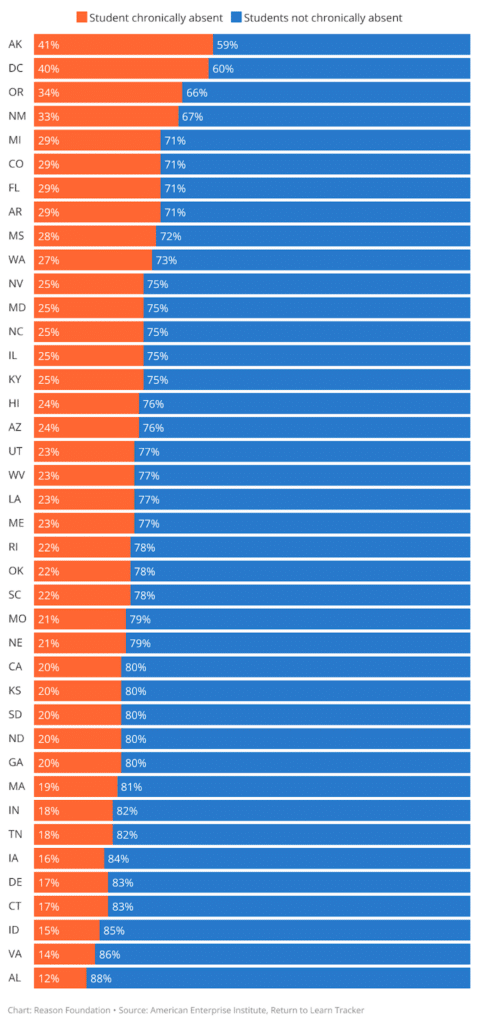

The latest data from 39 states and Washington, D.C. (see Figure 1) show that 23% of students were categorized as chronically absent during the 2024-25 school year, still well above prepandemic levels.

Figure 1: Chronic absenteeism rates in 39 states and Washington, D.C., 2024-25 school year

While most states improved their rates of chronic absenteeism compared to the previous school year, most gains were smaller than before. High rates of absenteeism remained unchanged in nine states, including Washington and Ohio, and increased in New Mexico, Mississippi, and Arkansas, indicating that many states still have significant work to do.

While two states, Alabama and Delaware, reduced their chronic absenteeism rates to within one percentage point of prepandemic levels, no state has returned to prepandemic levels.

So while more kids are back in school today, chronic absenteeism remains a pervasive problem and is described as “public K-12 education’s own case of long COVID” by the American Enterprise Institute’s Nat Malkus.

When students miss significant time from school, they are at higher risk of falling behind in coursework and dropping out. For example, chronically absent elementary students have a harder time reading at grade level than their peers.

Some policies implemented during the pandemic to accommodate students, such as no consequences for late or missing work entirely, and the option to retake exams, have persisted after students returned to school. These policies unintentionally reinforce families’ perceptions that missing school or not turning in homework doesn’t have consequences.

In some cases, teachers themselves are sending the wrong message to students. A Brookings report showed that teacher absences surged after the pandemic in Nevada, Connecticut, South Carolina, and Illinois. For example, 40% of Chicago teachers were chronically absent during the 2024-25 school year.

When educators can’t be bothered to come to school, it’s unfair to blame students for following their lead.

School administrators need to get back to basics and start holding students accountable for missing school, and end any residual pandemic-era policies that allow students to miss homework or exams without consequences. Rolling back outdated policies alone isn’t likely sufficient. School districts may need to implement new policies to encourage students to attend school more regularly.

A 2026 AEI report by Sam Hollon, Nat Malkus, Sarah Winchell Lenoff, and Jeremy Singer suggested that schools build strategies to address single-day absences, which are most likely to snowball into chronic absenteeism, and to target “interventions based on attendance patterns and reasons for attendance, not just rates of absence.”

Other strategies included restructuring curricula to schedule important lessons on Mondays or Fridays, when students are more likely to miss class, to create incentives to attend on those days and to send a message to parents that they aren’t optional.

