The economic headlines sure look better than they did a year ago. Gross domestic product (GDP) is finally growing again, rising by 2.2 percent in the third quarter of 2009, with an early estimate of 5.7 percent for the fourth. The fourth quarter number will probably be revised down, but it will still likely mark the fastest growth since 2003. The unemployment rate, after a nosedive, leveled off in the last few months of the year, and the stock market has regained 40 percent of its value after a March 2009 low. Four of the five largest bailed-out banks have either repaid the government or received permission from the Treasury Department to do so in the near future. Inflation slowed to a standstill in November after 10 months of increasing consumer prices. Construction of new homes and apartments increased in 2009 from 2008 levels, the first annual growth in housing starts since 2005.

“The Recovery Act has created jobs and spurred growth,” President Barack Obama said in a December speech trumpeting the success of his economic policies. “We are in a very different place today than we were a year ago.” Lawrence Summers, director of the White House National Economic Council, concurs. “Everybody agrees that the recession is over,” Summers said that same month on ABC’s This Week.

But a closer look reveals those appealing numbers sit on a dangerously shaky foundation. Economic growth in 2009 was largely dependent on a historic level of government spending that even the president acknowledges is unsustainable in the long term. The root problem of mortgage delinquencies has yet to be worked out. Bank lending is sparse amid ongoing uncertainties surrounding regulatory reform. As a result, manufacturers and small businesses continue to struggle with limited credit. All that translates into historic job losses and a bleak outlook for meaningful growth in 2010 and 2011.

Worst of all, many of the core problems in the housing, banking, manufacturing, and service sectors are being perpetuated and exacerbated by the very federal programs the president credits with jump-starting economic growth. Instead of confronting the roots of the crisis head on, as Obama has repeatedly boasted of doing, his administration and the Democratic Congress have kicked the can down the road, postponing the day of reckoning for real estate, the auto industry, and the toxic mortgage-backed securities that were at the heart of the economic meltdown. These unsolved problems will keep looming over the economy until they’re finally addressed.

Government Domestic Product

The much-noted “jobless recovery” is not just a problem. It’s an anomaly. Not since the post-World War II recession in 1945 has unemployment risen this quickly: five percentage points in the 24 months after the downturn began in December 2007.

To put that in perspective, it took 43 months for unemployment to hit its peak during the 1979-82 recession. In 2009 alone the economy shed a staggering 3.9 million jobs. And though the headline unemployment rate stabilized at 10 percent during the final months of the year-17.3 percent if you include part-time workers-initial jobless claims for January 2010 jumped at a rate not seen since the previous August. It’s not at all clear the worst is behind us.

The gains on Wall Street have been goosed largely by government spending and guarantees, not the usual private sector-funded growth. And federal spending cannot continue indefinitely without deficits and debt service spiraling out of control. John Silvia, chief economist for Wells Fargo, says, “We have seen a recovery, but it’s driven primarily by federal spending and special federal projects. The character of this recovery is very different than we’re used to.”

Consider that 37 percent of the third-quarter GDP growth was due to motor vehicle purchases, which were stimulated almost entirely by the Cash for Clunkers program. “The third quarter was really just a lot of Cash for Clunkers spending that won’t be sustained in the foreseeable future,” Silvia says. (Final statistics for fourth quarter spending were not available at press time.)

