The passage of the SECURE Act 2.0 legislation requires employers with new 401(k) and 403(b) retirement plans created after December 29, 2022, to automatically enroll employees in the plans with a 3%-20% employee contribution rate and automatically increase their contributions by 1% per year until it reaches a maximum of 10%-to-15%. This is a change from previous law that allowed—but did not require—employers to include automatic plan design features to increase employee participation in employer-based retirement savings plans.

According to a Senate committee’s summary of the legislative history of the Setting Every Community Up for Retirement Enhancement (SECURE) Act 2.0, the rationale for this change is:

“One of the main reasons many Americans reach retirement age with little or no savings is that too few workers are offered an opportunity to save for retirement through their employers. However, even for those employees who are offered a retirement plan at work, many do not participate.”

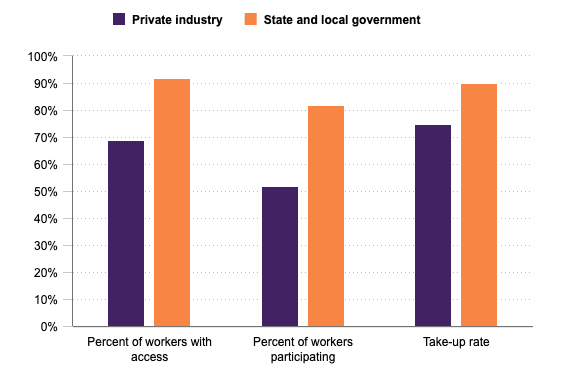

There is data to back up this concern. The Bureau of Labor Statistics (BLS) reported in 2022 that 69% of private industry workers had access to retirement benefits through their employer, and of those with access, only 52% chose to participate.

Retirement benefits access, participation, and take-up rates. March 2022

Source: U.S. Bureau of Labor Statistics

This adjustment in federal retirement benefits policy, however, is not likely to materially change the participation rates for a large number of individuals in this country because it only applies to new plans established after 2022 and because employers are still not required to offer a retirement savings plan in the first place and SECURE 2.0 will not likely change that.

The SECURE ACT 2.0 requires auto-enrollment and auto-contribution increase features for new plans. This policy attempts to address the problem that the purely voluntary retirement savings approach to one of the legs of the proverbial three-legged stool of retirement security—Social Security, employer retirement plans, and personal savings—isn’t working for many Americans.

The solutions adopted in SECURE 2.0, and over the years by Congress, rely heavily on the ‘libertarian paternalism’ philosophy that individuals should not be forced into retirement savings plans but should instead be ‘nudged’ into participation by using auto-enrollment and auto-increase features with the ability to opt-out. This nudge approach steers individuals into retirement participation but preserves their freedom of choice to not participate.

But will this approach work?

One way to try and answer the question is to look at the previous BLS chart more closely. Interestingly, the BLS data show a marked difference between the retirement plan participation rates for private sector and public sector employees, with over 80% of state and local government employees taking advantage of their retirement plan vs. just over 50% for private sector employees. Why the difference?

A significant reason for the difference is that for long-standing public policy reasons, participation in core retirement plans of state and local governments has been mandatory—not voluntary. State and local governments have made retirement plan participation a firm part of their total compensation and benefits policies. Public employees, generally, must participate and may not opt-out.

Special federal tax code provisions have even been adopted to support this approach. An important one is the Internal Revenue Code Section 414(h)(2) pick-up arrangement, which allows mandatory salary reduction pre-tax employee contributions. This simple difference in tax code rules around how employee contributions can be made pre-tax is one important reason the public sector retirement plan participation rates are significantly better than the private sector. Under current tax law, private-sector employers cannot use the same mandatory pre-tax employee contribution.

This fundamental difference in retirement plan coverage and participation policies between the private and public sectors must be examined more closely. As noted, a voluntary-based approach to the private sector employer-based retirement plan system does not and will not approach the results of what happens for employees of state and local governments—even with increased nudges as imposed by SECURE 2.0.

Should the federal government stretch the boundaries of its voluntary employer-based retirement system to allow employer and employee mandates like state and local governments? Or, is this a step too far and an unwarranted intrusion on the choices of individuals? The consequences are substantial on individuals and society in general. One thing is certain—SECURE 2.0 isn’t going to be the final answer.

Stay in Touch with Our Pension Experts

Reason Foundation’s Pension Integrity Project has helped policymakers in states like Arizona, Colorado, Michigan, and Montana implement substantive pension reforms. Our monthly newsletter highlights the latest actuarial analysis and policy insights from our team.