Reintroducing basic standards like these reinforces to students and parents that being at school and doing the work are important. Until families get this message, the nation’s schools will struggle to recover from the pandemic.

From the states

New Hampshire considers an expansive open enrollment proposal, Louisiana returns to the private school scholarship funding debate, and Kansas considers lifting the cap on its tax-credit scholarship.

In New Hampshire, Senate Bill 101-FN, which would expand the state’s open enrollment policy to allow students to transfer to any public school with open seats, was approved by the Senate and is now under review in the House. If codified, New Hampshire would receive a B- grade rather than an F grade in Reason Foundation’s best open enrollment practices and annual rankings.

Mississippi House Bill 2, an omnibus education proposal to establish private school scholarships and strengthen the state’s open enrollment law, was rejected by the Senate Education Committee. However, state policymakers can still expand students’ education options. The Senate approved Senate Bill 2002, which would improve Mississippi’s open enrollment law. The bill is under review by the House Education Committee.

Last year, Louisiana policymakers allocated $43.5 billion to the LA GATOR private school scholarship program, which was less than half of Gov. Jeff Landry’s requested funding. Now the governor wants the legislature to pay the difference, requesting an additional $44.2 million to fund the program. During the 2025-26 school year, the LA GATOR program provided scholarships to 6,000 students, totaling about $7,250, which recipients can use for eligible education expenses, such as tutoring, textbooks, or private school tuition.

The Virginia House of Delegates Education Committee approved House Bill 359, which would require private schools that receive public funds to comply with nondiscrimination rules in student admissions and to administer the state if they receive public funds. If signed into law, the bill could affect private schools that receive funding from the federal tax-credit scholarship program. The bill is now under consideration by the House Appropriations Committee.

The Kansas House advanced House Bill 2468, which would lift the $10 million cap on the state’s tax-credit scholarship program. Students whose household income is at or below 250% of the federal poverty line can receive a scholarship valued at about $3,000 to pay for approved education expenses, such as private school tuition and transportation costs. The bill is now under review in the Senate.

What to watch

Twenty-eight states plan to opt into the federal tax-credit scholarship program; Idaho’s Supreme Court upholds its tax-credit scholarship program.

The Idaho Supreme Court unanimously ruled that the state’s Parental Choice Tax Credit Program was constitutional. Participants can use their funds to pay for private school tuition, tutoring, and other eligible expenses. Opponents of the program argued that it unconstitutionally expanded publicly funded education outside of public schools. The state Supreme Court ruled that while the legislature must fund a public school system, it isn’t prohibited from funding other education policies. Chief Justice Richard Bevan explained in his decision that the constitution’s mandate to fund a system of public schools “establishes a floor, and not a ceiling” on the legislature’s authority.