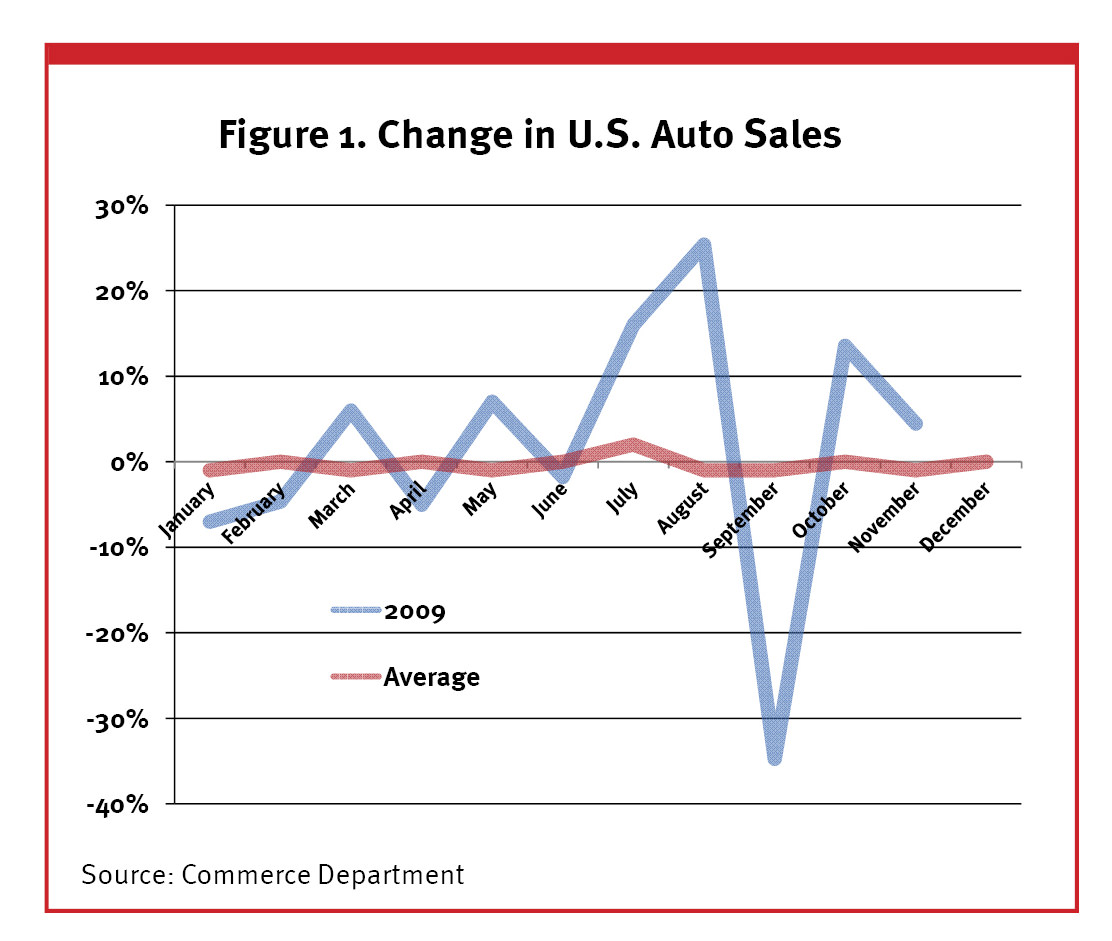

The car scheme, an attempt to jump-start the bankrupt auto industry, offered consumers a government-funded credit of up to $4,500 if they traded in their gas guzzlers for more eco-friendly vehicles. But since most participants probably were already planning to buy a new car, the program essentially shifted future demand for automobiles to the third quarter of 2009. Instead of continuing to grow, car sales dropped 34 percent immediately after the program ended. Figure 1 shows U.S. auto sales in 2009 largely following the 10-year average month-to-month change until the Cash for Clunkers credit jolted demand, followed by a subnormal drop.

Another 20 percent of third-quarter GDP growth came from new residential investments, propped up largely by the First-Time Homebuyer Credit. The credit was first offered in 2008 as a federally backed no-interest loan of up to $7,500, paid back over 15 years. The February 2009 stimulus package extended the program to September, increased the maximum to $8,000, and eliminated the repayment requirement. With the free cash giveaway set to expire at the end of the third quarter, builders and buyers rushed to close on homes, concentrating larger than normal residential investment into third-quarter GDP. Due to the “success” of the program, the credit has been extended again until April 2010. But the program has only helped individual buyers and sellers, not the housing market as a whole.

