The National Association of State Budget Officers recently released its 2024 Fiscal Survey of States, providing an updated overview of fiscal conditions in all 50 states. According to the report, many states are now projecting budget surpluses due to increases in general fund revenue and slower spending growth, enabling them to increase the size of their reserves significantly.

While allocating these surpluses to new programs is tempting, doing so would establish higher annual budget obligations and likely exacerbate government deficits in the long run. Instead, states should focus on investing these surpluses prudently by paying down expensive long-standing debts, particularly by paying for unfunded pension obligations.

The National Association of State Budget Officers (NASBO) survey indicates that most states are projecting continued growth in general fund revenues and a slowing in spending for 2025, though a few large states skew the aggregate growth rates. Thirty-three states reported that their 2024 general fund revenues exceeded original estimates. For the 2025 fiscal year, general fund revenues are projected to reach $1.2 trillion—a 1.6% increase from 2024—with 34 states projecting revenue growth.

On the expenditure side, general fund spending for 2025 is projected to be $1.22 trillion, a 6.2% decrease from 2024. This decrease is largely driven by significant reductions in California (-9.6%) and Florida (-16.5%) and a missed estimate in Virginia. Still, 27 states are budgeting for general fund spending increases, with a median annual growth rate of 1.1% for fiscal 2025.

With ongoing growth in general fund revenues and better-managed spending, states’ rainy-day fund balances and total balances are strengthening. A rainy-day fund, or budget stabilization fund, is a reserve to cover budget shortfalls during economic downturns. The total balance of a state budget typically includes the leftover general fund (or ending balance) and the rainy-day fund.

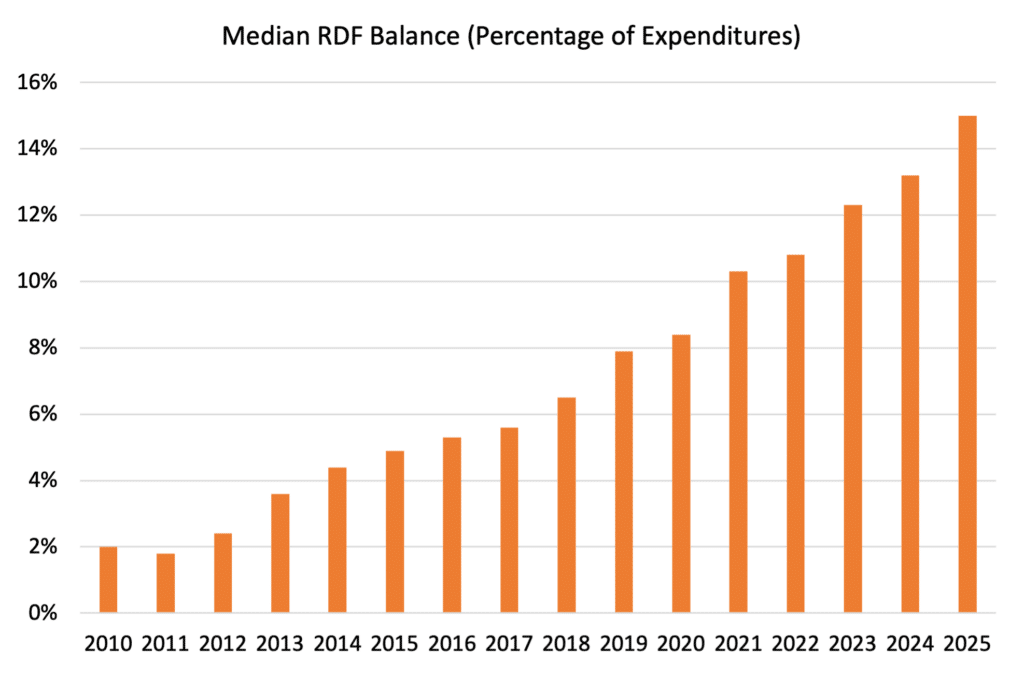

In 2024, 33 states are expected to add to their rainy-day fund balances. As the chart below shows, the median rainy-day fund balance as a share of spending is projected to rise from 13.2% in 2024 to 15.0% in 2025, up from 7.9% in 2019 and just 2.0% in 2010. Total balances, including ending balances and rainy-day funds, are projected to reach 23.2% of general fund expenditures by the end of 2025—double the level seen in 2019, NASBO finds.

These increased balances have helped many states manage fiscal uncertainties and ease long-term budgetary pressures. While rainy-day funds are intended to buffer against revenue shortfalls, surplus general funds are often used for one-time investments, such as paying down debt, making additional pension payments, or taking other proactive economic measures.

For example, in Connecticut, the state’s rainy-day fund, known as the Budget Reserve Fund, reached its cap of $3.3 billion in 2023, enabling the state to make additional contributions to its retirement systems, including the Teachers’ Retirement Fund (TRF) and the State Employees’ Retirement Fund (SERF). In 2020, the funded ratios—the pension plans’ assets compared to their liabilities—for SERF and TRF were 36.0% and 51.7%, respectively. By 2023, these had increased to 50.4% and 58.1% due to an accumulated $5.8 billion in additional contributions.

Similarly, Arizona has taken steps to pay down its public pension liabilities, particularly in its Public Safety Personnel Retirement System, or PSPRS. In 2020, the funded status for the pension system’s tier 1 and tier 2 members was 46.9%. Over the next three years, additional contributions from the state and local employers surpassed $5 billion, raising the funded ratio to 66.3% in 2023 and gradually reducing contribution rates from 56.2% in 2020 to 46.0% in 2023.

According to new actuarial modeling from Reason Foundation, the most recent $4 billion infusion into PSPRS (the combined extra contributions from 2022 and 2023) is projected to yield between $863 million and $2 billion in taxpayer savings over the next 30 years, depending on investment performance.

As states continue to manage budget surpluses and bolster their reserves, they have a unique opportunity to address long-term fiscal challenges. By prioritizing the use of surplus funds to pay down public pension obligations, states can ease future fiscal strain and strengthen their financial stability for the long term. This prudent approach ensures that states are better prepared to weather economic downturns and fulfill their obligations to public employees, ultimately securing a more stable fiscal future.