This is an excerpt from the policy brief—The 2021 Texas Power Crisis: What Happened and What Can Be Done to Avoid Another One?

While the Texas power grid is back in business, the financial fallout is likely to continue for months, maybe years. Resolving financial problems as soon as reasonable will reduce uncertainty and likely help facilitate the investment needed to improve integrated energy systems in Texas. Much analysis has already identified specific problems in the Texas energy system contributing to the outages, but investigations should be continued. As the Texas Legislature was already in session at the time of the outages, hearings already have been held and bills already have been introduced in response.

The Federal Energy Regulatory Commission/North American Electric Reliability Corporation (FERC/NERC) 2011 Report will be one place to look for recommendations, updated to reflect the more extreme cold conditions experienced in 2021. FERC and NERC are collaborating on analysis and recommendations addressing Texas’ 2021 experience. Presumably, the degree of compliance with recommendations from the 2011 Report will be among the topics investigated.

Likely better to let investigations continue before imposing significant reforms. The high stakes of failure demand a well-informed and well-considered response.

What changes are called for to help the system improve reliability?

Recommendations

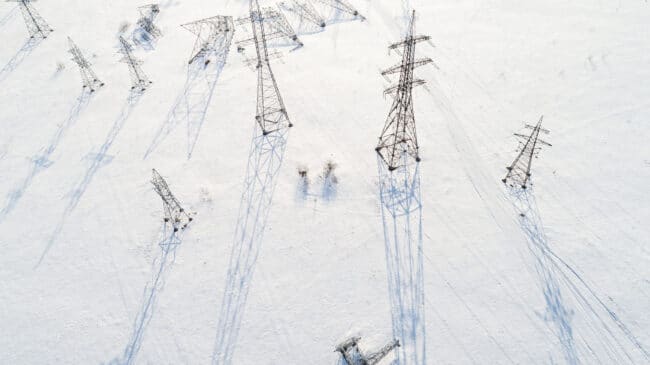

Winterization

More-stringent winterization requirements seem politically unavoidable, though again the degree to which winterization is needed depends on the critical assessment of the cold. The severity of failures in 2021 may lead the incautious to say any cost of winterization is justifiable, but that is not true. It is the potential severity of failures in the future that demand that resources be devoted to where they will be most effective. Benefit-cost analysis is the standard approach for answering the question, “Where should resources be devoted to secure the best overall protection?”

Winterization standards should allow power plant operators significant flexibility to adapt plants to colder weather. It may be reasonable to prioritize implementation for Texas power plants that failed in February 2021 or February 2011, and possibly appropriate to excuse plants that performed well through both events from any new rules. It may be reasonable to set standards differently in the northern and southern parts of the state. Whatever winterization requirements ought to apply to panhandle wind turbines, they are likely more stringent than those applied to coastal wind turbines. Rules will likely be tailored to generating technologies, with some rules targeting wind energy, others targeting natural gas generation, and so on. Care should be taken to ensure requirements do not unreasonably burden any one type of generation or region of the state.

Lack of fuel supply is a concern. The loss of natural gas generation came both from plant outages and from a lack of natural gas supply. Winterization standards should not neglect the natural gas production and distribution system. Natural gas plants can be adapted to allow the plants to run on fuel oil when gas is not available, and regulators should consider whether some minimum amount of dual-fuel capability is desirable. In addition, gas pipelines should take the opportunity to have their facilities listed as critical services during rolling outages in order to avoid unintentional cuts to otherwise available gas supplies. While gas generation contributed the largest share of outages, coal-fueled plants and nuclear plants also deserve attention.

In assessing Texas’ winterization requirements, the public and policymakers should be aware that owners of power plants have strong financial incentives to avoid failures and will take steps to improve their plants with or without added regulations. Each additional MWh of power a generator could supply during the grid emergency could have earned $9,000, an amount almost 300 times higher than typical market prices. Any power plant already contracted to supply power, but unable to do so because of the cold, was likely paying that $9,000 MWh price to replace the power they could not provide. The prospects of earning that revenue or avoiding that cost provide a strong market signal. The good news, then, is that regulations can be focused on systemic challenges beyond investments that will already happen.

A related issue arises with calls for “bailing out” companies hard hit financially by the failures. If bailouts provide cover directly or indirectly for losses suffered by generators, it will reduce generator willingness to spend their own money to prevent failures. If bailouts cover losses incurred by retail electric suppliers, then it undermines incentives for retail providers to engage in long-term firm contracts that can encourage investment in new power plants. Bailouts for residential customers struck by $1,000 power bills raise more complex issues, but having seen the risks residential consumers will likely be much more cautious about supply offers that expose retail consumers directly to wholesale prices.

As part of ERCOT’s winterization response, it should fully reassess its resource adequacy analysis and the manner in which that analysis figures into its operational decisions.29 Scheduling of maintenance outages and reliability commitment policies for winter weather should be among operational practices updated. The PUC of Texas failed to produce annual reports on electric power winter readiness, as required in a law passed after the February 2011 rolling outages. Had it done so, potential failures may have been foreseen and avoided. As should go without saying, regulators should comply with the law.