A Wells Fargo survey found that 56 percent of home-buyers who purchased a home in the second or third quarter of 2009 did so because of the special tax incentive. Such federal jiggering not only steals demand from the future, distorting growth numbers; it skews recovery in the real estate market. Housing prices are up in 2010 from a year ago, but that is because the government is giving away money to buy homes. The $8,000 giveaway pushes up the costs of all homes, not just the ones purchased with the credit, because sellers have raised their prices in anticipation of a buyer armed with stimulus cash. The credit suggests an increase in demand that isn’t really there.

The growth in the housing market that the White House brags about is inherently unsustainable. Home prices would not be up without the government’s support, and they will decline once the support is removed. That’s one reason Congress extended the First-Time Homebuyer Credit, even though it only puts off the inevitable and creates more problems. This skewed demand creates the possibility that homes will be constructed by builders who mistakenly believe the market is reviving, when in fact it is only Uncle Sam subsidizing a buying spree until the money runs out.

Overall, government support accounts for roughly 77 percent of economic growth in the third quarter of 2009, according to my analysis of Commerce Department statistics. This means that non-Washington GDP growth was closer to 0.34 percent from July to September 2009, instead of 2.2 percent.

It could be even worse. When one aspect of GDP grows significantly, it lifts other components that might not otherwise rise; this is known in economics as the “slingshot effect.” Without the temporary, distorting aid of Obama’s programs, the economy might have seen continued negative growth. Even Christina Romer, chairwoman of the White House Council of Economic Advisers, admitted in a statement accompanying the release of the third-quarter numbers that without the extraordinary government intervention, “real GDP would have risen little, if at all.”

This is not real growth. It’s the national equivalent of a credit-card buying spree, with the bills-in the form of debt service and unfunded liabilities-to be paid off later. It is a faux recovery.

The president is betting that private-sector consumption will take over for fiscal stimulus as the main economic driver in 2010 and beyond. This gamble fails to take into account the ways in which the band-aid rescue programs are delaying efforts to address the economy’s deeper problems.

As Goes Housing, So Goes the Economy

Like unemployment and GDP growth, the housing market seemed to show green shoots in early 2010. Housing starts were up 22 percent from January 2009, and the Internal Revenue Service estimated that 1.4 million taxpayers used the First-Time Homebuyer Credit to buy a new house between February and September of 2009.

But there is still significant rot at the roots. Tom Zimmerman, a managing director at the commercial banking giant UBS, predicts troubles ahead. “The housing market has a lot of wood to chop to get through this cycle,” Zimmerman said in October 2009 at an American Enterprise Institute event. “We’re not over by any means in terms of the negative part of the housing market.”

