An updated version of this post with 2024 data is available here.

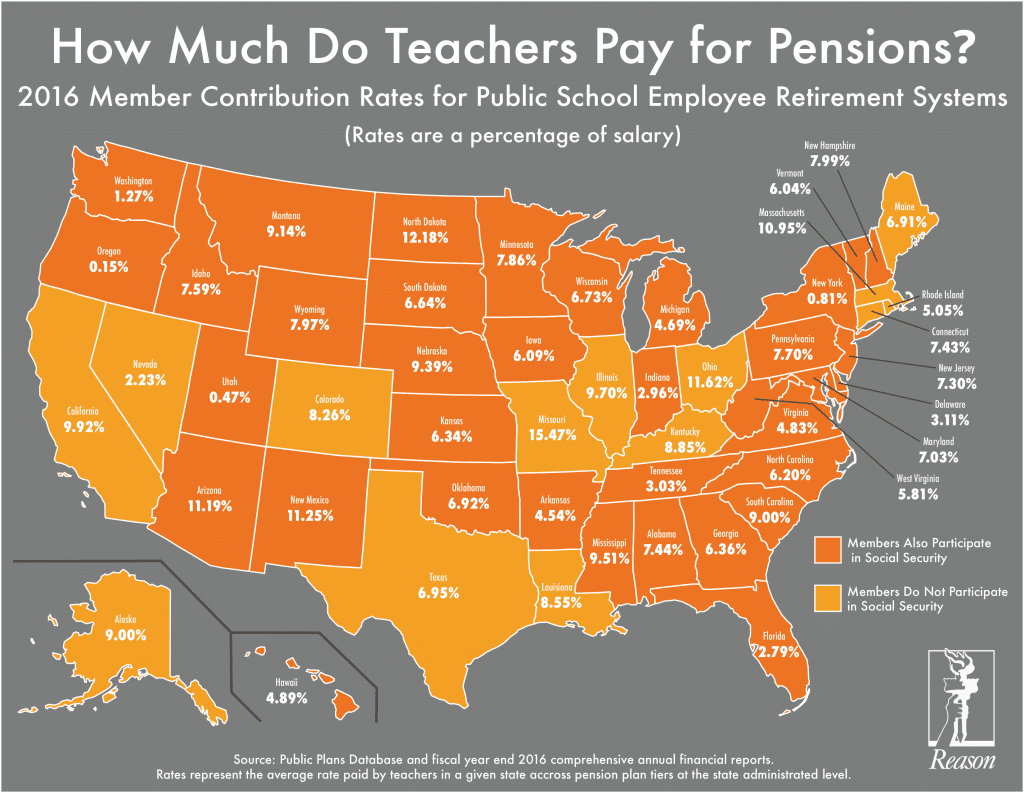

Most defined benefit pension plans require a contribution from the participant, which is drawn as a percentage from their paycheck. For teachers’ pensions, the contribution rate varies greatly from state to state. This map shows the average percentage of payroll that teachers contributed towards their future pensions in 2016.

Contribution rates range from 0% (such as in Oregon and Utah), to an average of 15.47% for teachers in Missouri. By average contribution rate, we mean the average amount that teachers contribute for state administrated pension plans across all tiers of benefits within their state. Many states have varying contribution rates for teachers depending on the year they were hired.

Several factors drive these differences in teacher payment rates from state to state.

First, each state has its own policy on whether or not public employees participate in the federal Social Security program. For states that decline Social Security for their employees, higher benefits and contribution rates are expected to make up the difference. The states that participate in Social Security are labeled in dark orange on the map.

Second, states offer a wide range of benefits for teachers, leading to varying total normal cost rates and thus different approaches from state legislators as to how much to require from employees to cover those normal costs. For example, Ohio is known to have some of the highest average benefit payments for retirees — it is thus no surprise that they have one of the highest employee contribution rates in the country.

Third, some states require that the employee contribution rate increase in connection with the employer contribution rate — and as unfunded liabilities for defined benefit pension plans have increased, the higher unfunded liability amortization payments required from employers have dragged up the teacher contribution rate. For example, Arizona’s plan for teachers uses 50% employer/50% employee cost sharing that causes the employee rate to grow whenever debt payments grow. Similarly, Missouri’s contribution rate (the highest in the nation) is the result of not only their policy to not participate in Social Security, but also a unique policy that requires the employees to contribute the same amount as the employer

It is worth noting that in some states the employee contribution rate is actually paid for—or “picked up”—in full by the employer as part of a collective bargaining agreement. In such a case, the employee does not see a contribution reduction taken out of their paycheck — though the employer pick-up will still influence the future capacity to increase teacher compensation, as pension contributions are tacitly reduced from teacher take home pay anyway.

At least two states, Oregon and Utah, require no contribution from their teachers, yet still have small contribution percentage displayed due to voluntary service cost purchases from their employees.

The amount that teachers contribute to their pensions has many important ramifications for each state. Looking at the average rates across the country can help state policymakers put employee contributions to teacher pension plans in full context relative to other states and can help inform policy debates about reforming underfunded teacher pension systems. These contributions rates, along with all benefit structures, are also important factors for teachers to consider when making decisions on where to work.

Notes on the Data

Contribution rates were calculated by taking the total employee contributions for state administrated defined benefit plans and dividing them by the total covered payroll in 2016. By state administrated we mean plans that are authorized by state statute and managed by a statewide entity, but not municipally administrated plans that might cover local teachers. For example, in Missouri most state teachers are in the Public School Retirement System of Missouri, but teachers in St. Louis are in the Public School Retirement System of the City of St Louis, which is not captured in our data set.

For some states, our reported rates slightly exceed the statutorily required employee contributions due to service credit purchases, which are added as member contributions in valuation reports and CAFRS. Since the rates are calculated from the total employee contributions, they display the average percentages over all tiers within a plan.

Many states have several tiers of benefits based on hire date or some other factor. These tiers each require different contribution rates for their participants. Some states have varying contribution rates based on voluntary selections by the employer — for example, Michigan previously allowed its teachers to select from a defined benefit plan with a 1.5% multiplier and 4% contribution rate and 1.25% multiplier and 0% contribution rate. This analysis combines all of the tiers and selection ranges within a state administrated teacher plan and averages them for one singular contribution rate.

The source of payroll, contribution, and Social Security data for this figure includes data from the Public Plans Database as well as analysis of Comprehensive Annual Financial Reports for states with missing data from the PPD.

Additional notes on specific states include:

-

New York: The contribution rate for New York includes data from the New York State Teachers Retirement System and excludes data from the New York State and Local Employee Retirement System, as the latter serves local (not state) members, including those employed by New York City. For NYSTRS, Tier 3 and 4 members are mandated to contribute 3% of their salary to the Retirement System until they have been a member for 10 years or have 10 years of service credit, whichever occurs first. Tier 5 members are required to contribute 3.5% of their salary throughout their active membership. Tier 6 members are required to contribute at a variable rate based on earnings throughout their active membership. Tier 1 and 2 members are not required to contribute to the System.

-

Oregon: Member contributions from teachers have been closed since 2004 except for service credit purchases.