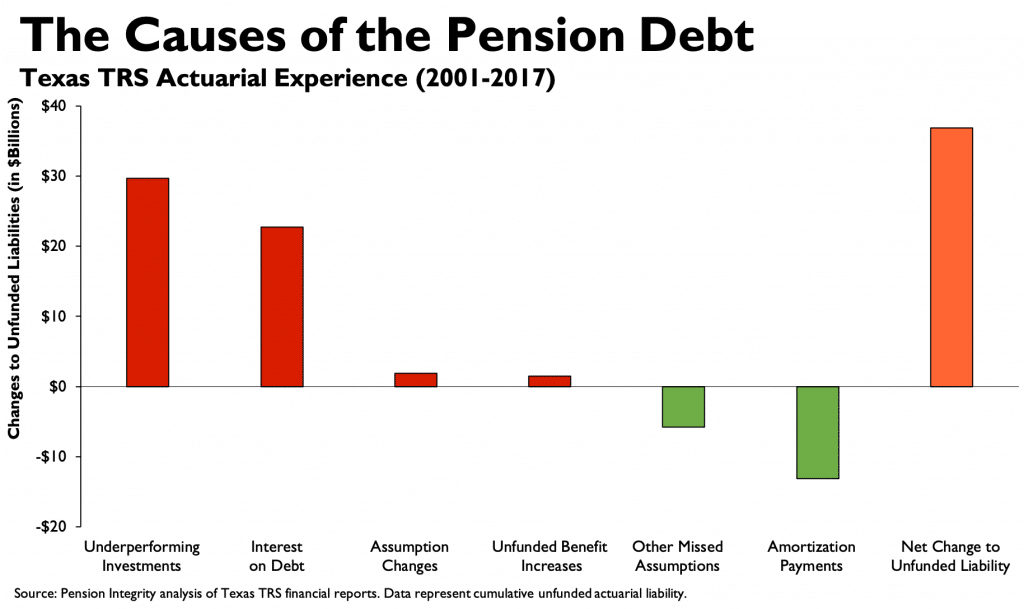

The Teacher Retirement System (TRS) of Texas reported an unfunded pension liability of $35.4 billion in 2017. An analysis of historical TRS reports going back to 2001 makes it possible to identify the key factors driving growth in TRS’ unfunded liability.

Unrealistic Expectations on Investment Returns

- Underperforming investments have added $29.7 billion to the TRS unfunded liability since 2001.

- In a step to fix this issue, the TRS board lowered its assumed rate of return from 8 percent to 7.25 percent, but even the new assumption may still be too optimistic. If returns average below 7.25 percent for any sustained period, which they have in the recent past, there will be even more growth in TRS’ unfunded pension liabilities.

- TRS actuaries place the probability of achieving a 7.25 percent return over the next decade at around 50 percent, though other forecast models calculate this probability to be closer to 30 percent.

Interest on Pension Debt

- Interest on TRS pension debt has added $22.7 billion to the unfunded liability since 2001, which outpaced annual contributions into the plan by $9.6 billion.

- Negative amortization—when interest exceeds contributions—results in growing pension debt, even when the required contribution is paid in full.

Unfunded Benefit Increases

- $1.5 billion of the current debt comes from benefits added but not funded since 2001.

- These benefits were $1.1 billion added in 2005 and $400 million added in 2007.

How the Texas TRS Unfunded Liability Grew to $35.4 Billion

For more information, please visit — Pension Solvency Overview: Teacher Retirement System (TRS) Of Texas