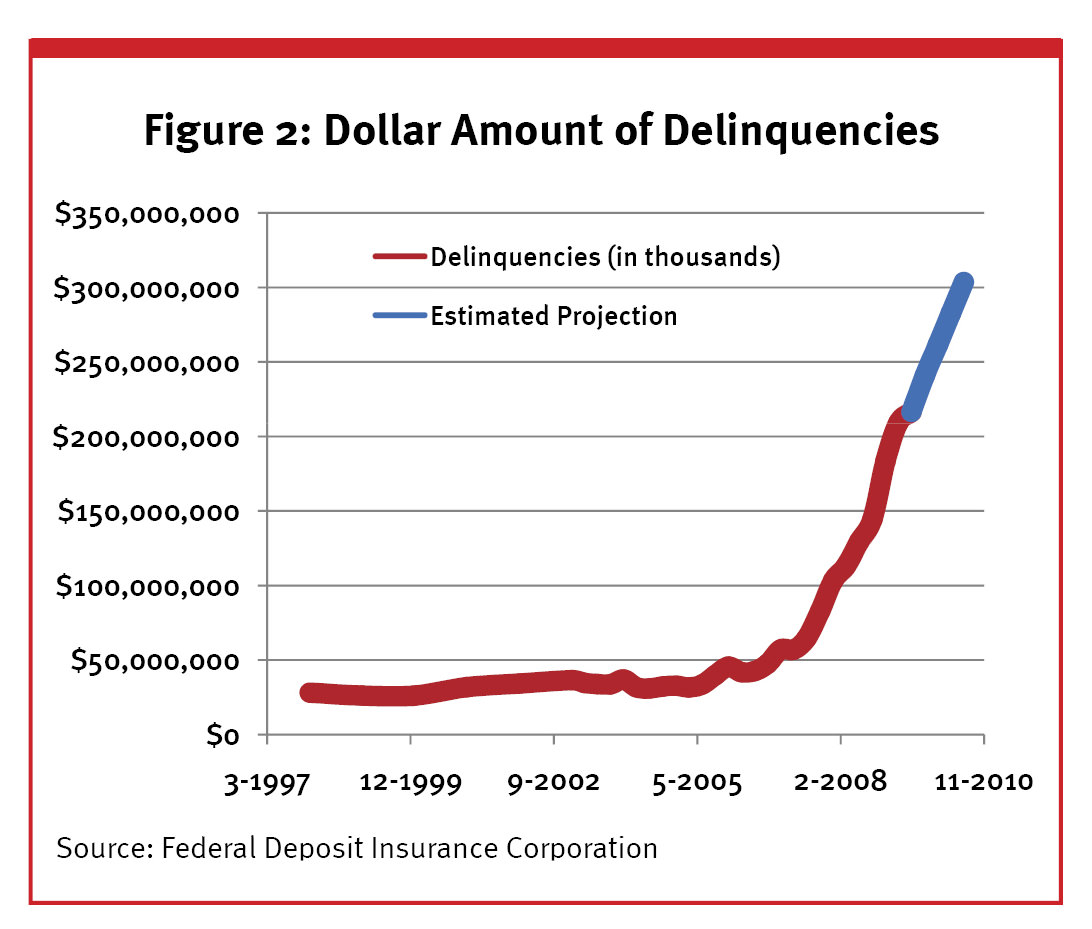

One of the looming negatives is the continued rise of mortgage delinquencies. Going into 2010, one-third of all homeowners owed more on their homes than they were worth. This phenomenon has led to record levels of home abandonment. Coupled with high unemployment and ballooning adjustable rate mortgages, banks are seeing defaults rapidly rising (see Figure 2). If delinquencies continue to rise at their current rate, we could see more than $300 billion in delinquent mortgages by the summer of 2010. The most recent housing data shows 6.25 percent of U.S. mortgages are 60 or more days past due, up 58 percent from a year ago. Why keep paying for your home if you’re going to lose money on the investment?

Some analysts will counter that the trend lines are improving, since the growth in people falling behind on their mortgage was only 7.6 percent from July to September, down from 14 percent in the second quarter. But Wells Fargo’s Silvia disagrees. “Delinquencies and foreclosures traditionally lag the economic cycle,” he says. “We’re likely to see delinquencies continue for the next three to six months. In some areas it might be nine months to a year.”

A possible reason for the delayed reaction is the high concentration of delinquencies in a few areas of the country. According to the Federal Reserve Bank of New York, as of September 2009, 31 percent of homes in foreclosure are located in five states: California, Florida, Nevada, Arizona, and New Jersey. This concentration creates massive headaches for banks trying to recover losses on mortgages gone bad, since what they need most of all is for the foreclosed homes to sell. Not only is selling difficult in areas with high foreclosure rates, but when a market appears prices tend to be disproportionately low-even considering the homebuyer credit-meaning less money recovered by banks.

These numbers, bad as they are, still don’t reflect the full depth of the toxic mortgage problem. In most states, the mortgage holder can legally foreclose on a home once the homeowner is more than 120 days late on payments. But banks and other mortgage owners have refrained from pushing delinquents into foreclosure. While the number of homes delinquent for 90 days or more increased by 2.9 percent in 2009 over the previous year, the number of foreclosures increased only 1.3 percent.

