Is it prudent for Louisiana to contribute $2 billion to the state’s underfunded teacher retirement system to help free up education funds for teacher pay raises? Louisiana legislators thought so and agreed to liquidate three education-related funds worth $2 billion to help local school districts reroute pension contributions from the retirement fund toward teacher pay raises.

While the $2 billion infusion contained in Louisiana House Bill 7 (H.B. 7), which passed and was sent to the governor, may seem appealing on the surface, actuarial modeling suggests that any pension investment underperformance in the short to medium term would erase the expected employer contribution savings and make the pension system worse off unless such a move were paired with meaningful reforms.

Currently reporting $8.5 billion in debt, the Teachers’ Retirement System of Louisiana (TRSL) is clearly in dire need of more money to generate the investment returns needed to fully fund benefits and protect retirees from inflation over the long term. The goal underlying this accounting move is the assumption that the $2 billion worth of debt that gets erased by H.B. 7 will provide local employers with a lower contribution requirement. According to the guidelines established in Louisiana House Bill 5 (H.B. 5, which was also passed and sent to the governor), the difference will be used for educator pay raises. In the end, the effect is a taxpayer-funded supplemental contribution that will immediately lower the employer’s contribution rate. Still, this move comes with a tradeoff—it undermines the financial resilience of Louisiana’s largest public pension system.

Contributing more taxpayer money without addressing the root causes of the state’s multi-billion-dollar pension problem is akin to attempting to bail out a leaking boat without first fixing the hole. According to TRSL modeling done by the Pension Integrity Project at Reason Foundation, any negative market performance in the short to medium term will likely erase the employer contribution savings expected by H.B. 7 and its $2 billion taxpayer supplemental payment.

A great way to visualize how little progress H.B. 7 alone will make in resolving the state’s oldest and most expensive debt is by looking at the legislation’s impact on TRSL over the next 30 years in both ideal and underperforming markets.

Figure 1 below, generated by Reason Foundation’s modeling of TRSL, shows how the $2 billion supplemental payment to the Teachers’ Retirement System of Louisiana is expected to increase the funded ratio, or percentage of funds on hand, versus what’s expected, from 77.2% to 82.8%. But, because the bill does nothing to address the actual source of the system’s growing debt, the pension system will remain vulnerable to market outcomes.

For example, TRSL continues to operate under a return assumption that is above the national average. Until policymakers adopt safer assumptions, the probability of experiencing more unfunded liabilities remains high.

Figure 1: The Impact of House Bill 7 on the Teachers’ Retirement System‘s Funding

According to the 2024 TRSL valuation, for the year ending June 30, 2024, the system’s actuarial rate of return of 7.01% was less than the 7.25% expectation, resulting in a new $63,905,843 unfunded liability that will be amortized over 20 years. While the $2 billion from HB 7 does help the system recover from this and previous market-driven funding shortfalls, it does not address the glaring vulnerability to returns below the system’s lofty investment assumption.

The core shortcoming of H.B. 7 is its disregard for the effective way the Teachers’ Retirement System of Louisiana currently responds to investment underperformance. Although not cheap to employers and taxpayers currently, TRSL employers are committed to funding their constitutionally protected public pension benefits according to what system actuaries determine is needed year to year—also referenced to as the actuarially determined contribution rate (ADEC). The rate adjustments are automatic under the current ADEC policy and used by employers and the state to fund TRSL benefits. Employers see their required contributions rise and fall from year to year according to the system’s needs.

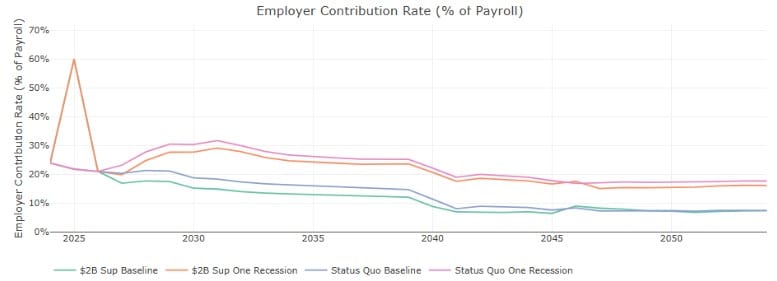

Figure 2 shows how House Bill 7 will allow for a lower employer rate compared to the status quo. However, these rates, even with the $2 billion applied, will necessarily rise well above current levels if the system were to experience a recession. Maintaining an above-average investment assumption under House Bill 5 and its plan to reallocate the Teachers’ Retirement System of Louisiana’s employer contributions to pay raises will only exasperate TRSL vulnerabilities and likely lead to local employer rates increasing when investments underperform. A good way to visualize that aspect of the legislation is by forecasting the employer contribution rate under underperforming conditions.

Figure 2: The Impact of House Bill 7 on TRSL Employer Contribution Rates

The supplemental payment established in House Bill 7 clearly reduces annual costs in the short term, which policymakers hope to use—through House Bill 5—to increase teacher salaries. The problem with this approach is that any dip in the market will squeeze local school districts and property taxpayers on both the employee and employer sides. When investments underperform, taxpayers will be left 100% financially responsible.

There is no question that an extra $2 billion contribution to a public pension system that is $8.5 billion in debt is going to have an immediate, clear, and positive impact on the health and status of the system. However, policymakers, stakeholders, and taxpayers should be aware of the strategic mistake it will be to not address the systemic issues that created the $8.5 billion TRSL debt and its current sky-high cost.

Figure 3 illustrates how ineffective $2 billion alone will be if TRSL continues to underperform. If the system experiences a single recession in the short- to medium-term, H.B. 7 could increase costs, remove any prospects for a future cost-of-living increase for retirees, and prevent the state and the system from making any meaningful progress on improving the teacher pension’s funding over 30 years.

The Teachers’ Retirement System of Louisiana could realistically be just as underfunded in 2055 as it is today.

Figure 3: TRSL Unfunded Liability (Market Value)

Simply injecting public funds into any of the state’s multi-billion-dollar indebted pension systems alone isn’t a good idea for taxpayers on its own terms unless it actually buys better than slightly less cost for a few years. Rerouting any funds away from servicing a billion-dollar debt will result in the proverbial can being kicked down the road. That’s what the modeling shows as the most likely scenario for TRSL and its participating school districts.

All the most successful state pension reforms in the United States started with fixing the broken pension and then increasing spending to service what is usually every state’s most expensive debt. Successful, sustainable, and resilient pension reform has an order of operations, and Louisiana lawmakers should be aware that H.B. 7 and H.B. 5 do not currently represent the best process to achieve a long-term resolution to the state’s long-term public pension problem.