Capacity Market

Installing a capacity market would achieve little without a better resource adequacy assessment, but how the resource adequacy assessment should be improved depends upon how and why the assessment was wrong. While the errors of the assessment are clear in hindsight, the relevant question concerns how it can be improved using information available as much as three to six months before the season arrives. Improvements in resource adequacy assessments are critical.

However, a better resource adequacy assessment combined with reasonable winterization of electric power and natural gas systems in Texas are likely adequate to the task. Fundamental changes to the Electric Reliability Council of Texas (ERCOT) market design could impose additional costs without predictable benefits.

Transmission Links

More substantial connections to neighboring grids would have reduced the depth and duration of the crisis. Proposals have been made, but appear to be mired in regulatory processes. The Public Utility Commission of Texas had directed ERCOT to prioritize rule developments needed for the Southern Cross proposal, but rules will mean little if the project cannot obtain regulatory permission from other states involved. FERC does not currently have authority to mandate transmission siting, but does bear significant responsibility for interstate transmission and wholesale power transactions crossing state borders. FERC’s authority over power flows in interstate commerce suggests it examine ways in which it can promote interstate transmission more effectively.

Many state legislatures, including in Texas, have granted existing transmission owners a right of first refusal (ROFR) over the construction of new transmission projects in their states. Supporters of ROFR provisions point to the benefits of working with experienced transmission owners. Critics of ROFR provisions say the provisions unnecessarily add costs and tend to discourage transmission expansion. If transmission expansion is part of the state’s response to the February energy emergency, the legislature may want to reconsider its ROFR law.

ERCOT and the PUC should ensure rules can accommodate Southern Cross and then are generalized for any subsequent link. The PUC and FERC should adopt standardized procedures for such links to add predictability to regulations. FERC should guard against the use of state regulatory processes to impede interstate commerce in power.

New Technologies

The ERCOT market design has demonstrated an ability to accommodate new and improving technologies from wind and solar to batteries to distributed energy resources. Retail market rules have allowed REPs to offer the most diverse selection of retail supply contracts available, including market-based net metering proposals and offers providing home energy management capabilities. Risks associated with retail offers passing through wholesale costs have demonstrated such contracts are not wise for most consumers, but they have not undermined the value of allowing experimentation by retailers. Rather, competition in the market should be protected to foster continued innovation as technology and communications improve and open up new ways of creating customer value.

These changes are not likely to provide more than modest improvements to winter reliability in the short run, but are nonetheless desirable and will continue. Resource adequacy assessments should reflect whatever reliability benefits new technologies offer.

Financial Reforms

Resolving financial problems surrounding the energy emergency will be a particular challenge. A quick resolution reduces uncertainty, which allows market participants to move forward more confidently. Few investors will be willing to put millions of dollars into a system in which billion-dollar obligations remain unresolved. But resolving problems quickly can raise the cost or force the liquidation of market participants that may otherwise have been capable of reestablishing their financial position.

Legislators and regulators also have to be concerned about imposing unnecessary costs on outside investors and financial market participants. The presence of purely financial market participants helps the market run more smoothly by making it easier for physical market participants to enter into both short-term and long-term contracts. Costs that do not reflect the costs associated with market participation will unnecessarily raise the cost of capital for market participants, slowing investment and ultimately resulting in somewhat higher prices for consumers.

Retail Competition

Some critics of retail competition in electric power took the opportunity of the Texas power outages to again state their case. One such article stated the point in its headline, “The real problem in Texas: Deregulation.” Reporters at The Wall Street Journal claimed that residential consumers in Texas had paid billions of dollars too much because of retail competition, although their calculations are inadequate to justify their conclusion. Adjusted for inflation, retail power rates in the competitive retail parts of Texas are lower than the rates charged in those areas when they were last regulated by the state PUC, which makes the overcharge claim hard to accept. The best economic analysis of Texas retail power prices, a peer-reviewed academic study published in the journal Energy Economics, found that retail competition brought cost savings to end consumers. Also, it is not the case that savings have come by cutting corners on reliability. Industry veterans Devin Hartman and Beth Garza report competitive markets have a superior reliability record overall.

Looking Forward

In responding to the power system failures, the identification of the root causes of failures will be critical. Many critics and analysts were quick to offer their long-favored prescriptions—limit renewables, add a capacity market, return to vertical integration—but the very rapidity of the prescriptions ensured they were not based on a deep understanding of what happened.

The days following the emergency have allowed a tentative picture of circumstances to be assembled, but more investigation remains. The weather was colder for longer across a larger portion of the state than ever recorded before. The widespread damages caused by a lack of access to electricity, including loss of life as Texans struggled to cope with the extreme cold, were disastrous, but examining ERCOT’s response shows that ERCOT did its job during the emergency.

The major failings happened before the bad weather hit. It may not prove to be cost-effective to fully weatherize every system component against the possible extremes of cold and heat experienced in Texas. Yet the severity of the failures, the lives lost to the cold, and the significant costs imposed on the state demand a careful look at the range of possible alternatives.

We should not overlook the point that the ERCOT power system has performed well under a wide variety of weather conditions. The regulations established promoting competition in ERCOT’s wholesale and retail market have served the state well. While these regulations must change in response to the failures of February 2021, this fundamental commitment to competition should be maintained.