This divergence is a historical anomaly, according to Molly Boesel, senior economist for the property information and analytics firm First American CoreLogic. Delinquency and foreclosure rates traditionally track. “These mortgages should be moving through the process, but they are being held up for various reasons,” Boesel says.

One reason is that many banks and mortgage servicers don’t have the capacity to digest the foreclosures fast enough. But the main reason is that some mortgages from this pool have been modified or refinanced to keep the delinquent homeowner under the same roof. The bulk of mortgage alterations have been funded through the White House’s $75 billion Home Affordable Modification Program (HAMP). By the end of 2009, 130,000 mortgages had been refinanced through HAMP, and more than 700,000 other mortgages were being processed.

The chief problem with this approach is that the average redefault rate for HAMP participants, according to a September report from the Treasury Department’s Office of Thrift Supervision, is a wretched 50 percent. At the behest of the federal government, banks are lowering their lending standards for their least credit-worthy customers, and the results are predictable. Meanwhile the political pressure to prevent foreclosures continues to increase: states, counties, and cities across the country have ordered foreclosure moratoriums, limiting the legal authority for banks to move against nonpaying homeowners. These laws have merely postponed the inevitable, artificially propping up prices and preventing a real market from emerging in both housing and mortgage finance.

The Obama administration and Congress keep putting off the day when the housing market, the root of the economic crisis, gets cleaned out. It will be difficult for a real economic recovery to take off until they stop.

The Banking Mess

Toxic, mortgage-backed securities are still sitting on banks’ books, waiting for a market to emerge for them. Joe Engelhard, a former Treasury Department official, observes that “the stabilization of the banking sector will not be complete until housing issues are worked out.” With housing losses still mounting, banks are struggling to remain solvent.

Residential loans are just part of the problem. Troubled commercial real estate loans totaling about $3 trillion will start coming due during the next few years. Many of these loans, because they were for longer terms, have taken longer to hit the market than the residential loans that blew up in 2007, but they bear disturbingly similar characteristics. Widespread commercial real estate losses in the coming months threaten to destroy any gains Wall Street has seen during the last year.

This threat has many analysts predicting a rise in the number of banks going belly up. More than 170 banks have failed since the beginning of the recession. To put that in perspective, only three banks failed between July 2004 and December 2007. And the bank closures show no signs of slowing down. In October the feds shut down 20 banks, the most of any month since 1994. Some analysts have predicted that as many as 1,000 banks will have imploded by the time the economy recovers.

The glass-half-full banking results that the administration has been touting have been based largely on government support that masks significant losses. “These banks are going through a terrible, terrible period of loss, but we have nicely disguised it,” says Christopher Whalen, managing director of the financial markets research group Institutional Risk Analytics. “Third-quarter bank profits were short-term, subsidy-supported profits.”

The Troubled Asset Relief Program (TARP) and various Federal Reserve actions have put surviving banks on federal life support, especially if they’re part of the lucky few deemed too big to fail. The bailout policies of the current and last administration have sent a signal to the market that big banks can be trusted, and are therefore worthy of loans at much cheaper interest rates. Cheaper credit means more profits, and bigger surviving banks.

In October the Center for Economic and Policy Research released a study finding that the credit risk guarantee had provided up to $34.1 billion in benefits to the nation’s top 18 banks. The report looked at the gap between the interest rates paid by big banks and those paid by small banks. Adjusting for the fact that big banks normally get better rates, the numbers show that bank profits are largely a product of the too-big-to-fail guarantee. The report estimated that cheap credit accounted for 166 percent of Capital One’s profits over the past year-i.e., the bank really didn’t make any money on its own.

Without this subsidy and the TARP loans, both of which are politically unpopular, many large banks would be in bankruptcy or receivership today. “What happens when you remove those supports?” Wells Fargo’s Silvia asks. “It is problematic.”