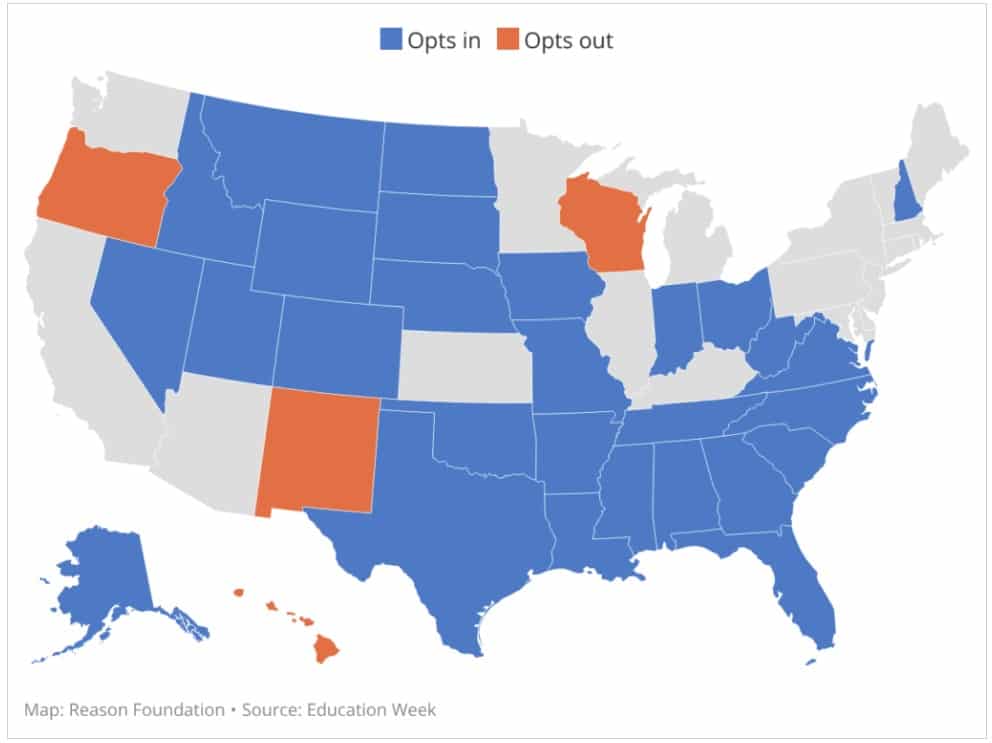

Nationwide, 28 states have announced plans to participate in the new federal tax-credit program. The latest states to announce their participation include: Georgia, Florida, Indiana, Mississippi, Montana, North Dakota, New Hampshire, Nevada, Ohio, Oklahoma, Utah, West Virginia, and Wyoming. So far, four states, Hawaii, Oregon, New Mexico, and Wisconsin, have indicated that they will not participate. Set to launch in 2027, the new law allows individual taxpayers to contribute up to $1,700 annually to an approved scholarship-granting organization. Scholarship recipients may use these funds to cover approved education expenses, such as private school tuition, tutoring, or school uniforms. Figure 2 summarizes the states’ decisions to participate in the program to date.

Figure 2: State decisions to participate in the federal tax-credit scholarship program

The Oklahoma Statewide Charter School Board unanimously rejected the Ben Gamala Jewish School Foundation’s charter school application, citing the 2024 Oklahoma Supreme Court’s decision that religious charter schools were unconstitutional. The foundation and the Becket Fund for Religious Liberty announced plans to sue over the denial.

The Latest from Reason Foundation

Many families choose public schools other than their assigned ones

How public schools measure capacity for K-12 open enrollment transfers

Missouri can embrace open enrollment for students while addressing school funding concerns

Mississippi’s open enrollment proposals would be a step in the right direction for students

California’s public school funding should be based on students actually enrolled

Reason Foundation submitted testimony on open enrollment proposals in Michigan and Alaska.

Recommended reading

Study: 98% of Teens Attend Schools Limiting Cellphones, but Most Still Use Them

Lauren Wagner at The74

“As schools across the nation implement cellphone restrictions, new research shows that teens mostly support the policies — but that doesn’t mean they follow them. And students spend an average of an hour and a half using the phone in school every day, no matter how restrictive the policies are, despite the consequences.”

Introducing “End Fed Ed Watch”

Neal McClusky at Cato Institute

“Public schools are spending more per pupil than ever, but teachers are enduring serious salary cuts. New money is instead being used to hire more non-teachers and fund pension plans that penalize beginning teachers. Meanwhile, about a fourth of all students are chronically absent from school, and average student achievement has fallen steeply.”

The Rise Of An Outdoor School Network Educating Nearly 1,000 Students

Kerry McDonald at Forbes

“CKC is part of a diverse ecosystem of emerging K-12 schools, built by entrepreneurial parents and teachers and driven by families looking for entirely different learning models that prioritize both academic success and social-emotional well-being. This educational ecosystem was developing before 2020, but it has gained significant traction in the years since the pandemic. Frustrated by Chromebook-centric classrooms, cookie-cutter curriculum and testing and rising youth mental health concerns, some parents are seeking—and building—alternatives to conventional schooling.”