Before the coronavirus pandemic, state public pension debt was already over $1 trillion nationally and growing. Although the long-term effects of the pandemic and economic downturn are unclear, initial estimates from the Pension Integrity Project at Reason Foundation suggest that public pension plans could see their unfunded liabilities skyrocket to between $1.5 trillion and $2 trillion if the latest returns fall between 0 percent and -15 percent for the current fiscal year.

As states and cities prepare to face mounting budget challenges, we can help you understand what impact the COVID-19 economic crisis will have on public pension plans across the nation.

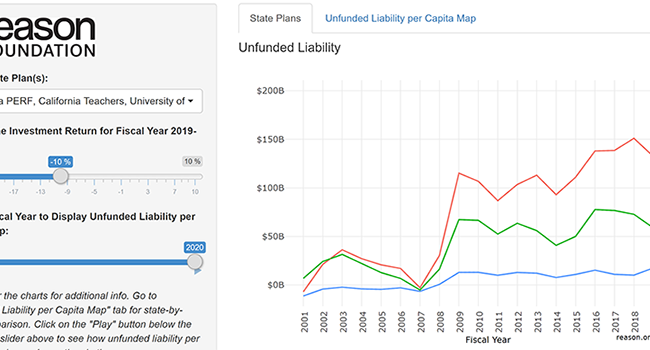

In the tool below, choose your preferred state public pension plans and investment return rate to see how their unfunded liabilities and funded ratios are being impacted by the market and economic downturn. Please note that the interactive tool will automatically sleep after a certain idle time and can be restarted simply by refreshing the page.

We recommend viewing this interactive chart on a desktop for the best user experience. If you are having trouble viewing the chart and interactive options on your device, please find a mobile-friendly version here.

With the above interactive data tool, you can view how the COVID- 19 economic fallout may affect public pension plans in each state. The simple-to-use tool shows how state pension assets will react in a variety of economic scenarios. By selecting plans and toggling between a range of potential investment returns, you will be able to view how multiple plans’ funding ratios and total unfunded liabilities would change based on the selected market conditions.

You can also select the “Unfunded Liability per Capita Map” to see projected public pension debt levels broken down on a per capita basis. Using the same tool to predict a variety of investment returns, you will see how unfunded liabilities grow and continue to impact taxpayers. This tool also allows you to see the progression of your state’s public pension debt per capita among all states between 2001 and 2019.

While the entire country has been impacted by the COVID-19 pandemic, several states had their public pension plans better positioned to take this economic hit than others. Prior to the coronavirus crisis, the primary culprit of growing pension debt has been the across-the-board investment underperformance of pension assets relative to plans’ own return targets.

After the financial crash of 2007-08, several state pension systems were so underfunded that even the longest economic recovery in history did not appear to help them dig out of the deep underfunding trenches. Now that the bull market has come to a grinding halt and the country is facing a severe economic downturn, it is more important than ever to address public pension solvency issues to better protect our retirees and taxpayers alike.