Banks are aware of this problem. Interbank lending remains limited as confidence problems continue to plague the financial industry. “There is no grease in the engine in terms of bank credit or trade credit,” CreditRiskMonitor.com CEO Jerry Flum told The Institutional Risk Analyst in October. The goal of the TARP capital injections was to get the lending engine going, but banks have largely been sitting on the money, holding increased excess reserves.

With so much money sitting idle, cash flow is a major concern for banks and their customers. It is unclear when the market will see stability again, and until new operational norms emerge banks are likely to remain tight with their cash. With the administration now promoting the biggest banking regulatory overhaul since the 1930s, the uncertainty will likely continue. Bank analyst Joe Engelhard warns, “The regulation overhaul process has created a cloud of uncertainty for investors and institutions over what the new normal will be for profitability at large banks.”

In December the House of Representatives passed the Wall Street Reform and Consumer Protection Act, creating a permanent bailout fund and legal authority for the government to take over any financial institution, whereas regulators now only have that power over banks. The bill includes requirements that banks keep higher amounts of cash on hand relative to risk, places tight new restrictions on derivative products, and limits executive pay. The legislation also would create a Consumer Financial Protection Agency to strictly regulate products and operating policy, which may end up protecting small businesses and economic growth to death.

All of this is disconcerting to banks trying to get back on their feet. David Parshall, general partner at private equity secondary PEI Funds, warns that badly designed changes could hurt the economy even more than the uncertainty about them. More extensive reporting requirements, tighter capital regulations, and proposed powers to break up banks would all increase the cost of doing business and hobble the recovery, Parshall says. And continuing to waffle on regulatory reform means the markets will waffle as well.

There is a vicious circle here. Uncertainty breeds hoarding, hoarding breeds liquidity problems for manufacturers and small businesses, liquidity problems create unemployment problems, and unemployment hurts the broader market that banks operate in. If none of this changes, the Federal Reserve will likely keep interest rates effectively at zero, which in turn will incentivize banks to build their reserves. All of the above will likely induce the president and Congress to push for more of the unsound lending practices that helped inflate the housing bubble in the first place.

“If we don’t get a turn in unemployment,” Whalen worries, “if we don’t get a recovery in housing and the real economy, then we’re going to see even higher credit loss experience for banks, even after next year. It’ll keep on going.”

Make Today’s Problems Today’s Problems

Whether the economy recovers quickly in 2010, stagnates for a while, or stumbles into the dreaded W-shaped double-dip recession, the policy response will depend on a calculus between short-term and long-term pain. The more Washington kicks the can down the road on spending, housing, and banking, the more long-term troubles the American economy will face. Obviously, giving federal money to consumers can be politically popular, just as bailing out bankrupt states can be politically expedient for politicians who depend on support from public-sector unions. But these short-term gimmicks do not lead to sustainable economic growth. And the president himself has indicated that the free money days might be coming to an end. “It is important though to recognize if we keep on adding to the debt, even in the midst of this recovery, that at some point, people could lose confidence in the U.S. economy in a way that could actually lead to a double-dip recession,” he said in November.

The Congressional Budget Office has projected that by the end of 2019 the U.S. will have nearly doubled its debt to more than $17 trillion, or 82 percent of GDP. And that’s before dealing with the peak of baby boomers draining Social Security and Medicare funds. And it’s not just government capital rapidly draining away. The administration’s political capital took a massive hit in January when an unknown Republican won Teddy Kennedy’s old Senate seat in overwhelmingly Democratic Massachusetts. The president is running out of other people’s money and with it the chance to maintain his Potemkin case that the economy is recovering.

“My guess is that the first two quarters of 2010 are not going to look as good as [2009’s third] quarter,” Joe Engelhard predicts. “We’re probably gonna go sideways for a while.”

Anthony Randazzo (anthony.randazzo@reason.org) is director of economic research for the Reason Foundation, which publishes this magazine. This column first appeared in Reason magazine’s April 2010 issue.